If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base

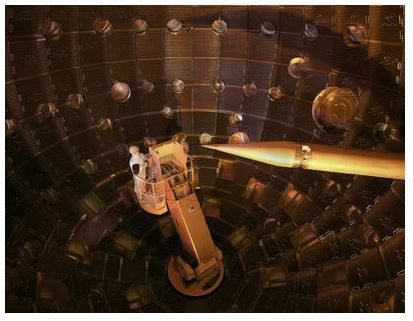

Expect to hear a lot about ignition in the next year. No, I don?t mean the rebuilt ignition for the beat up ?68 Cadillac El Dorado up on blocks in your front yard. I?m referring to the inauguration of the National Ignition Facility next door to me at Lawrence Livermore National Labs in Livermore, California.

Global Market Comments April 5, 2013 Fiat Lux Featured Trade: (NEW BOJ GOVERNOR CRUSHES THE YEN), (FXY), (YCS), (DXJ), (SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS), (THERE ARE NO GURUS), (WATCH OUT FOR THE MILLENNIAL VOTER) CurrencyShares Japanese Yen Trust (FXY) ProShares UltraShort Yen (YCS) WisdomTree Japan Hedged Equity (DXJ)

Wow! What a day! In perhaps the most dramatic policy move by any central bank, anywhere in history, the Bank of Japan pulled out all the stops to stimulate its moribund, demographically challenged economy. Japan is now lapping its competitors in Europe and the US in the international race to the bottom. The markets certainly

I have been banging the table for years now about the importance of demographic trends for the economy, the financial markets, and the housing market. Well, politics is no different. According to recent surveys, Millennials, who are now aged 21-32 (I have three of them) are suspicious of government, have a strong anti-business bias, are

Global Market Comments April 4, 2013 Fiat Lux Featured Trade: (JULY 8 LONDON STRATEGY LUNCHEON) (ANOTHER DINNER WITH ROBERT REICH), (TESTIMONIAL), (CONNECTING UP AMERICA)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2012. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds,

I never tire of listening to economics guru, Robert Reich, speak about the economy. He was former Labor Secretary under Bill Clinton, and ran against Mitt Romney for governor of Massachusetts (he lost). He has published 13 books. Oh, and he dated our recent Secretary of State, Hillary Rodham, when they were in law school

Until now, the country?s power grid has been divided into three unconnected, noncompetitive kingdoms (in the spirit of Game of Thrones), making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from periodic brown outs and sky high prices, electricity was given away virtually for free in Texas. A group

Global Market Comments April 3, 2013 Fiat Lux Featured Trade: (APRIL 19 CHICAGO STRATEGY LUNCHEON), (PULLING THE RIPCORD ON UNITED), (UAL), (EASTER AT INCLINE VILLAGE) United Continental Holdings, Inc. (UAL)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds, foreign

Delta announces that revenues grew by only 2% in the last quarter, so of course, they trash United Continental Group (UAL), taking it down 11% from the recent high.? As a former pilot myself, I always allow an extra safety margin separating me from a catastrophic event. This time it came in handy, my deep

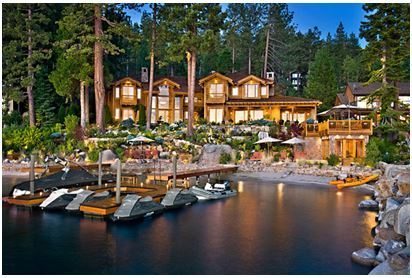

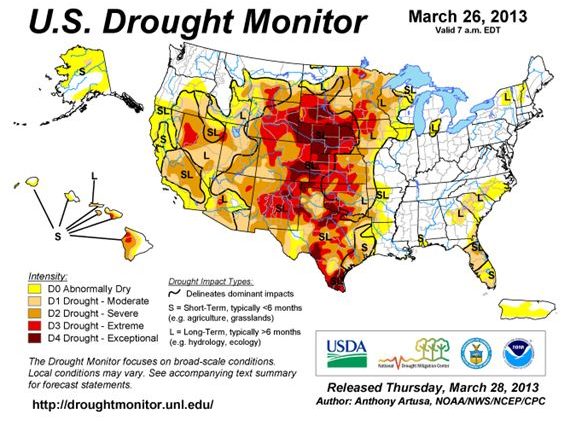

It has definitely been a tough year for ski bums, massage therapists, and black jack dealers at Incline Village, Nevada. After getting a prodigious eight feet of snow over one weekend at Christmas, there has been nary a flake since then. Hats off to the Diamond Peak ski resort for trucking down enough snow from

Global Market Comments April 2, 2013 Fiat Lux Featured Trade: (APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON), (THE US DOMINANCE IN HIGHER EDUCATION), (AN EVENING WITH JAMES BAKER III), (THE CORN CRASH CONTINUES), (CORN), (WEAT), (SOYB), (DBA) Teucrium Corn (CORN) Teucrium Wheat (WEAT) Teucrium Soybean (SOYB) PowerShares DB Agriculture (DBA)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

I spent the weekend attending a graduation in Washington State, a stone?s throw from where the 2010 Winter Olympics were held. While sitting through the tedious reading of 550 names, and listening to the wailing bagpipes, I did several calculations on the back of the commencement program. I came to some startling conclusions. Higher education

?We have 3,500 nuclear weapons left over from the cold war we don?t need, they take 20 seconds to re-aim, we?re not afraid to use them. And by the way, they?re already aimed at you.? That is the approach James Baker III thinks America should take with Iran, Ronald Reagan?s Chief of Staff and Secretary

Pit traders of the ags are bruised, battered, and broken, in the wake of Thursday?s US Department of Agriculture crop report showing that there is a whole lot more food out there than anyone imagined possible. Corn was the real shocker. It has long been a nostrum in the ag markets that high prices cure

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

Global Market Comments April 1, 2013 Fiat Lux Featured Trade: (GET READY FOR THE NEXT GOLDEN AGE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.