The Booming Sub-Sector of eCommerce Furniture

Growth has been pummeled the last few days as the U.S. government has sent mixed signals from Fed Chair Jerome Powell and Treasury Secretary Janet Yellen.

On one hand, Powell has been steadfast, saying he will not even think about raising rates for years, but Yellen came out yesterday admitting the turbo-charged US economy might need a rate hike.

Growth companies get penalized the most for the perception of rising rates while banks get rewarded.

Rising rates mean that loss-making tech firms will need to bear a higher cost of financing while needing more things to go their way to become profitable.

They also need more time because theoretically, exorbitant financing raises the bar to becoming profitable.

For the real speculative tech firms in nascent sub-sectors, this is the last thing you want to hear.

We have seen this concept run amok in the SPAC market with many of these newly listed vehicles down big over this consolidation move.

One ecommerce firm on the brink of profitability that I might consider taking a look at if it drops to $50 from the current $78 is volatile furniture seller Overstock.com (OSTK).

Remember it's typical of OSTK to drop 7% on down days and surge 7% on up days.

Enter into this stock with caution.

Why do I ultimately like OSTK at $50?

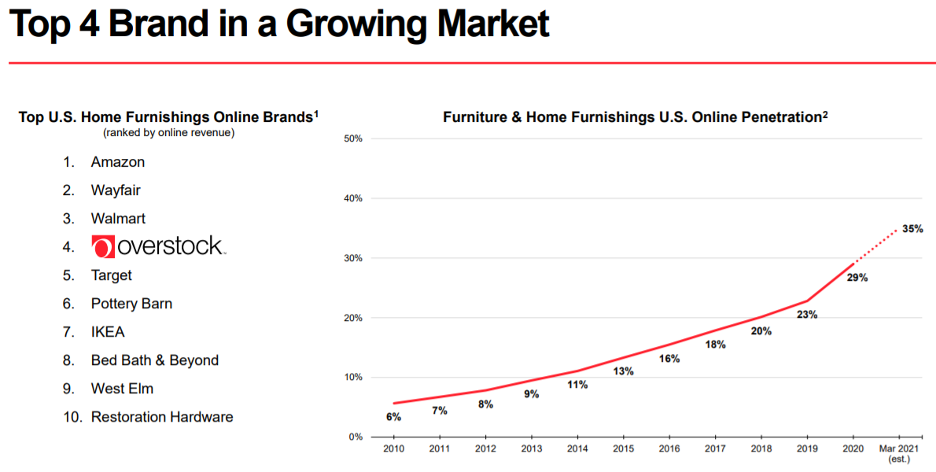

OSTK is now a top four brand in the large and growing U.S. online home furnishings market, this up from the 5th spot.

The total addressable market is growing and now estimated at $325 billion, up from $300 billion last year.

A true secular shift in consumer behavior is underway and not going away.

Permanent moves from cities to suburbs feel like a lasting structural shift in American life, one of the impactful themes to come out of the public health crisis.

Consumers have become accustomed to buying home furnishings online, just like they do so many other products.

It’s not a question of whether consumers will buy furniture and home furnishings.

It’s a question of where: online or in-store? As you know, housing starts surged in March, growing 37% versus March 2020, to the highest level since June 2006, exceeding economists' forecasts.

As the great reshuffling persists and home buying continues to increase, so too will demand for home furnishings.

Consumers will increasingly migrate to optionality, looking to marry up the best selection with high value and convenience of buying online.

Overstock’s motto is “where style and quality cost less.”

They hope to capture the smart value customers of home furnishings.

OSTK offers a value proposition that resonates with a particular subset of the market. The firm only specializes in furniture and home furnishings.

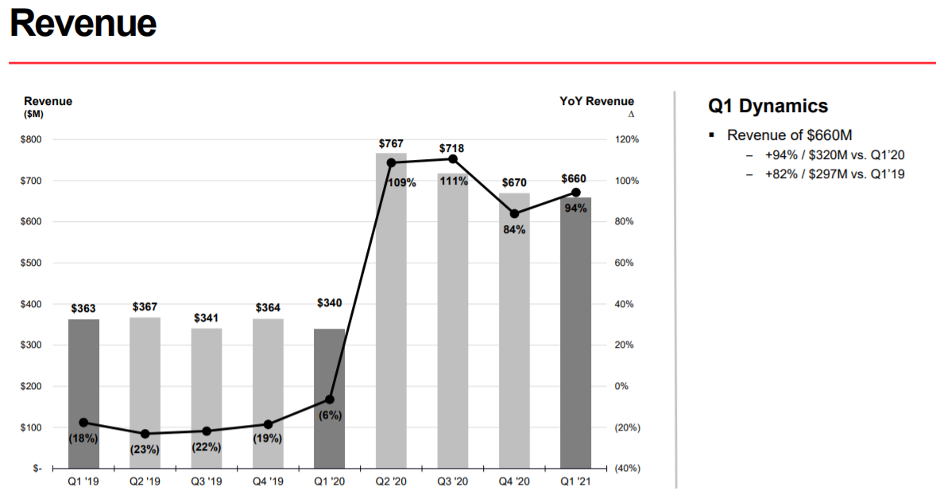

They posted revenue of $660 million in the first quarter, an increase of 94% year over year or 82% versus 2019.

This increase was primarily driven by a 66% increase in pandemic customer orders and a 17% increase in average order size.

Increased order activity was largely driven by new customer growth and strong repeat behavior catalyzed by work-from-home dynamics.

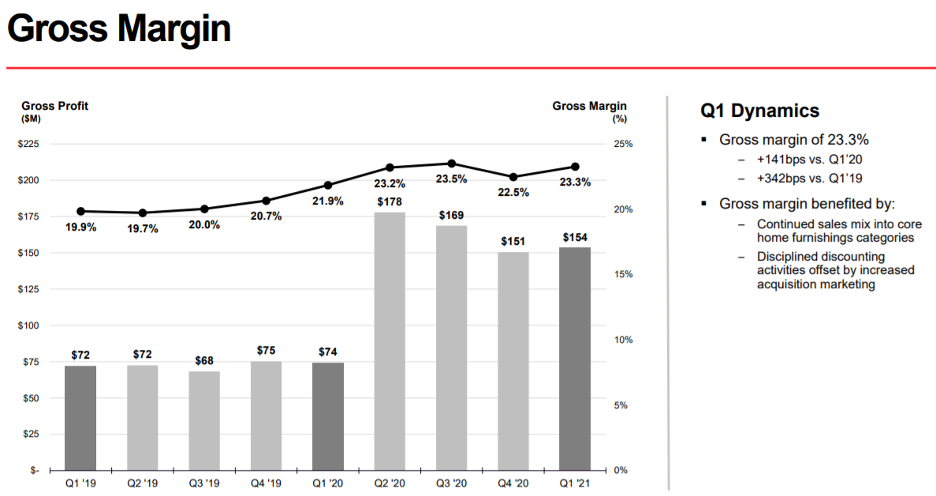

OSTKs gross profit came in at $154 million in the first quarter, an increase of $79 million year over year and an increase of $82 million versus Q1 of 2019.

Gross margin came in at 23.3%, which is an improvement of 141 basis points, compared to a year ago and 342 basis points compared to two years ago.

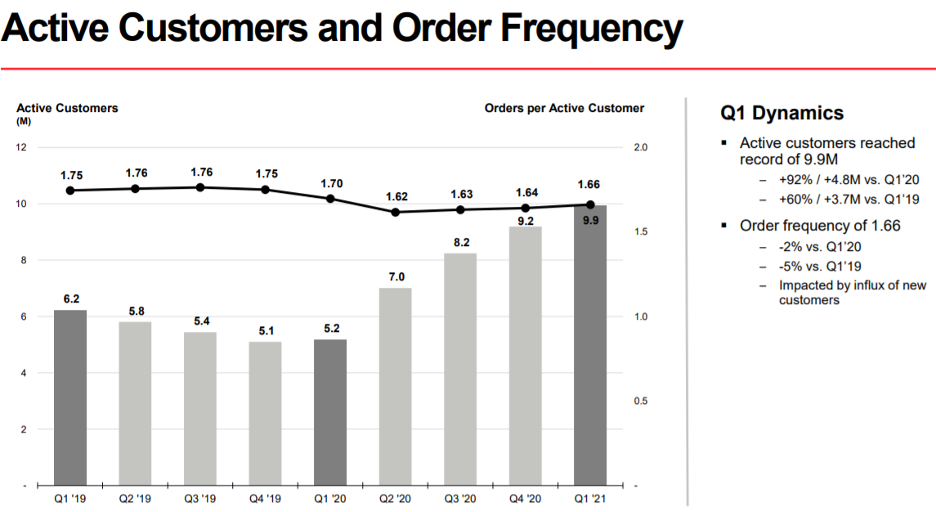

Active customers, meaning the total number of customers who made at least one purchase over the prior 12-month period, as of March 31, grew to 9.9 million.

This is the highest in OSTK’s operating history and represents an increase of 92% or 4.8 million active customers, compared to the first quarter of 2020 and a 60% increase versus 2019.

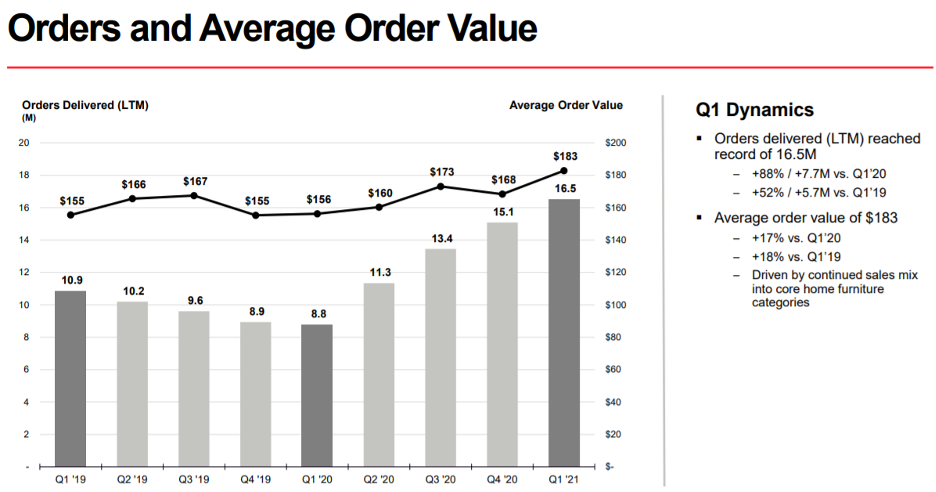

On a trailing 12-month basis, orders delivered reached a record 16.5 million as of March 31.

This is an increase of 88% compared to the prior year or 7.7 million orders and a 52% increase versus 2019.

Average order value increased by $27 or 17% versus the first quarter of 2020. This is mainly driven by a successful sales mix shift into core furniture and home furnishings.

Another key point I would like to touch on is the logistic solutions.

Free shipping is a key component of smart value. It also happens to be a top purchase driver, particularly for OSTK’s target customers.

OSTK has permanently launched free shipping on everything in 2020.

The word is out, at least with their existing customer base, which continues to rate OSTK favorably on shipping charges.

Pricing is also a key element to OSTK’s success.

Because savvy shoppers seek value, OSTK product pricing must be competitive.

One of their 2020 strategic initiatives was to clarify promotional messaging and refine the pricing model.

This meant ensuring OSTK’s products are optimally priced compared to the competition: not too low; and post promotion, certainly not higher.

As a result, 85% of OSTKs product is competitively priced in March 2021 compared to 55% in December 2019.

Lastly, unfortunately, the company does not provide guidance which doesn’t help quell the extreme volatility in the stock.

However, management did say that they face an imminent “difficult year-over-year second quarter comparison” which is the case for many tech firms that went gangbusters in Q2 2020.

Home furnishing revenue represents 93% of total revenue and the tough comparable data leave me no choice but to recommend waiting for this stock to drop to $50.

In the future, the company plans to expand into Canada and enter into government business, and these two planks of growth could help extract the incremental dollar.

However, I believe $70 is too high for OSTK and as many tech firms impossible benchmarks from 2020 to beat, I do believe a sell-off is more than likely in high growth names like OSTK.

In the end, I do believe $50 is a fair price for OSTK and should be bought and held if it comes down to that level.