Nvidia Earnings To Sway The Nasdaq

It’s been a steep drop for tech stocks the last few days and there is a lot to piece through here.

It was due at some point.

Look, we are at Himalayan highs in the Nasdaq and that doesn’t mean it will be smooth sailing from here.

To find that incremental dollar to push up tech stocks is not as easy as it once was.

We aren’t in the golden years of technology anymore.

The big question is why someone should input that extra dollar when there is a flattening of momentum in the entire tech establishment.

A.I. is the big two-letter acronym that everyone is focused on so it is not a surprise that profits are being taken leading up to Nvidia’s earnings.

Nvidia isn’t as ironclad as it used to be and that worries me.

Nvidia is carrying the market on its back like it has been doing for the past year and market breadth has remarkably narrowed.

If there was no Nvidia, we would be looking at a demonstrably lower stock market than this expensive stock market we are trading right now.

Remember that I urged readers to pile into tech stocks after that mid-January Deepseek selloff and that was the perfect elixir to profits.

Now, where do we find that indicator or signal to go green?

It’s a tough one and we must be patient.

All I have left in the portfolio is a bull call spread in Meta that has been taken out to the woodshed and beaten like the proverbial red-headed stepchild.

Then we look at other signs of liquidity and alternative barometers and Bitcoin has to scare you.

The quicksand drop to $85,000 per coin questions whether the bull market in tech stocks is still alive or kicking.

At the very minimum, the kicking is getting weaker and weaker each following earnings season.

But investors can hold on to hope for a few more hours. After the bell today, the world turns to fourth-quarter earnings for the linchpin of AI euphoria, Nvidia (NVDA).

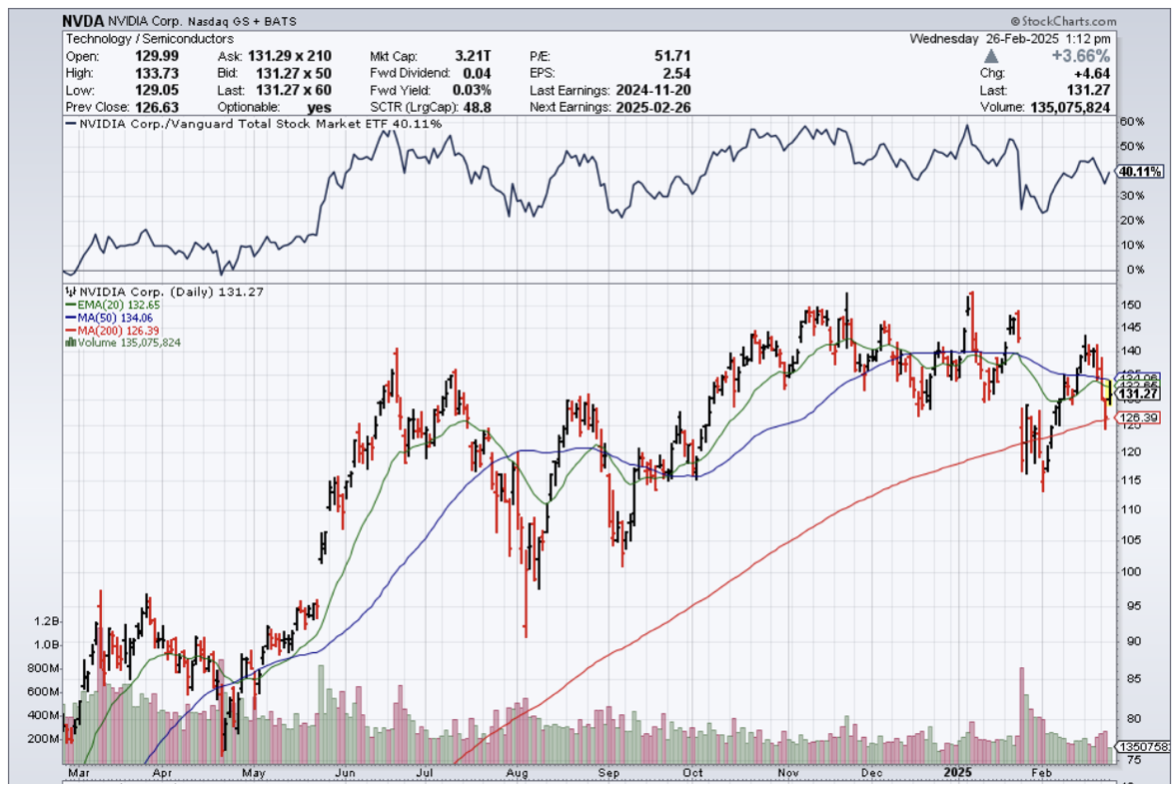

This two-plus-year bull market has weathered several multi-month periods when Nvidia's stock price sputtered. But the company's stock hasn't contributed to the bull market since last June, as its share price has effectively gone nowhere in that time.

Over the last 10 years (40 reports), buying Nvidia stock just before the earnings announcement has yielded a median return of 3% to 4% on the one-day, one-week, and one-month time frames. Holding for three months has yielded nearly 18%.

The disparity highlights the volatile earnings reactions that might net bullish results but can also cause significant discomfort in the near term.

But for the entire Nvidia obsession, investors are right to question how much AI is still a picks-and-shovels or even an energy trade (as it morphed into in 2024).

If I had to nail down a date, investors expect the 2nd half of 2025 to calculate what exactly future cash flow will look like and if the infrastructure investment in AI is really worth the hassle.

A great deal of capital was asked to front AI and we are creeping towards that day where AI will need to sink or swim.

As it stands, the AI overlords like OpenAI helmed by Sam Altman, still puts on a happy face like nothing will fail to surpass expectation. It is easier to put on a good face when someone is worth billions upon billions.

In the short, we are preparing for a buying opportunity in the best and brightest.