October 16, 2023

(THERE ARE MANY NARRATIVES ABOUT THE MARKET AND THE ECONOMY)

October 16, 2023

Hello everyone,

What’s on the Economic Calendar this week:

Monday

Australia RBA meeting minutes

Previous: N/A

Time: 8:30pm ET

Tuesday

Canada Inflation Rate

Previous: 4%

Time: 8:30am ET

Wednesday

UK Inflation Rate

Previous: 6.7%

Time: 2:00am ET

Thursday

Japan Inflation Rate

Previous: 3.2%

Time: 7:30pm ET

Friday

UK Retail Sales MoM

Previous: 0.4%

Time: 2:00am ET

Earnings reports continue this week.

Tuesday October 17

Goldman Sachs (GS)

Bank of America (BAC)

Johnson & Johnson (JNJ)

United Airlines (UAL)

Wednesday October 18

Morgan Stanley (MS)

Citizens Financial Group (CFG)

Western Alliance Bancorp (WAL)

Lam Research (LRCX)

Netflix (NFLX)

Thursday October 19

American Airlines (AAL) October 19

If we are in for a prolonged period of higher interest rates, we can also foresee:

Higher oil prices

Higher government deficits

Higher defense spending and

More political division

What will keep rates high?

A strong economy

Higher fiscal deficits

More Treasury issuance to cover budget deficits.

Investment implications:

A contrarian bias toward longer-duration debt and

Investment grade tax-free municipal bonds.

OIL

The Hamas attacks on Israel plus tighter supplies, declining inventories and limited spare capacity are lining up to keep energy costs high.

Investment implications:

Stay overweight energy as strong cash flow and earnings drive benefits to the sector.

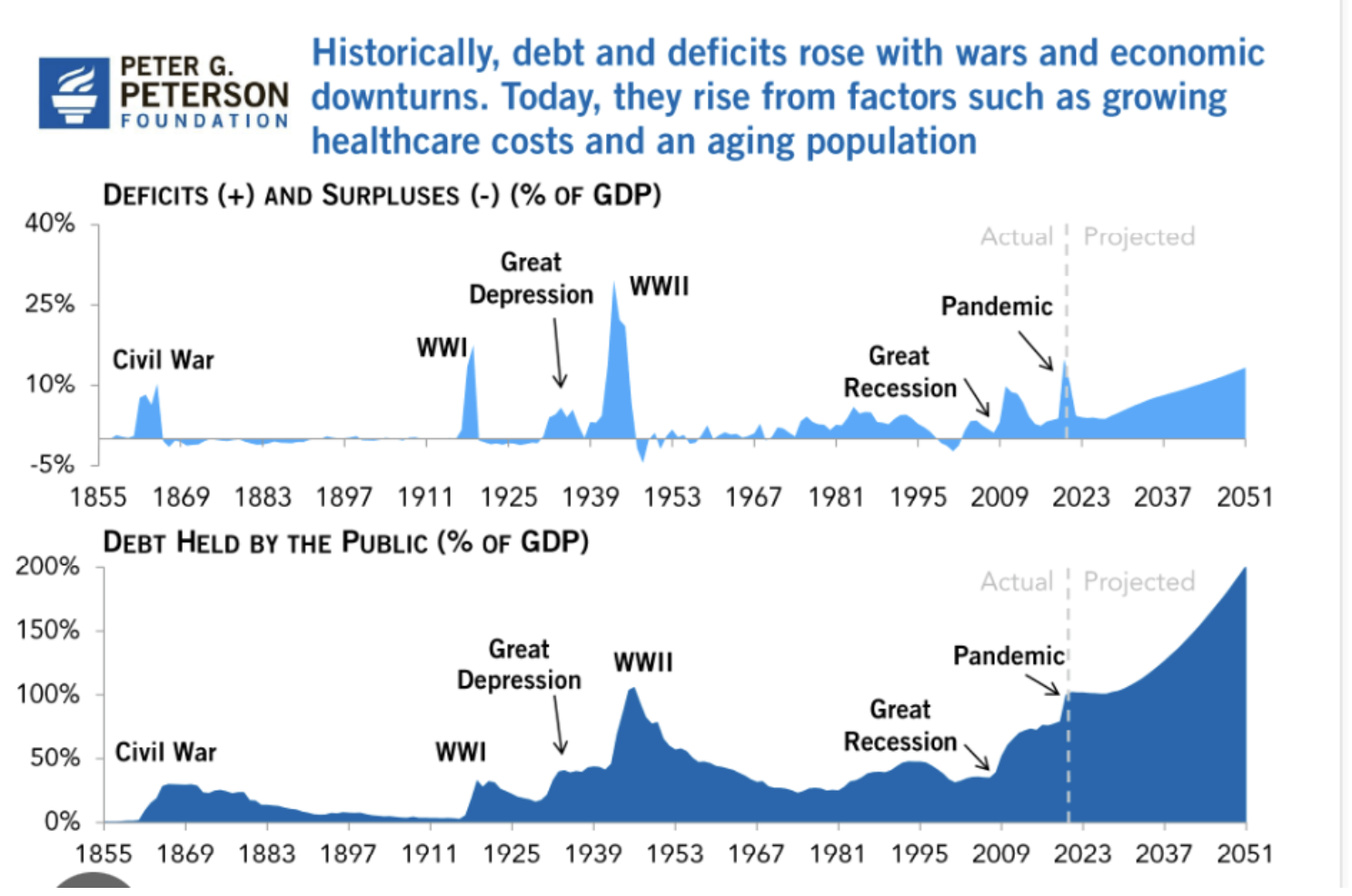

BUDGET DEFICITS

The U.S. government has racked up a budget deficit of more than $1.5 trillion.

It becomes a spiral – the market stresses out over America’s finances -> greater potential for higher interest rates, deferred social spending, credit downgrade, a weaker U.S.$ and fiscal consolidation.

DEFENCE SPENDING

Geopolitical tensions should lead to an increase in defense spending around the world. The war in Ukraine and now the war in the Middle East have heightened the need for investment in this sector.

Investment implications:

Given the geopolitical situation, you can expect an emphasis on ‘hard power.’ In other words, we could see coercive diplomacy, economic sanctions, military action, or the formation of military alliances to act as deterrence.

U.S. firms are global leaders in defense and cyber activities.

POLITICS

There is political uncertainty everywhere:

A presidential election next year

Another potential government shutdown in November

The election of the Speaker of the House

Markets hate uncertainty.

Investment implications:

A rising dollar could mean trouble for stocks (but a downward move could be close).

Another credit downgrade could rattle markets.

Another viewpoint:

We can also argue that rising yields may have done the job for the Fed, and we may not get another interest rate rise this year. The implication here is that bond market movements are working to tighten financial conditions by raising the cost of credit for companies and individuals.

The 10-year Treasury yield has reached a medium-term high and could drop by roughly 80 basis points by the end of the year, according to some analysts.

Why might this happen?

Growth could start to falter in the U.S. with the economy possibly falling into a mild recession. And this will help push inflation down more quickly than most anticipate. These movements may give the Fed enough reasons to cut rates sooner and by more than what is currently discounted in the markets.

In other news:

Australians voted NO in the Referendum held on Saturday, October 14 that would have given Indigenous Australians a voice in Parliament in the form of an advisory body.

Thoughts on the S&P 500

From an Elliott Wave perspective, we can still interpret the market to be in the early stages of a rally headed toward an Elliott Wave 5 target around the mid-4,500s in the weeks ahead.

Next resistance is at 4340/4386.

Gold

Gold has the potential to trend higher after its big jump last week. (There was a flight to safe-haven assets because of the Israeli/Hamas war.) Resistance is now at $1,960/$2,000. If Gold can clear the $2,000 level, then this precious metal can retest Chart resistance at $2,072.

Wishing you all a wonderful week.

Cheers,

Jacquie