Global Market Comments March 9, 2021 Fiat Lux Featured Trade: (THE CODER BOOM) (HOW TO EXECUTE A VERTICAL BULL CALL SPREAD) (AAPL)

Global Market Comments March 8, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WHAT’S UP WITH TECH?), (MSFT), (TSLA), (AAPL), (QQQ), (NVDA), (MU), (AMD), (BRKB), (ARRK), (ROM), (VIX), (FCX), (TLT), (BRKB), (TSLA), (JPM), (SPY), (QQQ), (SPX)

That great wellspring of personal wealth, technology stocks, has suddenly run dry. The leading stock market sector for the past decade took some major hits last week. More stable stocks like Microsoft (MSFT) only shed 8%. Some of the highest beta stocks, like Tesla (TSLA), took a heart-palpitating 39% haircut in a mere two months.

Global Market Comments March 5, 2021 Fiat Lux Featured Trade: (MARCH 3 BIWEEKLY STRATEGY WEBINAR Q&A), (BRKB), (CRM), (ZM), (AAPL), (AMD), (DIS), (CRSP), (BRKB), (PLTR), (NVDA), (TLT), (TSLA), (GLD), (SLV), (VSAT), (EUO), (GME)

Below please find subscribers’ Q&A for the March 3 Mad Hedge Fund Trader Global Strategy Webinar broadcast from frozen Incline Village, NV. Q: Are SPACs here to stay? A: Yes, but I think that in the next bear market, 80% of these SPACs (Special Purpose Acquisition Companies) will disappear, will deliver large losses, and will continue charging

Global Market Comments March 4, 2021 Fiat Lux Featured Trade: (THE BARBELL PLAY WITH BERKSHIRE HATHAWAY), (BRKA), (BRKA), (BAC), (KO), (AXP), (VZ), (BK) (USB), (TLT), (AAPL), (MRK), (ABBV), (CVX), (GM), (PCC), (BNSF)

It’s time to give myself a dope slap. I have been pounding the table all year about the merits of a barbell strategy, with equal weightings in technology and domestic recovery stocks. By owning both, you’ll always have something doing well as new cash flows bounce back and forth between the two sectors like a

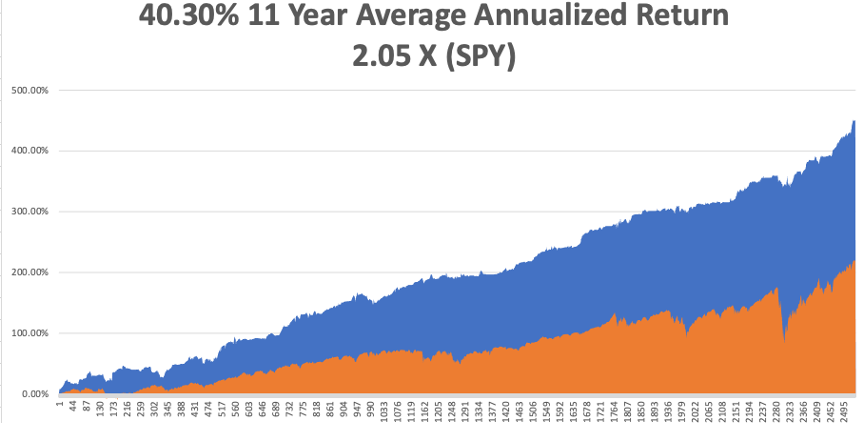

Global Market Comments March 3, 2021 Fiat Lux Featured Trade: (THE DEATH OF PASSIVE INVESTING), (SPY), (SPX), (INDU) (NOTICE TO MILITARY SUBSCRIBERS)

Global Market Comments March 2, 2021 Fiat Lux Featured Trade: (DINNER WITH DAVID POGUE), (TSLA) (WHY DOCTORS MAKE TERRIBLE TRADERS)

Global Market Comments March 1, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or WAKE UP CALL), (TLT), (JPM), (BAC), (C), (MS), (GS), (JNJ), (AAPL), (FB), (AMZN), (GOOGL)

This was the week the stock traders learned there was such a thing as a bond market. They know this because it was bonds that completely demolished their stock trading books. Suddenly, markets went from zero offered to zero bid. Many strategists labored under the erroneous assumption that ten-year US Treasury yields would never surpass

Global Market Comments February 26, 2021 Fiat Lux Featured Trade: (REVISITING THE GREAT DEPRESSION) (EXPLORING MY NEW YORK ROOTS)

Global Market Comments February 25, 2021 Fiat Lux Featured Trade: (TAKING A LOOK AT THE ROM) (ROM) (BRING BACK THE UPTICK RULE!)

Global Market Comments February 24, 2021 Fiat Lux Featured Trade: (LONG TERM ECONOMIC EFFECTS OF THE CORONA VIRUS), (ZM), (LOGM), (AMZN), (PYPL), (SQ), CNK), (AMC), (IMAX), (CCL), (RCL), (NCLH), (CVS), (RAD), (WMT)

The world will never be the same again. Not only is the old world rapidly disappearing before our eyes, the new one is breaking down the front door with alarming speed. In short: the future is happening fast, very fast. To a large extent, long-term economic trends already in place have been given a turbocharger.

Global Market Comments February 23, 2021 Fiat Lux Featured Trade: (THE UNITED STATES OF DEBT), (TLT), (TBT), ($TNX)

Global Market Comments February 22, 2021 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or TIME FOR A BREAK) (GME), (TLT), (FB), (AMZN), (AAPL), (XME), (FCX), (MS), (GS), (BLX), (KO), (AMD)

I know you’re not going to want to hear this. I might as well be trying to pull your teeth, lead you down a garden path, or sell you a high-priced annuity. But there is nothing to do in the market right now. Nada, diddly squat, bupkis, and for all you Limey’s out there, bugger

Global Market Comments February 19, 2021 Fiat Lux Featured Trade: (FEBRUARY 17 BIWEEKLY STRATEGY WEBINAR Q&A), (USO), (XLE), (AMZN), (SPY), (RIOT), (T), (ZM), (ROKU), (TSLA), (NVDA) (TMQ) (TLRY), (ACB), (KO), (XLF), (AAPL) (REMX), (GLD), (SLV), (CPER)

Below please find subscribers’ Q&A for the February 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from frozen Incline Village, NV. Q: Are we buying gold on dips? A: Not yet. As long as you have a ballistic move in bitcoin going on, you don't want to touch gold. Eventually gold does get dragged up

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.