"Ask not what your country can do for you, but what you can do for your country," said John F. Kennedy, America's 35th president.

Global Market Comments November 25, 2024 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD or WHAT TO DO ABOUT NVIDIA), plus THE WORLD’S WORST INVESTOR), (NVDA), (GLD), (JPM), (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK) (TSLA), (TLT)

Boy, did I make the right move going into the election? I always have a propensity to reduce risk going into a major event. Let the newbies stick their necks out. I’ll collect the low-hanging fruit afterward while trampling over their bodies. As they used to say at Morgan Stanley, “It’s the pioneers who get

“Wars are easier to get into than to get out of,” said former Secretary of Defense, Robert M. Gates.

Global Market Comments November 22, 2024 Fiat Lux Featured Trade: (WEDNESDAY, JANUARY 22, 2025 ST AUGUSTINE FLORIDA STRATEGY LUNCHEON) (NOVEMBER 20 BIWEEKLY STRATEGY WEBINAR Q&A), (NVDA), (TSLA), (TLT), (OXY), (SLB), (MSTR), (USO), (PLTR), (SMCI), (KRE), (SMR), (UUP)

Below, please find subscribers’ Q&A for the November 20 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada. Q: What are your stock recommendations for the end of the first quarter of 2025? A: I say run with the winners. Dance with the girl who brought you to the dance. I think

Global Market Comments November 21, 2024 Fiat Lux Featured Trade: (THURSDAY, JANUARY 16, 2025 SARASOTA FLORIDA STRATEGY LUNCHEON) (TEN REASONS WHY I ONLY EXECUTE VERTICAL CALL DEBIT SPREADS) (AAPL), ($VIX), (SPY)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting in Sarasota, Florida on Thursday, January 16, 2025. The cost of the luncheon will be $277. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I’ll be

Global Market Comments November 20, 2024 Fiat Lux Featured Trade: (THE JOHN THOMAS BIOGRAPHY IS OUT) (THE EIGHT WORST TRADES IN HISTORY)

Global Market Comments November 19, 2024 Fiat Lux Featured Trade: (JANUARY 10 MIAMI FLORIDA STRATEGY LUNCHEON) (THE MAD HEDGE DICTIONARY OF TRADING SLANG), (TESTIMONIAL)

Global Market Comments November 18, 2024 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD or OUT WITH THE NEW, IN WITH THE OLD) Plus REPORT FROM THE QUEEN MARY II), (TLT), (TSLA), (DHI), (LEN), (KBH), (LMT), (RTX), (GD), (GLD), (SLV), (GOLD), (WPM), (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (SPY)

“Take things as they are and profit off the folly of the world.” That is one of my favorite quotes from Anselm Rothschild, founder of the Rothschild banking dynasty, which ruled the financing of Europe for centuries. I lived next door to his great X 10 grandson in London for ten years, the late Jacob

"The government is now the biggest impediment to economic growth," said my old friend Steven Rattner of the Quadrangle Group.

Global Market Comments November 15, 2024 Fiat Lux Featured Trade: (TESTIMONIAL) (CONTANGO IN THE VIX EXPLAINED ONE MORE TIME), (UVXY), ($VIX), (SPY)

Global Market Comments November 14, 2024 Fiat Lux Featured Trade: (JOIN ME ON MY JANUARY 3, 2025 PANAMA CANAL SEMINAR AT SEA LUNCHEON)

Global Market Comments November 13, 2024 Fiat Lux Featured Trade: (DON’T GET SCAMMED BY THE MUTUAL FUNDS), (TESTIMONIAL)

Global Market Comments November 12, 2024 Fiat Lux Featured Trade: (WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Global Market Comments November 11, 2024 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD or S&P 500 6,000 TARGET ACHIEVED, plus REPORT FROM THE FROZEN WASTELANDS OF THE WEST), (CCI), (DHI), GLD), (SLV) (JPM), (MS), (BLK), (CCJ), (NVDA), (AMZN), (TSLA), (DGE)

I was reviled, abused, and outright laughed at by the investment community when, last January 5, I predicted that the S&P 500 would hit 6,000 by yearend, click here for the link. I was accused of sending out clickbait. Yet here, ten months and change into the year here, we are with an intraday high

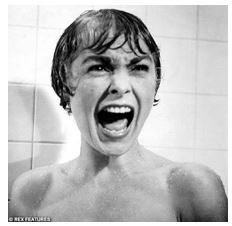

“Transparency is a good idea. Like my shower door, it lets in the light, but keeps out the flies,” said former Federal Reserve governor, Bob McTeer.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.