Below please find subscribers’ Q&A for the November 16 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California. Q: What do you see Tesla (TSLA) moving to from here until next year? A: Not much; I mean if you’re lucky, Tesla won’t move at all. The problem is Twitter is looking

“Something everyone knows isn’t worth knowing,” said Bernard Baruch, one of the greatest stock traders of all time and advisor to President Franklin Roosevelt.

Global Market Comments November 17, 2022 Fiat Lux Featured Trade: (WATCH OUT FOR THE COMING COPPER SHOCK) (FCX), ($COPPER)

You remember the two oil shocks, don’t you? The endless lines at gas stations, soaring prices, and paying close attention to OPEC’s every murmur? Now we are about to get the 2020’s environmentally friendly, decarbonizing economy version: the copper shock. For copper is about to become the new oil. The causes of the coming supply

Global Market Comments November 16, 2022 Fiat Lux Featured Trade: (THEY’RE NOT MAKING AMERICANS ANYMORE)

Global Market Comments November 15, 2022 Fiat Lux Featured Trade: (LEARNING THE ART OF RISK CONTROL)

Global Market Comments November 14, 2022 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TOP FIVE TECHNOLOGY STOCKS OF 2023), (RIVN), (ROM), (ARKK), (PANW), (CRM), (FXE), (FXY), (FXA), (LEN), (KBH), (DHI), (TLT), (UUP), (META), (TSLA), (BA), (JNK), (HYG), (BRKB), (USO)

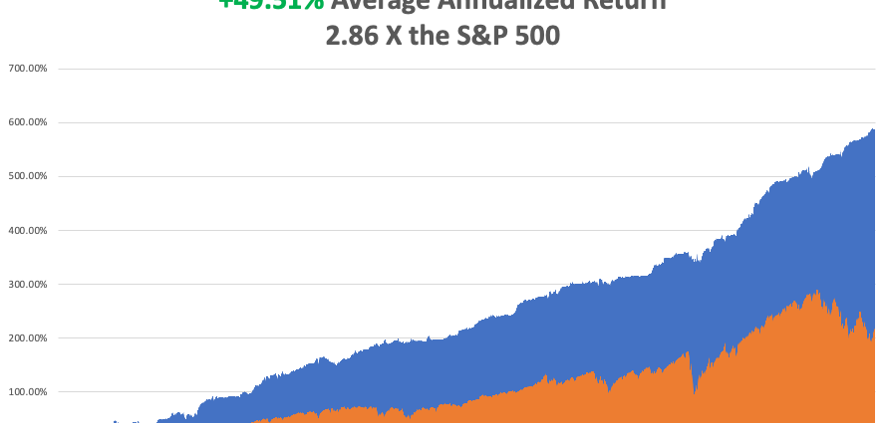

The year 2022 has been driven by rising interest rates, a strong dollar, a weak economy, a bear market in stocks. A massive reversal is about to take place. 2023 will gain the benefit of gale force macroeconomic tailwinds for the right stocks. So far this year, Mad Hedge earned an astounding 77.20% profit cashing

Global Market Comments November 11, 2022 Fiat Lux SPECIAL VETERANS DAY ISSUE Featured Trade: (A TRIBUTE TO A TRUE VETERAN)

Global Market Comments November 10, 2022 Fiat Lux Featured Trade: (TEN MORE TRENDS TO BET THE RANCH ON), (AAPL), (AMZN), (GOOGL), (TSLA), (CRSP), (EDIT), (NTLA)

Global Market Comments November 9, 2022 Fiat Lux Featured Trade: (TESTIMONIAL), (THE DEATH OF PASSIVE INVESTING), (SPY), (SPX), (QQQ), (META), (UUP), (GLD), (INDU)

Global Market Comments November 8, 2022 Fiat Lux Featured Trade: (TESTIMONIAL) (WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Aloha John, Damn, you’re good! I loaded the boat with all your trade alerts. I’m grinning ear to ear. I will contact you soon to discuss investment strategy for fresh piles of cash. I’m thoroughly enjoying Concierge Service and The Bitcoin Letter, and look forward to your mentorship navigating this turbulent market in 2022.

“If we are just going to argue about how much money we can burn to stay warm while the heater is broken, the unemployment rate is going to come down only 1.5% a year," said economist Austin Goolsby.

Global Market Comments November 7, 2022 Fiat Lux Featured Trade: (MARKET OUTLOOK FOR THE WEEK AHEAD, or THE FED GIVETH AND THE FED TAKETH AWAY) (SPY), (TLT), (JNK), (AAPL), (MSFT), (AMZN), (GOOGL), (META)

Now you see it, now you don’t. The rip-roaring rally that started in October, with which we made so much money on, vaporized in a heartbeat. Traders lulled into a false sense of security with happy talk among themselves were suddenly throwing up on their shoes. Fed governor Powell clearly indicated that interest rates will

Global Market Comments November 4, 2022 Fiat Lux Featured Trade: (NOVEMBER 2 BIWEEKLY STRATEGY WEBINAR Q&A), (SPY), (LLY), (TSLA), (GOOG), (GOOGL), (JPM), (BAC), (C), (BRK), (V), (TQQQ), (CCJ), (BLK), (PHO), (GLD), (SLV), (UUP)

Below please find subscribers’ Q&A for the November 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California. Q: The country is running out of diesel fuel this month. Should I be stocking up on food? A: No, any shortages of any fuel type are all deliberately engineered by the

Global Market Comments November 3, 2022 Fiat Lux Featured Trade: (LONG TERM PORTFOLIO UPDATE) (BMY), (AMGN), (CRSP), (LLY), (EEM), (BABA), (GOOGL), (AAPL), (AMZN), (SQ), (TBT), (JNK), (JPM), (BAC), (MS), (GS), (FXA), (FXC), (SLV)

“Innovation has not died at the tech companies, but valuation has,” said Mark Lehman, CEO of JPM Securities.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.