October 30, 2009

October 30, 2009

Featured Trades: (SPX), (TBT), (FISKER AUTOMOTIVE), (TAR SANDS)

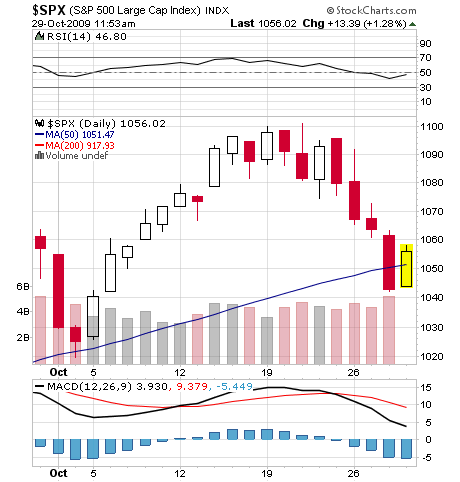

1) Those of you who heeded my GLOBAL RISK ALERT on October 13 (click here for report ) missed the top of the market by six trading days and 10 S&P points. I?m sorry; I?ll ring the bell more precisely next time, with a more accurate date and time. Since then, technical sell recommendations have been breaking out like acne at a junior year prom dance. You are all now out of your positions, or love them so much that you are willing to carry them through another crash. At the risk of hubris, even PIMCO?s Bill Gross has jumped on the bandwagon, although I doubt he needs my help ascertaining the direction of stocks and bonds. The way everything turned tail and ran at exactly the same time was a complete vindication of my theory that a tsunami of liquidity was raising all boats, completely unjustified by the underlying fundamentals. Long time readers of this letter know the only short I have advocated this year was in long dated Treasury bonds through the TBT. But the better than expected Q3 GDP of 3.5%, obviously fueled by temporary government programs like ?cash for clunkers? and the first time homebuyers tax credit,? may be presenting one of those pristine, ?sell on the news? moments. Will this data finally give us our long awaited double top? Fading rallies in stocks is looking more enticing by the day.

2) I can?t imagine a finer example? of? ?creative destruction? than Fisker Automotive?s takeover of a General Motors plant in Boxwood, Delaware that once built unwanted Pontiacs and minivans, but closed in July. The startup car maker will use a $528 million US government loan to build 100,000 plug-in hybrid electric cars a year that will sell for under $40,000. The firm?s Danish entrepreneur founder, Henrik Fisker, describes the new car as a ?green BMW.? The firm plans to export at least half its production. The Irvine, California based company is already building a high end electric sports sedan in Finland called the ?Karma? for $87,500. Joseph Schumpeter?s spirit must be smiling.

3) Anyone who has any illusions about the Canadian tar sands business should take a look at the March issue of National Geographic (click here), not normally a prime source of financial and economic news for me. I?m not a fanatic, sandal wearing, organic bean sprout eating environmentalist, but just looking at the glossy, eye opening pictures tells you that is this an eco disaster of Biblical proportions. A $50 billion investment by several firms over the last decade is now producing 750,000 barrels/day, and another $100 billion was headed north before prices crashed last year. You have to cut down a whole forest, remove two tons of peat, then another two tons of sand, and burn 100 barrels of oil equivalent to heat rivers of water to steam, just to produce a single miserable barrel of oil. This gives you the world?s highest production cost, thought to be $80-$100/barrel. There are now 50 square miles of sludge ponds in Northern Alberta leaching a witch?s brew of poisons into the water supply, which has caused the local cancer rate to explode tenfold. We?re not just talking about a few sick geese here. Canada is the largest foreign supplier of oil to the US, accounting for 19% of our total, and half of that is coming from tar sands. One can only assume that the whole industry was built as a hedge against some Third World War, Armageddon type total cut off of all foreign crude supplies that would drive prices to $500/barrel, making all of this hugely profitable someday. Maybe the owners think they can get away with this because it is in the middle of nowhere. An army of lawyers hitting these projects with a tidal wave of litigation think otherwise. After looking at these pictures and analyzing the numbers, you have to ask if it is really worth it, just so I can drive my Hummer to Wal-Mart.

QUOTE OF THE DAY

?Nobody in our industry was immune. Everybody has done a few deals which in hindsight we wish we hadn?t done. But you live and learn,? said David Rubenstein, Managing Director of the $86 billion private equity firm, the Carlyle Group