October 15, 2009

October 15, 2009Featured Trades: (WHEAT), (WZ09), (HELEN THOMAS), (TROLL DOLLS)

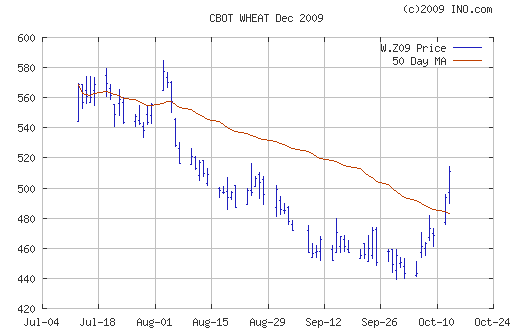

1) I bet I?m the only guy you know whose wedding was filmed by the KGB. My friend, the TASS correspondent,? shot 8mm film of the entire assembled foreign press at the event at The Foreign Correspondents Club of Japan in the seventies, no doubt for their files in Moscow. No wonder they lost the cold war. We?ve stayed in touch through the years, through the collapse of the Soviet Union and the many wars, revolutions, booms, and busts that followed. He now advises a Russian hedge fund. What else? He called me the other day to tell me I was right on track with my recommendation to buy wheat (WZ09), because the Ukrainian grain crop had just come in 12% lower than last year. Poor weather had caused yields to plummet, and this would no doubt be good news not only for wheat, but corn and soybeans as well. The country was once known as the bread basket of Europe, which was one of the reasons why it was invaded by Napoleon in 1812 and the Germans in 1942. They still have a sizeable impact on global prices. I have also gotten an assist from my trading partner is the Midwest, one Jack Frost, whose early arrival has analysts slashing forecasts of grain crops here, leading to a 18% pop in price in the last week to $5.18/bushel. It?s even getting nippy hear in Fog City, where the roses in my front yard have commenced an early die off.?? I?ve noticed over the decades that when do the hard research and get your fundamental call right, all of the accidents and surprises tend to happen in your favor. That seems to be happening here.

2) One of the joys of having small children is that you get to know the guy at the local plumbing supply shop really well. It?s amazing what will fit down a toilet these days. He once told me that when Troll Dolls hit the market, every plumber in the country was guaranteed a job for life. When I went there yesterday I thought I?d pick up some leading economic indicators as well. After a deadly year, business is picking up a bit. Sure, it is still down a third from two years ago, but there is a definite improvement going on. The Eureka moment! His comments confirm the sort of ?L? or ?square root? shaped recovery I have been expecting. We aren?t going to zero anymore, but it is not exactly off to the races either. Throughout the nineties, a salesman at Circuit City (RIP) walked me through every generation of technology, and he was worth his weight in gold. All I had to do was buy a new TV from him every year, and they kept getting bigger and more expensive. I bought the second high definition TV sold in California, after George Lucas, who I used to run into at the local IHOP. Sometimes figuring out the direction of the economy is as simple as going down to the local butcher, baker, or candlestick maker and asking. They are on the front lines of economic activity, and they will see any changes months before those of us glued to computer screens. Asking George Lucas also helps.

3) I managed to catch up with my former white House Press Corp colleague, Helen Thomas, when her national book tour swung through San Francisco. At 89, Helen is the oldest and longest serving member of this esteemed group of journalists, and has the traditional right to ask the first question at each press conference. The native Kentuckian has covered every president since Kennedy, but has been observing the political scene since the Roosevelt era (Franklin, not Teddy). I knew her when I was a wet nosed apprentice writer during the Carter administration and she was a senior writer for the old United Press International. Helen hasn?t changed an iota, and is as feisty as ever. John F. Kennedy was her favorite president, a man of peace who knew war, who inspired people and launched the space program and the Peace Corp. Lyndon Johnson brought to life the most sweeping social programs since FDR?s New Deal, but saw his legacy shattered by the Vietnam War. She pitied Richard Nixon, who at the end felt the wrath of the nation fall upon his shoulders. Gerald Ford was a decent human being, too nice, really, for the job that was thrust upon him. Ronald Reagan was a master at managing the press. George W. Bush lied to the people about WMD?s in Iraq and hung the albatross of torture around America?s neck. He then sanitized the war for public consumption, and cowed the press into fearing being called unpatriotic and anti-American. Bush heard that Helen was murmuring that he was the worst president in US history, and broke with a century of precedent by conspicuously ignoring her seniority during his administration. Obama, who shares a birthday with Helen, lacks the courage to do the right thing and should stick to his guns. But all new presidents come in completely unaware of what they have signed up for and there is a tortuous learning process. Investigative reporting is gone forever because newspapers can?t afford it. Helen has seen public morals become more liberal for ourselves, but more strict for our public officials. I know there isn?t any real investment insight here, and I will probably get some angry e-mails from conservatives. But hey, when a piece of living history crosses your path, you grab on to her with both hands and shake her until the gems of insight she possesses fall loose. If Helen could only bottle and sell the energy she has at her age, she could make a fortune.

QUOTE OF THE DAY

?Seek the truth, and let the chips fall where they may,? Said Helen Thomas about her profession, adding ?I?m a cynic with hope.?