Global Market Comments

October 21, 2016

Fiat Lux

Featured Trade:

(OCTOBER 26TH LIVE GLOBAL STRATEGY WEBINAR),

(DEFLATION IS STILL ACCELERATING),

(USO), (CORN), (SOYB), (WEAT), (DBA),

(THE WORST TIMED TRADE OF ALL TIME),

(GLD)

United States Oil (USO)

Teucrium Corn ETF (CORN)

Teucrium Soybean ETF (SOYB)

Teucrium Wheat ETF (WEAT)

PowerShares DB Agriculture ETF (DBA)

SPDR Gold Trust (GLD)

A number of friends have recently approached me asking the best way to refinance their home.

Should they be ultra conservative and lock in a historically low 3.6% conventional fixed rate 30-year loan?

Or should they throw caution to the wind and be seduced by a 5/1 ARM (adjustable rate mortgage) available for half the monthly payment?

I tell them that the answer is obvious.

I ask them to consider the average real wage gain for US blue-collar workers over the past 30 years which happens to be zero.

If my answer puzzles them, I then direct them to the recent statement by the Saudi Oil Minister, who says he is happy with prices at the current $50 a barrel level.

If they then appear perplexed, I point out to them that US ethanol production just surpassed a once unimaginable 1 million barrels a day, a new all time high.

Corn prices have fallen so far that it is cheaper to burn food than to eat it.

At this point, the expression on my friends? faces is now one of complete befuddlement. They start checking their watch, their iPhone for any new text messages, look for new tweets, or updates to their Facebook account.

Now my friends are utterly clueless. Wasn?t this supposed to be a conversation about homes, loans, and interest rates.

If they still don?t get it, I then spell it out more clearly, with the appropriate soaring logic and literary flourishes.

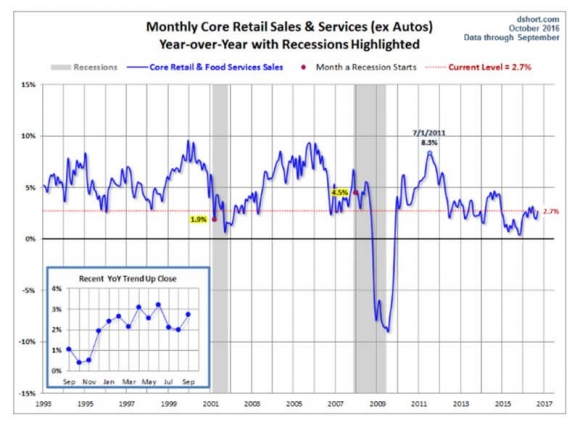

The bottom line for all of these disparate data points is that deflation is accelerating.

The continuing collapsing cost of many commodities is still driving prices relentlessly downward.

Adding fuel to the fire is the relentless march of technology, which is replacing expensive humans with cheap machines, further lowering costs.

The offshoring of jobs, once a major driver of the ongoing price collapse, is barely a factor anymore.? Rapidly rising wages are steadily pricing Chinese labor out of the market.

Sure, there has been some modest cost increases on the US wage front with the new minimum wage movement. Many cities like Seattle and San Francisco have already mandated wage hikes from $8 to $15 an hour.

But these only apply to a tiny fraction of the total job market.

This will only bring higher prices for those who eat fast food cheeseburgers, tacos, and burritos, which my doctors have expressly forbidden me to consume.

What this means is that interest rates are going to remain far lower for longer than even the Federal Reserve can imagine.

Sure, we will get a 25 basis point rise in December, followed by a second one in 2018. But that may be it.

As unbelievable as it may seem, we might go into the next recession WITH INTEREST RATES ALREADY CLOSE TO ZERO!

All of this makes my friends? choice about how to refinance their home a complete no brainer.

Take the 5/1 ARM, NOW!

Chances are that we will enter a recession sometime in the next five years, before the first five-year interest rate reset. Then they can refinance again, probably at an interest rate even lower than the subterranean one they are getting now.

How low can home mortgage rates go?

One of my Latvian readers informed me that with Euro interest rates at -0.40, the interest rate on his 5/1 ARM home loan is 1.9%.

By the way, real estate in Latvia is booming.

They can also reconsider the 30-year fixed rate at that time, as I expect inflation to return with a vengeance sometime in the 2020s.

More than a few homeowners have already figured out that the only way to afford sky-high housing prices in San Francisco and New York is to finance them with the ultra low giveaway cost of money.

The only pre conditions for this plan to work is for them to keep their jobs, the payments on time, and their credit rating up.

At this stage, my friends thank me effusively and rush off to call their loan brokers.

People who have known me a long time are used to me making incredible, spectacular, out-of-consensus long-term forecasts which eventually come true.

Gold is going from $34 to $1,000 an ounce (1972).

Of course the Nikkei Average is about to rise tenfold from Y3,500 to Y35,000 (1982).

Dow 10,000 by 2,000? You betcha (1992)!

Why can?t oil collapse from $100 to $50 if we make peace with Iran (2014)?

Consider it all part of being Mad.

So, Where?s the Inflation?

$50 Oil? No Problem!

Now that I see gold closing today at $1,269 today I am reminded of one of the worst calls I have seen in my 50-year trading career.

One of the great asset management blunders of all time has to be the European Community?s decision to sell its gold reserves in the wake of the launch of the Euro in 1998.

The decision led to the fairly rapid sale of 3,800 metric tonnes of the yellow metal at an average price of $280/ounce, reaping about $56 billion, according to the Financial Times.

The ECB almost perfectly picked the bottom of the market.

Today, the stash would be worth $253 billion. On top of this, the Swiss National Bank is poorer by $60 billion, after offloading 1,550 tons of the barbaric relic.

The large scale, indiscriminate selling depressed gold prices in the early part of the last decade, and made the final bottom of a 20-year move down.

It is a classic example of what happens when bureaucrats take over the money management business, ditching the best performing investment on the eve of a long-term bull market.

Where did all that gold go? To hedge funds, gold bugs, and inflationistas of many stripes, despite the fact that long dreaded price hyperinflation never showed.?

The good news for gold bugs is that these reserves are largely drawn down now, and future selling will trail off in the years ahead.

The shrinking supply can only be positive for prices.

?Amazon?s Jeff Bezos IS Dr. Evil. He intends to take over the world. He WILL succeed.? said Michael Pachter, a technology analyst at Wedbush Securities.

Global Market Comments

October 20, 2016

Fiat Lux

Featured Trade:

(PLEASE BRING BACK QE!),

(DXJ), (HEDJ), (UUP), (SPY), (TLT),

?(FXY), (FXE), (GLD), (USO), (CU), (UNG),

(NOTICE TO MILITARY SUBSCRIBERS)

WisdomTree Japan Hedged Equity ETF (DXJ)

WisdomTree Europe Hedged Equity ETF (HEDJ)

PowerShares DB US Dollar Bullish ETF (UUP)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen ETF (FXY)

CurrencyShares Euro ETF (FXE)

SPDR Gold Shares (GLD)

United States Oil (USO)

First Trust ISE Global Copper ETF (CU)

United States Natural Gas (UNG)

You wanted clarity in understanding the current state of play in the global financial markets?

Here?s your #$%&*#!! clarity.

But maybe that is the cabin fever talking, as I have been cooped up in my Tahoe lakefront estate for a week, engaging in deep research and grinding out Trade Alerts, devoid of any human contact whatsoever.

Or, maybe it?s the altitude.

I did have one visitor.

A black bear broke into my trash cans last light and spread garbage all over the back yard. He then left his calling card, a giant poop, in my parking space. Is there a subtle message there?

Judging by the size of the turds, I would say he was at least 600 pounds. This is why you never take out the trash at night in the High Sierras.

Ah, the delights of Mother Nature!

We certainly live in a confusing, topsy-turvy, tear your hair out world this year. Good news is bad news, bad news worse, and no news the worst of all.

The biggest under performing week of the year for stocks is then followed by the best. Net net, we are absolutely at minimal movement, and lots of clients complaining about poor returns on their investment.

I tallied the year-on-year performance of every major assets class and this is what I found.

+18.05% - Gold (GLD)

+16.65% - Japanese Yen (FXY)

+12.68% - Natural Gas (UNG)

+10.71%? - Bonds (TLT)

+10% - My House

+6.59% - Stocks (SPY)

+4.76% - Hedged European Stocks (HEDJ)

+1.44% -? Copper (CU)

0% - Euro (FXE)

0%? - Oil (USO)

-2.69% - US dollar Basket (UUP)

-10.20% - Hedged Japanese Stocks (DXJ)

There are some sobering conclusions to be drawn from these numbers.

Gold (GLD) has been the top performing asset of 2016.

It is followed by the Japanese yen (FXY), the currency with the world?s worst long term fundamentals.

Stocks came in at the middle of the pack, and with dividends, post at 8.60%. Not bad.

Quite honestly, you only needed one trade this year to outperform 99% of active managers net of fees, and that was to buy Amazon (AMZN).

My former Morgan Stanley colleague, Jeff Bezos,? has seen the shares of his creation rise an eye popping 197%. Blame it all on artificial intelligence.

If you missed Amazon for valuation reasons, you also could have run the bell with Facebook (FB) (+25%),? Apple (AAPL) (12.5%), or Alphabet (GOOG) (+6.1%).

Subscribers to the Diary of a Mad Hedge Fund Trader can?t help but know and love these ticker symbols.

They?ll notice that our long plays were found among the assets classes with the best performance, while our short bets populated the losers.

The problem with that is most financial advisors are not permitted to place client funds in the sort of inverse or leveraged ETFs that most benefit from these kinds of moves (like the Yen (YCS), Euro (EUO), and Oil (DUG)).

That left them reading about the success of others in the newspapers, even when they knew these trends were unfolding (through reading this letter).

How frustrating is that?

What was one of my best investments of 2016?

My San Francisco home, which has the additional benefits in that I get to live in it, have a place to stash all my junk, and claim big tax deductions (depreciated home office space, business use of phone, blah, blah, blah).

Of course, I do have the advantage of living in the middle of one of the greatest technology and IPO booms of all time. Every time one of these ?sharing? companies goes public, the value of my home rises by a few hundred grand.

The real problem here is that investing since the end of the Federal Reserve?s quantitative easing program ended a year ago has become a real uphill battle.

While the government was adding $3.9 trillion in funds to the economy, we traders enjoyed one of the greatest free lunches of all time. It made us all look like freakin? geniuses!

Heaven help us if they ever try to actively unwind some of that debt!

Janet has promised me that she isn?t going to engage in such monetary suicide. So far, natural attrition has taken the Feds bond holdings down to only $3.4 trillion.

The Fed is continuing with Ben Bernanke?s plan to run all of their Treasury bond holdings into expiration, even if it takes a decade to achieve this.

And with deflation accelerating, the need for such a desperate action is remote.

Still, one has to ponder the potential implications.

It all kind of makes my own 20% Trade Alert gain in 2016 look pretty good. If added to the list above, it would be the best performing asset class of all.

But I don?t want to boast too much. That tends to invite bad luck and losses which I would much rather avoid.

What! No QE?

Global Market Comments

October 19, 2016

Fiat Lux

Featured Trade:

(HAVE WE BECOME A NATION OF COUCH POTATOES?),

(NFLX), (M), (AMZN),

(THE ?INTRODUCTION TO RISK MANAGEMENT? TRAINING VIDEO IS POSTED),

(DECODING THE GREENBACK)

Netflix, Inc. (NFLX)

Macy's, Inc. (M)

Amazon.com, Inc. (AMZN)

Three sets of data crossed my screen today that blew my mind.

Retail Sales are clearly in a secular long-term decline. Indeed, Macy?s (M) announced only a few months ago that it is closing 100 of its 769 stores, sending its stock soaring.

Restaurant revenues dropped 3.3% YOY.

However, Netflix (NFLX) earnings rocketed, sending the shares up a ballistic 15% in minutes.

Are these numbers revealing a major new trend in our society? Are we soon to have our every need catered to without lifting a finger?

Have We Become a Nation of Couch Potatoes?

After spending weeks preparing a major research piece for a private client on artificial intelligence, I would have to say that the answer is an overwhelming ?Yes!?

Artificial intelligence, or AI, is far more pervasive than you think. Half of all apps now rely on some form of AI, and within five years, all of them will.

Within a decade, AI will cure cancer and most other human maladies, drive our cars, decide our elections, and do our shopping.

As a result, the earnings and share prices of its most active practitioners are rocketing. Look no further than the dominant player, Amazon (AMZN), whose share are now up a staggering 193% since January.

AI has become the leading market theme for 2016.

People my age all remember George Jetson, the space age cartoon character, who only had to work an hour a day because machines did the rest for him.

The modern incarnation of his ultra light workweek will be far darker and more sinister.

Instead of a one-hour day, it is far more likely that one person will keep a full time eight hour a day job, while another seven unfortunates become full time unemployed.

By the way, I am determined to be that one guy with a job. So should you.

Indeed, I am increasingly coming across dire predictions that 30% of all jobs will disappear within ten years.

I?m sure that they will. The real question is whether that 30%, or more, will be replaced by jobs yet to be invented. I bet they will. Evolution and creative destruction are now happening on fast forward.

After all, some 25% of the professions listed on the Department of Labor website did not exist a decade ago.

SEO manager? Concert social media buzz creator? Online affiliate manager? Solar panel installer? Reputation defender?

What does the stock market do in this new dystopian society? It goes through the roof. After all far fewer workers creating a greater output generate much larger earnings that send share prices soaring.

It is all a crucial part of my ?Golden Age? scenario for the 2020s. For more on this, purchase my book by clicking Stocks to Buy for the Coming Roaring Twenties.

Having said all that, I think I?ll go binge watch Netflix?s tropical film noir Bloodline. I hear it?s hot.

Downton Abbey is over, and Game of Thrones and House of Cards don?t restart until next year.

If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill.

?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.?

The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.?

The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction.

An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds.

Thank freemason Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s historical adventure movie ?National Treasure.?

The balanced scales in the seal are certainly wishful thinking and a bit quaint if they refer to the Federal budget.

Study the buck closely, because there are soon going to be a lot more of them around, thanks to the efforts of former Fed Chairman, Ben Bernanke.

What Did You Really Mean, Ben?

What Did You Really Mean, Ben?

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.