October 21, 2009

Global Market Comments

October 21, 2009

Featured Trades: (GOOG), (MS),

(1987 CRASH), (CVA), (AMSC)

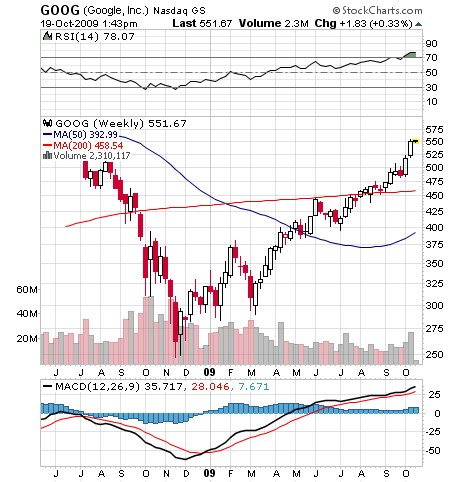

1) When people ask me what is the one stock they should put in their kid?s college fund and forget about, I always give them the same company: Google (GOOG). The toll taker for the Internet that controls 70% of the global market for search just announced record Q3 profits of $1.6 billion on a revenue rise from $4 billion to $4.4 billion. In this economic environment these numbers are nothing less than astounding, making GOOG one of the few US firms that has actual top line growth.? Google earnings, in fact, have turned into a valuable leading economic indicator by telling us that the strong ad growth came in the retail, travel, and the automotive sectors. This bang up performance is further proof that the irresistible tectonic shift away from old line media like newspapers, radio, and TV, to online, is accelerating, offering advertisers far and away the highest return on investment. Google is fast becoming the operating system for all advertising. While critics focus on the myriad ways the company recklessly burns money on peripheral businesses like Google TV, YouTube, forays into print media, and their private space program, I see gigantic growth opportunities that will prevent the company from becoming another Microsoft (MSFT). Mobile search grew 30% QOQ as the growing legion of sophisticated portable devices are increasingly used for search. Also, click rates cratered in the great recession, the price of ?investment advisor? for example plunging from $4 to pennies. A recovery could bring an equally ferocious rebound in rates that fall straight to GOOG?s bottom line. Most analysts are now targeting the high $600s for the stock price, which I believe will prove conservative. If you are ever worried about America?s future, then just look at these two kids, Larry Page and Sergey Brin, who built a $400 billion company out of their dorm room at Stanford in virtually no time, with no capital. Just ignore the office foosball table, volley ball court, and at-desk massage service.

2) With the orgy of recollections about the 1987 stock market crash on the 22nd anniversary yesterday, I suppose I should throw in my two cents worth. I was in Paris visiting Morgan Stanley?s top banking clients, who then were making a major splash in Japanese equity warrants, my particular area of expertise. I was escorting around our Tokyo economist, David Gerstenhaber, now a noted hedge fund manager, who waxed on bullishly about the long term prospects for the Japanese economy. When we walked into our last appointment, David casually asked how the market was doing (Paris is six hours ahead of New York). We were told the Dow was down 300. Stunned, I immediately asked for a private conference room so I could call the equity trading desk in New York to buy some stock. A woman answered the phone, and when I said I wanted to buy, she burst into tears and threw the handset down on the floor. Redialing found? all transatlantic lines jammed. I never bought my stock, nor found out who picked up the phone. I grabbed a taxi to Charles de Gaulle airport, and flew my twin Cessna as fast as the turbocharged engines would go, breaking every known air traffic control rule. But by the time I got back to London, the Dow had closed down 512. Then I learned that George Soros asked us to bid on a $250 million blind portfolio of US stocks after the close. He said he had also solicited bids from Goldman Sachs, Merrill Lynch, JP Morgan, and Solomon Brothers, and would call us back if we won. We bid 10% below the final closing prices for the lot. Ten minutes later he called us back and told us we won. How much did the others bid? He told us that we were the only ones who bid at all. Scrotums tightened throughout the firm. The next morning the Dow continued its plunge, but after an hour managed a U-turn, and ensued on a monster rally that went on the rest of the year. We made $75 million on that one trade. It was the worst investment decision I have seen in the markets in 35 years, executed by its most brilliant player. Go figure. Maybe it was George?s risk control discipline kicking in. At the end of the month, we then took a $75 million hit on our share of the British Petroleum privatization, because Margaret Thatcher refused to postpone the issue, giving Morgan Stanley?s equity division a flat P&L for the month of October, 1987. I think I sweated off five pounds that day Even now, I refuse to gas up at a BP station, no matter how green it is.

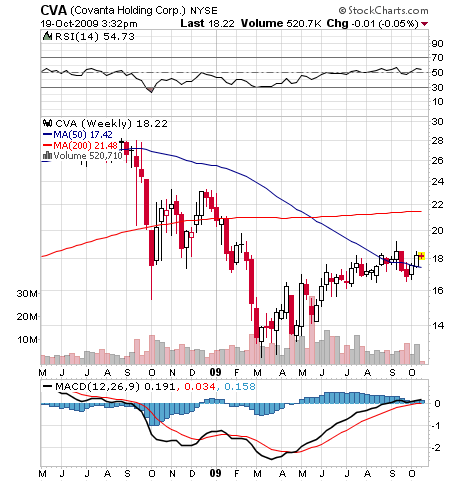

3) If the 2009 Clean Energy Bill passes, it is going to pave the way for major structural changes to the US economy, which few of the non-engineering types voting for it in Congress understand. The bill encourages electric power utilities to switch to renewables, upgrade the electric power grid, and put in place a cap and trade system which places an enormous burden on the power industry to go green (click here for background report). The bill is expected to sail through the House, but faces a major fight in the Senate, where the administration is going to have to get all of their ducks in a row for it to pass. The bill provides the legal structure to spend that $100 billion for alternative energy already passed in the stimulus bill. In his cheerleading press conference for the bill, Obama correctly declared that dependence on hydrocarbons was jeopardizing our national security. He also cleverly described this as a massive creator of high tech jobs that can?t be exported.?? I?m not highlighting this because I live in California, wear sandals all year, drive a Prius, or have a refrigerator stuffed with organic greens as if a giant gerbil does my shopping. Since this economic crisis started, the key has been to buy whatever the government is buying, and since they are going into alternatives in a big way, you want to be right ahead of them (click here to see my solar piece). Time to add more alternative energy names to your list to buy on the bigger dips. Look at American Superconductor (AMSC), which is involved in advanced wind turbine designs and electric power grid upgrades. Also take a peek at Covanta (CVA), an established business that profitably burns trash to create electricity.

e.LUV