My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations. Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic

Global Market Comments June 24, 2014 Fiat Lux Featured Trade: (LAST CHANCE TO ATTEND THE JUNE 26 ISTANBUL, TURKEY STRATEGY LUNCHEON), (THE BEST FINANCIAL BOOK EVER), (A DAY WITH TOM FRIEDMAN OF THE NEW YORK TIMES)

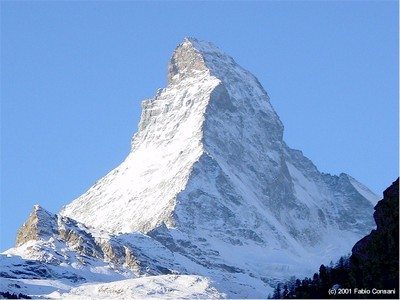

Global Market Comments June 23, 2014 Fiat Lux Featured Trade: (JULY 24 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR), (THE NEW COLD WAR), (WHY I LOVE/HATE THE OIL COMPANIES), (XOM), (USO), (THE WORST TRADE IN HISTORY), (AAPL) Exxon Mobil Corporation (XOM) United States Oil (USO) Apple Inc. (AAPL)

Come join me for afternoon tea for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Thursday, July 24, 2014. A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and

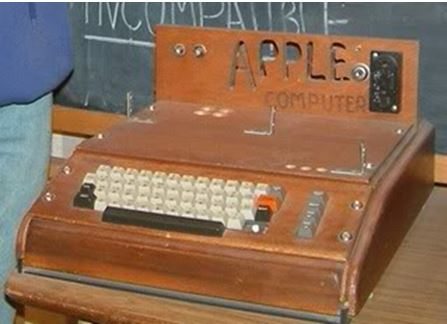

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976. What would that stake be worth today? Try $22 billion. That is the harsh reality that Ron Wayne, 76, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant. Ron first met

Global Market Comments June 20, 2014 Fiat Lux Featured Trade: (JULY 11 SARDINIA, ITALY STRATEGY LUNCHEON) (THE CHINA VIEW FROM 30,000 FEET), (FXI), (DBC), (DYY), (DBA), (PHO). (TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN) (TESTIMONIAL) iShares China Large-Cap (FXI) PowerShares DB Commodity Index Tracking (DBC) PowerShares DB Commodity Dble Long ETN (DYY) PowerShares DB

Global Market Comments June 19, 2014 Fiat Lux Featured Trade: (JULY 7 ROME, ITALY STRATEGY LUNCHEON) (NOTICE TO MILITARY SUBSCRIBERS), (CHINA?S COMING DEMOGRAPHIC NIGHTMARE)

Global Market Comments June 18, 2014 Fiat Lux Featured Trade: (JUNE 26 ISTANBUL, TURKEY STRATEGY LUNCHEON) (AMERICA?S NATIVE INDIAN ECONOMY)

Global Market Comments June 17, 2014 Fiat Lux Featured Trade: (JUNE 18 GLOBAL STRATEGY WEBINAR), (LAST CHANCE TO ATTEND THE JUNE 23 LONDON STRATEGY LUNCHEON) (ARE JUNK BONDS PEAKING?), ?(JNK), (HYG), (A TOUCHDOWN FOR USC), (INTC) SPDR Barclays High Yield Bond (JNK) iShares iBoxx $ High Yield Corporate Bd (HYG) Intel Corporation (INTC)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, June 23, 2014. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks,

Global Market Comments June 16, 2014 Fiat Lux Featured Trade: (LAST CHANCE TO ATTEND THE JUNE 17 NEW YORK STRATEGY LUNCHEON), (DIAMONDS ARE STILL AN INVESTOR?S BEST FRIEND), (SO YOU THINK THEY?RE NOT WATCHING YOUR PC?)

Come join Mad Day Trader Jim Parker and I for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheon, which we will be conducting in New York, NY on Tuesday, June 17, 2014. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

Global Market Comments June 13, 2014 Fiat Lux Featured Trade: (JUNE 18 GLOBAL STRATEGY WEBINAR), (JULY 11 SARDINIA, ITALY STRATEGY LUNCHEON) (BE CAREFUL WHO YOU SNITCH ON), (COULD YOU QUALIFY TO BECOME A US CITIZEN?)

Global Market Comments June 12, 2014 Fiat Lux (TAKING OFF FOR EUROPE)

Global Market Comments June 11, 2014 Fiat Lux Featured Trade: (MAD HEDGE FUND TRADER TOPS 2014 GAIN OF 17.8%), (AAPL), (GOOG), (TLT), (FXY), (THE BEST STOP LOSS OF THE YEAR), (VXX), (SPY), (JUNE 17 NEW YORK STRATEGY LUNCHEON) Apple Inc. (AAPL) Google Inc. (GOOG) iShares 20+ Year Treasury Bond (TLT) CurrencyShares Japanese Yen Trust (FXY)

The industry beating performance of the Mad Hedge Fund Trader?s Trade Alert Service has punched through to a new all time high almost every day for the past ten days. The total return for my followers so far in 2014 has reached 17.82%, compared to a far more modest 4.6% for the Dow Average during

Traders throughout the industry have been left with their jaws hanging open in the wake of the complete collapse of volatility for the S&P 500 (SPY). When the volatility hit the $10 handle a few days ago, it was the lowest level in nearly a decade. Especially hard hit has been the iPath S&P 500

Global Market Comments June 10, 2014 Fiat Lux Featured Trade: (JULY 25 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR), (IT?S ?RISK ON? AGAIN), (SPY), (CAT), (IBM), (JPM), (MSFT), (AAPL), (TLT), (TBT), (MUB), (LQD), (LINE), (ELD), (FXE), (ABOUT THAT TESLA RECOMMENDATION), (TSLA) SPDR S&P 500 (SPY) Caterpillar Inc. (CAT) International Business Machines Corporation (IBM) JPMorgan Chase & Co.

?Well, I?ll either be up 25% by the end of June or I just blew up my 2014 performance.? That is what I told my esteemed colleague, Mad Day Trader Jim Parker, right after I engineered a major ?RISK ON? adjustment for my model trading portfolio. If I am right, and bonds peaked and yields

Come join Mad Day Trader Jim Parker and I for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheon, which we will be conducting in New York, NY on Tuesday, June 17, 2014. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.