Not All That Glitters Is Lily

I've been so busy chasing after Eli Lilly (LLY) and its trillion-dollar dreams that I nearly overlooked a gem in the making.

While everyone's obsessing over LLY's march towards that coveted $1 trillion market cap, there's another pharma giant that's been quietly chugging along, building value like it has for over a century.

I'm talking about Johnson & Johnson (JNJ). You know, that little company that's only been around for 138 years.

I understand that JNJ isn’t as exciting as the likes of Crispr Therapeutics (CRSP) with their fancy gene editing therapies, or Intuitive Surgical (ISRG) with their robotic surgeons, but, let me tell you, sometimes boring is beautiful – especially when it comes with a 3% dividend yield and a rock-solid business model.

Let's break it down, shall we?

First off, JNJ isn't sitting on its laurels. Just last week, they dropped $1.7 billion to snatch up a private heart-device company. That's not chump change, even for a behemoth like JNJ.

And speaking of big moves, the FDA just gave them the green light for a chemotherapy-free lung cancer treatment.

We're talking about Rybrevant plus Lazcluze, which showed a 30% reduction in the risk of disease progression or death compared to AstraZeneca's (AZN) offering.

That's not just incremental progress – that's potentially life-changing stuff for patients.

But they’re not stopping there. They're also shelling out $600 million upfront (with potential milestone payments up to $1.1 billion) for V-Wave, a company making shunts for heart failure patients.

This deal's expected to close before the year's out, beefing up JNJ's already impressive MedTech division.

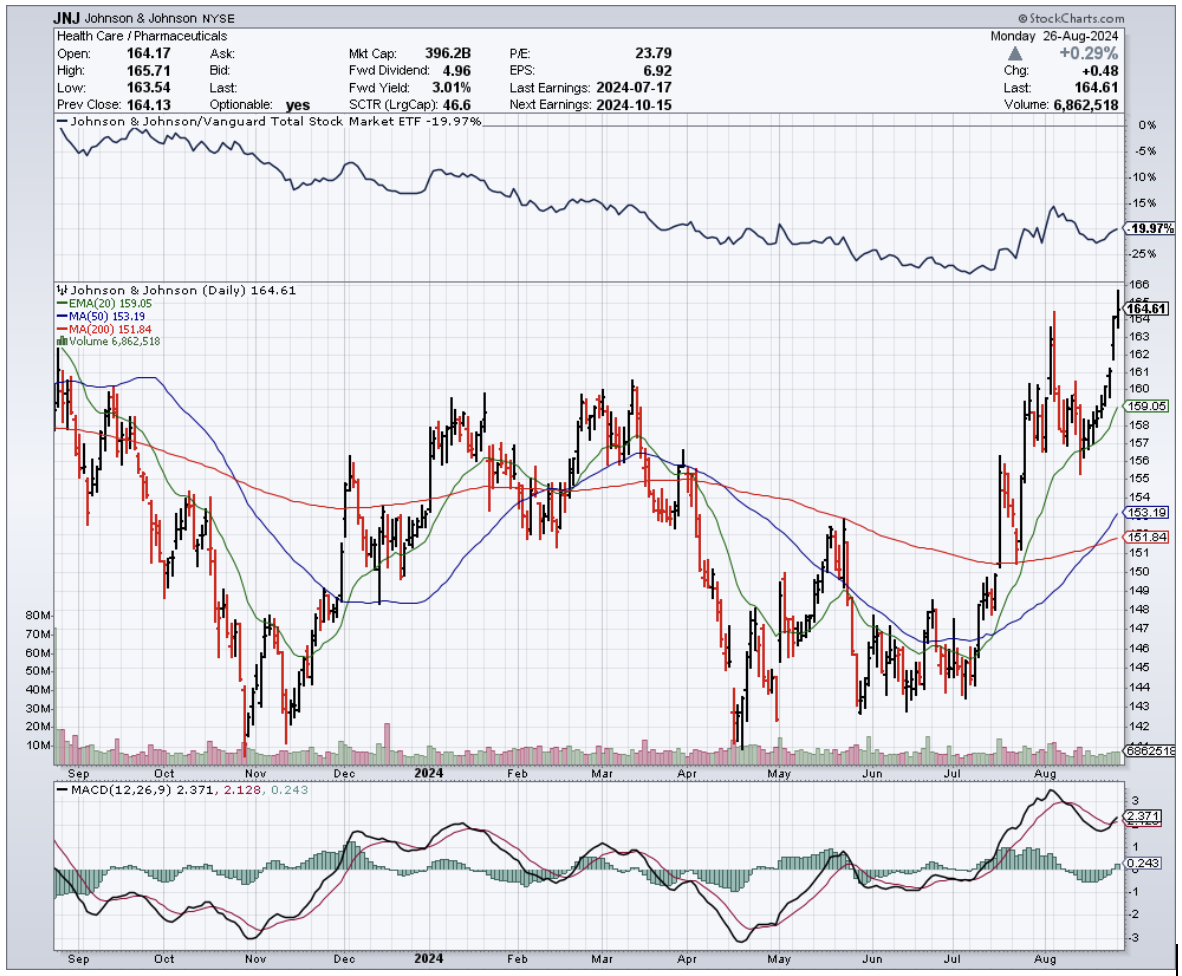

Now, let's talk numbers. JNJ's current market cap is sitting pretty at just under $400 billion. Sure, it's not in Lilly's $850 billion stratosphere, but remember – slow and steady wins the race.

And speaking of winning races, JNJ was the global leader in pharmaceutical sales last year, raking in $85 billion. That's a cool 30% higher than their closest competitor, Roche (RHHBY).

But here's where it gets interesting for value hunters. JNJ's currently trading at an enterprise value of 12.8 times forward EBITDA. In English? It's reasonably priced compared to its peers.

Even better, it's trading near the bottom of its five-year range for forward P/E ratio, EV-to-EBITDA, and price-to-free cash flow. Translation: This stock's on sale, folks.

Now, I know what some of you are thinking. "But what about those talcum powder lawsuits?" Fair question.

JNJ's looking at potentially settling around $6.5 billion worth of claims. That's not a small amount, even for these guys.

But here's the kicker – they've got over $25 billion in cash on hand and generated about $19 billion in free cash flow over the last 12 months. They can take the hit and keep on ticking.

Let's talk products. Stelara, Tremfya, Darzalex, Erleada – these aren't just random drug names. They're cash cows for JNJ. And with a diverse portfolio where no single drug accounts for more than 13% of total sales, they're not putting all their eggs in one basket.

Still, I'm not saying JNJ is going to double overnight. This isn't some flashy tech stock riding the AI hype wave.

But for those of us with a long-term horizon and a love for steady income, JNJ looks mighty attractive.

Think about it – they've raised their dividend for over six decades straight. That's longer than some of you reading this have been alive.

And with a 77% payout ratio, they've got room to keep that streak going.

Sure, over the past decade, JNJ's total return of 106% might not set your hair on fire. It lags behind the S&P 500's 234% and even the Health Care Select Sector SPDR Fund ETF's (XLV) 189%.

But remember, past performance doesn't always guarantee future results.

Here's my take: JNJ isn't for the get-rich-quick crowd. It's for investors who appreciate a good night's sleep knowing their money's in a company that's weathered world wars, depressions, and yes, even lawsuits.

Will JNJ hit that trillion-dollar mark? I'd bet my last bottle of Tylenol on it. It might take a decade, but hey, good things come to those who wait.