November 25, 2009

November 25, 2009

Featured Trades: (HEDGE FUND RADIO),

(PLATINUM), (PGM), (PTM)

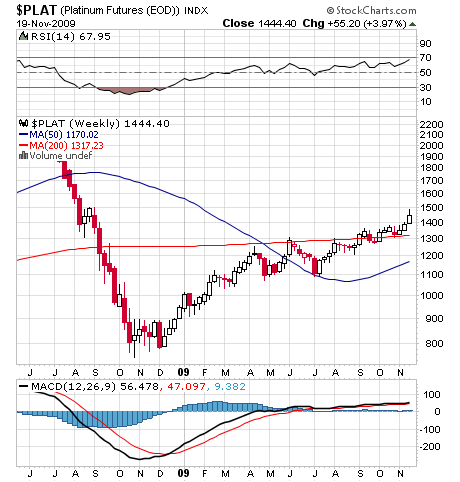

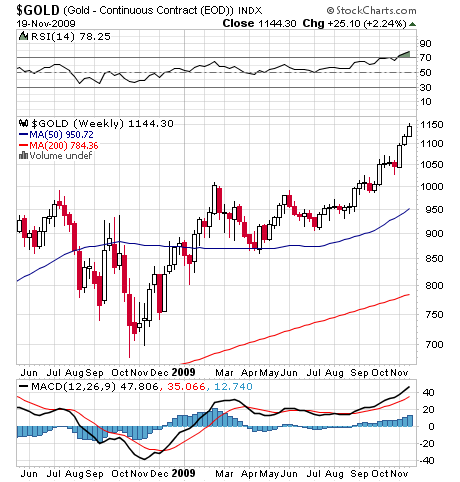

2) Since you?ve been romancing gold, you should check out platinum, her younger, racier, and better looking sister, who wears the thong and the low riders. The white metal has risen by 67% this year compared to the more sedentary 44% appreciation seen in gold. While gold has made a hard fought new all time high, the Pt has to rise a further 50% from here just to match its 2008 high of $2,200, suggesting that some catch up play is in order. I have always been puzzled by the fact that platinum is 30 times more rare than gold, but at $1,500 an ounce, trades at a mere 30% premium to the barbaric metal. You have to refine a staggering 10 tons of ore to come up with a single ounce of platinum. The bulk of the world?s 210 tons in annual production comes from only four large mines, 80% of it in South Africa, and another 10% in the old Soviet Union. All of these mines peaked in the seventies and eighties, and have been on a downward slide since then. That overdependence could lead to sudden and dramatic price spikes if any of these are taken out by unexpected floods, strikes, or political unrest. While no gold is consumed, 50% of platinum production is soaked up by industrial demand, mostly by the auto industry for catalytic converters. Only last week, no lesser authority than Jim Lentz, the CEO of Toyota Motors Sales, USA, told me he expects the American car market to recover from the current 10 million units to 15-16 million units by 2015. That?s a lot of catalytic converters. Jewelry demand for platinum, 95% of which comes from Japan, is also strong, as the global pandemic of gold fever spreads to other precious metals. You can trade Platinum futures on the New York Mercantile Exchange, where a margin requirement of only $6,075 for one contract gets you exposure to 50 ounces of platinum worth $75,000, giving you 12:1 leverage. Email me at madhedgefundtrader@yahoo.com if you want to learn how to do this. For those who like to get physical, the US mint issues Platinum eagles from 1997-2008 in nominal denominations of $100 (one ounce), $50 (?? ounce), $25 (1/4 ounce) and $10 (1/10th ounce) denominations. Stock traders should look at the ETF?s (PGM) and (PTM).

3) I guess it?s a sign of the times when the comedy show, Saturday Night Live, pokes fun at America?s trade deficit with China. In an imaginary press conference, President Hu Jintao told Obama he was not allowed to pay off the US debt to the Middle Kingdom by giving them the 750,000 clunkers he bought with last summer?s stimulus program. He then asked how many jobs his program has actually created, and Obama had to give the sorry answer that it was none. China?s president then asked how the $1 trillion health care plan for 31 million uninsured Americans was going to cut the deficit, while China?s 1.3 billion went without coverage. I won?t tell you what happened next, except that China?s president complained he wasn?t being taken out to dinner and a movie first. Where is the Federal Communications Commission when you need them? Have America?s economic policies become the laughing stock of the world? I never thought I?d see the day when out budget and current account deficits became a target for popular culture, but here we are. Better take another look at the TBT.

4) The Mad Hedge Fund Trader is taking a break to have Turkey with the family. I ate an entire pumpkin pie last night just to give my digestive system notice that some heavy lifting was on its way. The next letter will be published on Tuesday, December 1. I am the oldest of seven of the most fractious and divided siblings on the planet. No doubt by brother will show up in his new Bentley Turbo R, flaunting his outrageous bonus check from Goldman Sachs. My born again Christian sister will be bemoaning Sarah Palin?s drubbing at the polls last year. The gay rights activist sister will be arguing the case for same sex marriage. A third sister does humanitarian work visiting the many American women held in Middle Eastern jails. Don?t even think about pulling out of Iraq! Sister no. 4, who is making a killing in commodities in Australia, and is up to her eyeballs in iron ore, will be missing. My poor youngest sister took it on the nose in the subprime derivatives market, and is holding on for a comeback. She is the only member of the family I was not able to convince to sell her house in 2005 to duck the coming real estate collapse because she thought the nirvana would last forever. My two Arabic speaking nephews in Army Intelligence will again delight in telling me that they can?t talk about their work or they?d have to kill me. Another nephew will be back from his third tour in Iraq with the Marine First Division without a scratch, God willing. My oldest son won?t be able to make it because they don?t have a Thanksgiving break in China, and he is trading shares like a demon anyway. We all be thankful that my yougest son wasn?t arrested in the latest round of rioting at the University of California at Berkeley. Reading the riot act will be my spritely, but hardnosed mother, who at 82 can still prop herself up on a cane well enough to knock down 14 out of 15 skeet with a shotgun, although we have had to move her down from a 12 to a 410 gage because of her advanced age and brittle bones. Suffice to say, that we?ll be talking a lot about the weather. I?ll be rejoining you next week. That i

s, if I survive.

?I think we?re headed towards VAT taxes. It?s only a question of how long it takes for them to wake up and figure it out. You can?t tax the wealthy enough to close the budget deficit we have,? said Leon Cooperman of hedge fund Omega Advisors.