Contrary to widespread predications, the sun rose this morning and the world did not end. The overnight reduction in our defense spending did not prompt expansionist, vengeful Mexicans to try to retake California and Texas, kicking soccer balls all the way. Cigar chomping Cuban communists did not capture Florida. Hockey stick brandishing Canadians failed to

The focus of this letter is to show people how to make money through investing in fast growing, highly profitable companies which have stiff, long-term macroeconomic winds at their backs. That means I ignore a large part of the US economy whose time has passed and are headed for the dustbin of history. According to

Global Market Comments March 4, 2013 Fiat Lux Featured Trade: (MARCH 6 GLOBAL STRATEGY WEBINAR), (THE DEATH OF GOLD, PART II), (GLD), (GDX), (GDM), (FXE), (UUP), (FXB), (GBB), (USO), (CU), (THE REAL ESTATE MARKET IN 2030), (TESTIMONIAL) SPDR Gold Shares (GLD) Market Vectors Gold Miners ETF (GDX) GOLD MINERS INDEX (GDM) CurrencyShares Euro Trust (FXE)

I have been pounding the table trying to get readers out of gold since early December. Now, my friend at stockcharts.com, Mike Murphy, has produced a stunning series of charts showing that this may be more than just a short-term dip and another buying opportunity. Mike explains that a number of traditional chart, technical, and

A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when

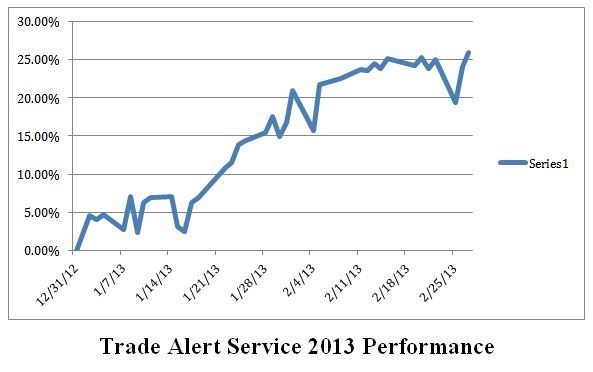

Global Market Comments March 1, 2013 Fiat Lux Featured Trade: (TRADE ALERT SERVICE CLOCKS 26% GAIN IN 2013) (A CONVERSATION WITH THE BOOTS ON THE GROUND), (DINNER WITH NOBEL PRIZE WINNER JOSEPH STIGLITZ)

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 26.01% profit year to date, taking it to another new all time high. The 26-month total return has punched through to an awesome 81.06%, compared to a miserable 15% return for the Dow average during the same period. That raises the average

I have spent many hours speaking at length with the generals who ran our wars in the Middle East, like David Petraeus, James E. Cartwright, and Martin E. Dempsey. To get the boots on the ground view, I attended the graduation of a friend at the Defense Language Institute in Monterey, California, the world's preeminent

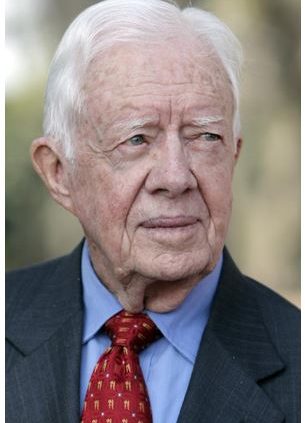

Global Market Comments February 28, 2013 Fiat Lux Featured Trade: (SUNDAY WITH PRESIDENT JIMMY CARTER)

When I heard that our 39th president, former governor of Georgia, and Nobel Peace Prize winner, Jimmy Carter was coming to town, I moved heaven and earth to meet him. I served in the White House Press Corps as the The Economist correspondent during the latter part of his term, and was dying to get

Global Market Comments February 27, 2013 Fiat Lux Featured Trade: (WHY THE MARKETS COULD CARE LESS ABOUT SEQUESTRATION), (BE CAREFUL WHO YOU SNITCH ON)

They say a picture is worth 1,000 words. The map below is worth a PhD thesis, and perhaps a weighty tome. Prepared by my friends from government data at the online financial site run by Henry Blodget, Business Insider, it ranks the states most impacted by the sequestration of federal spending that starts on Friday,

Buried in the recently passed Dodd-Frank financial reform bill are massive financial rewards for turning in your crooked boss. The SEC is hoping that multimillion-dollar rewards amounting to 10%-30% of sanction amounts will drive a stampede of whistleblowers to their doors with evidence of malfeasance and fraud by their employers. If such rules were in

Global Market Comments February 26, 2013 Fiat Lux Featured Trade: (SUDDENLY THOSE ITALIAN LESSONS ARE PAYING OFF), (FXE), (EUO), (EWI), (VIX), (UUP), (NEW BOJ GOVERNOR CRATERS YEN), (FXY), (YCS), (UUP), (PETER F. DRUCKER ON MANAGEMENT) CurrencyShares Euro Trust (FXE) ProShares UltraShort Euro (EUO) iShares MSCI Italy Capped Index (EWI) VOLATILITYS&P500 (VIX) PowerShares DB US Dollar

Welcome to the first black swan of 2013! You couldn?t mistake the meaning of the cries of topless female protesters as they flung themselves at police guarding Italian polling stations on Monday. Basta! Basta! Enough! Enough! The purpose of their demonstration was visibly scrawled in large letters across their nubile bodies in black ink for

At long last, Japanese Prime Minister, Shinzo Abe, has appointed a new governor to the Bank of Japan, Haruhiko Kuroda. The foreign currency markets responded immediately, taking the Japanese yen down to ?94.60, a new three year low. It also broke new ground in a range of currency crosses, including Euro/Yen, Ausie/Yen, and Kiwi/Yen. It

If you have been living in a cave for the last 72 years and missed the work of management guru, Peter F. Drucker, here is your chance to catch up. I just finished reading The Essential Drucker, a weighty tome of 368 pages which summarized the high points and pearls of wisdom of the author's

Global Market Comments February 25, 2013 Fiat Lux Featured Trade: (ANOTHER DAY IN THE LIFE OF THE MAD HEDGE FUND TRADER), (SPY), (SPX), (QQQ), (AAPL), (HPQ), (YHOO), (CSCO), (TLT), (TBT), (FXF), (UUP), (FXE), (GLD), (GDX), (TSLA), (USO) SPDR S&P 500 (SPY) SPX Corporation (SPW) PowerShares QQQ (QQQ) Apple Inc. (AAPL) Hewlett-Packard Company (HPQ) Yahoo! Inc.

Diary Entry for Friday, February 22, 2013 Dear Diary, 4:30 PM Thursday- Thought I?d check my Bloomberg to see how the Asian markets were opening. Wow! Shanghai is really taking it in the shorts, down 5%. Looks like when Ben Bernanke catches a cold, the Chinese markets catch pneumonia. They must be more dependent on

Global Market Comments February 22, 2013 Fiat Lux Featured Trade: (FOLLOW UP ON TESLA), (TSLA), (DON?T MISS THIS REAL ESTATE BUBBLE), (A VERY SHORT HISTORY OF HEDGE FUNDS), (POPULATION BOMB ECHOES), (POT), (MOS), (AGU), (RJA), (CORN), (WEAT), (SOYB) Tesla Motors, Inc. (TSLA) Potash Corp. of Saskatchewan, Inc. (POT) The Mosaic Company (MOS) Agrium Inc. (AGU)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.