October 11, 2010 - Where to Buy the Next Dip in Gold

Featured Trades: (GOLD), (GLD), (AEM), (KGC), (INIVX)

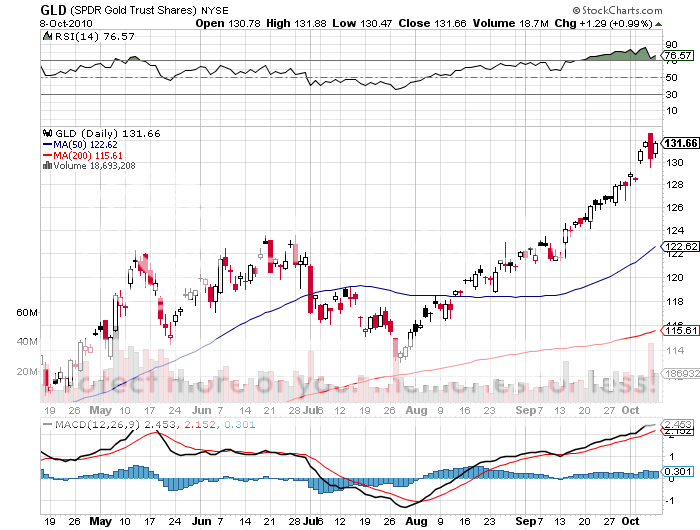

SPDR Gold Trust Shares

Van Eck International Investor's Gold Fund

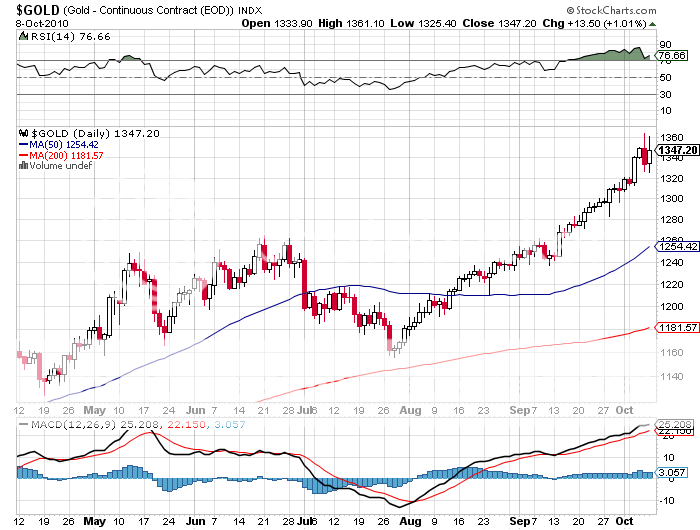

3) Where to Buy the Next Dip in Gold. After the violent moves in the gold market last week which took it to another all time high of $1,363, and then a wrenching $25 pull back in a matter of hours, many traders are left grasping for an intelligent way to deal with the barbarous relic. Those who were too clever by half and traded out of the yellow metal early are now trying to buy it back on any dip, driving it relentlessly higher.

The gold bugs who read this letter will not be surprised to hear that the Van Eck International Investor's Gold Fund (INIVX) has been the top performing US mutual fund for the past five years, with an annual 27% return. The firm focuses on buying miners with good management and decent growth prospects. These are often found listed on the Sarbanes-Oxley free Toronto Stock Exchange. Its three top picks now are Agnico Eagle (AEM), Kinross Gold Corp. (KGC), and Rangold Resources (GOLD).

The gold industry is in a supply/demand sweet spot now, as supplies have been ex-growth for a decade in the face of a rising tide of demand. Peak gold is upon us, and unexploited deposits are getting farther and fewer between. There will be no more of history's 'gold rushes' as seen in California, South Africa, Australia, and Alaska, as the world has been scoured to death for new deposits. This is happening while failed economic policies around the world create ever larger numbers of buyers.

Gold may be overbought for the short term, but the world is waiting to buy it on any $100 dip, where emerging market central banks will be jostling with private institutions and individuals to top up existing positions, and 'newbies' fight to open new ones. Van Eck's conservative one year target is $1,700/ounce. They think the bull market has a good five years to run, and won't end until we see an inflationary spike, taking prices to who knows where.

There Must Be Some Gold In Here Somewhere