November 25, 2024

(INVESTORS ARE LOOKING FOR CLARITY ON THE PATH OF INTEREST RATES IN THANKSGIVING WEEK)

November 25, 2024

Hello everyone

WEEK AHEAD CALENDAR

MONDAY NOV. 25

8:30 a.m. Chicago Fed National Activity Index (October)

Earnings: Agilent Technologies

TUESDAY NOV. 26

8:00 a.m. Building Permits final (October)

9:00 a.m. FHFA Home Price Index (September)

9:00 a.m. S&P/Case -Shiller comp. 20 HPI (September)

10:00 a.m. Consumer Confidence (November)

10:00 a.m. New Home Sales (October)

10:00 a.m. Richmond Fed Index (November)

2:00 p.m. FOMC Minutes

8:00 p.m. New Zealand Rate Decision

Previous: 4.7%

Forecast: 4.25%

Earnings: HP, Dell Technologies, CrowdStrike, NetApp, J.M. Smucker, Analog Devices, Best Buy, Autodesk

WEDNESDAY NOV. 27

8:30 a.m. Durable Orders (October)

8:30 a.m. GDP second preliminary (Q3)

8:30 a.m. Initial Claims (11/23)

8:30 a.m. Personal Income (October)

8:30 a.m. Wholesale Inventories preliminary (October)

10:00 a.m. PCE Deflator (October)

10:00 a.m. Pending Home Sales Index (October)

10:00 a.m. Pending Home Sales (October)

THURSDAY NOV. 28

8:30 a.m. Continuing Jobless Claims (11/16)

6:30 p.m. Japan Unemployment Rate

Previous: 2.4%

Forecast: 2.5%

Events: NYSE closed for Thanksgiving Day

FRIDAY NOV. 29

2:00 a.m. Canada GDP Growth

Previous: 0.5%

Forecast: 0.4%

9:45 a.m. Chicago PMI (November)

Events: NYSE closes 1:00 p.m.

WHAT’S ON THE RADAR THIS WEEK?

Interest rate outlook will take centre stage this week with key inflation data Federal Reserve meeting minutes coming out ahead of Thanksgiving.

The October personal consumption expenditure (PCE) price index set to be released Wednesday may give further insight into the likelihood of a rate cut in December. Many economists are expecting that the PCE may show sticky inflation. It looks like the last stretch to a 2% inflation target could be very challenging.

The FOMC minutes for the November meeting will be closely watched by investors. They want to know what the Fed’s path going forward is regarding interest rates. Are they still committed to interest rate cuts? If investors are confident that the Fed remains committed to further cuts, the investment case for a broadening of the rally in 2025 may well be intact.

It certainly seems that investors are confident about stocks closing out 2024 on a high, which is due to a strong underlying economy, earnings growth potential, and the strength of the artificial intelligence trade.

Earnings to watch include Dell Technologies and CrowdStrike.

Volume is likely to be lower due to the holiday this week, so movement could be sharper because of the lack of liquidity in the market.

The consensus amongst strategists for 2025 is for a roughly 10% gain or more for the broader index.

2025 will be the third year of the bull market.

The S&P500 surged 24% in 2023, and so far in 2024, the S&P500 is up 25%.

S&P500 predictions for the end of 2025

Goldman Sachs = 6,500

Morgan Stanley = 6,500

UBS – 6,400

BMO Capital = 6,700

WILL GOOGLE BE FORCED TO SELL OFF CHROME?

Google and other tech giants’ dominance of the internet and search has been under the microscope of American authorities in recent years.

In August this year, a judge ruled Alphabet had a monopoly over online search and related ads.

District Judge Mehta agreed with the US Department of Justice (DOJ) that Google broke the law by paying $41 billion to ensure it was the default search engine on smartphones and browsers.

Recently, the DOJ asked the same judge to force Google to sell Chrome due to its market dominance.

They say the company should also share data and search results with rival browsers like Edge, Firefox, or Safari.

The DOJ’s court filing accuses Google of “unlawful behaviour” by trying to prevent rivals from being able to get a foothold in the market.

Like many countries, the U.S. has “antitrust” laws, which allow the government to break up monopolies and large corporations through the court.

If Judge Mehta rules in favour of all the DOJ’s demands, it would mean:

# Google would be forced to sell Chrome

# It would be banned from releasing a new web browser for five years.

# If competition doesn’t improve, Google will have to sell its Android operating system for smartphones.

# Google would be banned from paying billions of dollars to companies like Apple to make itself the default search engine on their devices.

Of course, this is unlikely to happen overnight, as experts say Google has the option to appeal any rulings.

We also need to consider the new administration and its stance on Big Tech.

Regardless of the position they take, experts say it’s unlikely Judge Mehta will agree with all the DOJ’s demands.

If Google is forced to sell Chrome, who would be the buyer? At around $US15 billion, they would need deep pockets. My thinking here - US-based artificial intelligence players.

And what would this mean for the internet? We are likely to see more innovation and competition in the web browser market.

MARKET UPDATE

S&P500 – Bull run to continue

As I said last week, we are watching the 5,697 level. Any significant break below that level could take the market back to around 5,400 in the short to medium term and then extend to 5,120.

But let’s work with what we see in front of us now. We are extending in this 5th wave, and there may be a likelihood that this wave stretches to around 5,465.

Support = ~5925/5890

Immediate resistance = ~6,017/6085

GOLD – Uptrend to persist

We should see gold continuing to advance. The recent correction/consolidation was well overdue. Recently, I did recommend taking some profits (scale out/take a % off the table) to lock in some profits. This provides some income (if you don’t do LEAPS/options) while still holding positions in your portfolio. In other words, you are taking a little bit of profit - 10%-25% – but you are still left with a healthy investment in your stock/s to allow for growth.

Short term Support = $2,675

Next Target = $2,820

BITCOIN – Rally to continue

The uptrend in Bitcoin is still intact; there are no signs of exhaustion yet.

Very short-term support = ~ $95,650/$94,900/$85,100

Next target = ~$100,600 and then around $109,250

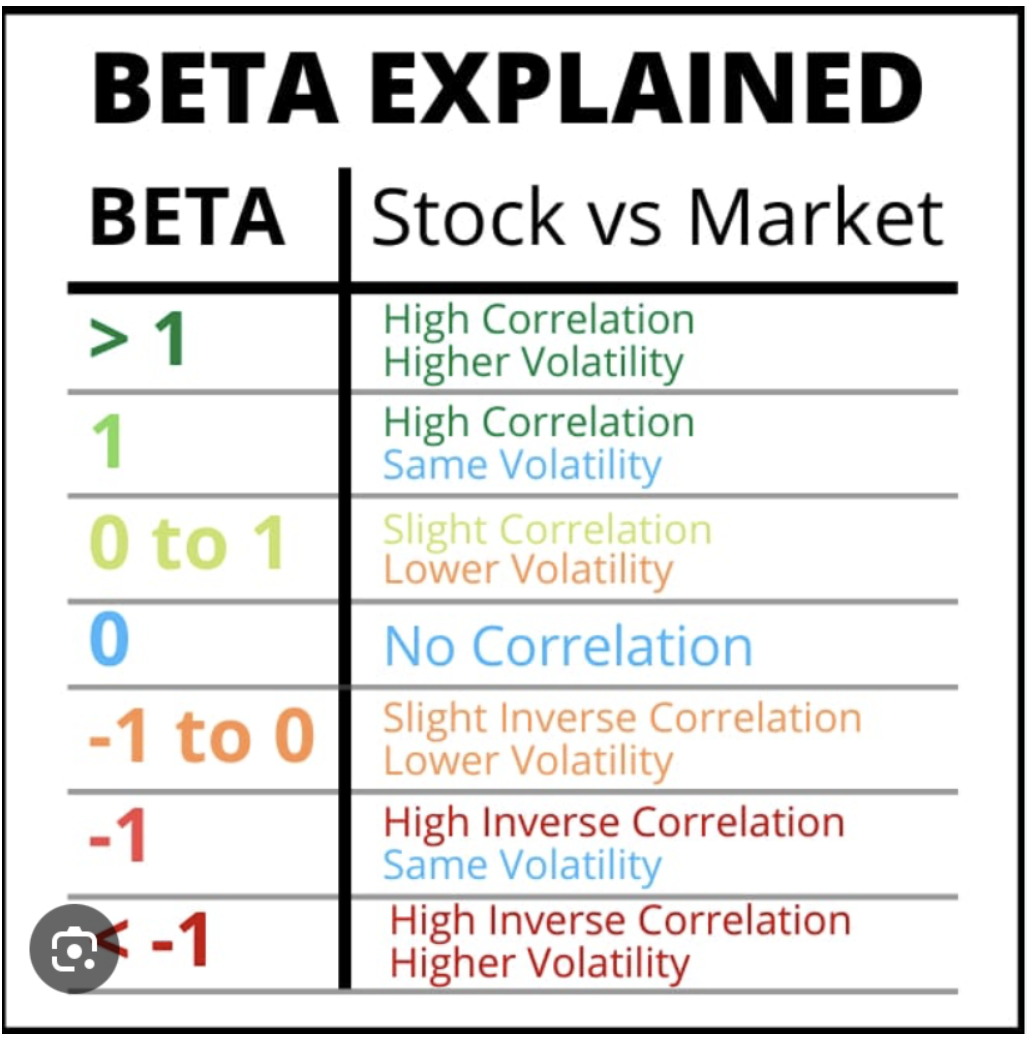

WHAT IS BETA?

Beta is a measure of a company’s stock volatility relative to the overall market. In other words, you are looking at a company’s stock returns (change in stock price) relative to the overall market returns (change in market stock price).

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie