Global Market Comments

October 8, 2024

Fiat Lux

Featured Trade:

(OCCIDENTAL PETROLEUM LEAPS),

(OXY)

Global Market Comments

October 8, 2024

Fiat Lux

Featured Trade:

(OCCIDENTAL PETROLEUM LEAPS),

(OXY)

Trade Alert - (OXY) – BUY

BUY the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $0.80 or best

Opening Trade

10-8-2024

expiration date: January 16, 2026

Number of Contracts = 1 contract

China certainly brought out a big bazooka with its massive stimulus package last week. If this one proves inadequate, they can bring out many more. China is no longer the poor country I knew 50 years ago. For a start, they own $869 billion worth of US Treasury bonds.

And what is the best leverage China plays out there?

Oil.

It just so happens that energy is virtually the only cheap sector in the stock market and the worst stock market performer of 2024.

Oil consumption in China amounted to 16.6 million barrels per day in 2023, up from 15 million barrels daily in the prior year. That is 17.2% of the 96.4 million barrels in global oil production last year. Between 1990 and 2023, figures increased by more than 14 million barrels per day, up from 1 million barrels a day.

It has been China’s lagging economy that has dragged down the price of West Texas Intermediate Crude by 31%, from $94 a barrel to $65. China has published GDP growth figures this year of 5%, but most who know China well believe the real figure is close to zero. Get China back in business, and we could revisit $94 in no time.

We have just seen a healthy 32% correction in the shares of California-based oil major Occidental Petroleum (OXY), and I am starting to salivate. Finally, I can put to work my 50-year relationship with the company (see research piece below).

If you don’t do options, buy the stock. My target for (OXY) in 2025 is $74, up 37%.

I am therefore buying the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS at $0.80 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

This is a bet that Occidental Petroleum (OXY) will not fall below $62.50 by the January 16, 2026, option expiration in 15 months.

To learn more about the company, please visit their website at https://www.oxy.com

Don’t pay more than $1.20 or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Occidental Petroleum (OXY) January 2026 $60-$62.50 out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $0.50-$1.50. Enter an order for one contract at $0.50, another for $0.60, another for $0.70 and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then, enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is minuscule, less than 10% since the time value is so great and you have a long position simultaneously offset by a short one.

This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month, just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below, and you will see that a 15.74% rise in (OXY) shares will generate a 212% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 13.46:1. Across the $60-$62.50 space. LEAPS stands for Long-Term Equity Anticipation Securities.

(OXY) doesn’t even have to get to a new all-time high to make the max profit. It only has to get back to $62.50, where it traded in July.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

Here are the specific trades you need to execute this position:

Buy 1 January 2026 (OXY) $60 calls at………….…....……$5.25

Sell short 1 January 2026 (OXY) $62.50 calls at…………$4.45

Net Cost:………………………….………..………….…...............$0.80

Potential Profit: $2.50 - $0.80 = $1.70

(1 X 100 X $1.70) = $170 or 212% in 15 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

Take a Look at Occidental Petroleum (OXY)

There are a lot of belles at the ball, but you can’t dance with all of them.

While a student at UCLA in the early seventies, I took a World Politics course, which required me to pick a country, analyze its economy, and make recommendations for its economic development.

I chose Algeria, a country where I had spent the summer of 1968 caravanning among the Bedouins, crawling out of the desert starved, lice-ridden, and half-dead.

I concluded that the North African country should immediately nationalize the oil industry and raise oil prices from $3/barrel to $10. I knew that Los Angeles-based Occidental Petroleum (OXY) was interested in exploring for oil there, so I sent my paper to the company for review.

They called the next day and invited me to their imposing downtown headquarters, then the tallest building in Los Angeles.

I was ushered into the office of Dr. Armand Hammer, one of the great independent oil moguls of the day, a larger-than-life figure who owned a spectacular impressionist art collection and who confidently displayed a priceless Fabergé egg on his desk. He said he was impressed with my paper and then spent two hours grilling me.

Why should oil prices go up? Who did I know there? What did I see? What was the state of their infrastructure? Roads? Bridges? Rail lines? Did I see any oil derricks? Did I see any Russians? I told him everything I knew, including the two weeks in an Algiers jail for taking pictures in the wrong places.

His parting advice was to never take my eye off the oil industry, as it is the driver of everything else. I have followed that advice ever since.

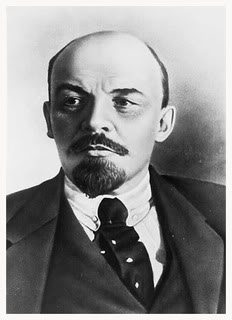

When I went back to UCLA, I told a CIA friend of mine that I had just spent the afternoon with the eminent doctor (Marsha, call me!). She told me that he had been a close advisor of Vladimir Lenin after the Russian Revolution, had been a double agent for the Soviets ever since, that the FBI had known this all along, and was currently funneling illegal campaign donations to President Richard Nixon.

Shocked, I kicked myself for going into an interview so ill-prepared and had missed a golden opportunity to ask some great questions. I never made that mistake again.

Some 50 years later, while trolling the markets for great buying opportunities set up by the recent China bazooka, I stumbled across (OXY) once more (click here for their site at http://www.oxy.com /). (OXY) has a minimal offshore presence, nothing in deep water, and huge operations in the Middle East and South America.

OXY’s horizontal multistage fracturing technology will enable it to dominate California shale. The company offers a respectable dividend of 1.65% and has a submarket earnings multiple of only 13.7 times. Need I say more?

Oh, and I got an A+ on the paper, and the following year, Algeria raised the price of oil to $12.

Lenin and Hammer

A Faberge Egg

Global Market Comments

October 7, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or GOLDILOCKS ON STEROIDS, plus A KERFFUFLE IN PARIS),

(SPY), (FXI), ($COMPQ), (CCJ), (SLB), (OXY), (TSLA),

(TLT), (DHI), (NEM), (GLD), (TSLA)

The 6,000 targets for the S&P 500 are starting to go mainstream.

That was my forecast on January 1, back when everyone said I was nuts. The inflation rate is 2.2%, GDP growth is 3.0%, and interest rates are falling sharply, on their way to 3.0% by next summer.

Goldilocks is back, but this time she’s on steroids.

Also helping is that we are in the midst of a global interest rate decline. The US, Europe, China, and Australia are all cutting interest rates at the same time. Japan is the sole exception, which is on the verge of raising rates from 0.25%. All of this has a compounding effect on the health of the global economy.

Long-term market veterans like myself are amazed, astounded, and astonished that here we are on October 7, and instead of testing new lows for the year, we are punching through to new all-time highs. It’s proof that if you live long enough, you see everything.

Some five seconds after Jay Powell cut interest rates by a shocking 0.50%, everyone in the world suddenly realized they had way too much cash and not enough stocks. This is the kind of market you get from that realization, one that doesn’t breathe, take a break, have a correction, nor let in outsiders.

Further confusing matters is that we are witnessing the most contentious presidential elections in history. One party is proclaiming how great the US economy is, while the other is claiming it is the worst ever.

Those who believed the former description are having a great year. Those who bought the latter are having an awful one, with many owning no stocks at all. Fortunately, election concerns will disappear in four weeks not to return for four years. This is hugely positive for stocks.

But as all steroid users eventually find out, they cause impotence, sterility, and cancer, so enjoy while it lasts. That may be a mid-2025 or 2026 event.

China (FXI) came back with a vengeance. A 25% rise in a stock market in a week is not to be taken lightly, although a lot of this was short covering. Pouring gasoline on the fire is a government promise to buy $1 billion worth of stocks.

The question bedeviling all investors is whether China is a one-hit wonder or is it reborn again. I know that if this stimulus package doesn’t work, they have the resources to follow up with many more. But there is a bigger problem.

Chinese stock markets have not exactly done well since Xi Jinping came into power in 2013. In fact, they are exactly unchanged. During the same period, the (SPY) was up 308%, and the NASDAQ ($COMPQ) was up 525%. Many investors, like my old friend hedge fund legend Paul Tudor Jones, don’t want to touch China until Xi vacates the scene.

In any case, if you want to play China, the best risk-adjusted plays are not there but here in the US. Any US blue chip oil play (OXY) (SLB) would be a great choice, as China is the world’s largest oil consumer. Oil happens to be the cheapest and worst-performing sector in the stock market. And you don’t have to worry about a CEO getting rolled up in a carpet and disappearing for a few years, as has happened in the Middle Kingdom. At least here, you get all the US investor protections.

We closed out September with a blockbuster +10.28% profit. My 2024 year-to-date performance is at +44.97%. The S&P 500 (SPY) is up +19.92% so far in 2024. My trailing one-year return reached a nosebleed +62.77. That brings my 16-year total return to +721.60. My average annualized return has recovered to +52.32%.

With my Mad Hedge Market Timing Index at the 70 handles for the first time in five months, it was a good week to take profits. I sold longs in (CCJ) and (TSLA) and covered a short in (TLT). I stopped out of my long in (TLT) because of the blowout September Nonfarm Payroll Report on Friday.

This is what we’ve got left:

Risk On

(NEM) 10/$47-$50 call spread 10.00%

(TSLA) 10/$200-$210 call spread 10.00%

(DHI) 10/$165-$175 call spread 10.00%

Risk Off

NO POSITIONS 0.00%

Total Net Position 30.00%

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 58 of 77 trades have been profitable so far in 2024, and several of those losses were really break evens. Some 16 out of the last 17 trade alerts were profitable. That is a success rate of +75.32%.

Try beating that anywhere.

September was Great, but October is Looking Tough, right on the doorstep of the November 5 election and the market waiting for another interest rate cut on November 6. I think I’ll run out the positions I have into the October 18 options expirations, then wait for the market to come to me. I am up too much this year to take on needless risk.

Nonfarm Payroll Report Comes in Hot, as US employers added 254,000 jobs in September, topping economists’ estimates. The payroll gain, the biggest advance since March, was led by leisure and health care. The headline Unemployment Rate fell to a three-month low of 4.1%.

Interactive Brokers Starts US Election Forecast Trading on the heels of a federal court ruling in their favor. The following Forecast Contracts on US election results will be available:

*Will Kamala Harris win the US Presidential Election in 2024?

*Will Donald Trump win the US Presidential Election in 2024?

Plus a dozen other election outcomes. The opening bids were 49% for Harris and 50% for Trump.

The port Strike is Settled with a 62% six-year settlement. The bananas were rotting. 54 container ships queued outside ports, risking shortages. The Strike cost the U.S. economy $5 billion/day. Shipping stocks tumble across Asia and Europe. Expect the US to move to full automation, where Europe went 30 years ago.

EC Imposes 45% Tariffs on Chinese EVs in a desperate bid to save the local car industry. The Commission, which oversees the bloc's trade policy, has said it would counter what it sees as unfair Chinese subsidies after a year-long anti-subsidy investigation, but it also said on Friday it would continue talks with Beijing. Expect the same to follow in the US.

A possible compromise could be to set minimum sales prices.

Hedge Funds Stampede into China on news that government agencies promised to pour $1 billion into local stock markets. Chinese equities saw the largest net buying ever from hedge funds last week, marking the most powerful weekly purchase on record, according to Goldman Sachs prime brokerage data.

Weekly Jobless Claims Climb to 225,000, not straying too far from a four-month low touched in the prior week. That is an increase from an upwardly-revised mark of 219,000 last week, data from the Labor Department showed on Thursday. Economists had anticipated 222,000.

Will This Crisis Take Gold to $3,000? Almost certainly, yes, given the way the barbarous relic traded yesterday. Buy all gold (GLD), plays on dips, the metal, ETFs, futures, and miners.

Tesla Bombs, with Q3 deliveries down flat, but the shares fell only 5%. Total deliveries came in at 462,890, while total production was 469,796. YOY Tesla is facing increased competitive pressure, especially in China, from companies like BYD and Geely, along with a new generation of automakers, including Li Auto and Nio.

US Car Makers Get Slaughtered, with Stellantis stock falling by double digits after the Jeep maker cut its 2024 financial guidance, citing deteriorating industry dynamics and Chinese competition. The warning, amid similarly negative news from other car makers, also dragged down shares of (F) and (GM). Avoid the auto industry except for (TSLA).

Nvidia Still has more to Run, so says Samantha McLemore, the founder and Chief Investment Officer of Patient Capital Management. Nvidia has been crushing every quarter for a year. CEOs want to make the decision to invest more [in AI] rather than getting caught behind. She doesn’t see the bull market ending soon. Current operating profit margins are 65%. Buy (NVDA) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy is decarbonizing, and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, October 7 at 8:30 AM EST, Used Car Prices are out

On Tuesday, October 8 at 6:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, October 9 at 11:00 PM, the Fed Minutes from the last meeting is printed.

On Thursday, October 10 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the Consumer Price Index.

On Friday, October 11 at 8:30 AM EST, the Producer Price Index and the University of Michigan Consumer Price Index are announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, dentists find my mouth fascinating as it is like a tour of the world. I have gold inlays from Japan, cheap ceramic fillings from Britain’s National Health, and loads of American silver amalgam, which are now going out of style because of their mercury content.

But my front teeth are the most interesting as they were knocked out in a riot in Paris in 1968.

France was on fire that year. Riots on the city’s South Bank near Sorbonne University were a daily occurrence. A dozen blue police buses packed with riot police were permanently parked in front of the Notre Dame Cathedral, ready for a rapid response across the river. They did not pull their punches.

President Charles de Gaulle was in hiding at a French air base in Germany. Many compared the chaos to the modern-day equivalent of the French Revolution.

So, of course, I had to go.

This was back when there were five French francs to the US dollar, and you could live on a loaf of bread, a hunk of cheese, and a bottle of wine for a dollar a day. I was 16 years old.

The Paris Metro cost one franc. To save money, I camped out every night in the Parc des Buttes Chaumont, which had nice bridges to sleep under. When it rained, I visited the Louvre, taking advantage of my free student access. I got to know every corner. The French are great at castles….and museums.

To wash, I would jump in the Seine River every once in a while. But in those days, not many people in France took baths anyway.

I joined a massive protest one night, which originally began over the right of men to visit the women’s dorms at night. Then the police attacked. Demonstrators came equipped with crowbars and shovels to dig up heavy cobblestones dating to the 17th century to throw at the police, who then threw them back.

I got hit squarely in the mouth with an airborne projectile. My front teeth went flying, and I never found them. I managed to get temporary crowns, which lasted me until I got home. I carry a scar across my mouth to this day.

I visited the Left Bank again just before the pandemic hit in 2019. The streets were all paved with asphalt to make the cobblestones underneath inaccessible. I showed my kids the bridges I used to sleep under, but they were unimpressed.

But when I showed them the Mona Lisa at the Louvre, she was as enigmatic as ever. The kids couldn’t understand what the fuss was all about.

Everyone should have at least one Paris in 1968 in their lifetime. I’ve had many and am richer for it.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

1968 in Paris

2019 in Paris on Top of the Eiffel Tower

Global Market Comments

October 4, 2024

Fiat Lux

Featured Trade:

(JOIN ME ON CUNARDS QUEEN MARY 2 FOR MY JULY 11 TRANSATLANTIC SEMINAR AT SEA LUNCHEON), (EUROPEAN STYLE HOMELAND SECURITY)

The English are feeling the pinch in relation to recent geopolitical events and have therefore raised their security level from "Miffed" to "Peeved."

Soon, though, security levels may be raised yet again to "Irritated" or even "A Bit Cross." The English have not been "A Bit Cross" since the blitz in 1940 when tea supplies nearly ran out.

Terrorists have been re-categorized from "Tiresome" to "A Bloody Nuisance." The last time the British issued a "Bloody Nuisance" warning level was in 1588 when threatened by the Spanish Armada.

The Scots have raised their threat level from "Pissed Off" to "Let's get the

Bastards." They don't have any other levels. This is the reason they have been used on the front line of the British army for the last 300 years.

The French government announced yesterday that it has raised its terror alert

level from "Run" to "Hide." The only two higher levels in France are "Collaborate" and "Surrender." The rise was precipitated by a recent fire that destroyed France's white flag factory, effectively paralyzing the country's military capability.

Italy has increased the alert level from "Shout Loudly and Excitedly" to

"Elaborate Military Posturing." Two more levels remain: "Ineffective Combat Operations" and "Change Sides."

The Germans have increased their alert state from "Disdainful Arrogance" to

"Dress in Uniform and Sing Marching Songs." They also have two higher levels: "Invade a Neighbor" and "Lose."

Belgians, on the other hand, are all on holiday as usual; the only threat they

are worried about is NATO pulling out of Brussels.

The Spanish are all excited to see their new submarines ready to deploy. These beautifully designed subs have glass bottoms, so the new Spanish navy can get a really good look at the old Spanish navy.

Australia, meanwhile, has raised its security level from "No worries" to

"She'll be alright, Mate." Two more escalation levels remain: "Crikey! I think we'll need to cancel the Barbie this weekend!" and "The Barbie is canceled." So far, no situation has ever warranted the use of the final escalation level.

-- John Cleese - British writer, actor, and tall person.

2015 in Marrakesh, Morocco

“Bonds are priced artificially because you’ve got some guy buying tens of billions of dollars’ worth a month. That will change at some point, and when it does, people are going to lose a lot of money,” said the Oracle of Omaha, Warren Buffett.

Global Market Comments

October 3, 2024

Fiat Lux

Featured Trade:

(THE MAD HEDGE SEPTEMBER 17-19 SUMMIT REPLAYS ARE UP),

(HOW TO EXECUTE A MAD HEDGE TRADE ALERT)

From time to time, I receive an email from a subscriber telling me that they are unable to get executions on trade alerts that are as good as the ones I get. There are several possible reasons for this:

1) Markets move, sometimes quite dramatically so.

2) Your Trade Alert email was hung up on your local provider’s server, getting it to you late. This is a function of your local provider’s capital investment and is totally outside our control.

3) The spreads on deep-in-the-money options spreads can be quite wide. This is why I recommend readers place limit orders to work in the middle market. Make the market come to you. Better yet, if I send you a limit order at $9.00, split it up into five pieces and enter them at $9.00, $9.10, $9.20, $9.30, and $9.40. You might get the last one or two done immediately. When the high frequency traders dump their positions at the end of the day you might get filled on everything. If you enter a “Good until Cancelled” order you might get even better prices the next morning if the stock goes your way. This is what I do.

4) Thousands of market makers read Global Trading Dispatch. The second they see one of my Trade Alerts, they adjust their markets accordingly. This is especially true for deep-in-the-money options. A spread can go from totally ignored to a hot item in seconds. I have seen daily volume soar from 10 contracts to 10,000 in the wake of my Trade Alerts.

On the one hand, this is good news, as my Trade Alerts have earned such credibility in the marketplace. It is a problem for readers encountering sharp elbows when attempting executions in competition with market makers.

5) Occasionally, emails just disappear into thin air. This is cutting edge technology, and sometimes it just plain doesn’t work. This is why I strongly recommend that readers sign up for my free Text Alert Service as a back up. Trade Alerts are also always posted on the website as a secondary back up and show up in the daily P&L as a third. So, we have triple redundancy here.

The bottom line on all of this is that the prices quoted in my Trade Alerts are just ballpark ones with the intention of giving traders some directional guidance. You have to exercise your own judgment as to whether the risk/reward is sufficient with the prices you are able to execute yourself. Sometimes it is better to pay up by a few cents rather than miss the big trend. The market rarely gives you second chances.

Good luck and good trading.

John Thomas

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.