Traffic Sags for the Generational Technology

OpenAI’s splash into AI was the secret sauce as to why tech stocks have gone parabolic in 2023.

The platform achieved a remarkable milestone by amassing 100 million monthly active users quite early on, setting a record for the fastest-growing user base.

With ChatGPT’s widespread absorption, OpenAI has been looked at as the savior for revenue models in Silicon Valley.

However, this period of AI enthusiasm has proved to be short-lived, as the technology experiences its first real pullback.

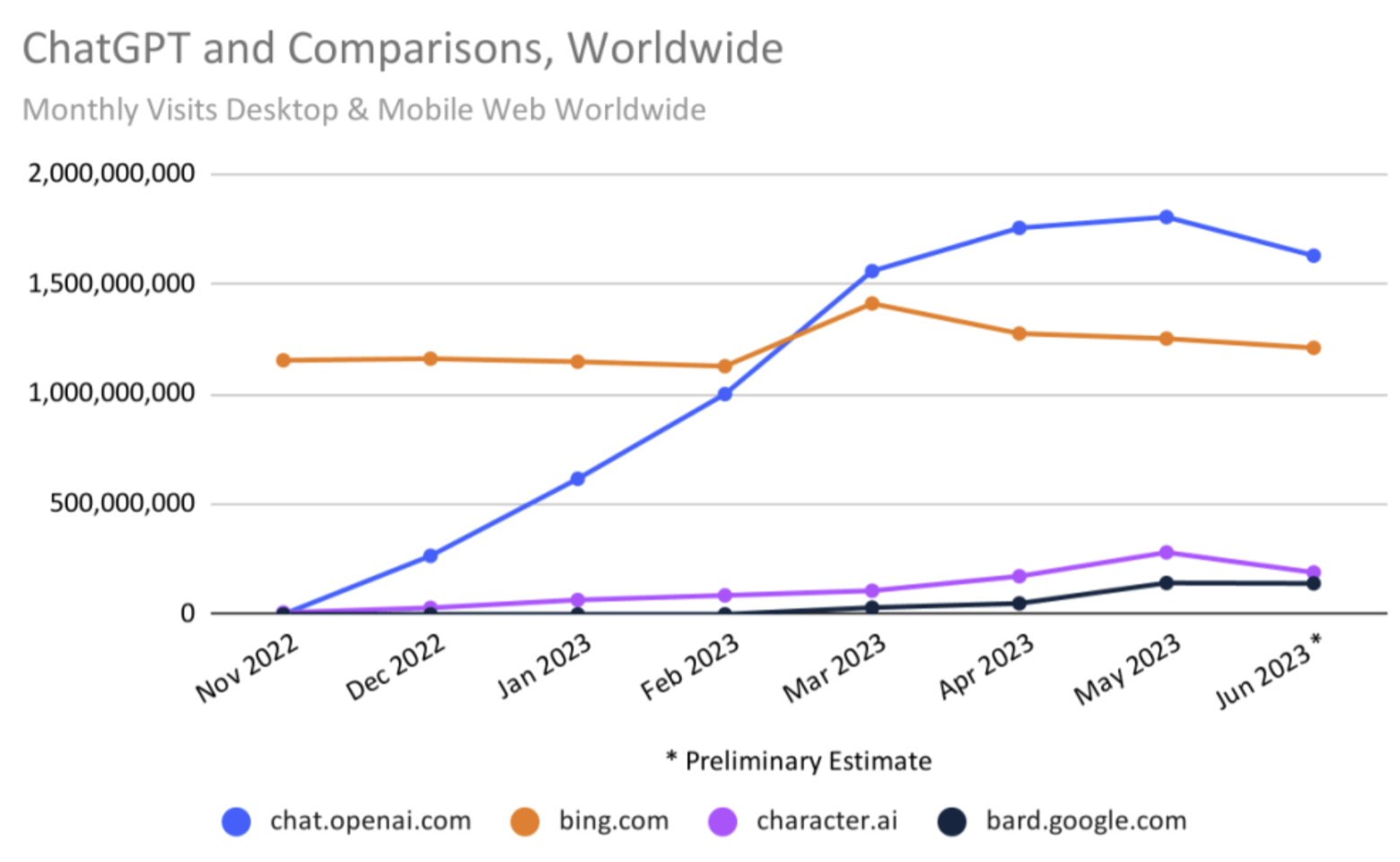

Based on the latest data, ChatGPT experienced a 9.7% decrease in desktop and mobile web traffic during June. The site also saw a decline of 5.7% in unique visitors.

This was followed by an 8.5% decrease in the average time users spent on the site. In the United States, the month-on-month traffic decline for the website was recorded at 10.3%.

The downtrend in traffic is quite surprising considering that groundbreaking new technologies which are still in their honeymoon phases never report any decrease in eyeballs whatsoever.

There's been a lot of buzz around artificial intelligence since ChatGPT was released seven months ago. About a month and a half before the chatbot was released to the public, the stock market bottomed in a bear market around the middle of October.

I am not saying the bottom will fall out of tech stocks, but the gaps up will probably cool down in the short term.

Take example one stock that has performed spectacularly – Nvidia (NVDA).

They have even managed to achieve this against a backdrop of challenging macroeconomic headwinds and a hawkish Federal Reserve.

The drop in ChatGPT interest is a warning sign that the beautiful girl has hit the wall.

It can’t be as simple as investors cheering on AI from the sidelines and then stocks go magically up. It’s not that easy.

The inherent technology needs evidence of outperformance and cannot lack substance.

A significant majority, comprising 61%, of ChatGPT’s user base consists of individuals from Generation Z.

This AI tool has gained considerable popularity for its educational applications.

For example, according to a research report, respondents reported using ChatGPT for educational purposes, with 33% utilizing it for educational assistance. 18% rely on it to comprehend complex concepts, and 15% use it to acquire new skills.

Investors need to understand that sliding interest in ChatGPT could be a catalyst for the AI bubble to lose air.

At the moment, AI's risks are as massive as its potential. We won't know until ten years later whether AI's impact is more akin to the internet or the Google Glass.

There are also other issues. Sam Altman, chief executive at OpenAI, has described the cost of running the services as “eye-watering.”

ChatGPT is free to use but also provides a premium subscription, where users can pay $20 a month to access OpenAI’s more advanced model, GPT-4.

Some 1.5 million people have signed up for the subscription, but the other tens of millions aren’t on board yet. For many people, it’s not worth paying for yet.

OpenAI has projected $200 million in revenue this year.

I believe it is time to take a short-term breather for the moment in AI. AI might turn out to be the shiny star many experts think it will be, but it doesn’t take one day to become that shiny start especially when the majority of OpenAI users are applying it to do their homework.