October 28, 2009

Global Market Comments

October 28, 2009

Featured Trades: (ROACH MOTELS) (FCX), (COPPER), (DOLLAR), (ALTERNATE RESERVE CURRENCY), (LONDON OLYMPICS)

1) This is how you trade this market. Buy the dips on any pull back in any asset, keep a tight stop loss, and run like Hell if it get?s triggered. No doubling up or leaning in. There is only one problem with this strategy. This is how the entire rest of the world is trading! So after the first couple of mouse clicks to the downside, the markets will seize up, as they did last year.?? Anyone with a position larger than the change under your living room sofa cushions won?t be able to get out. Portfolio managers will helplessly watch as their positions get marked down with no trade. The world has been borrowing dollars at zero and buying anything and everything, and the time to pay the piper is fast approaching.?? Dr. Nouriel Roubini, the Turkish economics professor at New York University whose recent negativity has brought him guru like status, made some interesting points yesterday. The Fed is keeping rates low to hasten a recovery before the next election, but Wall Street is jumping on the gravy train and avariciously coining it, creating a new bubble worse than the last one. When the inevitable synchronous global crash happens, it will make last year?s affair look like a walk in the park. There will be no place to hide. If we learned anything last year, it?s that the global capital markets have become Roach Motels. You can check in, but you can?t check out.

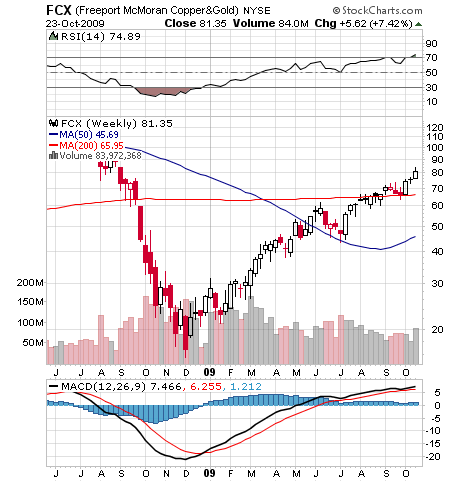

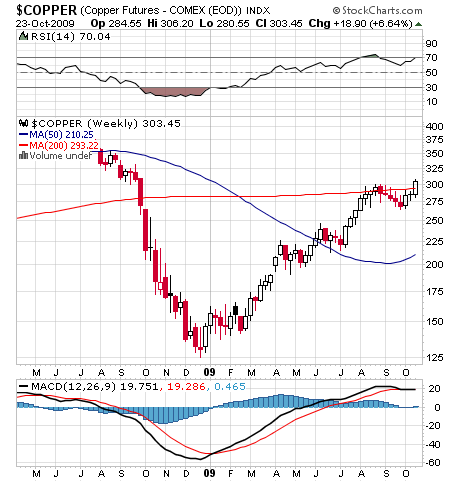

2)Last February, I told you I would kill myself if you didn?t buy the world?s largest copper producer, Freeport McMoRan (FCX) (click here for the call). OK, I exaggerate. I said I would throw myself in front of a train. Who knows, I might have survived the train. Since you all followed my advice, you are all now as rich as Croesus, as the stock has since gone parabolic, from $15 to $85, up 560%. Providing the rocket fuel for this move was copper?s leap from $1.25 to $3.00.?? CEO Richard Adkerson is the kind of burly, no nonsense kind of guy you might expect to find in an afterhours bar near one of the many open pits the company works around the world. Although Q3 revenues fell from $4.6 billion to $4.1 billion YOY, FCX has reinstated its dividend, and is clearly back in the catbird seat. China is importing record amounts of copper both for stockpiling and consumption by it explosively growing auto, consumer, infrastructure, and power industries. Record gold prices, which FCX also mines, are giving a further boost. Projects mothballed last year are back on track, and idle equipment is going back to work. When I was at Morgan Stanley during the eighties, any association with the red metal was considered career death, as it was in the grips of a 20 year bear market, trading as low as 60 cents. The guy who covered our big client in the sector was nice enough, but people avoided his table in the company cafeteria in the GM building like he had AIDS. I have to pinch myself when I see copper?s performance today. I wonder where that guy is now?

3) Will people pleeease stop incessantly nattering about the possibility of China dropping the dollar as a reserve currency? What else are they going to use? Monopoly money? Taiwanese dollars? Collectable postage stamps? At $2.3 trillion and rising fast, the Middle Kingdom?s reserves are so enormous that no other currency in the world could accommodate the switch, and no other security offers the necessary depth and liquidity but US Treasuries. China only needs to breathe on any other market for it to skyrocket, we have seen in the relatively Lilliputian commodity markets this year. And really, how likely is it that China embarks on radical new monetary policies that suddenly halves the earnings of it?s exporters, as well as its 30 year hoard of accumulated savings? The demise of the dollar has been predicted more often than the ditching of Microsoft?s Windows as the global PC operating system, and is just as likely.?? Hate the greenback as much as you like, but there just isn?t any other alternative. I have been hearing these arguments ever since the US went off the gold standard in 1971. First there was a perennial Arab threat to price crude in a basket of currencies. Gee, they never seem to complain when the buck is going up. Then there was the speculated emergence of the ?Yen Block?, in the eighties, back when Japan was dominating international trade and the yen was bumping up against ??80 to the dollar. Remember the book ?Japan as Number One? What a laugh. Then we got all that European whining after the launch of the euro, when the weak dollar was every trader?s free lunch. Let?s face it, Europeans hate using someone else?s currency as the primary reserve instrument. Before the dollar, sterling was the de facto reserve currency, and was equally despised. So rather than waste time discussing this issue anymore, let?s talk about something more important, like who is going to win the World Series this year. I?m wearing my Yankees hat.

4) With the British economy mired in a vicious recession, many are wondering if hosting the 2012 London Olympics was such a great idea. The original plan was to convert the one square mile, Lower Lea Valley site into a new suburb, and sell the condos to hungry buyers at high prices. Market conditions today couldn?t be more hostile. Runaway cost overruns have pushed the budget from $2.8 billion to a back breaking $9.3 billion. The East London neighborhood is so bad that ?when you take the tube out there, life expectancy declines with every stop,? said one staffer. A profusion of undiscovered WWII bombs, a stone age cemetery, and a toxic waste dump have also caused delays. When I lived in England I flew over this area weekly to skirt the Eastern edge of the London air traffic control zone, and I will be charitable in calling this place an industrial wasteland. The last time the British attempted a major project like this, the 2000 Millennium Park, multibillion dollar losses resulted. But who can forget that great film Chariots of Fire? Maybe it?s worth it for the Brits after all?

?We cannot continue to run trillion dollar deficits and remain a powerful nation,? said Leon Panetta, Director of the CIA