This year seems to be the year of the windfall. In January, we loaded up on Big Tech (AMZN), (MSFT), which then went ballistic. In February, we doubled up on NVIDIA (NVDA), which then nearly doubled. In March, spotting the shift into commodities, energy, and precious metals we loaded the boat with gold Freeport McMoRan

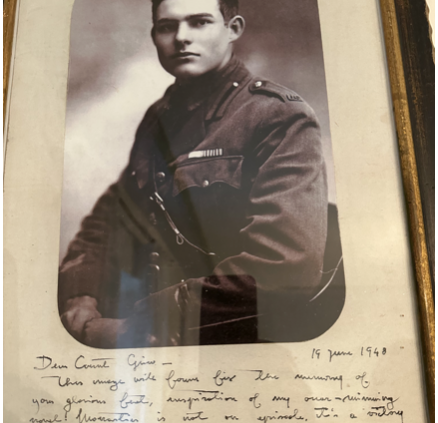

"The greatest glory in living lies not in never falling, but in rising every time we fall." said the great American novelist, Earnest Hemingway.

Global Market Comments April 5, 2024 Fiat Lux Featured Trade: (APRIL 3 BIWEEKLY STRATEGY WEBINAR Q&A), (TSLA), (TLT), (GOLD), (GLD), (WPM), (NVDA), (OXY), (XOM)

Below please find subscribers’ Q&A for the April 3 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Key West, Florida. Q: What’s going on with gold (GLD)? A: Well it’s simple; gold hasn’t moved in a year and people want to rotate out of big tech into something that hasn’t moved. Gold has a

“When less experienced investors are panicking, seasoned investors see opportunities,” said legendary value investor Ron Baron.

Global Market Comments April 4, 2024 Fiat Lux Featured Trade: (A NOTE ON OPTIONS CALLED AWAY), (FCX), (XOM), (OXY), (WPM), (TSLA)

Occasionally, I get a call from Concierge members asking what to do when their short position options are assigned or called away. The answer was very simple: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly. We have the good fortune to

Global Market Comments April 2, 2024 Fiat Lux SPECIAL PRECIOUS METALS ISSUE Featured Trades: (WHAT’S UP WITH GOLD?)

Have you ever held a basketball underwater in a swimming pool and let go? It flies to the upside and pops you in the nose. That is exactly what Gold is doing. After the barbarous relic peaked at $2,080 in May 2023, it traded like an absolute pig, giving up 8.7% in a matter of

Global Market Comments March 29, 2024 Fiat Lux Featured Trade: (A NOTE ON OPTIONS CALLED AWAY), (TLT), (FCX), (XOM), (OXY), (WPM), (TSLA) (FCX)

Occasionally I get a call from Concierge members asking what to do when their short positions options were assigned or called away. The answer was very simple: fall on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly. We have the good fortune to have

Global Market Comments March 28, 2024 Fiat Lux Featured Trade: (HOW TO RELIABLY PICK A WINNING OPTIONS TRADE)

You’ve spent vast amounts of time, money, and effort to become options trading experts. You know the difference between bids and offers, puts and calls, exercise prices, and expiration days. And you still can’t make any money. Now what? Where do you apply your newfound expertise? How do you maximize your reward versus your risk?

Global Market Comments March 27, 2024 Fiat Lux Featured Trade: (WHY BUSINESS IS BOOMING AT THE MONEY PRINTERS) (WHY YOUR OTHER INVESTMENT NEWSLETTER IS SOOO DANGEROUS)

With US deficits exploding, the National Debt racing towards $35 trillion, and the velocity of money (or the turnover) ticking up, one particularly industry is suddenly doing particularly well. Business is fantastic at the money printers. The only problem is that there is no way you can participate in this boom as an individual investor,

Global Market Comments March 26, 2024 Fiat Lux Featured Trade: (THE DEATH OF THE MALL….NOT), (SPG), (MAC), (TCO), (QUANTITATIVE EASING EXPLAINED TO A 12-YEAR-OLD)

We’ve all heard this story before. Malls are dying. Commerce is moving online at a breakneck pace. Investing in retail is a death wish. No less a figure than Bill Gates, Sr. told me before he died that in a decade, malls would only be inhabited by climbing walls and paintball courses, and that was

I know it’s been two years since the US dumped its reflationary policy of quantitative easing. However, Japan and Europe are still pursuing it with a vengeance. So, it’s best to be familiar with what it is. For a quick tutorial please watch this highly insightful and humorous video. Click on the link below to

Global Market Comments March 25, 2024 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE BEST WEEK OF THE YEAR), (PANW), (NVDA), (LNG), (UNG), (FCX), (TLT), (XOM), (AAPL), (GOOG), (MSTR), (BA), (FXY)

You need to have a sense of humor and a strong dose of humility to work in this market. After predicting last week that the market would NOT crash but grind sideways, it then posted the next week of the year. Stocks are actually accelerating their move to the upside. Of course, we got a

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.