Global Market Comments April 1, 2013 Fiat Lux Featured Trade: (GET READY FOR THE NEXT GOLDEN AGE)

I believe that the global economy is setting up for a new golden age reminiscent of the one the United States enjoyed during the 1950?s, and which I still remember fondly. This is not some pie in the sky prediction. It simply assumes a continuation of existing trends in demographics, technology, politics, and economics. The

Global Market Comments March 28, 2013 Fiat Lux Featured Trade: (APRIL 3 GLOBAL STRATEGY WEBINAR), (APRIL 19 CHICAGO STRATEGY LUNCHEON), (REAL ESTATE BIDDING WARS GO NATIONAL), (LEN), (KBH), (PHM) Lennar Corp. (LEN) KB Home (KBH) PulteGroup, Inc. (PHM)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Friday, April 19. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period. I?ll be giving you my up to date view on stocks, bonds, foreign

Two years ago, there was an open house listed in the San Francisco Chronicle in my neighborhood for $1.8 million. It offered a cavernous 6,000 square feet, five bedrooms, a generous den I could use as a home office, a gourmet kitchen, and a spectacular view of the entire bay area. It was a slow

Global Market Comments March 27, 2013 Fiat Lux Featured Trade: (APRIL 12 SAN FRANCISCO STRATEGY LUNCHEON), (WHY WARREN BUFFETT HATES GOLD), ?(GLD), (GDX), (ABX), (US HEADED TOWARDS ENERGY INDEPENDENCE), (USO), (UNG), (XOM), (OXY), (KOL), (A TOUCHDOWN FOR USC) SPDR Gold Shares (GLD) Market Vectors Gold Miners ETF (GDX) Barrick Gold Corporation (ABX) United States Oil

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in San Francisco on Friday, April 12, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on stocks,

The 'Oracle of Omaha' expounded at length today on why he despises the barbarous relic. The sage doesn't really care about the yellow metal, whatever the price. He sees it primarily as a bet on fear. If investors are more afraid in a year than they are today, then you make money. If they aren't,

My inbox was clogged with responses to my recent prediction of US energy independence. This will be the most important change to the global economy for the next 20 years. So I shall go into more depth. The energy research house, Raymond James, put out an estimate that domestic American oil production (USO) would rise

One of my many alma maters, the University of Southern California, announced that they had received their largest private donation in history. As a third generation alumni of this fanatical football factory (I went to school with Mark Harmon, Lynn Swan, and, oops, OJ Simpson), I still receive their alumni newsletter, where I learned the

Global Market Comments March 26, 2013 Fiat Lux Featured Trade: (MAY 8 LAS VEGAS STRATEGY LUNCHEON), (HERE COMES THE ROLLING TOP), (VIX), (BAC), (UAL), (SPX), (IWM), (A DIFFERENT VIEW OF THE US) VOLATILITY S&P 500 (VIX) Bank of America Corporation (BAC) United Continental Holdings, Inc. (UAL) S&P 500 Large Cap Index (SPX) iShares Russell 2000

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period. I?ll be giving you my up to date view on

The S&P 500 is now at 1,564, and most strategist forecasts for the end of 2013 hover around 1,550-1,600, plus or minus some spare change. So the next nine months are going to be incredibly boring. Or they won?t. Even in a bull market, one expects to see pullbacks of at least one third of

My mother lives in Pakistan, my daughter in Greece, and I have a ski chalet in Peru. What's more, I have strategy luncheons planned for Australia, Thailand, and Turkey. At least these would be my conclusions after looking at a map of the United States prepared by my esteemed former employer, The Economist magazine, renaming

When I was a young, clueless investment banker at Morgan Stanley 30 years ago, the head of equity sales took me aside to give me some fatherly advice. Never touch the airlines. The profitability of this industry was totally dependent on fuel costs, interest rates, and the state of the economy, and management hadn't the

Global Market Comments March 22, 2013 Fiat Lux Featured Trade: (BUY EVERY BLACK SWAN), (SPY), (QQQ), (IWM), (AAPL), (UAL) (REVISITING CHENIERE ENERGY), (LNG), (UNG), (USO), (DVN), (CHK) SPDR S&P 500 (SPY) PowerShares QQQ (QQQ) iShares Russell 2000 Index (IWM) Apple Inc. (AAPL) United Continental Holdings, Inc. (UAL) Cheniere Energy, Inc. (LNG) United States Natural Gas

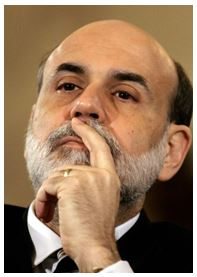

At least that?s what Ben Bernanke thinks. He said as much in his press conference yesterday in the wake of the latest Fed statement. He might as well have waved a red Flag at a bull. The central bank took the opportunity to downgrade its US growth forecasts going forward as a result of sequestration

Occasionally, I so totally knock the ball out of the park that I qualify for a place in the stock picker?s Hall of Fame. That was the case when I put out a recommendation to buy LNG exporter, Cheniere Energy (LNG), a year ago (click here? for Take a Look at Cheniere Energy (LNG). Since

Global Market Comments March 21, 2013 Fiat Lux Featured Trade: (TRADE ALERT SERVICE SEIZES 31.8% GAIN IN 2013), (SPY), (FXY), (IWM, (BAC), (AIG), (FCX), (FXE), (FXB), (GLD), (USO), (THE BULL CASE FOR BANK OF AMERICA), (BAC), (WHEN STERILIZATION IS NOT A FORM OF BIRTH CONTROL), (TLT), (PCY), (MUB), (JNK), (TESTIMONIAL) SPDR S&P 500 (SPY) CurrencyShares

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 31.8% profit year to date, taking it to another new all time high. The 27-month total return has punched through to an awesome 86.9%, compared to a miserable 18.5% return for the Dow average during the same period. That raises the average

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.