October 5, 2009

October 5, 2009 SPECIAL ?I TOLD YOU SO? ISSUE

Featured Trades: (TBT),

(BRAZIL), (EWZ)

1) For the last six months there has been a great big whopping contradiction in the markets. The stock market has been discounting a return to the ?Roaring Twenties,? while the bond market has been anticipating another ?Great Depression.? After yesterday?s publication of the Labor Department?s September nonfarm payroll number showing the loss of another 263,000 jobs, it looks like the bond market now has the upper hand. This takes the unemployment rate up 0.1% to 9.8%, and total job losses for this recession to 7 million. The really disturbing aspect of this number is that 57,000 teachers were fired, as states chop budgets to the bone. This is really eating our seed corn by the bushel full. Of course, I have been banging pots and pans, setting off distress flares, and yanking the fire alarm, trying to alert readers that this kind of disappointment was coming. Shares have dropped 5% from last week?s peak, as the bond market soared, the ten year yield reaching nosebleed territory of 3.05%. The dollar maintained its flight to safety status, which to me is one of the great ironies of all time. It?s like that reprobate, alcoholic uncle with the bad teeth, who, when your car breaks down in the middle of a downpour in a bad neighborhood, will always let you crash on his sofa. Let?s call him your Uncle Sam. You have to hand it to PIMCO?s inveterate card counter, Bill Gross, who says this is all about transitioning to a ?new? normal of 1%-2% real GDP growth. That?s why he was loading the boat with bond yields at 4%, a ?ballsey? move at the time, which now smells like roses. I guess that?s why they call him the ?Bond King.?

2) In light of the disappointing September nonfarm payroll figures reported yesterday, I?m afraid that my recommendation to buy the Proshares Ultra Short Treasury Trust (TBT), a bet that US Treasury bonds are going down, is starting to look a little green around the gills. I first recommended the TBT at the beginning of the year (click here for report ), catching a nice run from $35 to $60, and then told investors to bail at $60. I have since advised readers to start scaling back in around $45. It traded down to $43 yesterday and is at risk of turning from a trade into an investment. Of course, the fundamentals behind the TBT are still as valid as ever. Treasury bonds are without a doubt the world?s most overvalued asset, and the only political certainty we can count on is the continued exponential growth in the supply of government bonds of all maturities. Like all Ponzi schemes, their eventual collapse is just a matter of time. But as the noted economist, John Maynard Keynes, liked to remind his students, ?Markets can remain irrational longer than you can remain liquid.??? Better to live to fight another day. If you have the TBT, keep some mental stop losses under the markets, as ETF?s don?t offer owners the real thing. If the economy does enter the second half of a ?W,? the sushi could really hit the fan. As for me, I?m never wrong, just early. Sometimes way early.

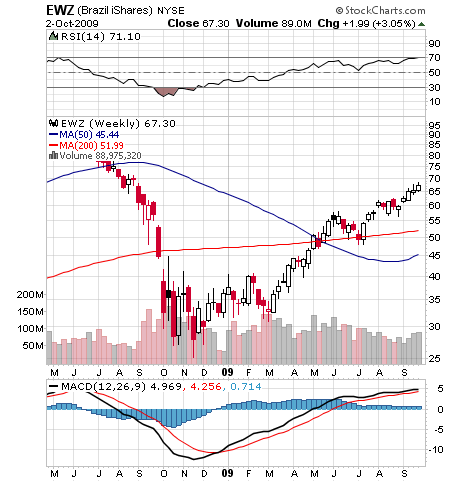

3) Hoping to beat the rush, I ordered my Rosetta Stone Portuguese language program last week, fully expecting Rio de Janeiro to win the 2016 Olympics bid. Pick pockets of the favellas of Latin America?s largest city were ebullient. A cheer even went up on the floor of Chicago?s CME, now that the denizens of the Windy City are dodging a monster tax bill. Of course, Obama was in a no win situation, with mud on his face for his failed pitch, and blamed for defeat if he didn?t go. There was never any doubt that the home of the string bikini and the banana thong was going to win. In order to justify the gargantuan cost of the modern games, the International Olympic Committee long ago turned this into an emerging market development program. The great news for investors is that corresponding emerging stock markets have a history of tenfold returns going into the games. Look at South Korea and China. Only the 2004 Athens games were a bust, the home of the Olympics building a games that were far more than it could afford. I have long been a fan of the country that is doing everything right, with a perfect demographic pyramid and a liberal pro business government fueled by resource and energy exports. I managed to catch a 270% leap for my subscribers in the ETF (EWZ) this year. I wouldn?t? rush out tomorrow and buy on the news, as an impending global stock market selloff is likely to pull it down with everything else. But it definitely should be at the top of your ?buy on dips? list.

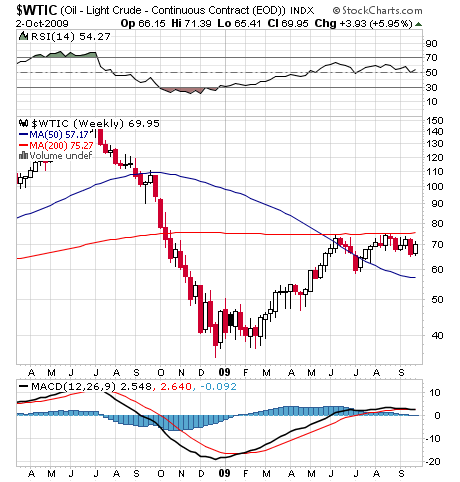

4) Since energy is going to be the dominant factor in making our investment decisions for the next decade, I thought it would be a good time to sit down with Carl Pope, Executive Director of the Sierra Club. Carl, who makes frequent appearances in this week?s PBS broadcast on the National Parks, is as sharp as a tack, with the fervor of an evangelist-always a dangerous combination. In the spirit of full disclosure, I have to tell you that I was a member of the Sierra Club back in the sixties when they were mostly interested in identifying mountain wildflowers and bird calls. They changed a little after that. Carl says that the ?Earth has a fever,? with temperatures rising, glaciers melting, forests burning, oceans rising and acidifying, and the overwhelming cause is hydrocarbon burning. The US needs to cut CO2 emissions to 2 tons per person, per year, by 2050, or down 90% from today?s levels. To do this we need to ban the burning of coal by 2030, unless it is sequestered, and stop all petroleum consumption by 2040. We can accomplish this by converting all cars to electric and moving freight via an electrified rail system. Petroleum needs to be classified as toxic waste, and a cleanup superfund needs to be set up, funded by 10% of the earnings of the oil companies for the next ten years. If we eliminate oil consumption, our trade deficit will improve by $100 billion/year, that money can be invested in the US to create 10 million jobs, and we will all be a lot healthier. The biggest and quickest way to cut CO2 emissions is to convert all coal fired power plants to natural gas immediately, and Carl likes the Pickens Plan (click here for the full analysis ). Carl is not shy about using his 40 man Washington DC office to twist the arms of recalcitrant Senators and Congressmen to achieve these ambitious goals. I had to pinch myself. The Sierra Club has backed off from its earlier, more radical positions, and that some of what they are saying actually economic sense. No more going back to a bicycle based economy. Does he know he is also advocating a strong dollar policy? While 40 years is not exactly tomorrow, look how fast the last 40 have gone by. Remember pedal pushers, thin ties, fins on Chevy?s, and the Bay of Pigs? When contemplat

ing your risk positions, you always have to consider all views. Who knew that $147/barrel would turn us all into environmentalists?

?If we don?t get our macro house in order, it will put the dollar in danger, and the most critical element there is long term fiscal stability,? said Chairman of the Federal Reserve, Ben Bernanke.