“Man, it feels more and more like 1999 every day. Risk is being discounted tremendously,” said venture capitalist, Bill Gurley.

Global Market Comments

May 16, 2024

Fiat Lux

Featured Trade:

(THE COMMODITY SUPER CYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Global Market Comments

May 15, 2024

Fiat Lux

Featured Trade:

(WHY WATER WILL SOON BE WORTH MORE THAN OIL),

(CGW), (PHO), (FIW), (TTEK), (PNR)

Global Market Comments

May 14, 2024

Fiat Lux

Featured Trade:

(LOOKING AT THE LARGE NUMBERS)

(TLT), (TBT) (BITCOIN), (MSTR), (BLOK), (HUT)

Global Market Comments

May 13, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE GREAT AMERICAN GOLDEN AGE HAS ONLY JUST BEGUN and SWIMMING WITH THE SHARKS)

(AAPL), (NVDA), (META), (GLD), (GOLD), (SLV), (WPM), (MSFT), (NVDA), (TLT), (FCX), (FXI), (BRK/B)

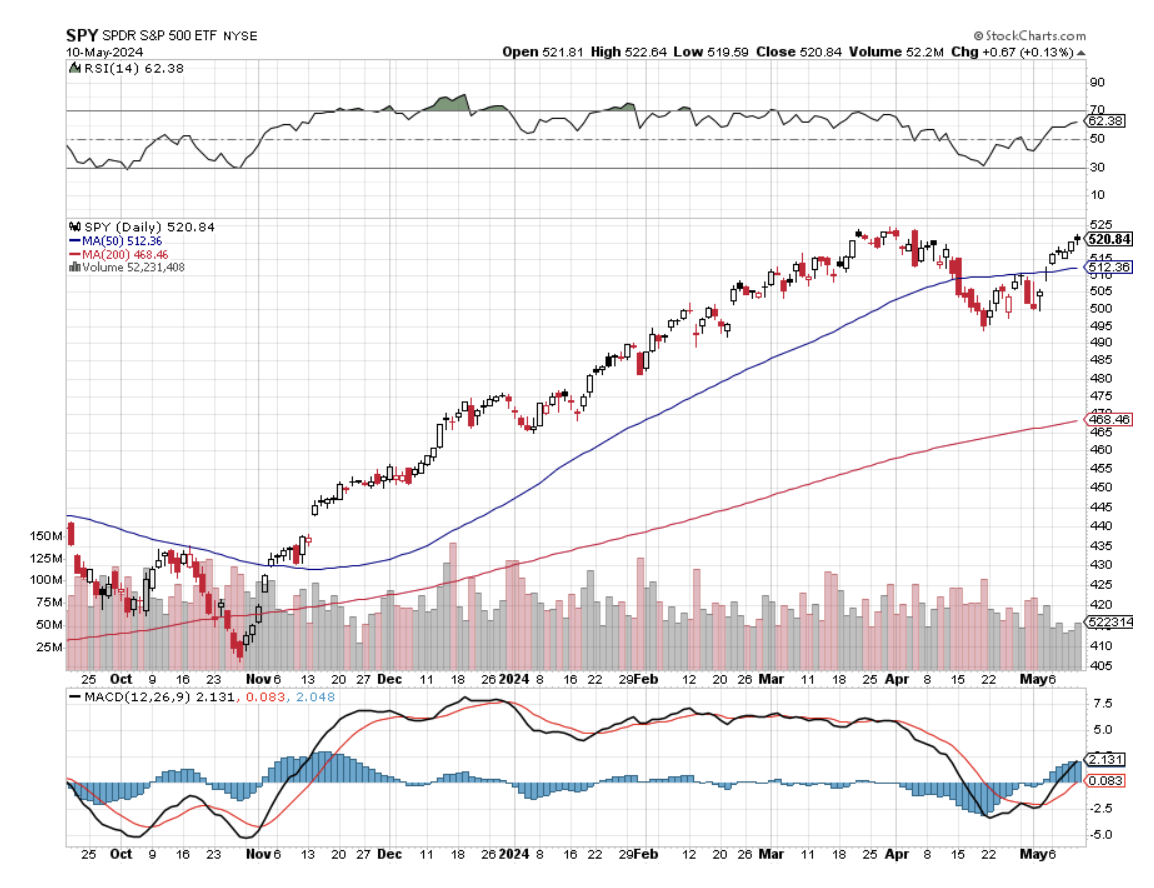

The Bull Market has Five More Years to Run, with S&P 500 growing earnings at 10% a year for the foreseeable future. Last year brought in $222 per share, 2024 will see $250, 2025 $270, and $300 for 2026. The Great American Golden Age has only just begun.

Profit margins will expand to all-time record highs. Falling interest rates and a weak dollar will boost exports to a recovering Europe and Japan. Inflation should hit the Fed’s 2% in 2025 as AI chatbots replace workers at a breakneck rate, cutting costs dramatically as they already have at some firms. The future is happening fast. Buy everything on dips, even bonds.

The stock market couldn’t even manage a 10% correction in April. We got a measly 6.10% instead. It’s all about the economy, stupid. Leftover massive Covid spending and the $280 billion CHIPS Act have created a tidal wave of cash surging through the system with much of it ending up in stocks.

The top eight tech companies (the Magnificent Seven plus Netflix (NFLX)) accounting for 30% of the entire market cap are only getting stronger. The (SPY) has a current price-earnings multiple of 20X with the Big 8 and 17X without them going forward. It’s not cheap but better than a poke in the eye with a sharp stick.

Boring old high-yielding utilities will become a big play as the electric power grid has to triple in size to accommodate the voracious appetites of EV’s and AI. And as we have already seen in California and much of the country, utilities have no reservations about raising prices.

We are back to normal with interest rates, returning to pre-financial crisis levels. Certainly, a stock market at all-time highs is happy with rates. The real concern here is that the Fed DOES cut rates too fast to bail out the loan-dependent half of the economy and the US Treasury as well. That could trigger a melt-up in stocks that would make the last six months pale in comparison and make my own $6,000 target for the (SPX) look ridiculously conservative.

There is also a major generational change in demographics underway. Previous retiring generations, having experienced the Great Depression, hoarded savings and were a drag on the economy. The Baby Boomers are spending like there is no tomorrow because after going through COVID-19, there might not BE a tomorrow. The Boomers have thus turned into the greatest job creators of all time through their spending.

I’ve seen them everywhere in recent weeks in Florida, Cuba, Ecuador, the Galapagos Islands, Panama, and of course, San Francisco where a Big Mac Happy Meal costs $11. What they don’t spend is being passed on to Gen Xers and Millennials, creating a $75 trillion wealth transfer, the largest in history. A lot of this is going into stocks as well. Wonder where all that “meme stock” money is coming from?

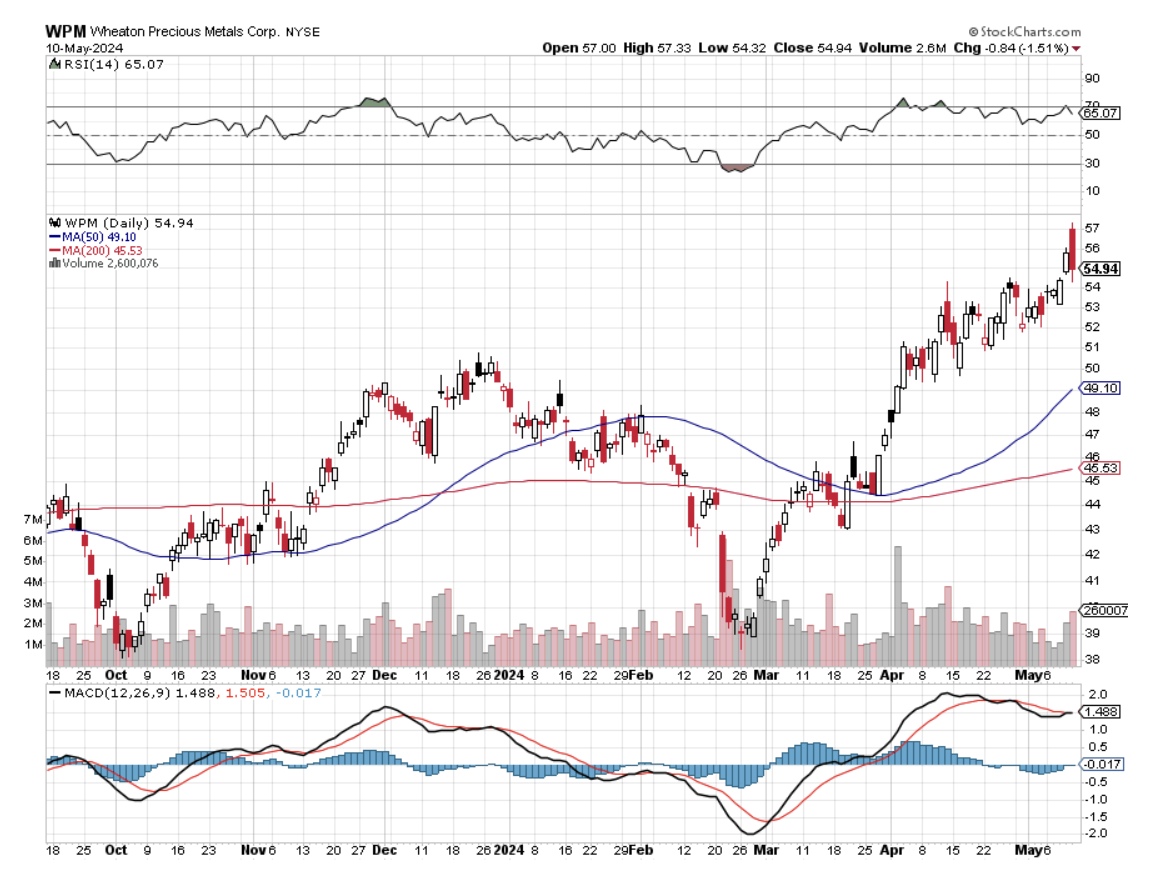

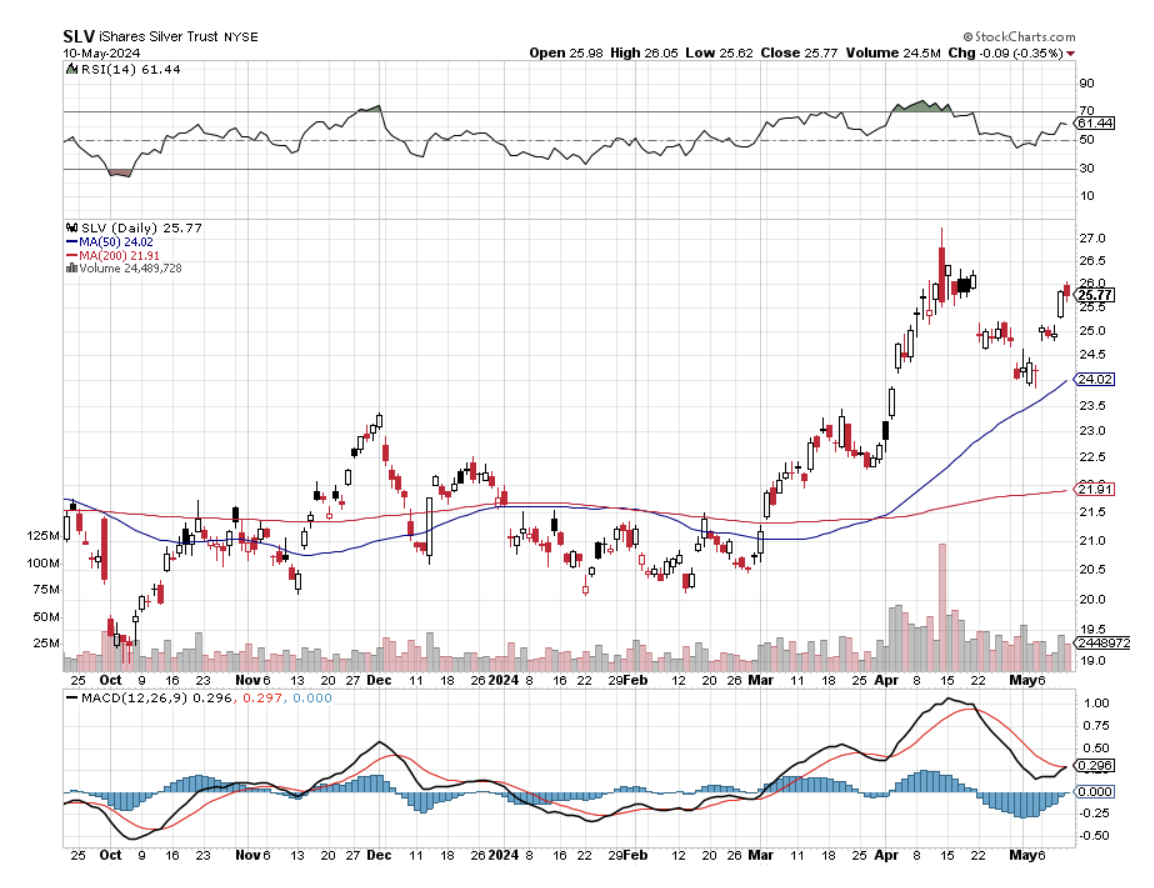

And from the “Department of I Told You So”, notice that precious metals were on an absolute tear last week, with gold (GLD) up 4.78% and silver posting a gob-smacking 7.40%. The new demand that I was aware of but had no hard data on finally became public. Solar Panels are Driving Global Silver Demand in an unprecedented fashion. Global investment in solar PV manufacturing more than doubled last year to around $80 billion.

Miners are expanding their operations and ramping up production as prices for the precious metal climb to decade highs, sending gross revenues to the moon. Demand for silver from the makers of solar PV panels, particularly those in China, is forecast to increase by almost 170% by 2030, to roughly 273 million ounces—or about one-fifth of total silver demand.

That’s a lot of silver. Buy (SLV) and (WPM) on dips.

So far in May, we are up +4.14%. My 2024 year-to-date performance is at +18.75%, a new all-time high. The S&P 500 (SPY) is up +10.48% so far in 2024. My trailing one-year return reached +35.79% versus +30.58% for the S&P 500.

That brings my 16-year total return to +695.38%. My average annualized return has recovered to +51.83%.

I stopped out of short positions for small losses in (AAPL) and (NVDA) last week. I took profits on my long in (META). I am running my longs in (GLD) and (SLV) and my shorts in (MSFT) and (NVDA) into the Friday, May 17 options expiration. The only new position I added last week was a short in the (TLT).

Some 63 of my 70 round trips were profitable in 2023. Some 27 of 37 trades have been profitable so far in 2024.

Weekly Jobless Claims Hit a Nine Month High at 233,000, the bitter fruit of persistently high interest rates. New York City public school workers such as bus drivers are allowed to apply for benefits during winter and spring breaks, which tend to boost weekly claims numbers. Claims also picked up in California, Indiana, and Illinois.

Underwater Home Mortgages are Soaring, with the South taking the biggest hit. Roughly one in 37 homes are now considered seriously underwater in the US and that share is much higher across a swath of southern states. Nationally, 2.7% of homes carried loan balances at least 25% more than their market value in the first few months of the year. That’s up from 2.6% in the previous quarter. It’s another cost of high rates.

Online Retail Spending Up 7%, during the January-April period YOY. Cheaper items are seeing the fastest growth. Consumer discretionary spending has been in focus over the past several months, as sticky inflation has forced shoppers in various categories to trade down to more affordable products. It’s another sign of a modest slow, 1.6% growing economy.

Morgan Stanley (MS) Pushes Back Rate Cut Expectations to September. I couldn’t agree more. You see this in the $4 rally in bonds since last week. Sell short (TLT) for the very short term.

TikTok Sues the US Government, claiming its first amendment rights have been violated in a ban imposed on Congress. They will probably win. The national security threat posed by millions of dancing teenagers has never been showed. It’s just another talking point for technology-ignorant politicians egged on by Facebook (META) and other competitors. No one ever said the people in Silicon Valley were nice.

Social Security Trust Fund to Go Broke by 2035, according to US Treasury estimates. I knew they wouldn’t pay me after 55 years of contributions. Medicare is in less bad shape, not running out until 2036, a five-year extension. Retirees, the baby boomers, and exceeding new contributors, the Gen Xers. Expect your taxes to go up to fill the gap.

Berkshire Hathaway Delivers Blockbuster Earnings in Q1, thanks to a $9 billion pop in (AAPL) stock last year. Buffet just cut his massive position by 13% and will cut more. Total 2023 profits came in at a mind-numbing $93 billion. The company — whose divisions include insurance, the BNSF railroad, an expansive power utility, Brooks running shoes, Dairy Queen and See’s delivered a sharp swing from its $22 billion loss in 2022 because of the bear market. Its vast insurance operations that include Geico car insurance and reinsurance reported $5.3 billion in after-tax earnings for 2023, thanks to steep premium increases which we have all felt. Sell (AAPL), buy (BRK/B).

Bond Investors are Making a Killing, with the US Treasury paying out $900 billion in interest in 2023. That’s double the annual cost of the past decade. Remember those coupons? That’s another reason for the Fed to cut rates soon, to lessen this backbreaking burden on the government. After being held hostage by zero-rate policies for almost two decades, US Treasuries are finally reverting to their traditional role in the economy. Bonds are becoming respectable again after a long winter. Buy (TLT) on dips.

China Home Sales Plunge by 47%, as the real estate crisis deepened, indicating that a recovery may be far off. But when it does bounce back, expect all commodities to hit record highs. Buy (FCX) on dips.

Biden Piles on the Foreign Tariffs, announcing new China tariffs aimed at the EV Industry that is currently decimating Europe. Europe is in danger of giving away its edge in cars to the Chinese and a proactive response would ensure American car manufacturers can stand up to the low-priced onslaught.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 13, at 10:30 AM EST, the Consumer Inflation Expectations are announced.

On Tuesday, May 14 at 8:30 AM EST, Producer Price Index for April is released.

On Wednesday, May 15 at 8:30 AM EST, the Consumer Price Index is published

On Thursday, May 16 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, May 17 at 8:30 AM the Monthly Options Expiration takes place at the close.

At 2:00 PM the Baker Hughes Rig Count is printed.

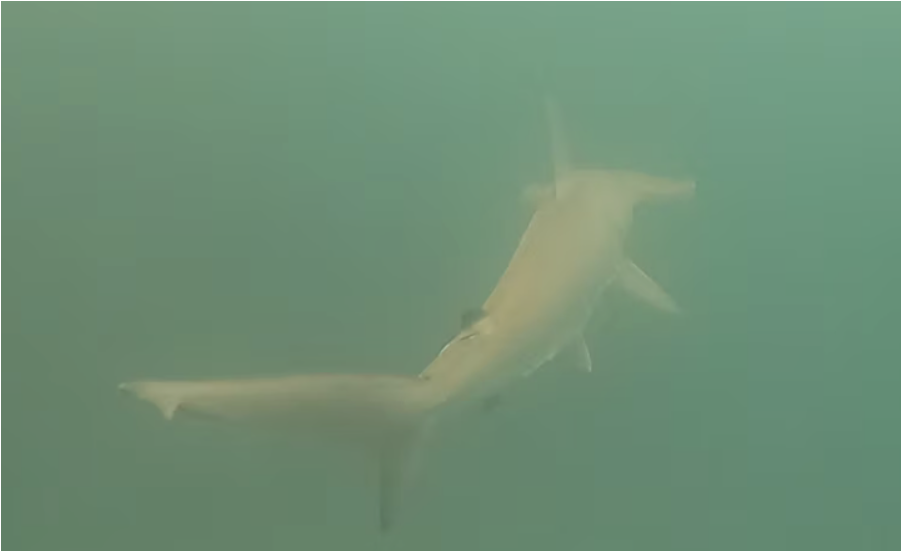

As for me, I will never forget the words from my underwater guide: “Stay where you are and the current will bring the sharks to you.”

Is that something we want, I queried in my fractured Spanish. “Don’t worry”, he answered, “The sharks are vegetarians.” Yes, but did anyone tell the sharks that they were vegetarians?

Sure enough, two six-foot-long hammerhead sharks hungrily swam by me within feet in the green murk, not even pausing to give me the time of day. They swam so close that one almost slapped me in the Face with his tailfin. I guess I wasn’t on the menu that day, not even as a special.

Fortunately, I brought a GoPro underwater video with me and filmed the whole thing. Otherwise, you wouldn’t believe me for a second (click here for the link.)

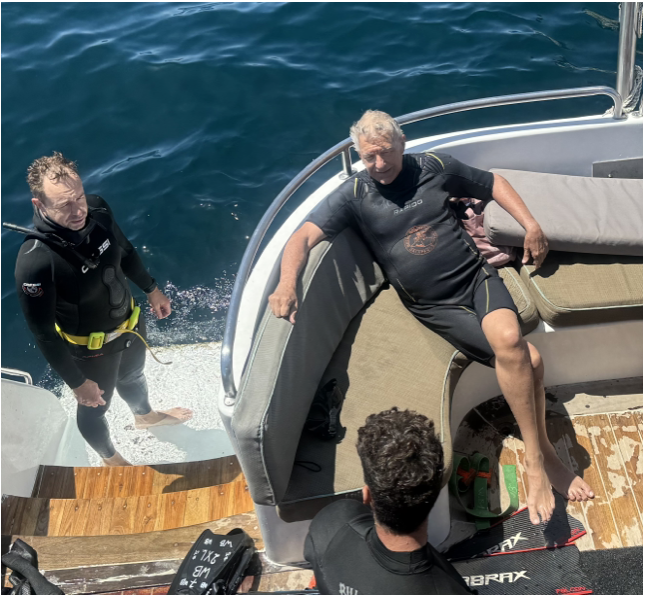

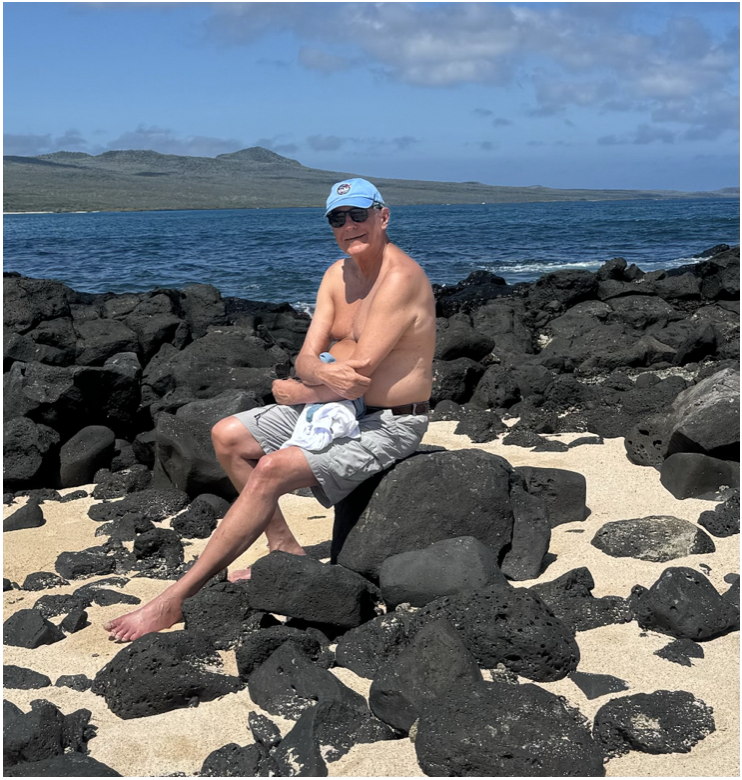

Such was the high point of my week in the Galapagos Islands last week, a remote archipelago of 13 volcanic islands some 600 miles west of Ecuador, 2 degrees South Latitude in the Pacific Ocean. Sitting in my beachfront house in San Cristobal, I worked all morning, knocking out some eight trade alerts on the week, and explored every afternoon.

It was bliss.

You scientists out there will already know the Galapagos Islands as the place where Charles Darwin landed in 1835 on the HMS Beagle and collected the data that led to the Theory of Evolution and the concept of the Survival of the Fittest. (It was all about black Finches, now known as Darwin’s finches, of which I saw hundreds).

Darwin was at first widely ridiculed, as are the creators of all new revolutionary advances. Critics highlighted his close relationship with monkeys. Now it’s required reading for all high school students. While I was there a reproduction of the Beagle sailed in from Holland to celebrate the 200th anniversary of Darwin’s discoveries….11 years early.

The Galapagos Islands are not an easy place to get to. It was a four-hour flight from Miami to Quito in Ecuador, the worlds third highest airport at 9,500 feet. A lot of transients get altitude sickness. Then an hour's flight to Guayaquil on the coast where the Ecuadorian drug trade is run and another hour to San Cristobal. When I tried to visit here in the 1970’s there was only one ship a week and no planes.

Galapagos connected to the outside world just last year when Space X’s Starlink service initiated a 200mb/sec service. With that, I can trade stocks as if I were in downtown Manhattan. This is true for virtually every remote location in the world now, the consequences of which we have yet to imagine. I set up a Starlink in Ukraine last October while under fire and the Russians never were able to jam it.

The Ecuadorian government has gone through great lengths to keep the Galapagos Islands a pristine eco-tourism destination and they have largely succeeded. I counted only one Cessna G5 jet at the airport. Incoming luggage is X-Rayed for foreign fruit and sniffed for drugs by German Shepherds. Residents are limited to a tiny southwestern sliver of San Cristobal island and the rest is a national park.

A friend charitably turned down a $20 million offer from the Four Seasons international hotel chain for his 120 acres of land there. There are not a lot of places in the world left where you can walk out of your front door to a deserted beach unscarred by footprints. Yet, it offers Ecuadorian prices, about one-third of those found in the US.

I think you should visit there.

HMS Beagle, kind of

55 Years of Trading and Finally my Own Beach!

Let the Current Bring the Sharks to You

Chillin with the Crew

My New Office

The View from Home

My New Neighbors

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 10, 2024

Fiat Lux

Featured Trade:

(A DIFFERENT VIEW OF THE US)

Global Market Comments

May 9, 2024

Fiat Lux

Featured Trade:

(DECODING THE GREENBACK),

(BRING BACK THE OLD ASSET ALLOCATION RULES)

(TLT), (JNK), (HYG), (REIT), (BKLN)

Global Market Comments

May 8, 2024

Fiat Lux

Featured Trade:

(TAKING A LOOK AT HOME DEPOT)

(HD)

I have been out shopping the neighborhood for good non-tech plays and I found another one.

You are going to think that I am completely MAD by thinking about this trade right now. But I’ve gotten used to that by now.

If you had to pick one sector of the 100 or so that Standard & Poor’s tracks, that is universally hated by all traders and investors, it would have to be the retailers.

Widely viewed as headed for the dustbin of history, many retailers are not going to make it to Christmas, let alone stay in business through 2025.

Do any value screen of all listed stocks, and about half of all the bargain stocks are found in the retail industry.

These are the buggy whip manufacturers of 1901 before they got run over by the auto industry.

Of course, you can blame Amazon, which is rapidly taking over all sales of everything in the US. They have about a 50% market share of all online sales. No wonder the government is going after them with an antitrust case.

This is thanks to their cutting-edge technology and massive economies of scale.

Amazon is probably the number one job destroyer in the US today, with some 5 million retail jobs on the chopping block over the next five years.

However, there is one safe haven that so far seems immune from Amazon’s appetite and that would be Home Depot (HD).

I am using the recent 18% sell-off in the shares to look at (HD), which is occurring, not because of anything Home Depot did, but because of higher interest rates for longer.

Longer term, I think Home Depot will continue to appreciate, as the housing and remodel boom will take off like a rocket once interest rates DO fall. That could be in four months….or sooner.

Then we will have a home remodeling boom that has years to run, and possibly decades. The more expensive homes get, the more inclined owners are to fix up their existing digs. They go to Home Depot to do that.

If you want to make a safer play, buy the iShares US Home Construction ETF (ITB) on this dip, which gives you broader exposure to the real estate recovery and has a much more solid bottom.

Baskets of shares always have lower volatility than single stocks, but lower returns as well.

We just have to give the market a chance to have a few more heart attacks before the current correction ends.

Home Depot is in a tiny retail niche that has so far avoided the Amazon onslaught. There are many reasons for this.

When you need a particular screw, lighting fixture, or unique plumbing part, calling Amazon will get you absolutely nowhere.

You need (HD)’s sympathetic, knowledgeable customer service people, usually retired contractors themselves, to point you in the right direction and assist with a few helpful suggestions.

They’ve done this for me a million times.

Home remodeling and repair is also an industry where a premium is paid for making parts available NOW! A burst pipe won’t wait for an Amazon priority delivery, nor will a leaky roof or broken sprinkler head.

A lot of independent contractors are now not even able to plan supplies weeks or months in advance. They buy what they see.

The home repair and remodel boom will continue, as it is the working man’s solution to high home prices, especially on the coasts, as the profusion of home repair YouTube videos testify. You can fix ANYTHING on YouTube.

While Home Depot recently reported annual revenues of $34.79 billion, up 2.92%. Operating income was reported at $4.8 billion, up 12.82%. Net income came in at an impressive $2.8 billion, up 16.69% YOY. Yet, you get a low 22.7 times price-earnings multiple typical of retailers.

They should do much better in the spring Q2 reporting season. We will know for sure when the company reports on Q2.

This gives us a great discount entry point for a super long-term company, which doesn’t care what the US dollar is doing, which will soon be falling.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.