Nine Surprises that Could Kill Off This Bull Market

I have lately been besieged with emails from readers asking if they should sell everything, put all their money into cash, and if the great bull market is well and truly over.

My answer is the same to all. If a full-throated and affirmative “NOT YET”. Things may look scary now, but they could get a lot worse, and eventually, that will take place, maybe by 2030.

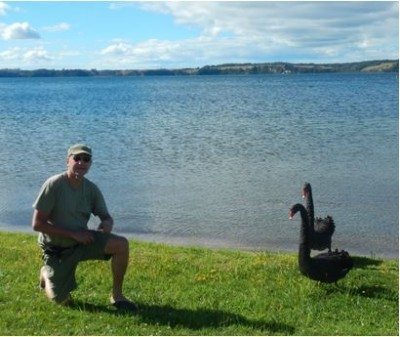

But if 50 years of trading has taught me anything, it is always be prepared for the “black swan”. I have a laundry list of issues that could kill the bull once and for all. And while some of them are flashing alarm signals, many aren’t. I’ll go through them one by one.

The Pandemic Gets a Fourth Wave – Shutting down much of the economy and preventing kids from going back to school. As the stimulus tap (call it what it really is, disaster rescue) runs dry, tens of millions will lose jobs….again. Stocks could make a secondary low similar to the one we saw in 2020.

A New Pandemic Emerges – We may learn that the price of a globalized economy is more frequent pandemics. A greater mixing of global peoples is creating brand new pathogens from scratch at an unprecedented rate. We’ve had four new fatal bug attacks in the last 20 years. Before that, a serious one came along only every 20 years. It took six months for the 1918 Spanish Flu to spread around the world. Covid-19 took about a week. All of a sudden it went from southern China to rural northern Italy to remote eastern Colorado.

Cyber Terrorism – Has been brought to the fore once again by the Colonial Pipeline hack, which cut off gasoline supplies for much of the US East Coast. In the end, a $5 payment got the gas pumps flowing again. Imagine that you sat down to turn on your computer one day and nothing happened. The entire Internet was down, all financial transactions ceased, the power went out, and all food distribution ceased. America’s Internet infrastructure is far more vulnerable than most people realize. That's why I have been recommending cybersecurity stocks like Palo Alto Networks (PANW) and Snowflake (SNOW) for the past decade. Certainly, my own local utility, PG&E (PGE) doesn’t maintain security to a military standard. It should. That’s why I’m off the grid.

Debt Levels in China – It’s easy to forget that perhaps 40% of China’s government-owned financial institutions are de facto bankrupt. They have been accumulating bad loans for decades and hiding them on their balance sheets and essential negative net worth’s. If one suddenly goes under, it could easily lead to a cascading series of bankruptcies much like we saw in the US during the 2008 financial crisis that spills over to the US and Europe. Back then, we lost Lehman Brothers and Bear Stearns, and could have lost everyone if the government hadn’t stepped in.

Debt levels in the US – If Biden gets everything he wants with economic stimulus bills, the US national debt will soar from $28.2 to $40 trillion by 2025. With the ten-year US Treasury bond yielding a paltry 1.64%, the markets don’t see this as a problem….for now. When it does, bond yields could rocket to 5%-10% and stocks will crash. Maintain a core short position in the (TLT) as insurance.

2024 Election – is going to be loaded with fireworks for sure since they’re still counting votes from the last one. The rancor may get so extreme on both sides that it literally scares people out of the market. If Trump gets reelected, you can count on the stock market dropping by half in months. We barely survived the last round, when the Dow Average crashed 12,000 points in six weeks and 586,000 died.

Middle East War – War with Iran, always on the table, will be an enormous drag on the US economy. Investment shifts from machinery to weapons, which have no impact on productivity. Government borrowing soars more.

Biden Dies – Not an impossibility for a 78-year-old man in the highest-pressure job in the world. The current lifespan for American white males is, you guessed it, 78. Vice president Kamala Harris will take over but lacks the market soothing experience, the credibility, and the electability of Biden. Expect a headline shock.

Climate Change Accelerates – That is already happening but is hurting countries closer to the equator than ourselves, like India and Egypt. I just installed a new electric Mitsubishi mini-split heat pump to protect against the record temperatures of the coming summer. The US military certainly considers this an existential threat. Increased category five hurricanes, heat-caused crop failures, uncontrollable wildfires, and more frequent out-of-the-blue flooding are already having catastrophic localized effects. Imagine all that getting much worse. And there are severe impacts which we haven’t even thought about yet. The first effect we have already seen? Higher insurance premiums for everyone. Good luck getting new fire insurance in California or flood insurance in Florida. Mine just went up 40%.