November 18, 2009

November 18, 2009

Featured Trades: (CALIFORNIA DEMOCRACY ACT OF 2010),

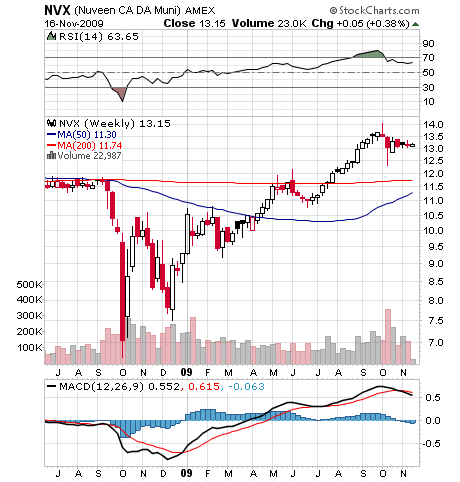

(VCV), (NCP), (NVX), (LITHIUM),

(SQM), (CVX), (BIOFUEL), (XOM)

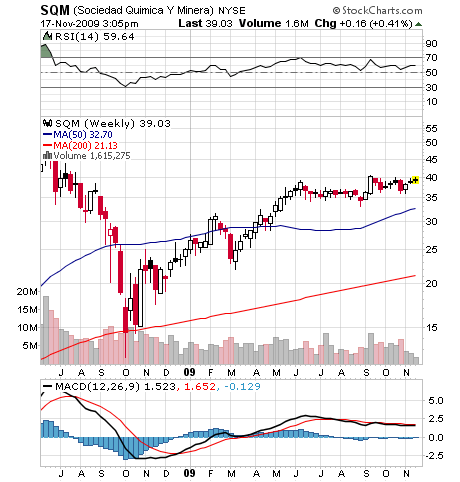

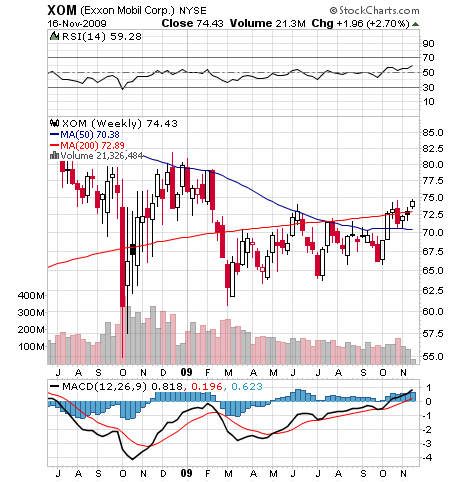

2) It?s 1910, and I?m trying to get you to buy a company that refines gasoline, just before the number of cars in the world explodes from 1.3 million to 250 million. That?s what I?m trying to accomplish when I pile investors into Sociedad Quimica Y Minera (SQM), the Chilean company that is the purest play on lithium production (click here for their website). Early believers have booked a 60% gain so far, and there is a lot more to go (click here for my call). The Electrification Coalition, an industry trade group, says that the number of electric cars on the road is about to go ballistic, with a dozen companies planning all-electric model launches in the next two years.?? The first 120 million vehicles will shrink our oil imports by 8 million barrels a day to nearly zero, cutting our bill by $250 billion annually, and no doubt putting a major dent in the price of oil. Fire departments are even training first responders on how to deal with huge lithium batteries in car accidents with ?hazmat? teams. A battery charge is 75% cheaper than filling up a tank with gas, meaning our transportation costs are about to fall dramatically. SQM has to increase its production by a factor of ten, or face a takeover by a much larger company looking to move into the alternative energy space, possibly from an American oil major. Is anyone at Exxon (XOM) or Chevron (CVX) listening?

3) Since we?re on the topic of oil major diversification, let?s take a look at Exxon?s (XOM) biofuel program. As a former research biochemist at UCLA, I have long viewed biofuel as a huge waste of time, because there are not enough hamburger stands in the whole world to generate the needed grease for recycling. Ethanol was never more than expensive pork for corn producing swing states, and it?s no surprise they are going bankrupt, even with large subsidies. That?s ignoring the fact that they were burning food to power our chrome wheeled Cadillac Escalades, driving up prices for the starving masses in emerging markets. But when the progeny of John D. Rockefeller (I knew his grandson David) commits $600 million to move algae from the realm of science fiction to mass production, I have to sit up and pay attention. This is not a company that is interested in tree hugging or saving the world, but in the hardnosed business of finding and selling energy for a profit. There is no law confining them to the oil business, and it is wise for them to find alternatives while they have the bucks to do it. Never underestimate the power of pond scum. Algae have been used for centuries to produce agar and additives for food, cosmetics, and medicines. You?re probably already eating more than you realize. According to Exxon, one acre of algae also has the ability to produce 2,000 gallons of fuel per year, compared to 650 gallons from palm trees, 450 gallons from sugar cane, and 250 gallons from corn. As any marine biologist will tell you, these simple organisms accomplish this by absorbing massive amounts of carbon dioxide and turning it into oxygen, killing two birds with one stone, from an environmentalist?s point of view.? The catch is that no one has ever tried to do this on an industrial scale, and the production problems are certain to be formidable, with enormous inputs of water and nutrients required. You probably wouldn?t want to live next door to where this is happening either. But if we have to hold our nose to beat the next energy crisis, so be it.

QUOTE OF THE DAY

?There is still that great sucking sound of liquidity coming out of the market,? said Meredith Whitney of the Meredith Whitney Advisory Group, an independent research boutique, who is recommending aggressive sales of bank stocks.