When Netflix (NFLX) announced surprise subscriber growth, triggering a monster 10% pop in the stock, we got the good cop.

When Goldman Sachs (GS) revealed the true cost of their disastrous foray into the retail market, taking the stock 10% we got the bad cop.

Good cop.

Bad cop.

Good cop.

Bad cop.

No wonder the stock market is confused, trapped in the narrowest trading range in recent memory, and taking the Volatility Index ($VIX) down to a subterranean $15.

Welcome to the Q1 earnings season, which is turning out better than expected, but which is befuddling nonetheless. And it may be months before the markets breakout, not until we get an actual interest rate CUT from the Federal Reserve.

The economic data is now steadily weakening across the board. Yet, stocks won’t crash because institutional investors are holding stocks for the end of the year, not for the end of the day. We are so close to the end of this bear market that it is not worth selling, incurring tax liabilities, then buying back in.

As a result, option-implied volatilities are falling off a cliff. (NVDA) plunged from 60% to 40%, while Tesla absolutely cratered from 100% to 50%, including 10% on Friday alone. That’s why most Mad Hedge followers were unable to get into my (TSLA) short strangle unless they moved the strike prices by $10 quickly. This will be the big one that got away.

I never saw the market enter May with a worse setup than this one. It has “SELL” written all over it. That’s why I have flipped from a fantastically aggressive 100% long position in financials to a market neutral 40% long, 40% short trading book.

But I doubt we will fall more than 10%.

If you are a long-term investor, you might as well take a long cruise, as I am planning to do this summer.

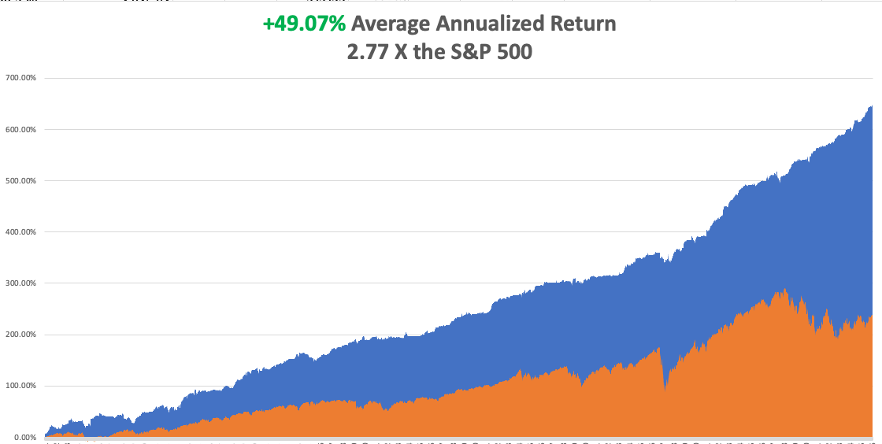

My big bet-the-ranch long in banks and brokers turned out to be the trade of the decade and paid off huge. We are now looking at an incredible +10.52% profit so far in April. My 2023 year-to-date performance is now at an eye-popping +57.14%. The S&P 500 (SPY) is up only a miniscule +11.05% so far in 2023. My trailing one-year return maintains a sky-high +112.63% versus -8.21% for the S&P 500.

That brings my 15-year total return to +654.33%, some 2.77 times the S&P 500 (SPY) over the same period. My average annualized return has blasted up to +49.07%, another new high.

I executed a boatload of trades last week. As April long positions reached max profit in (C), (FCX), (TSLA), (BAC), (IBKR), (MS), and (BRK/B), I rolled the cash into new May positions. Those include longs in the (TLT), (BA), and (TSLA), and shorts in the (SPY), (QQQ), and (TSLA) for a net market neutral position.

The Fed is Looking for “One and Done” with the next 25-basis rate hike on May 3. The regional banking crisis and slowing economic data are doing its work for it.

Cash is Pouring into Money Market Funds, as fears of a stock market correction mount. Yields on 90-day T-bills reached 5.175%, a 16-year high. It’s the 5th week in a row of inflows.

Earnings Season Sees Best Start in a Decade, with 90% beating estimates, albeit low ones. Only 10% (SPY) companies have reported so far with (JPM), out biggest long, leading the charge. Consensus (SPY) earnings are currently $220 a share giving a moderate price/earnings multiple of 18.77X.

Bank of America Rips, on a great earnings report. Customers increased spending by 8% in Q1 according to credit card transactions. The bank expects a mild recession in the second half of this year.

Space X Starship Explodes on Takeoff, setting back Elon Musk’s efforts to colonize Mars. The largest rocket ever built flew 50 miles before self-destructing. It’s clear from watching the video the gyroscope failed, causing the rocket to flip over. The launch was made from the company’s Boca Chica facility. The 400-foot rocket is expected to carry a staggering 100 tons into space.

Tesla Earnings Disappoint, taking the profit margin down to a two-year low. It’s all about market share now, spending profits to maintain global dominance in EVs. The company still made $2.5 billion in Q1. The shares dropped $18 on the news. Tesla still makes money selling EVs while the competition is losing billions.

Existing Home Sales Slide in March, down 2.4% to a 4.44 million annual rate. Some 28% of sales were above the asking price. Inventories remain extremely short at 980,000.

Goldman Sachs (GS) Bombs with an earnings shortfall, including a $470 billion write-off on their Marcus loans. The retreat from retail banking is proving costly. Q1 Revenues fell from $12.79 billion

Chile Nationalizes the Lithium Industry, sending (SQM) and (ALB) into a tailspin. The official reason is to make the industry more efficient. The real reason is so the government can skim off more profits in this exploding industry. Chile is the world’s second largest producer of lithium essential for EV batteries.

Weekly Jobless Claims Hit One-Year High at 239,000, a gain of 11,000. The Fed’s stiff medicine is finally starting to work.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, April 24 at 7:30 AM EST the Dallas Fed Manufacturing Index is out.

On Tuesday, April 25 at 6:00 AM, the S&P Case Shiller National Home Price Index is announced.

On Wednesday, April 26 at 11:00 AM, the US Durable Goods Orders are printed.

On Thursday, April 27 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get an update on Q1 US GDP.

On Friday, April 28 at 8:30 AM, the Personal Income & Spending is released.

As for me, someone commented that I walk kind of funny the other day, and the memories flooded back.

In 1975, The Economist magazine in London heard rumors that a large part of the population was getting slaughtered in Cambodia. We expected this to happen after the fall of Vietnam, but not in the Land of the Khmers, historically a kind and gentle people. So my editor, Peter Martin, sent me to check it out.

Hooking up with a right-wing guerrilla group financed by the CIA was the easy part. Humping 100 miles in 100-degree heat wasn’t. Carrying 20-pound cans of ammo only made the work harder.

We eventually came to a large village made of palm fronds that was completely deserted. Then my guide said, “Over here.” He took me to a nearby cave. Inside were the bodies of over 1,000 women, children, and old men contorted in tortured shapes that had been there for months.

I’ll never forget that smell.

With evidence and plenty of pictures in hand, we started the trek back. Suddenly, there was a large explosion and the man 20 yards in front of me vaporized. He had stepped on a land mine. Then the machine gun fire opened up.

It was an ambush.

I picked up an M-16 to return fire, but it was bent, bloody, and unusable. I picked up a second assault rifle and fired until it was empty. Then everything suddenly went black. A mortar shell had landed nearby.

I woke up days chained to a palm tree, covered in shrapnel wounds, a prisoner of the Khmer Rouge. Maggots infested my wounds, but I remembered from my Tropical Diseases class at UCLA that I should leave them alone because they only ate dead flesh and would prevent gangreen. That class saved my life. Good thing I got an “A”.

I was given a bowl of rice a day to eat, which I had to gum because it was full of small pebbles and might break my teeth. Farmers loaded their crops with these so the greater weight could increase their income. I spent my time pulling shrapnel out of my legs with a crude pair of pliers.

Two weeks later, the American who set up the trip for me showed up with cases of claymore mines, rifles, ammunition, and antibiotics. My chains we cut and I began the long walk back to Thailand.

It’s nice to learn your true value.

Back in Bangkok, I saw a doctor who attended to the 50-caliber bullet that grazed my right hip. One inch to the right and I wouldn’t be writing this today. It was too old to sew up so he decided to clean it instead. “This won’t hurt a bit,” he said as he poured in hydrogen peroxide and scrubbed it with a stiff plastic brush.

It was the greatest pain of my life. Tears rolled down my face.

But you know what? The Economist got their story and the world found out about the Great Cambodian Genocide, where 3 million died. There is a museum in Phnom Penh devoted to it today.

So, if you want to know why I walk funny, be prepared for a long story. I still set off metal detectors.

Doing Research in Asia

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader