November 20, 2009

November 20, 2009

Featured Trades: (LUMBER), (TBT), (ZIMBABWEAN DOLLARS), (GOLD), (SILVER)

(HEDGE FUND RADIO)

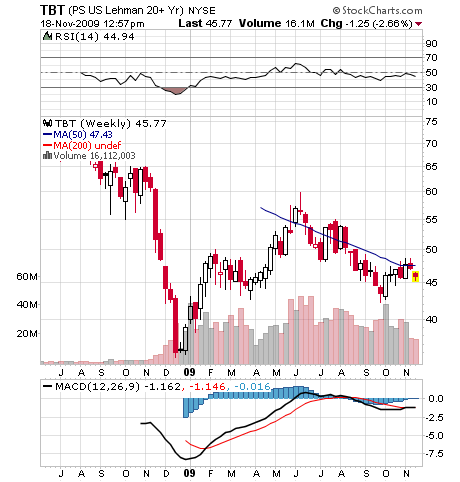

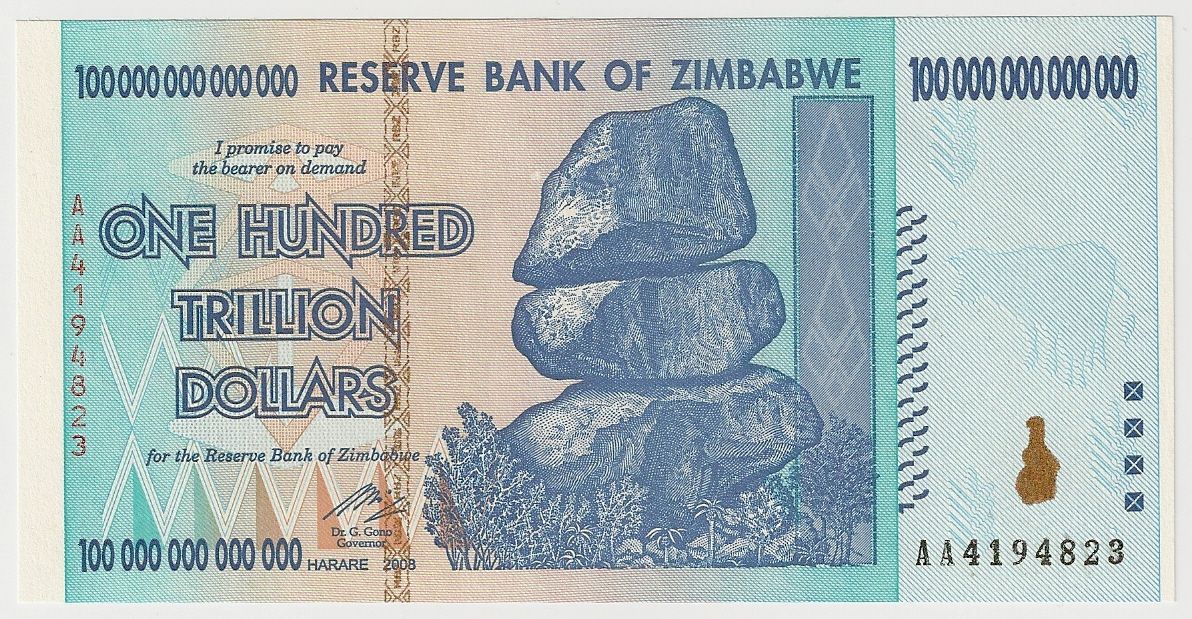

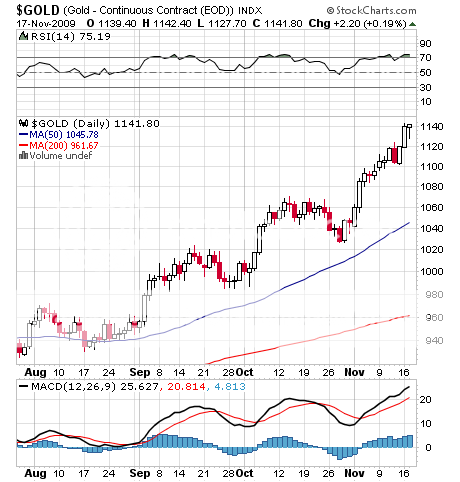

2) I want to thank the many readers who have been mailing in gold and silver coins in appreciation of my efforts to get them in at the beginning of the year at $800/ ounce for gold and $10/ounce for silver. Gold hit a new high today of $1,155, while silver tickled $18,75. The guys who leveraged up made an absolute killing, and they have numbers like $1,300, $2,300, and $5,000 dancing in their dreams. Hardly a day goes by without the mailman knocking on the door, a heavy but compact package in hand, smiling and winking while I sign. I also want to thank the reader who I got into the TBT in January. He had never heard of the thing, the ETF that bets on falling Treasury bond prices, but managed to ride this bucking bronco from the high thirties to $60 before pulling the ripcord. He sent me $300 trillion Zimbabwean dollars in cash in three crisp new $100 trillion banknotes hot of the printing press. He gave that amount because that is what it now costs to buy a cup of coffee in the hopelessly mismanaged African country. I see the TBT is back down to $45 handle again. Hmmm, looking at Obama?s latest deficit spending plans, I wonder if it is time to take another bite out of the apple?

3) There will be no letter on Monday, as I will be speaking at the San Francisco Hard Assets Investment Conference. No doubt things will be hopping this year. They say they have fascinating metal called ?gold? which magically levitates without the aid of hidden wires and pulley?s. I can?t wait to learn all about it. I?ll be reporting back. MHFT

?The real problem is that the subprime foreclosure crisis is mutating faster than our ability to keep ahead of it. You have not just a second wave, but a third wave coming, as well,? said Howard Glasser of the Glasser Group, a real estate consultant.

?Forget the stock market. I am putting everything into whisky, gold, and ammo,? said a reader of the Diary of the Mad Hedge Fund Trader to me yesterday.