Now that you know how to make money in the market, I’m going to teach you how to hang on to it. There is no point in booking winning trades only to lose money by making careless beginner’s mistakes. So today, I am going to talk about risk control.

The first goal of risk control is to conserve whatever capital you have. I tell people that I am too old to start over again as a junior trader at Morgan Stanley if I lose all my money. With my attitude, nobody would hire me anyway. So, I’m pretty careful when it comes to risk control.

The art of risk control is to make sure your portfolio is profitable, no matter what happens to the market. You want to be a winner, whether the market goes up, down, or sideways. This is what I do.

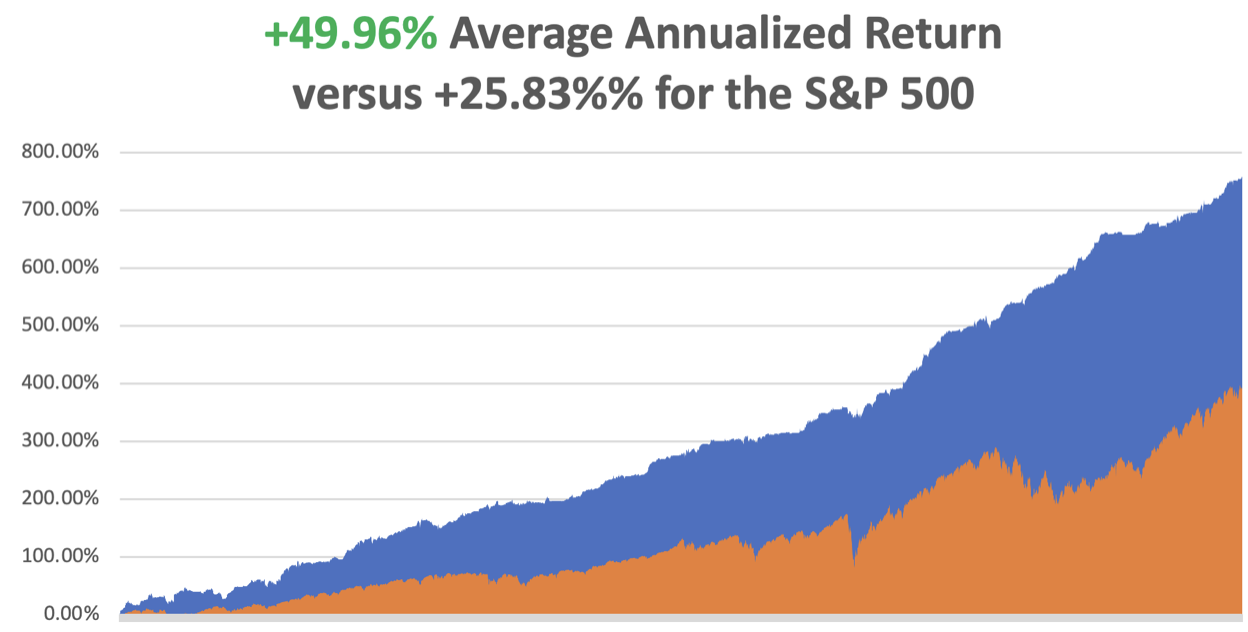

Remember, we are not trying to beat an index here. Our goal is to make actual dollars at all times, to keep the P&L chart always moving from the lower left to the upper right. You can’t eat relative performance, nor can you use it to pay your bills.

The second goal of a portfolio manager is to make your portfolio bomb-proof. You never know when a flock of black swans is about to alight on the market, or a geopolitical shock comes out of the blue causing markets to crash.

The biggest mistake I see beginning traders make is that they are in too much of a hurry to get rich. As a result, they make too much money too soon. I can’t tell you how many times I have heard of first-time traders losing all their money on their first trade, well before they got a handle on the basics.

I’m usually right 80% to 90% of the time (this year it’s 95%). That means I’m wrong 10% to 20% of the time. If you bet the ranch on one of my losing trades, you’ll get taken to the cleaners. Never bet the ranch.

If you do, you are turning a calculated list into random risk, or throwing darts at a dartboard and hoping for the best. It is akin to buying a lottery ticket. I often tell clients they have gambling addictions. Make sure you’re not one of them. You can’t trade yourself back from zero with no money.

If you can master the skills I'm teaching you, you can make a living at this FOREVER! So, what’s the hurry? As my old trading mentor used to tell me, the late Barton Biggs of Morgan Stanley, “Invest in haste, repent in leisure,” a time-tested nostrum that is always true in this business.

I recommend that you use NO real money on your first few trades. Start with paper trading only. All of the online trading platforms offer wonderful tools that allow you to practice trading before you try the real thing. If you lose in their “pretend money”, no harm, no foul. They don’t want you to go broke either. Broke customers don’t pay commissions. They also sue.

The more time you spend learning to trade, the more money you will get out of it. Remember, work in, money out. Spend at least an hour or two getting to know your own trading platform well.

Once you start trading will real money it will become a totally different experience. Your heart rate steps up. Your hands get sweaty. You start checking your watch. It’s a lot like going into combat. In fact, combat veterans make great traders, which is why the military recruits so actively from the military. I think all these instincts trace back to our Neanderthal days when our main concern was being chased by a saber-toothed tiger.

The time to learn a trading discipline is NOW. All of a sudden, your opinions, your ego, and your savings are on the line. It’s crucial for you to always start small when using real money.

That way, making a beginner’s mistake, like confusing “BUY” and “SELL” (I see it every day) will only cost you a cup of coffee at Starbucks, and not your kid's college education, your house, or your retirement. It won’t take long for you to grow from one contract to thousands, as I have done myself for many years.

It’s all about finding your comfort level and risk tolerance. You never want to have a position that is so large that you can’t sleep at night, or worse, call me in the middle of the night and ask what to do with it. My answer is always the same. Cut your position in half. If you still can’t sleep, cut it in half again.

I make a bold prediction here. The more experience you gain, the faster your risk tolerance goes up.

I’ll give you one more piece of advice. Take your broker's technical support phone number and paste it to the top of your computer monitor. You don’t want to go look for it when you can’t figure out how to get out of a position, or your platform breaks. These are machines. It happens. As they teach in flight school, it’s not a matter of if but when a machine breaks.

There’s one more thing. When you’re ready to commit real money, don’t forget to take your account off of paper trading. The profits you make there can’t be spent.

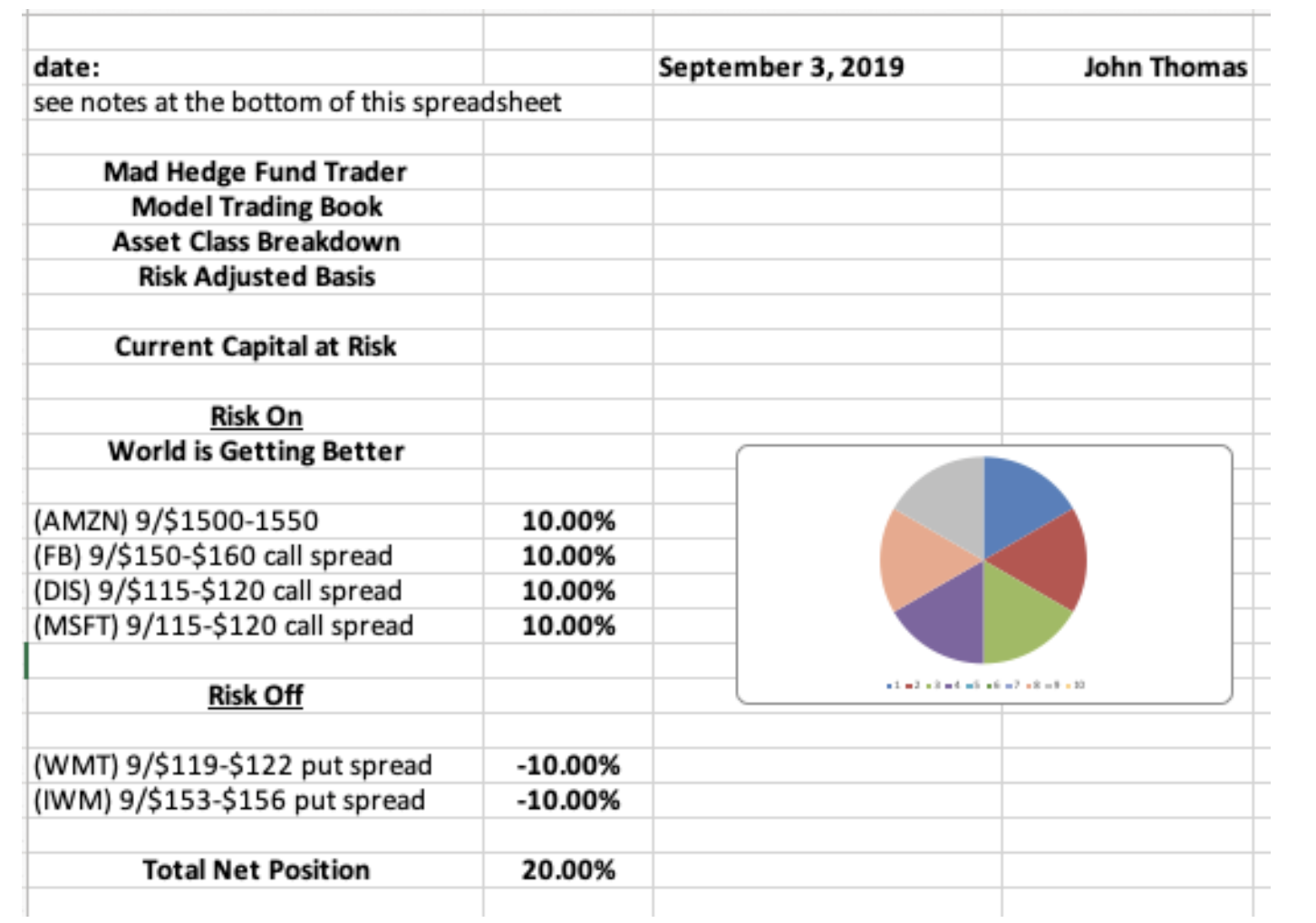

Risk management is an important part of the position sheet I update every day.

Take a look below at a past position sheet I sent out during sharply rising markets.

The important thing to look at here is my long/short balance. On the left is the position name and on the right is the position weighting. I usually run 10% positions so I don’t have all my eggs in one basket. Maybe twice a year, I’ll run a 20% position in a single stock, and once a year I’ll have a 30% weighting. Above that, I start to lose sleep.

I have further subdivided the portfolio into “RISK ON” and “RISK OFF.” “RISK ON” means the world is getting better, while “RISK OFF” means the world is getting worse. The long positions have positive numbers, while the short positions have negative ones.

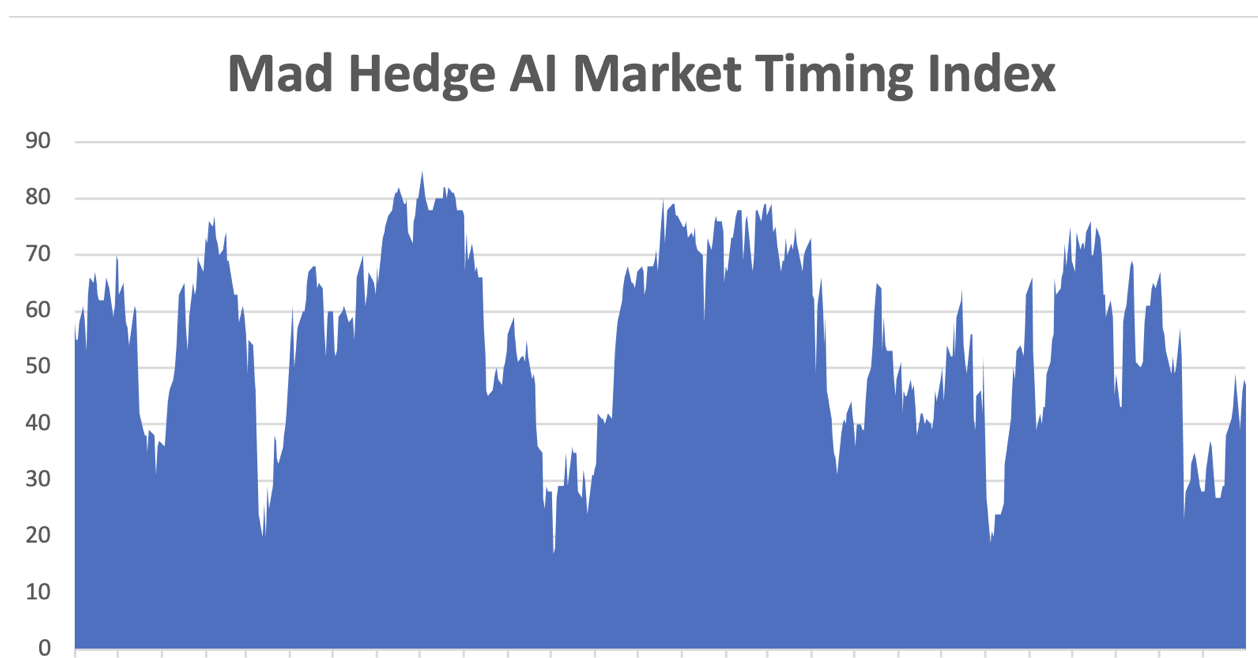

I like to balance “RISK ON” and “RISK OFF” to remove overall market risk from the portfolio. When markets are rising, I turn positive. When markets are falling, I tilt negative. At the bottom, I have my total net exposure. On this particular day, I was running 60% in long and 20% in shorts, for a total net position of 40% long. This is an aggressively bullish portfolio.

When I’m bullish, the net position is positive. When I’m bearish the net position is negative. When I have no strong views, the net position is zero. That way, if nothing happens you still get to rake the money in.

I have no positions at all only a few days a year. I only play when the risk/reward is overwhelmingly in my favor, and sometimes that is just not possible.

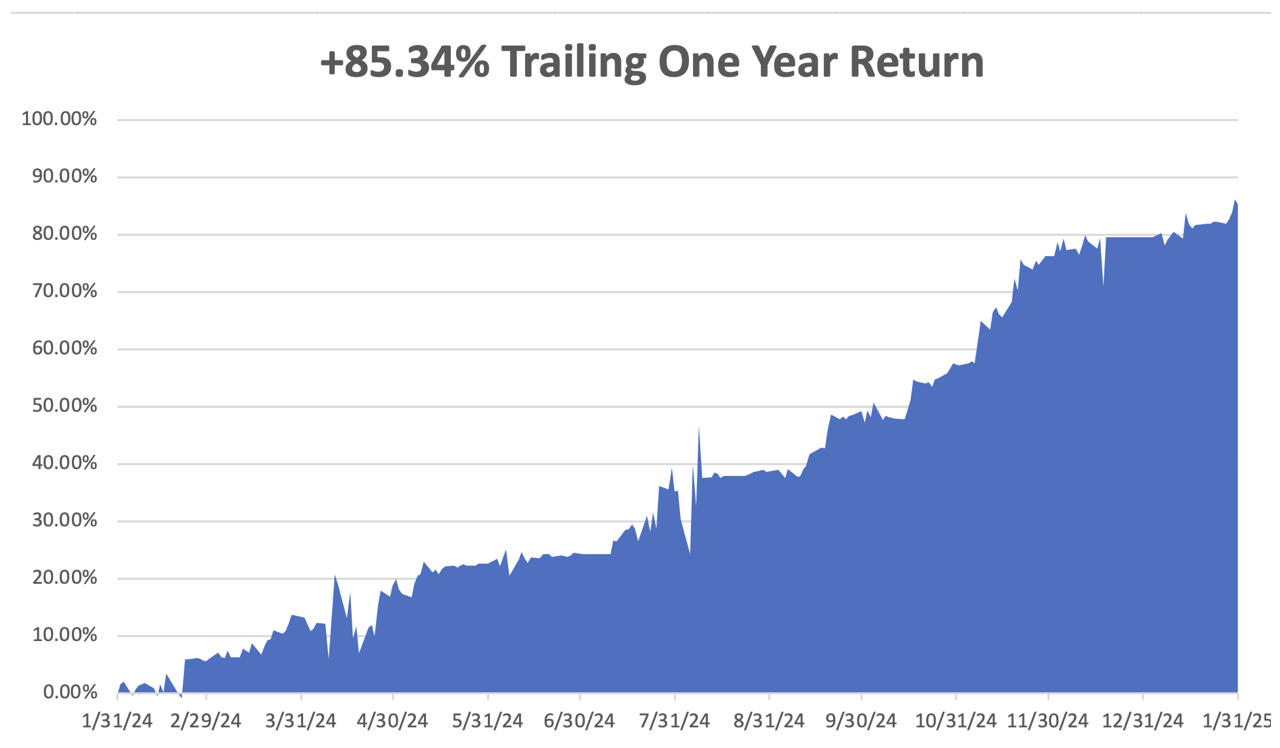

One more warning to the wise. There are literally hundreds of gurus out there marketing services promising 100% a year, if not 100% a month, or even 100% a day. They are all fake, created by 20-year-old marketing types who have never worked in the stock market, or even traded. Unfortunately, I work in an industry where almost everyone else is a crook.

I have worked in the markets for more than 50 years and have seen everything. Ray Dalio is the top-performing hedge fund manager in history and he only averages 35% a year. The number of real traders who are right more than 80% of the time you can almost count on one hand. If returns sound too good to be true, they never are.

I want to offer special caution about naked put shorting strategies which are promoted by 90% of these letters. This is where a trader sells short a put position without any accompanying hedge, hence the word “naked.” This is an unlimited-risk position.

You might take in a $1 premium with this approach, but if the market turns against you, and implied volatilities go through the roof, your losses could balloon exponentially to $100 or more, wiping you out. The newsletters recommending these have absolutely no idea when or if this is going to happen.

I call this the “picking up the pennies in front of the steamroller strategy.” No professional trader worth his salt will put money into it. It is banned by most investing institutions. And only a few brokers will still let you do this, and then only with 100% margin requirements, because when losses exceed 100% of capital, they’re left carrying the bag.

Many of those strategies you see being hawked online look great on paper but can’t actually be executed. In other words, you just paid thousands of dollars for a service that is utterly useless. Sounds like a “No Go” to me.

Stop losses are an important part of any trading strategy. No one is right 100% of the time. If they claim so they are lying. The best way to avoid a big loss is to take a small one.

There are many possible places to use stop losses. I use 2% of my total capital. If I start to lose more than that I am out of there. It’s easy for me to do this because 90% of the time the next trade will be a winner and I’ll make back all the money I just lost.

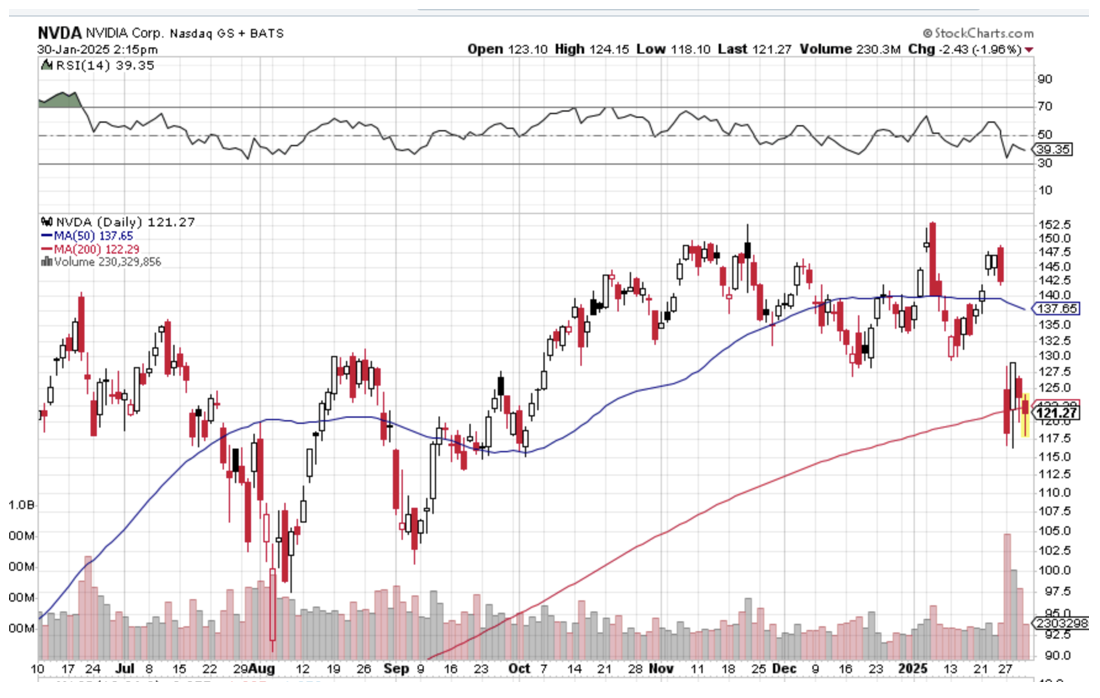

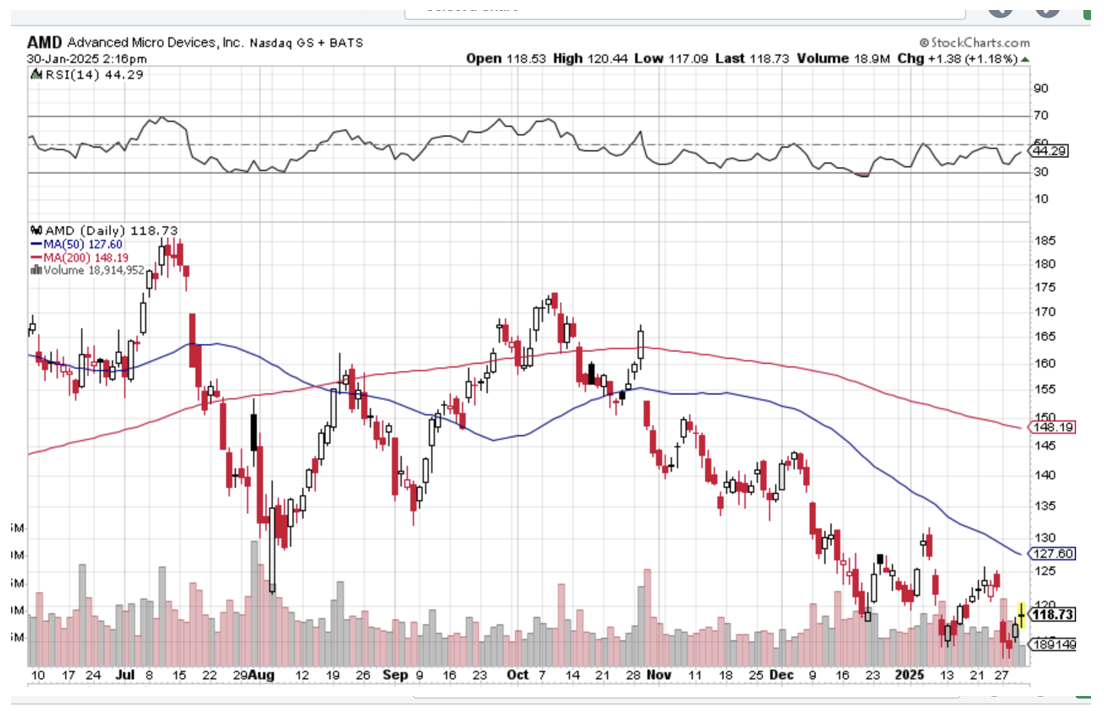

Others use a 10% decline in the underlying stock as a good arbitrary point to limit losses. Others rely on Fibonacci levels (I’ll get to him later). Many traders rely on key moving averages, like the 50-day or the 200-day.

The problem with this is that high-frequency traders have access to the same charting data as you do. They’ll program their algorithms to quickly take a stock through your stop loss level, buy your stock for cheap, and then take it right back up again to book a quick profit. You are left with a “SELL” confirmation in your inbox and no position in a rising market. No wonder people think Wall Street is rigged.

Another concept is the “trailing stop”. That’s when after an initial rise, you place a stop-loss order at your cost. That way you CAN’T lose money. This is known as “playing with the house's money.” This approach has one shortfall. You can’t place stop losses in the options market that are executed automatically. The same is true for options spreads.

In this case, you use what is known as a “pocket stop loss” where you set your mental level on when to get out. Also, these are not automatic, they do establish a trading discipline. Caution: You can’t execute a pock-stop loss when you’re playing gold or on a one-week cruise in the Caribbean.

So, there you have it. By managing your risk prudently, you can tip the risk/reward balance in your favor.

I hope this helps.