I've subscribed to John's trading service for several years. As a writer myself, I look forward to John's daily newsletters. They are loaded with great investment ideas and information affecting world markets. They are delivered in clear, entertaining?prose and are a joy to read. I learn something new from them every day. John's advice has

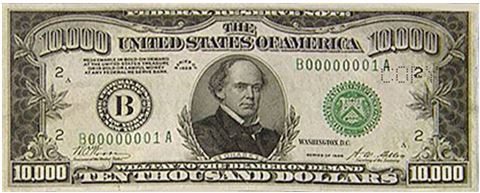

Global Market Comments May 17, 2016 Fiat Lux Featured Trade: (TEST DRIVING TESLA?S SELF DRIVING TECHNOLOGY), (TSLA), (WILL GOLD COINS SUFFER THE FATE OF THE $10,000 BILL?) (GLD), (GDX) (TESTIMONIAL) Tesla Motors, Inc. (TSLA) SPDR Gold Shares (GLD) VanEck Vectors Gold Miners ETF (GDX)

I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie. Well, if it's good enough for Steph, then it's good enough for me. Last week, I received a

The conspiracy theorists will love this one. Buried deep in the bowels of the 2,000 page health care bill was a new requirement for gold dealers to file Form 1099's for all retail sales by individuals over $600. Specifically, the measure can be found in section 9006 of the Patient Protection and Affordability Act of

Thanks for the swift answer about the (UVXY). I got 7% profit in one day, so I'll close. What about the (VXX)? Can that be held for longer?As for your question about Europe, it is not doing good. The reasons why are so simple. Spain, Portugal, Italy and Greece have very different economies and different

?US stock performance will be good in 2016, but is set to be outperformed by Japan, Europe, and emerging markets,? said a top manager at bond giant PIMCO.

Global Market Comments May 16, 2016 Fiat Lux Featured Trade: (THE DEATH OF THE FINANCIAL ADVISOR), (HOW TO USE YOUR CELL PHONE ABROAD)

I constantly receive emails from readers around the world inquiring how I accomplish this or that in my far-reaching travels around the globe. After all, I have visited 125 countries over the past 50 years. What?s more, I have run the Mad Hedge Fund Trader Global Empire for the last eight years on the fly

?The government is now the biggest impediment to economic growth,? said my old friend, Steve Rattner, of the Quadrangle Group.

Global Market Comments May 13, 2016 Fiat Lux SPECIAL 200% ISSUEFeatured Trade: (MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH), (SPY), (GLD), (USO), (FXE), (EUO), (FXY), (YCS), (SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS)SPDR S&P 500 ETF (SPY) SPDR Gold Shares (GLD) United States Oil (USO) CurrencyShares Euro ETF (FXE) ProShares UltraShort

Being the armchair historian that I am, I sense that I have just been through D-Day, the Battle of the Bulge, and Dien Bien Phu, ALL AT THE SAME TIME. That is what it's felt like trading these violent markets this year. After snoring for months, volatility came back with a vengeance. They?re now running

?Who knew the blockbuster this year would be a horror show,? said Tony Crescenzi, market strategist and portfolio manager at bond giant, PIMCO.

Global Market Comments May 12, 2016 Fiat Lux Featured Trade: (THE SECRET FED PLAN TO BUY GOLD), (GLD), (GDX), (PALL), (PPLT), (WHO SAYS THERE AREN?T ANY JOBS?), (TESTIMONIAL)SPDR Gold Shares (GLD) VanEck Vectors Gold Miners ETF (GDX) ETFS Physical Palladium (PALL) ETFS Physical Platinum (PPLT)

When I spoke to a senior official at the Federal Reserve the other day, I couldn?t believe what I was hearing. If the American economy moves into the next recession with interest rates already near zero, the markets will take the interest rates for all interest bearing securities well into negative numbers. At that point,

While winging my way across the South Pacific a few months ago, I spotted an unusual job offer:WANTED: Social worker, tax free salary of $60,000 with free accommodation and transportation, no experience necessary, must be flexible and self-sufficient.With the unemployment rate at 5.3%, and running as high as 45% for recent college grads, I was

I've been reading your blog for a while and found it a helpful beacon in a sea of confusing and contradictory information as I try and make sense of the world (and try and make money from sense!).Kind regards,Toby London, England

Global Market Comments May 11, 2016 Fiat Lux Featured Trade: (MINISTRY COMMENTS DEMOLISH THE YEN), (FXY), (YCS), (THE COST OF AN AGING WORLD), (EWJ), (EWI), (EWG), (EWQ), (EWL), (EWU), (PIN) CurrencyShares Japanese Yen ETF (FXY) ProShares UltraShort Yen (YCS) iShares MSCI Japan (EWJ) iShares MSCI Italy Capped (EWI) iShares MSCI Germany (EWG) iShares MSCI France

We are pretty much home free on our short position in the Japanese yen. At this morning?s mark of $2.92 we had captured 73.33% of the maximum potential profit, earning a tidy 8.15% in only eight trading days. As soon as this position expires on May 20, I?ll be rolling out to the June options.

Regular readers of this letter are well aware of my fascination with demographics as a market driver.They go a long way towards explaining if asset prices are facing a long-term structural headwind or tailwind.The great thing about the data is that you can get precise, high quality numbers 20, or even 50 years in advance.

?If a cop follows you for 500 miles, you?re going to get a ticket,? said Oracle of Omaha, Warren Buffet, in reference to Bank of America?s many legal problems.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.