Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Boca Raton, Florida on Friday, May 19, 2023. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period. I’ll be giving you my up-to-date view on stocks, bonds, currencies,

There isn’t a company in the world that isn’t playing around with AI right now. Think of the Internet, Microsoft Office, and Netscape Navigator all coming out on the same day. That is what is happening right now with AI. The gold rush has started. So, I instructed my programming staff to do the same.

“You be better off picking people randomly out of the phone book to run the country than relying on the faculty of Harvard,” said Tesla founder Elon Musk.

Global Market Comments May 17, 2023 Fiat Lux Featured Trades: (SOME SAGE ADVICE ABOUT ASSET ALLOCATION) CLICK HERE to download today's position sheet.

Global Market Comments May 16, 2023 Fiat Lux Featured Trades: (LAST CHANCE TO ATTEND THE THURSDAY, MAY 18, 2023 TAMPA FLORIDA STRATEGY LUNCHEON) (LOOKING AT THE LARGE NUMBERS) (TLT), (TBT) (BITCOIN), (MSTR), (BLOK), (HUT) CLICK HERE to download today's position sheet.

Global Market Comments May 14, 2023 Fiat Lux Featured Trades: (MARKET OUTLOOK FOR THE WEEK AHEAD, or I’M GOING ON STRIKE!) (TSLA), (TLT), (AAPL), (BRK/B), (BA), (GOOGL) CLICK HERE to download today's position sheet.

I think it’s time for me to go out on strike. I’m downing my tools, tearing up my punch card, and manning a picket line. I get up at 5:00 AM every morning, well before the sun rises here on the west coast, looking for great low-risk high return trades. But for the last several

Global Market Comments May 12, 2023 Fiat Lux Featured Trades: (THURSDAY, MAY 16, 2023 KEY WEST, FLORIDA STRATEGY LUNCHEON) (MAY 10 BIWEEKLY STRATEGY WEBINAR Q&A), (SCHW), (AAPL), (TLT), (BITCOIN), (FXA), (USO), (FCX), (LLY), (PYPL) CLICK HERE to download today's position sheet.

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Key West, Florida at 12 PM on Tuesday, May 16, 2023. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period. I’ll be giving you my up-to-date view on

Below please find subscribers’ Q&A for the May 10 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV. Q: Why is the market down on such great inflation data? A: Yes, a 4.9% annualized inflation rate is a big improvement from 9.1% nine months ago. The market only cares about the

“Everyone has the brainpower to make money in stocks. Not everyone has the stomach,” said legendary investor and former client Peter Lynch.

Global Market Comments May 11, 2023 Fiat Lux Featured Trades: (A NOTE ON ASSIGNED OPTIONS, OR OPTIONS CALLED AWAY) (TLT), (TSLA) CLICK HERE to download today's position sheet.

Global Market Comments May 10, 2023 Fiat Lux Featured Trades: (FRIDAY MAY 19, 2023 BOCA RATON, FLORIDA GLOBAL STRATEGY LUNCHEON) (WHY THE ROBOTICS INDUSTRY IS RAINING GOLD) (GM), (ISRG), (ABB), (TER), (YASKY), (FANUY), (AMZN), (BMWYY), (KUKAF) CLICK HERE to download today's position sheet.

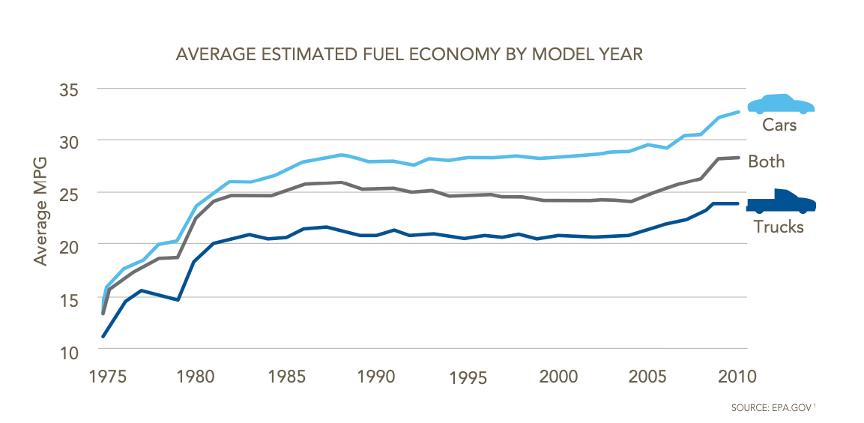

We need to look back to the ancient world to discover the origins of robots. During the industrial revolution, humans developed the structural engineering capability to control electricity so that machines could be powered with small motors. The idea of the humanoid machine was developed in the early 20th century. The first uses of modern

Global Market Comments May 9, 2023 Fiat Lux Featured Trades: (THURSDAY, MAY 18, 2023 TAMPA, FLORIDA STRATEGY LUNCHEON) (HOW TO JOIN THE EARLY RETIREMENT STAMPEDE) CLICK HERE to download today's position sheet.

Global Market Comments May 8, 2023 Fiat Lux Featured Trades: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GOLDEN AGE OF BIG BANKING HAS JUST BEGUN) (JPM), (FRC), (BAC), (C), (WFC), (AAPL), (GOOGL), (META), (AMZN), (TSLA), (NVDA), (CRM), ($VIX), (USO), (TLT), (QQQ) CLICK HERE to download today's position sheet.

The United States is about to change beyond all recognition. Most investors have missed the true meaning of the JP Morgan takeover of First Republic Bank for sofa change, some $10.6 billion. It in fact heralds the golden age of big banking. The US is about to move from 4,000 banks to four, with all

“Fear of missing out is losing to fear of looking stupid,” said Roelof Botha, partner at venture capital firm Sequoia Capital.

Global Market Comments May 5, 2023 Fiat Lux Featured Trade: (THURSDAY, MAY 18, 2023 TAMPA, FLORIDA STRATEGY LUNCHEON) (THE IRS LETTER YOU SHOULD DREAD), (PANW), (CSCO), (FEYE), (CYBR), (CHKP), (HACK), (SNE) CLICK HERE to download today's position sheet.

“Statistics building off an extremely small base is extremely misleading. The recent economic gains look like typos in some of these categories. Let me know when you have gains from the January base and I’ll believe in the recovery, ” said Josh Brown, an investment advisor.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.