October 6, 2009

October 6, 2009

Featured Trades: (OBAMA), (FSLR), (SOLAR)

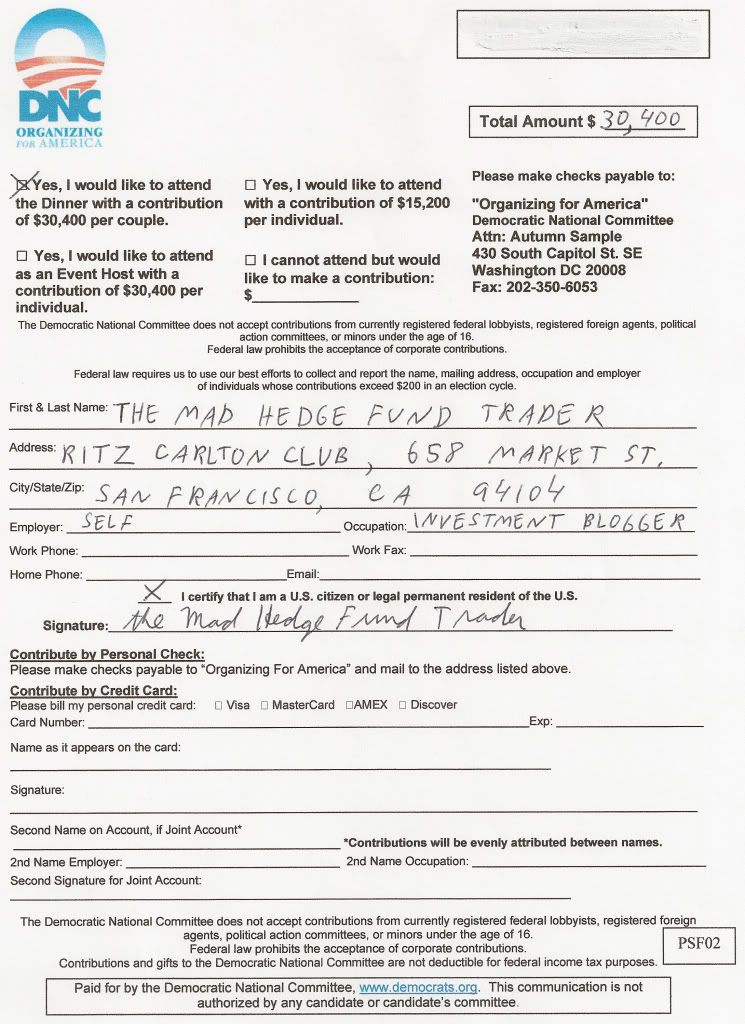

1) If you wonder where I am on the evening of Thursday, October 15, I will be having dinner with Barrack Obama, President of the United States. I received the invitation to San Francisco?s exclusive Saint Francis Hotel to meet the Commander-in-Chief with 250 of the city?s ?A-listers,? which I have reproduced below. Of course $30,400 for two is a bargain to sit down with the most powerful man in the world, but that doesn?t include another $10,000 for my date?s dress. I have been asked to arrive two hours early to provide for security screening. With my opinions plastered all over the Internet, that will no doubt involve a full proctologic exam. But hey, anything for some overcooked chicken.? Times are hard, and we all have to do our bit to stimulate the economy. Maybe I should go for a table of ten for only $150,000? Until then I shall be boning up on subjects I know are dear to the President?s heart to make chit chat, like playoffs for college football, or how he got stiffed in his Chicago Olympic bid. He could have made such a killing renting out his Hyde Park house that I visited last December (click here for story ), which would have been walking distance from many of the events! How much do you think I should leave for a tip?

2) Solar is about to become a big part of our lives, as it careens toward long sought profitability, and it will suit you to learn more about it. To get a good introduction to the industry, both through some good engineering statistics and some great pictures, then check out the September edition of National Geographic magazine by clicking here . Total world electricity demand today is 16 terawatts (16,000 megawatts), and that is expected to grow to 20 terawatts by 2020. Solar comes in two flavors, thermal and photovoltaic (PV). Thermal is the old dinosaur technology, with thousands of convex mirrors arrayed to heat piped oil, which is then used to power a conventional steam power plan, converting about 24% of the sun?s energy into electricity. The future is with photovoltaic solar, which uses the semiconducting ability of silicon to grab electrons directly from sunlight. PV is less efficient at a 10% conversion rate, more expensive, but is making great leaps forward. It would only take 100 square miles of PV panels placed on rooftops to meet all of the electricity demands of the US. The final goal is to develop silicon paint which you then apply to your house to generate power, all for the cost of a bucket of regular paint. PV chips in the lab are already achieving efficiencies of 40%. First Solar (FSLR) now owns the cutting edge with its thin film panels, a company I have written about extensively (click here for the report ). It is also a great trading vehicle, with plenty of volatility, and the recent silicon panel price war with China has knocked the stock down into ?buy? territory. The additional of FSLR to the S&P 500, the first alternative stock to do so, is the writing on the wall. I regularly mine this magazine for long term technology and environmental trends, and my kids love cutting up the pictures. After all, it was founded by one of the original venture capitalists, Alexander Graham Bell, the inventor of the telephone.

3) If anyone wants an update of my current iconoclastic, out of consensus, even ?Mad? views of the global financial scene, check out my interview published by the cutting edge online newsletter, Phil?s Stock World, by clicking here . It will save me a dozen pages of writing to you. Phil runs his own US equity option trading operation with a premium subscription service, and tacks on an aggregation of several other high end blogs, like Zero Hedge, Chart School, Andrew Wilkinson, and the Oxen Group. More about Phil?s efforts later.

?Whenever you find yourself on the side of the majority, it?s time to pause and reflect,? said Samuel Clemens, also Mark Twain.