Below please find subscribers’ Q&A for the February 21 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Silicon Valley, CA.

Q: What do you think of the comments of Ray Dalio and Jamie Dimon of an imminent war with Russia and China?

A: I think the chances of that are almost zero. You’re talking about Russia with a $1 trillion economy going to war against a combined GDP of the US and Europe of $50 trillion. Even Switzerland is sending tanks to Ukraine now. Our military is so dominant compared to any other country in the world, that it would be an instant wipeout. Russia and China know that, so they can threaten all they want but will take no action. That really has been the course since the end of WWII; talk is cheap. However, it is not a zero risk—a person like Ray Dalio, especially, always has to consider the 1% risk (Jamie Dimon less so.) I don’t worry about that at all; a lot of that is media hype. Newspapers have to fill their space every day of the year, even when nothing is happening.

Q: What about Russia putting nuclear weapons in space?

A: The US actually looked at doing this in the 60s and 70s when I was with the Atomic Energy Commission, and this is the problem: Uranium weighs four times that of lead, and it’s very hard to get any serious weight into space. And Russia has never been able to actually hit anything it aims at, so other than destroying a bunch of nearby Starlink satellites, it wouldn’t really accomplish much. Plus, we do have a treaty with Russia not to put nuclear weapons in space—not that agreements between the US and Russia are particularly trustworthy these days.

Q: Would you sell naked Nvidia (NVDA) puts right now?

A: Dan, somehow you got into my personal trading account and looked at all my positions! You know, I never advise people to sell naked puts unless they're happy to own the stock at that level. That means, first of all, you cannot leverage at all—the way people go bust on short put strategies is they sell far more puts than they have the money to support the cash buy if they have to do it. But I can tell you, I looked at the numbers this morning: if you sell short an Nvidia put now at 600 you can get about $10 for it. And, if Nvidia goes below 600 by option expiration day, you own Nvidia stock at a cost of $590. And I'm happy to own Nvidia at $590 because I think it could be worth $1,000 by yearend. There may be better ways to use your money with Nvidia at $600, like doing an at-the-money LEAPS which will get you a 100% return in a year even on no move. If you want to go, say, $40 out of the money or $50, like a 650-$650 Nvidia LEAPS, then you're looking at it with a 150% return in a year. So that is the better way to do it, it just depends on how aggressive you want to be and how eager you are to go back to work at Taco Bell if you lose all your money.

Q: What would you do with Super Micro Computer Inc. (SMCI) right now?

A: I would sell it, but then I would’ve sold it on the first 23x move. (SMCI) is a no-touch right now—I think they have a 3% float in their shares, and that’s what’s causing the spectacular market volatility.

Q: Will continued weakness in China (FXI) bring down the US markets?

A: No. We have very few investors from China in the US stock market. They really have no impact on our market. And the fundamentals couldn't be more different. You know, the US economy is in great shape right now (and getting better, I might add), while China continues to go down the toilet and is saber-rattling and warmongering. So, it's not good for stock prices for sure. You could put that at the bottom of the list of worries.

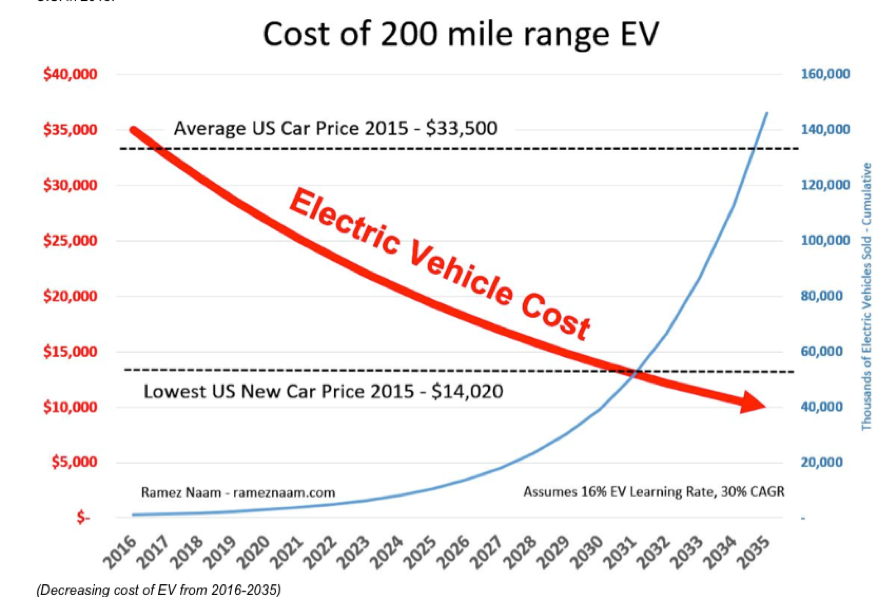

Q: Will Tesla (TSLA) ever turn around?

A: Well what you don’t know if you don't follow the company on a daily basis like I do, is that Tesla is continuously cutting costs, and increasing performance, and that will lead to greater sales and greater profits. But when that happens, I have no idea. I think the Tesla 2 coming out next year—the $25,000 EV could be a big turning point for the company. And of course, Tesla stock may front-run that by six months. So eventually, Tesla will come back.

Q: Thanks for your advice. I have a ton of Nvidia (NVDA) and some Tesla (TSLA). Should I sell my Tesla and put it in Nvidia?

A: No, you should do the opposite. Buy low, sell high—it’s my revolutionary new stock trading system which I’m thinking of copywriting. Nvidia has had one of the biggest stock gains in history, and Tesla is down year-on-year. So, that is the trade, and that is what a lot of long-term investors are doing, is doing that swap.

Q: Can we do a LEAPS on Palo Alto Networks (PANW)?

A: Absolutely. Wait for this selloff to finish, then go in at the money one year out and you should get a 100% or a double on your return. And by the way, when I’m convinced that tech stocks have finished this selloff, I’ll be issuing a whole bunch of LEAPS trade alerts. I’ll do the numbers and do the heavy lifting for you.

Q: Can Ukraine win the war against Russia without US aid?

A: No, in fact, it needs aid from both the US and Europe. Right now, Europe is carrying 100% of the burden, as the US has stopped providing aid to Ukraine, thanks to the Republican-led House of Representatives. And Ukraine is now ceding cities to Russia because they don’t have the ammunition or the missiles to defend them. So, give as much ammo as we can. Otherwise, it’s just a matter of time before US soldiers get involved in a European war once again. How the Republicans see cutting off as in America’s benefit, I can’t imagine, nor do many Republicans. They must be reading different news sources. But I’m also prejudiced on this, having been shot by Russians in Ukraine in October. (Those injuries are all healed by the way thanks to a stem cell injection and I’m back to hiking as usual.)

Q: When you say buy on dips, do you have a rule of thumb on what percentage a stock has to drop in order to consider it a dip?

A: It’s different for every stock because every stock has a different volatility. “Buy on the dip” might be a 5% for Cleveland Cliffs but it might be 20% for Nvidia. It’s all over the map—you just have to look at the charts and judge where the next support level is, before considering risking your own money.

Q: What’s your favorite dividend stock?

A: Well my Number One favorite, of course, is Crown Castle International (CCI)—the cellphone tower REIT—and REITS of any kind are going to be very high-yield and very attractive. Just stay away from the commercial office REITS, which are having their own well-publicized problems. Beyond that, the only attractive high dividend stocks are in energy: you have Exxon Mobil (XOM) yielding 3.7% and Diamondback Energy with the lovely ticker symbol of (FANG) yielding 4.48%. On the oils, you get a shot for not only the dividend but a nice capital gain on any recovery in the oil market. So that could be an attractive play once we finish bombing the Houthis and wiping out all their Iran-supplied missiles.

Q: What happened to the Japanese yen rally?

A: Well as with all other foreign currencies, it died and went to Heaven, because of the delay in US interest rate cuts. As long as the US doesn't cut interest rates, it will continue to have the strongest currency in the world. And when we get to the currency charts, you'll see exactly how strong the dollar has been. That does make the currencies very attractive right around here.

Q: Will commercial real estate blow up the banks, and therefore the stock market?

A: No, first of all, for big banks (XLF), commercial real estate is only 5% of their loan portfolio and if they lose 20% of that, that’s only a 1% loss of their total loans year for them and that is totally acceptable by in their business model. Second, if interest rates fall, the commercial real estate problem goes away because they can refinance at lower rates than you get now. Third, as the economy recovers, demand for office space will also recover, though it may take 5 years to soak up all the excess inventory that we have right now. San Francisco has an empty office space rate of about 30%, which is higher than it’s ever been. That is why a lot of smart, long-term real estate money is buying up buildings in San Francisco— they're buying them up for pennies on the dollar, so that sounds like a great investment. I remember back in the early eighties, Morgan Stanley did exactly the same thing in Houston after an oil collapse. You know, they were giving away office buildings—paying you to take them away, literally—and Morgan Stanley set up an in-house partner fund (it was only open for the partners from Morgan Stanley to invest in) and we went in and bought 600 million dollar’s worth of cheap Houston real estate. I think we ended up getting a 10x return on that, but that's what being a Morgan Stanley partner is all about. That was about 45 years ago, and it’s what’s happening now in San Francisco.

Q: Are you worried about Amazon (AMZN) with Jeff Bezos selling 8 billion dollars worth of stock?

A: Well, if you've made a couple of $100 billion you're allowed to spend $8 billion on yourself. And Amazon is one of the early leaders in AI technology, so I'm buying that on every dip. In fact, we had a long position in Amazon that just expired on Friday.

Q: Why is Home Depot Inc. (HD) stagnating?

A: Well that's easy: during the pandemic, everyone was stuck at home 24 hours a day, 7 days a week, so they wanted to fix stuff. With the end of the pandemic, that has ended and has slowed down business at both Home Depot and Lowes (LOW).

Q: Do you like Advanced Micro Devices (AMD) and would you buy it on a dip?

A: Absolutely, it’s all part of the same AI trade, as are all the other big chip stocks.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader