Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

Onshoring, the return of US manufacturing from abroad, is rapidly gathering pace. It is increasingly playing a crucial part in the unfolding American industrial renaissance. It could well develop into the most important new trend on the global economic scene during the early 21st century. It is also paving the way for a return of

Much of the recent buying of stocks has been generated by hedge funds panicking to cover shorts. Convinced of the imminent collapse of Europe, the impotence of governments to do anything about it, and slow economic growth at home, many managers were running a maximum short for the umpteenth time, and were forced to cover

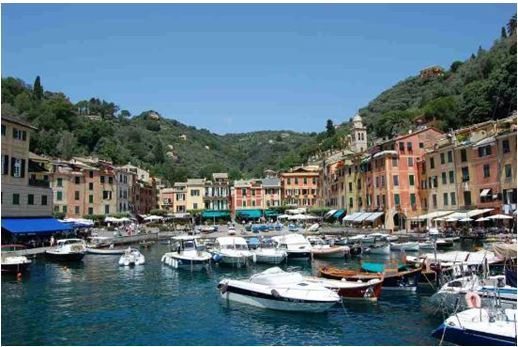

Global Market Comments May 22, 2013 Fiat Lux Featured Trade: (JULY 25 PORTOFINO, ITALY STRATEGY LUNCHEON), (FIVE STOCKS TO BUY FOR THE SECOND HALF) (TESTIMONIAL)

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting near Portofino, Italy on the Italian Riviera, on Thursday, July 25, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up

Take a look at the chart below for the S&P 500, and it is clear that we are at the top, of a top, of a top. How much new stock do you want to buy here? Not much. Virtually every technical trading service I follow, including my own, is now flashing distressed warning signals.

Global Market Comments May 21, 2013 Fiat Lux Featured Trade: (JULY 2 NEW YORK STRATEGY LUNCHEON), (THE END OF THE COMMODITY SUPER CYCLE) (GLD), (SLV), (CU), (BHP), (USO), (PALL), (PPLT), (CORN), (WEAT), (SOYB), (DBA), (FXA) SPDR Gold Shares (GLD) iShares Silver Trust (SLV) First Trust ISE Global Copper Index (CU) BHP Billiton Limited (BHP) United

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three-course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period. I?ll be giving you my up to

Traders have been watching in complete awe the rapid decent of the price of gold, which is emerging as the most despised asset class of 2013. But it is becoming increasingly apparent that the collapse of prices for the barbarous relic is part of a much larger, longer-term macro trend. It isn?t just the yellow

Global Market Comments May 20, 2013 Fiat Lux Featured Trade: (INTRODUCING THE MAD DAY TRADER), (A SPECIAL NOTE TO TRADE ALERT FOLLOWERS) (REVISITING THE FIRST SILVER BUBBLE), (SLV) iShares Silver Trust (SLV)

I am pleased to announce the introduction of my first major upgrade, The Mad Day Trader. While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a ten minute to three day window. It is ideally suited

As of today, we will be sending out two types of Trader Alerts, medium term ones from the Mad Hedge Fund Trader, and short term ones from the new Mad Day Trader service. Please be careful not to confuse the two. We have done what we can to distinguish the two, using different logos, colors,

With smoke still rising from the ruins of the recent silver crash, I thought I?d touch base with a wizened and grizzled old veteran who still remembers the last time a bubble popped for the white metal. That would be Mike Robertson, who runs Robertson Wealth Management, one of the largest and most successful registered

Global Market Comments May 17, 2013 Fiat Lux Featured Trade: (HANGING OUT WITH CONGRESSMAN BARNEY FRANK), (THE MOST FUNCTIONAL WORD IN THE ENGLISH LANGUAGE), (AN EVENING WITH NOBEL PRIZE WINNER MICHAEL SPENCE) (EEM),(EWZ), (EWY), (EWT), (EWS), (EWH),(TF), (IDX), (EWM), (FXI), (EWJ) iShares MSCI Emerging Markets Index (EEM) iShares MSCI Brazil Capped Index (EWZ) iShares MSCI

One of the highlights of last week?s SkyBridge Alternatives Conference was the blowout party on Wednesday night (click here for the blow by blow description). Seeking refuge from a band that was blasting my ears out, and fleeing the nubile young bodies that kept bumping up against me and spilling my margaritas, I sought out

Passed on by a friend with my apologies: Well, it's shit... That's right, shit! Shit may just be the most functional word in the English language. You can smoke shit, buy shit, sell shit, lose shit, find shit, forget shit, and tell others to eat shit. Some people know their shit, while others can't tell

Global Market Comments May 16, 2013 Fiat Lux SPECIAL TESLA EDITION Featured Trade: (ONE THE TESLA MELT UP), (TSLA), (F), (FIATY), (PEUGY), (SCTY), (BBRY), (HLF), (NFLX), (FSLR) Tesla Motors, Inc. (TSLA) Ford Motor Co. (F) Fiat S.p.A. (FIATY) Peugeot S.A. (PEUGY) SolarCity Corporation (SCTY) Research In Motion Limited (BBRY) Herbalife Ltd. (HLF) Netflix, Inc. (NFLX)

This was the short squeeze that was begging to happen. Five guys owned 50% of the company, including the visionary founder, Elon Musk. Of the remaining float, 45% had been borrowed and sold short by hedge funds. All that was needed to ignite a rally was for someone to say ?Boo.? That is exactly what

Global Market Comments May 15, 2013 Fiat Lux Featured Trade: (JULY 19 FRANKFURT, GERMANY STRATEGY LUNCHEON), (TESTIMONIAL), (MY FAVORITE SECRET ECONOMIC INDICATOR), (RUNNING THE SAN FRANCISCO BAY TO BREAKERS)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Frankfurt, Germany on Friday, July 19, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks,

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.