October 8, 2009

October 8, 2009 SPECIAL NATURAL GAS ISSUE

Featured Trades: (UNG), ($NATGAS),

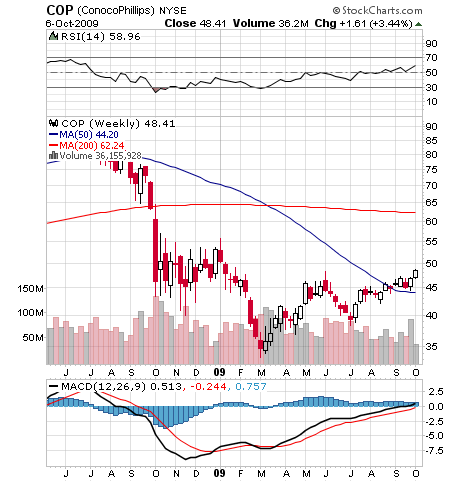

(CHK), (DVN), (USO), CRUDE), (COP), (PBR)

1)? Happy as I am to open beer bottles with my teeth and do my own tattoos, I have recently become a wimp when it comes to trading natural gas futures. I managed to warn my readers that a collapse of Biblical proportions was coming on June 2, when I recommended a sale at $4.40 (click here for the report ). Yes, you may fan me with ostrich feathers like a Middle Eastern potentate for that call. No, I did not predict a $1.90 bottom by throwing a dart at a dartboard. I simply called a half dozen buddies from my drilling days in the Texas Barnet shale and came up with a worst case cost of production of $2/MBTU. As it turned out we got a $2.40 bottom, and then a pop to $5/MBTU in a nanosecond, obviously the mother of all short covering squeezes. The industry is still on the horns of a massive dilemma. More than 100 years of supplies of CH4 have been discovered recently, but all of the main production companies may go under before we get much of it out of the ground if prices don?t stabilize. Virtually all natural gas storage facilities in the country are either full or locked up by hedge funds capitalizing on the massive contango, and it is impossible to export the stuff. Many shareholders have recently found religion, praying for a cold winter to balance out supply and demand. Long term, my bet is that the Pickens Plan (click here for my chat with the homespun Boone ) kicks in and pushes prices back up. If you still want to play where traders gulp down a quart of hot steaming volatility before breakfast every morning, e-mail me at www.madhedgefundtrader.com and I?ll tell you how to get set up. Just keep in mind, though, that you are moving into one of the toughest neighborhoods in the financial markets, where the ?widow maker? lives.

2) For an update on the Pickens Plan, I managed to catch the 81 year old Boone?s interview on CNBC yesterday, who spouted out statistics like the University of Oklahoma State University geology graduate that he is.?? After cutting through the love fest and the softball questions, I managed to get some actual facts out of it. Boone wants to target the country?s 6.5 million heavy trucks, converting them from diesel to natural gas on a replacement basis. These vehicles account for 2.5 million barrels a day of the 9.8 million barrels/day the US currently imports (click here for GOVT. stats) . To this end, he is pushing for the passage of the Natural Gas Act (HR 1835 and Senate bill 1408) which will create 18 year tax credits and subsidies for the production and use of natural gas vehicles along with the necessary infrastructure, like pipelines and pumps. His chances of success are good, as the last NG related bill, HR 1622, an appetizer sized $30 million five year project to promote NG, passed by an overwhelming 387 to 24. Of course, everything is on hold until health care passes, which may eat up the calendar for the rest of the year, so energy legislation will almost certainly be 2010 business. All of this is not soon enough for the industry, which is desperate for anything to keep their commodity from falling back to the mat.

3) T. Boone Pickens, CEO of BP Capital Managements, which manages three energy hedge funds, also made some interesting comments on oil. I worked with Boone on some of his ?pac man? oil company takeovers during the eighties when I was at Morgan Stanley, and he has been the best call on crude for the last 30 years. At least until last year, when the stunning speed of the crude collapse hit him squarely between the eyes, decimating his funds. Boone continues to ring the alarm bell about China. Its insatiable appetite for crude and other commodities led it to recently lock up 5 billion barrels in global reserves through foreign takeovers and partnerships, and that demand is only going to increase. During the last five years the Middle Kingdom?s consumption has soared from 3 million barrels/day to 8.1 million barrels/day, and half of that has to be imported. The super spike in oil prices is inevitable, unless the US does something radical to replace imports. With most reserves now controlled by foreign governments, the US is at risk of getting shut out of the oil market. Long time readers know that I have been a huge bull on crude prices since the beginning of the year when it traded at $32/barrel. The only question is how fast they will go up. If we do get a synchronized global economic recovery, then look out above! Single stock traders have Warren Buffet?s favorite, vertically integrated super major ConocoPhillips (COP) to look at, foreign stock investors should be focused on Petrobras (PBR), ETF players have the United States Oil Fund (USO), and if you want to play in the futures, where you can still get 7:1 leverage, then email me at madhedgefundtrader@yahoo.com to set up an account.

4) Note to subscribers: In view of the huge response I received on my upcoming dinner with President Obama, please e-mail me your favorite questions you would like me to ask him to madhedgefundtrader@yahoo.com.?? I will publish the top ten. Can?t guarantee you I will get all the answers though.

?It?s the labor market that is going to end the recession, and that?s not going to happen any time soon,? said Richard Suttmeier, the chief market strategist at ValueEngine.com.