I am pleased to announce that I will be participating in the Invest Like a Monster Trading Conference in San Francisco during October 25-26. The two-day event brings together experts from across the financial landscape who will improve your understanding of markets by a quantum leap and measurably boost your own personal trading performance. Tickets

When I first heard about Larry Summers decision to withdraw his name from consideration as the next Chairman of the Federal Reserve, I thought ?Whoa! ?RISK ON, here we come.? I knew immediately that global stock (SPY), bond (TLT), and commodity markets would rocket and the dollar would crash (FXA), except against the Japanese yen

Global Market Comments September 16, 2013 Fiat Lux Featured Trade: (NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON), (CATCHING UP WITH ECONOMIST DAVID HALE), (EEM), (GREK), (IWW), (EWJ), (NGE), (EWJ), (FXY), (YCS) (TESTIMONIAL) iShares MSCI Emerging Markets (EEM) Global X FTSE Greece 20 ETF (GREK) iShares Russell 3000 Value Index (IWW) iShares MSCI Japan Index (EWJ) Global

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

I have been relying on David Hale as my de facto global macro economist for decades, and I never miss an opportunity to get his updated views. The challenge is in writing down David?s eye popping, out of consensus ideas fast enough, because he spits them out in such rapid-fire succession. Since David is an

Global Market Comments September 13, 2013 Fiat Lux Featured Trade: (MAD HEDGE FUND TRADER HITS ANOTHER NEW ALL TIME HIGH), (FXY), (YCS), (FCX), (AAPL), (FXA), (LOADING UP ON AUSTRALIA), (FXA), (EWA), ($SSEC), ($BDI), (UPDATE ON FREEPORT MCMORAN) (FCX) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) Freeport-McMoRan Copper & Gold Inc. (FCX) Apple Inc.

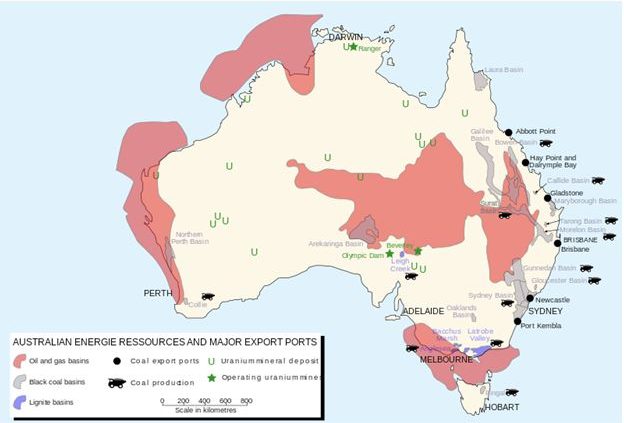

It looks like I?m Waltzing Matilda again. I am going to use the two-cent drop last night to scale into a long position in the Australian dollar. This is a dip in the (FXA) that gives up one quarter of the four-cent move off of the August 88 cent bottom. The decline was triggered by

Those who bought my Trade Alert on the Freeport McMoRan (FCX) October $28-$30 bull call spread at $1.68 or best two days ago will be thrilled to see the charts below. They were prepared by my friends at Stockcharts.com, who offer a very reasonable subscription technical analysis product (click here for their site http://stockcharts.com ).

Global Market Comments September 12, 2013 Fiat Lux Featured Trade: (BUY APPLE ON THE DIP), (AAPL), (CHL) (PICKING UP FREEPORT MCMORAN), (FCX), (CU), (ECH), ($SSEC) Apple Inc. (AAPL) China Mobile Limited (CHL) Freeport-McMoRan Copper & Gold Inc. (FCX) First Trust ISE Global Copper Index (CU) iShares MSCI Chile Capped (ECH) Shanghai Stock Exchange Composite Index

Buy the rumor, sell the news. That was again the lesson of yesterday?s new product launch, where Apple (AAPL) rolled out their new premium 5s and low-end 5c iPhones. So many commentators heaped such abuse on the company in the run up to the release that today?s weakness was a sure thing. Failure to announce

It is clear from the improving economic data from China that the hard landing scenario is off the table. This is great news for the producers of everything that the Middle Kingdom buys in bulk, especially copper. If you like copper, you?ve got to love Freeport McMoRan, one of the world?s largest producers for the

Global Market Comments September 11, 2013 Fiat Lux Featured Trade: (MY 2013 STOCK MARKET OUTLOOK), (SPY), (IWM), (AAPL), (TLT) SPDR S&P 500 (SPY) iShares Russell 2000 Index (IWM) Apple Inc. (AAPL) iShares Barclays 20+ Year Treas Bond (TLT)

It?s time to put on your buying boots and throw caution to the wind. The S&P 500 (SPY) is likely to rebound as much as 9% from the recent 1,630 low to as high as 1,780 by the end of December. What?s more, stocks could add another 10%-20% in 2014. The nimble and the aggressive

Global Market Comments September 10, 2013 Fiat Lux Featured Trade: (NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON), (BAILING ON MY OIL SHORT), (USO), (QUANTITATIVE EASING EXPLAINED TO A 12 YEAR OLD), (TESTIMONIAL) United States Oil (USO)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, November 1, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

We got the dollar drop over the weekend that I was expecting. There was no way that the war was going to start before Obama gave his speech on Tuesday and congress votes yea or nay later on. So when the missiles failed to show by the Monday morning opening, they took Texas tea down

Global Market Comments September 9, 2013 Fiat Lux Featured Trade: (JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE) (SEPTEMBER 11 GLOBAL STRATEGY WEBINAR), (THE EMERGING ?BUY? ON EMERGING MARKETS), (EWW), (EZA), (IDX), (THD), (EWM), (EPHE), (GXG), (ECH) iShares MSCI Mexico Capped (EWW) iShares MSCI South Africa Index (EZA) Market Vectors Indonesia Index ETF

I am pleased to announce that I will be participating in the Invest Like a Monster Trading Conference in San Francisco during October 25-26. The two-day event brings together experts from across the financial landscape who will improve your understanding of markets by a quantum leap and measurably boost your own personal trading performance. Tickets

No asset class has been beaten more severely this year than emerging markets. Since the March, 2011 high, the iShares MSCI Emerging Market ETF (EEM) has plunged from $48 to $35.80, a loss of 25%. Individual markets have fared far worse. The Market Vectors Indonesia ETF (IDX) has taken a 39% haircut, while the Powershares

Global Market Comments September 6, 2013 Fiat Lux Featured Trade: (MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH) (SAN FRANCISCO STRATEGY LUNCHEON POSTPONED TO NOVEMBER 1), (THE TAX RATE FALLACY), (THE COOLEST TOMBSTONE CONTEST)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.