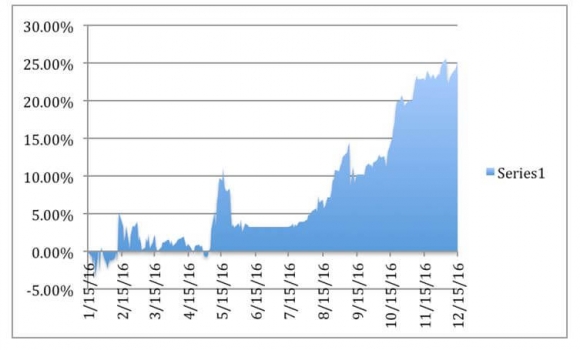

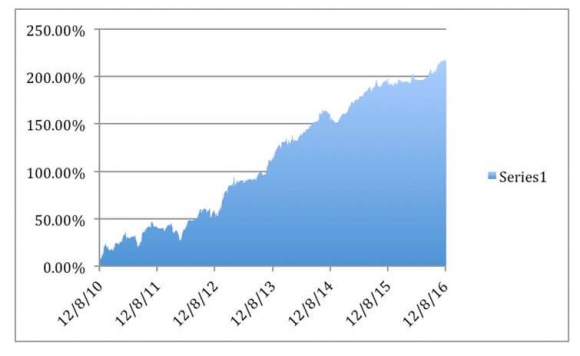

You are in the safe zone now, with your trading portfolios up more than 25% on the year, if you followed every one of my Trade Alerts to the letter.

I know a lot of you made much more.

I will be making a beeline for my beachfront estate at Incline Village on the pristine shores of Lake Tahoe and work from there for the next two weeks.? That is, if I can battle my way through the Sacramento traffic.

The car will be packed with Christmas presents, ski equipment, snowshoes, board games (yes, ?Qi? is a word in Scrabble), my backpack, and food for 12 guests for a week.

After working 12-hour days six days a week all year to make you wealthier and wiser, please read my last research piece of the year below which is written tongue in cheek.

And what a year it has been. Over 26 trips and 40 speaking engagements in 20 countries. I managed to log 75,000 flight miles, a distance of roughly three times around the world.

Some 250,000 frequent flier miles were posted to my various accounts. Whenever I board Virgin Airlines, the crew lines up at attention and snaps off a brisk salute. Needless to say, first class is the Land of Milk and Honey for me.

The research I gathered was enough to publish 260 daily letters totaling 350,000 words. That is about half the length of Tolstoy?s War and Peace, but then Tolstoy had to pen his tome with a quill and ink, not Word for Windows.

I also managed to pump out 90 trade alerts with a success ratio of 80%.

According to the email traffic, many of you did extremely well. If you are into triple digits, please send me an email. I would love to receive a testimonial from you.

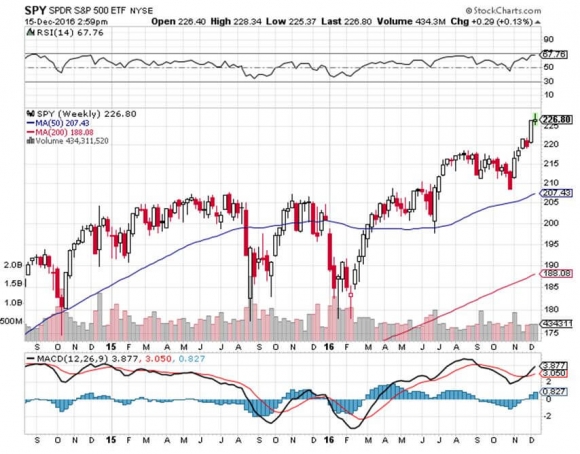

And this was a year that many professionals describe as the most difficult of their careers, what with the New Year meltdown, Brexit, and the presidential election from hell.

You know when they are advertising power tools and Pajamagrams on CNBC, it is time to get out of Dodge. I?m taking the hint.

Over the next two weeks, I will consume a suitcase full of research and, after much cogitation and contemplation, write my 2017 Annual Asset Class Review which will be published on Thursday, January 5th.

I will also be rethinking my business model, so if any of you have suggestions on how I can improve this service, send me an email at madhedgefundtrader@yahoo.com. Put ?Suggestions? in the subject line. My intention is to always keep improving the product so I can continue to under promise and over deliver my services.

A nostrum of Silicon Valley is that whenever you think you are finished, you?re finished.

Please forgive me in advance if I take a few hours catching some ?big air? off of Squaw Valley?s treacherous double X black runs.

If you have any trading questions, please seek me out on the northern section of the Tahoe Rim Trail around 11,000 feet where I will be snowshoeing my way around the lake in subzero temperatures.

I will probably be the only guy up there so you can just follow the first set of tracks you find. That is, if hungry mountain lions don?t get you.

I?ll have my Bowie knife and an industrial sized can of bear spray so I?ll be fine. As for you, I?m not so sure. This is what I do during my winter leisure time.

During my absence, I will be posting some of my favorite pieces from the last year which gave insights on how markets would play out over the coming decades as well as a lot of basic financial educational pieces.

I have thousands of new subscribers who will be reading these for the first time. Many legacy readers may have missed them the first time around or forgotten the data because they are older than me.

I hope you find them another useful step towards your education about the global financial markets. Charts and data have been updated to make them relevant.

Finally, I want to thank you all for an incredible year. I rode the Orient express from London to Venice. I lived in the lap of luxury at the Hotel Cipriani in Venice and at Raffles in Singapore.

And I managed to haggle the merchants in Tangier?s historic bazaar down on the price of the most elegant handmade carpets.

I had the opportunity to meet heads of state, CEOs, top money managers, our nation?s military leaders, and even a Maori chieftain.

I had the pleasure of flying the length of the Grand Canyon at low altitude, weaving my way along the Colorado River. And, oh yes, I made it to the top of the Matterhorn one more time.

I really did get to rub shoulders with the high and mighty who run the world and harvest their pearls of wisdom which I passed on to you.

I logged 200 hours as a pilot flying to such diverse locations as the Great Barrier Reef in Australia and Honda?s loading docks in San Francisco.

I never minded the horrendous jet lag, the well-deserved hangovers, or the traffic jams in China. Your subscriptions to my products, your support of my research, and your endless compliments made it all worth it.

I always tell people that I am not in this for the money, and it?s true.

Not a day goes by that I don?t receive an email from a grateful subscriber who claims that my research has helped them pay off their mortgage, fund a kid?s college education, or pay for a parent?s uninsured operation or a child?s chemotherapy.

Subscribers tell me I am teaching them to fish, thus, sparing them from the frozen tasteless kind they sell at Safeway which they must wait in line for to pay inflated prices. You can?t buy that kind of appreciation, not for all the money in the world.

It certainly beats the hell out of spending my retirement scoring a 98 on the local golf course. And I?ll never beat Tiger Woods, no matter how many blonds I date.

To leave you all in the Christmas spirit, I have posted a video and pictures of the Polar Express in Portland, Oregon.

Taking my 88-year-old mother for a ride has become an annual event, and it is a thrill for my younger kids as well. To watch a short video of one of the largest steam engines in the world, please click here at http://www.madhedgefundtrader.com/polar-express-2016/?

Merry Christmas and Happy New Year to All!

Good Trading in 2017!

John Thomas

The Mad Hedge Fund Trader