Congratulations on your success. Your path has been your own and your outside the box thinking is refreshing and powerful. No doubt, you have enjoyed it and yet surprised yourself and others with it over the years.The reason for my contact is your insight into the inevitability of solar energy costs going to nearly zero.

?The market is like a bathtub. Money is sloshing from one sector to another, but it is not leaving,? said strategist Louis Navellier, of Navellier Associates.

Global Market Comments July 8, 2016 Fiat Lux Featured Trade: (WHATEVER HAPPENED TO THE GREAT DEPRESSION DEBT?), ($TNX), (TLT), (TBT), (TESTIMONIAL), (THOUGHTS AT SEA ABOARD THE QM2-PART II) CBOE Interest Rate 10 Year T No (^TNX) iShares Trust - iShares 20+ Year Treasury Bond ETF (TLT) ProShares Trust - ProShares UltraShort 20+ Year Treasury (TBT)

8 degrees, 02.12 minutes North, 043 degrees, 42.08 minutes East, or 1,000 miles south of Greenland.When I visited the computer center, I was stunned to learn that they were offering three one hour long classes on Apple products and programs every hour, all day long.They covered iMacs, iPads, iPods, iPhones, and all of the associated

Global Market Comments July 7, 2016 Fiat Lux Featured Trade: (JANET YELLEN?S DIRTY LITTLE SECRET), (TLT), (TBT), (MUB), (JNK), (AMLP), (LQD), (ELD), (TESTIMONIAL) iShares 20+ Year Treasury Bond (TLT) ProShares UltraShort 20+ Year Treasury (TBT) iShares National Muni Bond (MUB) SPDR Barclays High Yield Bond ETF (JNK) Alerian MLP ETF (AMLP) iShares iBoxx $ Invst

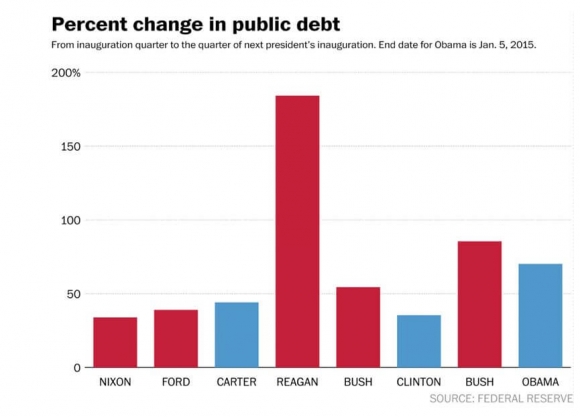

Given that this is a presidential election year, much has been made of the national debt. Since President Obama came into office on January 20, 2009, it has skyrocketed from $10.2 to just over $19 trillion, a gut punching increase of 86.2%. Has Obama just bankrupted the United States? Is default just around the corner,

I just stumbled across your writing and I love it! I have been reading it all weekend. The more I read, the more I have this weird sensation in my frontal cortex. I believe it used to be called "thinking" before the new world order arrived. Almost stimulating....like the stuff before decaf...? What a fresh

?Every geopolitical crisis in the world is squarely pointed at the heart of Europe right now, be it terrorism, the collapse of Europe, or the currency crisis, and that means it?s focused on Chancellor Angela Merkel of Germany,? said my friend, Ian Bremmer, of the political consulting firm, Eurasia Group.

Global Market Comments July 6, 2016 Fiat Lux SPECIAL GOLD ISSUE Featured Trade: (THE ULTRA BULL ARGUMENT FOR GOLD), (GLD), (GDX), (ABX), (SLV), (PALL), (PPLT), (TESTIMONIAL) SPDR Gold Shares (GLD) VanEck Vectors Gold Miners ETF (GDX) Barrick Gold Corporation (ABX) iShares Silver Trust (SLV) ETFS Physical Palladium (PALL) ETFS Physical Platinum (PPLT)

Your article on ?The Ten Baggers in Solar Energy? is the best, well informed, educated piece of literature I have read for a long time. Thank you for your honest and well informed article. I am going to be 86 years YOUNG in coming November and appreciate a simple jewel in this money chasing jungle.

?You always sound smarter when you?re a bear than when you?re a bull,? said Adam Parker of Morgan Stanley.

Global Market Comments July 5, 2016 Fiat Lux Featured Trade: (JULY 6 GLOBAL STRATEGY WEBINAR), (PROOF THE STOCK MARKET IS HEADED TO NEW HIGHS), (SPY), (TLT), (FXY), (YCS), (GLD) SPDR S&P 500 ETF (SPY) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Japanese Yen ETF (FXY) ProShares UltraShort Yen (YCS) SPDR Gold Shares (GLD)

There?s nothing like a quick morning dip in the eastern Adriatic to clear the mind, blow out the cobwebs, and focus thought. The great European postwar economic boom bypassed the former Yugoslavia for lack of capital and a bankrupt communist system. As a result, the waters here in Dubrovnik, Croatia are crystal clear compared to

?We are going to be working off backlogs of construction, mining, oil, and gas for years,? said my friend, famed short seller Jim Chanos of Kynikos Associates.

Global Market Comments July 1, 2016 Fiat Lux Featured Trade: (JULY 6 GLOBAL STRATEGY WEBINAR), (MY BRIEFING FROM THE JOINT CHIEFS OF STAFF), (CGW), (PHO), (RSX), (GOOGL), (CSCO), (FXI), (XLK), (WHY THE JGB MARKET MAY BE READY TO COLLAPSE), (FXY), (YCS), (DXJ) Guggenheim S&P Global Water ETF (CGW) PowerShares Water Resources ETF (PHO) VanEck Vectors

I have always considered the US military to have one of the world?s greatest research organizations. The frustrating thing is that their ?clients? only consist of the President and a handful of three and four star generals.So I thought that I would review my notes from a dinner I had with General James E. Cartwright,

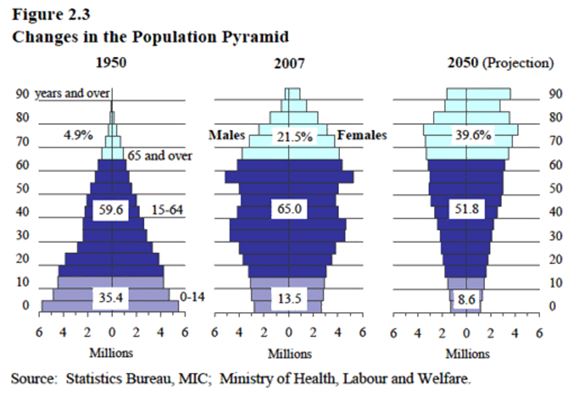

When I first arrived in Japan in 1974, international investors widely expected the country to collapse, a casualty of the overnight quadrupling of oil prices from $3 per barrel to $12, and the global recession that followed.Japanese borrowers were only able to tap foreign debt markets by paying a 200 basis point premium to the

?Free choice is not relevant in financial markets because there are too many players. A stock with a million holders is much more predictable than one with five.? said Charles Nenner, of Charles Nenner Research in Amsterdam.

Global Market Comments June 30, 2016 Fiat Lux Featured Trade: (JULY 9 FLORENCE, ITALY GLOBAL STRATEGY LUNCHEON), (THE BUY AND FORGET PORTFOLIO), (SPY), (IXUS), (EEM), (VNQ), (TLT), (TIP) ?SPDR S&P 500 ETF (SPY) iShares Core MSCI Total Intl Stk (IXUS) iShares MSCI Emerging Markets (EEM) Vanguard REIT ETF (VNQ) iShares 20+ Year Treasury Bond (TLT)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy luncheon, which I will be conducting in Florence, Italy on Saturday, July 9, 2016.A three-course lunch will be followed by an extended question and answer period.I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals,

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.