I remember back in 1990 when I was first starting my hedge fund in London England, one of the very first. I hired two Ph.D.’s in Mathematics from Cambridge University, and we started inventing one the first purely quantitative approaches to the stock market. We were playing around with statistical probability arbitrage and Monte Carlo simulations, things like that.

One day, one of my guys said he needed to buy a software patch from a company in Los Angeles. I said “Sure" thinking we could pay up and overnight some floppy discs via a new company called Federal Express (FDX). He said no need, he could simply download them.

I said what?!

Andrew proceeded to connect to the Internet with our screechy landline modem and pay for the software with my American Express card. I watched in utter amazement as the time bar turned green and we got our patch.

I thought “Holly Smokes!”

I immediately realized that this technology was going to change the global economy beyond all recognition and send the stock market soaring. I also realized that I had to move my company out of our leafy West London neighborhood to the peach orchards of Silicon Valley as soon as possible to get in on the ground floor. I did this over a weekend care of, you guessed it, Federal Express. Thank goodness my guys were single.

I then called the Head of Research at Normura Securities in Tokyo and informed him of the incredible power of the Internet, and that in five years, Normura would distribute all of its research online, completely eliminating paper. He said I was out of my mind. I was wrong. In the end, it took Nomura ten years to move to online-only research, vastly improving the profitability of the company.

Over the last month, I have realized that we are seeing a repeat of that magical 1990 “aha” moment. We are only one year into Dotcom Bubble Part II, which has several more years to run. Remember when Fed Chairman Alan Greenspan warned of “irrational exuberance” in December 1996? Technology stocks rocketed for 3 ½ more years, wiping out several hedge funds on the short side along the way.

Think of it as 1997 again. Now, if I can only get my 1997 hair back!

Need any further convincing? Today, graphics card maker NVIDIA (NVDA) is selling at a forward multiple of 20X earnings. In 2000, this type of stock (Cisco Systems, Yahoo, Dell Computer) was selling for 100 times earnings. Add a 2X multiple expansion and a 5X multiple expansion and you get a 10X growth in the lead stock prices in coming years.

The net, net of all this is that the most expensive stocks in the market are not really expensive, but the cheapest. Overbought? Technically insane? Doubled in a year?

Buy em!

For AI, five will continue dominating the market for the foreseeable future. The top five AI stocks are showing an average 60% profit gain in Q1. The remaining S&P 494 are showing a 10% loss. It is a 1990s Dotcom Bubble repeat in miniature. These stocks have gained $5 trillion in market value in only three months, and there is more to come.

What are these companies doing right? They developed the greatest new income streams in history, while at the same time carrying out the most ferocious cost-cutting efforts. The effect on profits is astronomical. It’s like they spent the last 10-40 years preparing for this one moment. Look no further than Meta (META), which cut staff from 87,000 to 67,000, tripling net income to $14 billion, and doubling the share price.

It will be a recurring story.

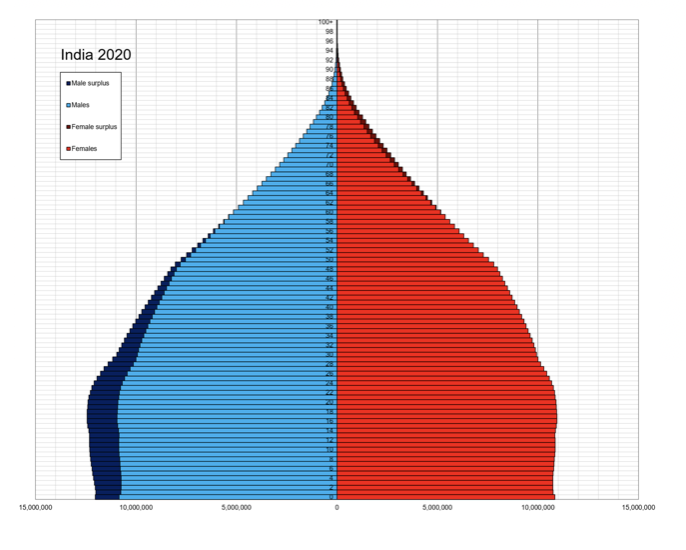

On a completely different topic, hedge funds are pouring into India once again as the next China. It has the world’s best demographic curve, with an average age of only 20 years old, meaning that in 20 years it will have the most big spending consumers. It has the world’s fastest-growing Services PMI. It is also the most populous country in the world, topping 1.4 billion, exceeding China.

Apple (AAPL), Tesla (TSLA), and many other Western companies are looking to expand there. You always follow direct investment as the head of JP Morgan’s investment division once told me. Buy the (INDA) and the (INDY).

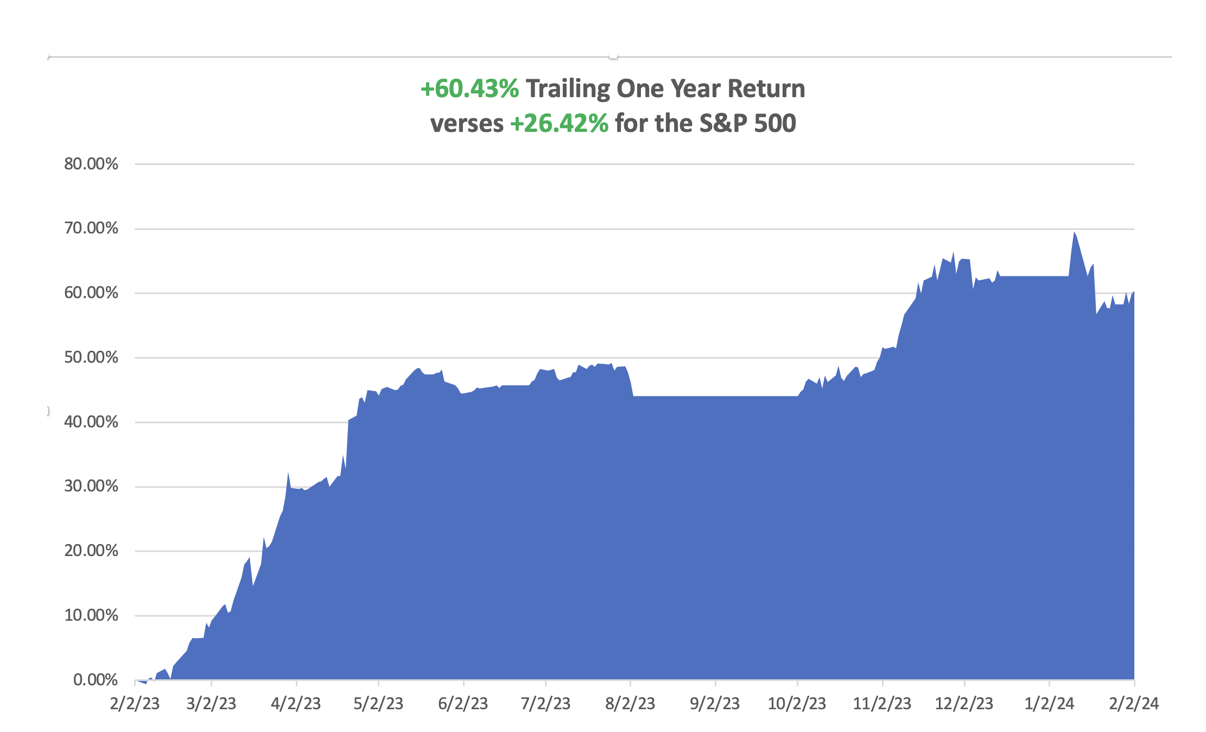

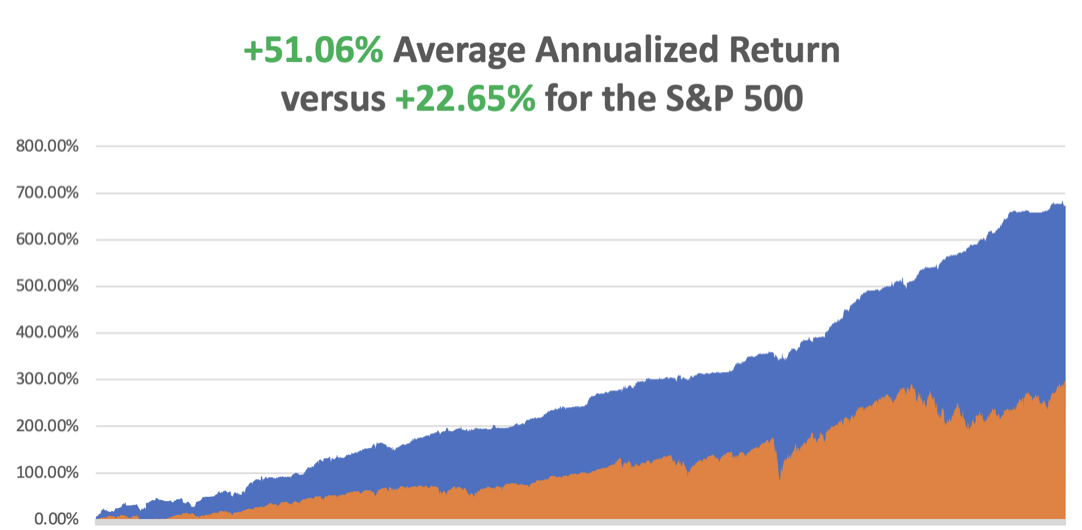

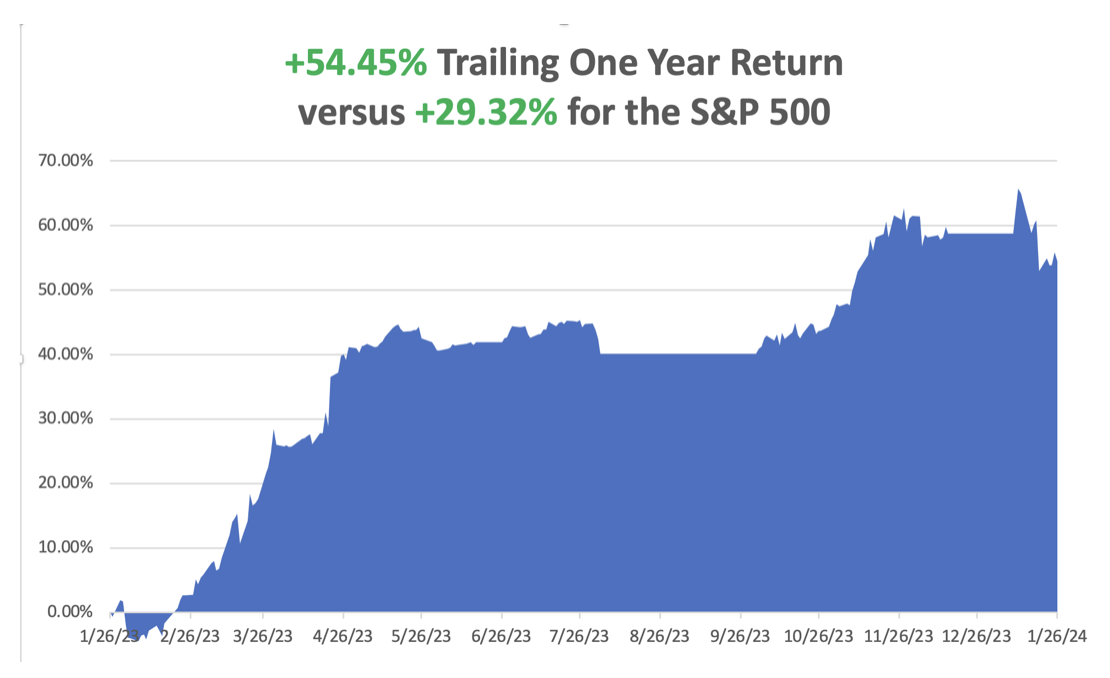

So far in February, we are up +2.04%. My 2024 year-to-date performance is also at -2.24%. The S&P 500 (SPY) is up +5.10% so far in 2024. My trailing one-year return reached +60.43% versus +20.48% for the S&P 500.

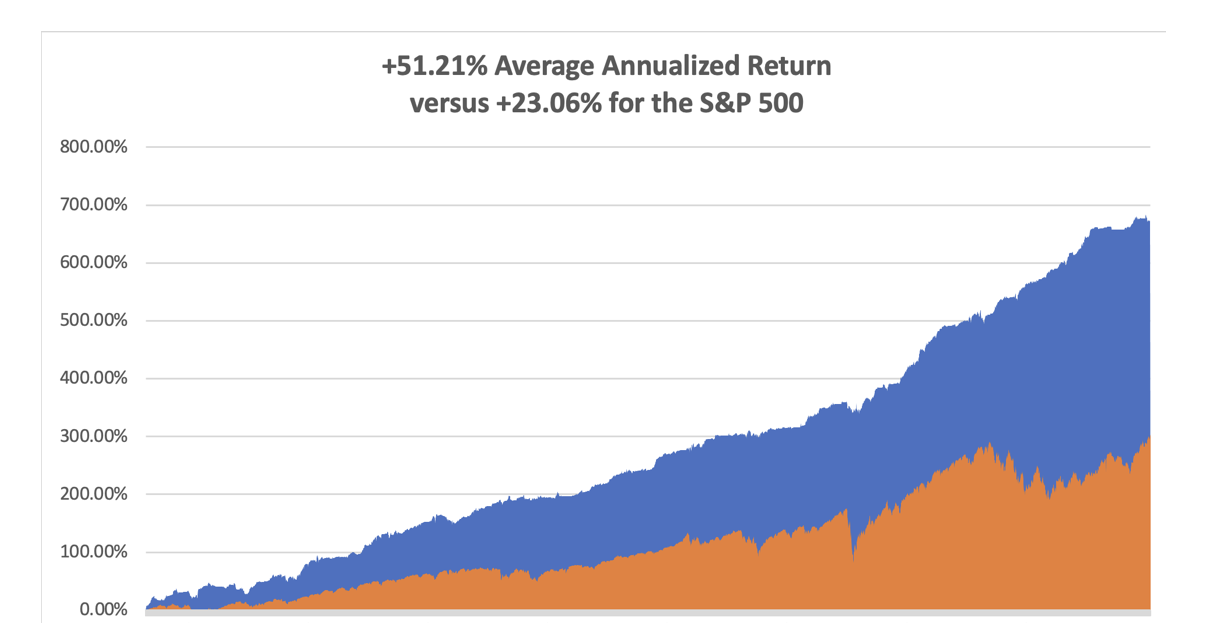

That brings my 16-year total return to +674.39%. My average annualized return has recovered to +51.21%.

Some 63 of my 70 trades last year were profitable in 2023.

I am maintaining longs in (MSFT), (AMZN), (V), (PANW), and (CCJ).

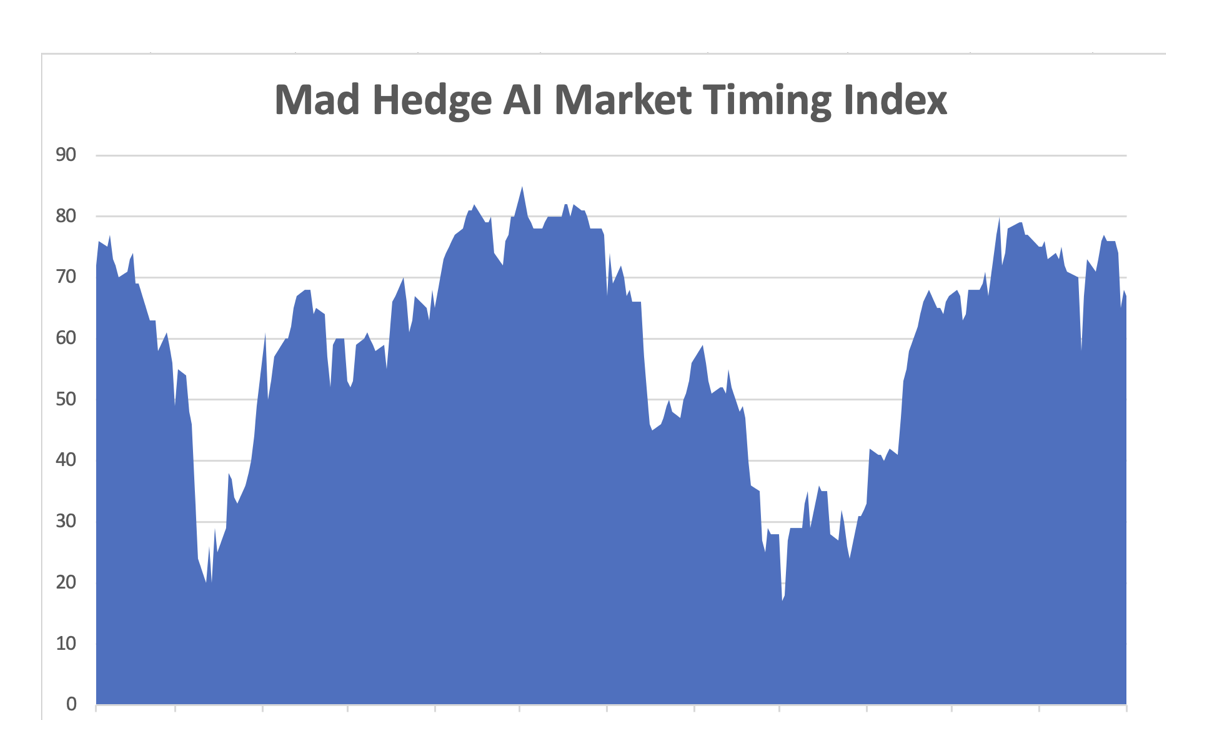

The Fed Turns Dovish, with all members expecting the next move to be a rate cut. It’s just a matter of how much, and how soon, but March was taken off the table. All bearish content from the Fed statement was removed. A classic “Buy the rumor, sell the news type of move. Look for a multi-week to one-month correction in tech, then a new rally.

US Treasury Borrowing to Hit $760 Billion in Q1, some $55 billion less than expected. Q2 then drops to only $202 billion. Bonds rallied on the good news. Buy (TLT) on dips.

S&P Case Shiller National Home Price Index Falls, in November for the first time in nine months. Detroit reported the highest year-over-year gain among the 20 cities, with prices rising 8.2% in November, followed again by San Diego with an 8% increase. Seattle and San Francisco reported the largest monthly declines, falling 1.4% and 1.3%, respectively. This was back when mortgage rates were peaking at 8.0%.

Saudi Arabia Cuts Oil Production Targets, cratering prices and destroying the entire energy sector. Lack of demand, especially from China, is the reason. New US output is fuel on the fire. Production will be throttled back a million barrels to 12 million barrels a day as a long-term goal. It couldn’t happen to a nicer bunch of people.

Microsoft Beats estimates the steady growth of its Azure cloud business, but the shares dropped. Revenue in the second quarter, which ended Dec. 31, rose 18% to $62 billion, while profit was $2.93 a share, the company said in a statement Tuesday. Azure cloud-services sales gained 30%. Buy (MSFT) on dips.

Biden to Announce Massive Chip Subsidies, to head off a coming shortage driven by AI. The coming announcements are aimed at kick-starting the manufacturing of advanced semiconductors that power smartphones, artificial intelligence, and weapons systems. The $43.5 billion to be spent also has national security implications in moving semiconductor manufacturing from China back to the US. Buy all semiconductor plays. It’s free money for them.

It's the 16th Year Anniversary of the Mad Hedge Fund Trader, and what a long and winding road it has been. Going into the 2008 crash, several investors pulled out of a new hedge fund I was starting because of cash calls so I decided to go into the newsletter business instead. Thanks for your 16 years of your support. We now publish 24 newsletters a week and run summits every three months with a global staff of 15.

My Ten-Year View

When we come out the other side of any recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, February 5, at 8:30 AM EST, the ISM Services PMI is announced.

On Tuesday, February 6 at 8:30 AM, the Total Household Debt is released by the Federal Reserve Bank of New York.

On Wednesday, February 7 at 2:00 PM, the US Imports and Exports are published. We also get the latest car data.

On Thursday, February 8 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, February 9 at 2:00 PM the Baker Hughes Rig Count is printed.

As for me, I’ll never forget when my friend, Don Kagin, one of the world’s top dealers in rare coins, walked into my gym one day and announced that he made $1 million that morning. I enquired “How is that, pray tell?”

He told me that he was an investor and technical consultant to a venture hoping to discover the long-lost USS Central America, which sunk in a storm off the Atlantic Coast in 1857, heavily laden with gold from the California gold fields. He just received an excited call that the wreck had been found in deep water off the US east coast.

I learned the other day that Don had scored another bonanza in the rare coins business. He had sold his 1787 Brasher Doubloon for $7.4 million. The price was slightly short of the $7.6 million that a 1933 American $20 gold eagle sold for in 2002.

The Brasher $15 doubloon has long been considered the rarest coin in the United States. Ephraim Brasher, a New York City neighbor of George Washington, was hired to mint the first dollar-denominated coins issued by the new republic.

Treasury Secretary Alexander Hamilton was so impressed with his work that he appointed Brasher as the official American assayer. The coin is now so famous that it is featured in a Raymond Chandler novel where the tough private detective, Phillip Marlowe, attempts to recover the stolen coin. The book was made into a 1947 movie, “The Brasher Doubloon,” starring George Montgomery.

This is not the first time that Don has had a profitable experience with this numismatic treasure. He originally bought it in 1989 for under $1 million and has made several round trips since then. The real mystery is who bought it last? Don wouldn’t say, only hinting that it was a big New York hedge fund manager who adores the barbarous relic. He hopes the coin will eventually be placed in a public museum. In 2021, the Brasher Doubloon sold at auction for $9.36 million.

Mad Hedge followers should start paying more attention to gold which I believe just entered another decade-long bull market, thanks to falling US interest rates. You can’t go wrong buying LEAPS in the top two miners, Barrack Gold (GOLD) and Newmont Mining (NEM).

Who says the rich aren’t getting richer?

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader