When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

April 4, 2025

Fiat Lux

Featured Trade:

(APRIL 4 BIWEEKLY STRATEGY WEBINAR Q&A),

(DAL), (LCID), (RIVN), (MSTR), (PLTR),

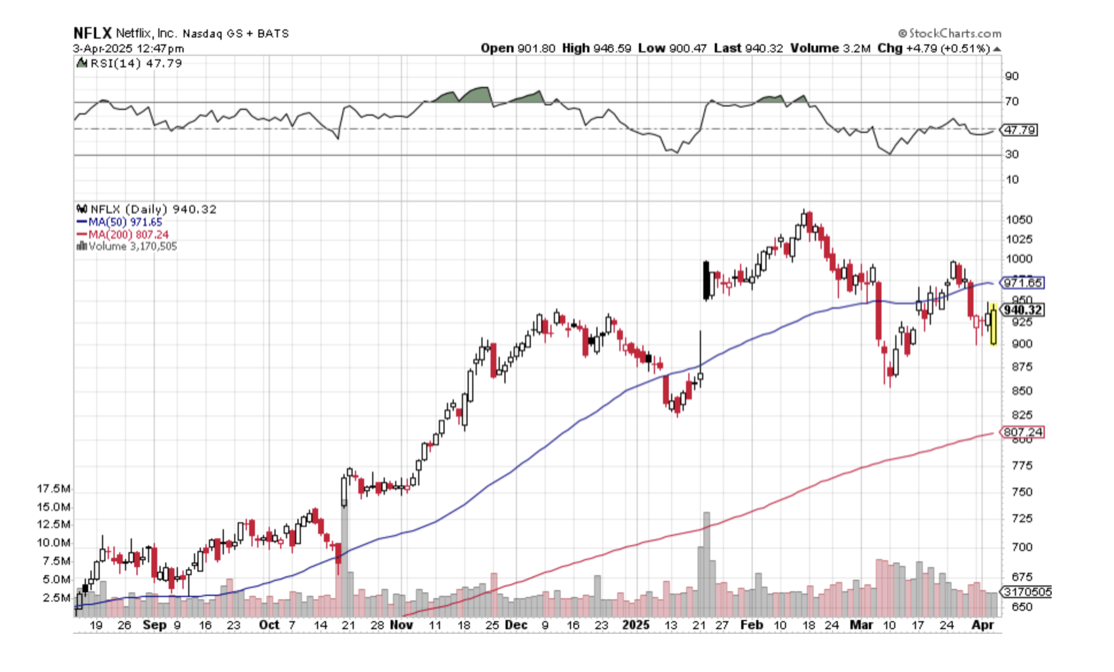

(AAPL), (GLD), (TSLA), (SLV), (SPY)

Below please find subscribers’ Q&A for the April 2 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why are there days when both bonds and interest rates are going up?

A: Well, there is a tug-of-war going on in the bond market. When recession fears are the dominant theme of the day, interest rates go down and bond prices go up. Remember, it's an inverse relationship. When the deficit and inflation are the big fears and you get those on the inflation announcement days—we get three or four of those a month—then interest rate goes up and bonds go down. That will be a big driver of stock prices because they are very sensitive to interest rates always.

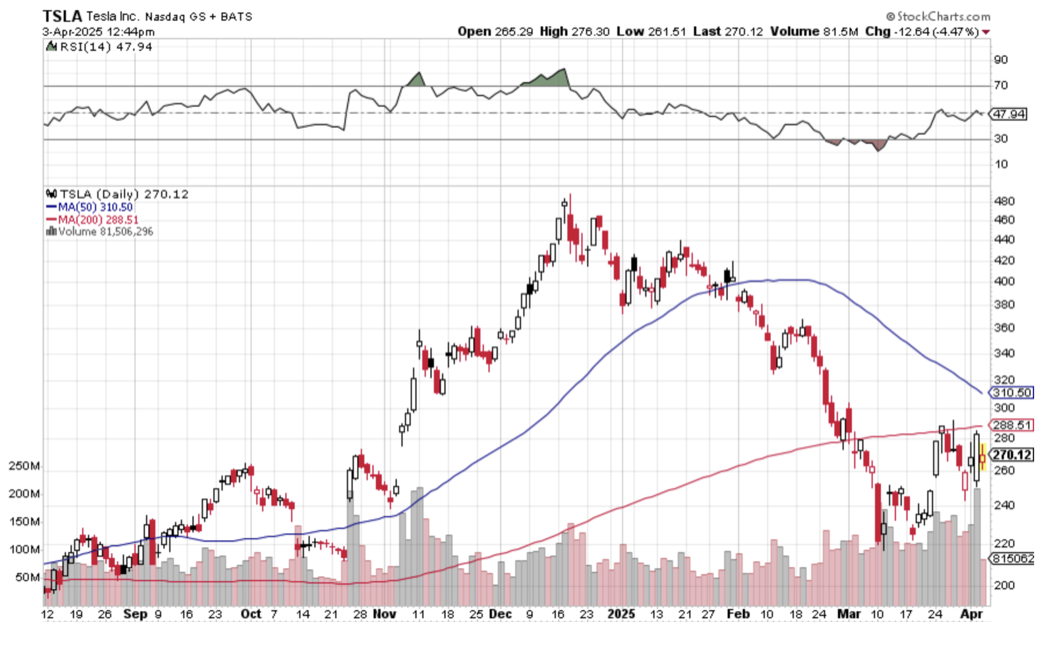

Q: Do you think Tesla (TSLA) has hit bottom?

A: I don't think so. I think the declining sales continue. I think the Tesla brand has been severely damaged as long as Elon Musk stays in politics. Also, no one buys cars in recessions—sorry, but that is the last thing that people or companies want to buy is a brand-new car.

Q: What will happen to the smaller EV makers?

A: They will all go bankrupt. You know, unless they have a very rich uncle like Lucin Group (LCID) does—Saudi Arabia can keep pumping money in there forever. Amazon owns a big piece of Rivian Motors (RIVN) I don't think any of the small EV makers will make it because they now have Tesla to compete against.

Q: Do you have any way to short restaurant stocks as an industry?

A: I don't know of a single industry ETF for restaurants only. Restaurants are not an industry I have spent a lot of time studying because the margins are so low. I prefer a 70% margin to a 3% margin ones. There are a lot of things like consumer discretionary, so you just have to go shopping in the ETF world. There are more than 3,000 listed ETFs these days in every conceivable subsector of the economy, more than there are listed stocks, so there might be something out there somewhere. Yes, you are correct in wanting to short restaurants going into a recession as well as airlines, rental car companies, and hotels, but these things are already down a lot—you know, 40% or so. So, be careful shorting after these things have already had enormous declines in a very short time.

Q: Will the recession cause Democrats to win midterm elections?

A: If I were a betting man—and of course I'm not, I only go after sure things, —I would say yes. But, you know, 18 months might as well be 18 years in the political world. So, who knows what will happen? Suffice it to say that yesterday's election results were overwhelmingly positive for the Democrats and represent a very strong “no vote” for Trump policies and Musk policies. Even in Florida where they won, the victory margin shrank from 35% six months ago to 12%. That is an enormous swing in the electorate away from Republicans, and that's why the Republicans are very nervous about any election. That's why the Texas governor is blocking a by-election there. He’s afraid he’ll lose.

Q: Is Tesla (TSLA) toast for good?

A: If Elon Musk went back to Silicon Valley and just managed Tesla and kept his mouth shut on non-Tesla issues, I bet the stock would double from these levels over the medium term. So yes, it just depends on how much Elon Musk wants his $200 billion back. That's how much he's lost on the stock depreciation since December.

Q: Is it time to short Delta Air Lines (DAL)?

A: You kind of missed the boat. No point in closing the barn door after the horses have bolted. This was a great short in February, and the same with hotels and rail companies. So be careful of your biggest recession indicators; they have all already collapsed and are more likely to bounce along the bottom.

Q: What are the probabilities that the tariff war could backfire, and we end up with massive job losses and a shortage of goods?

A: Actually, that is the most likely outcome. In my humble opinion, we know big layoffs are coming already. Prices are going to go up, so people will buy less. And prices will go up a lot because of the tariffs, so it's the perfect, perfect economy destruction strategy. And of course, that all feeds directly into the stock market.

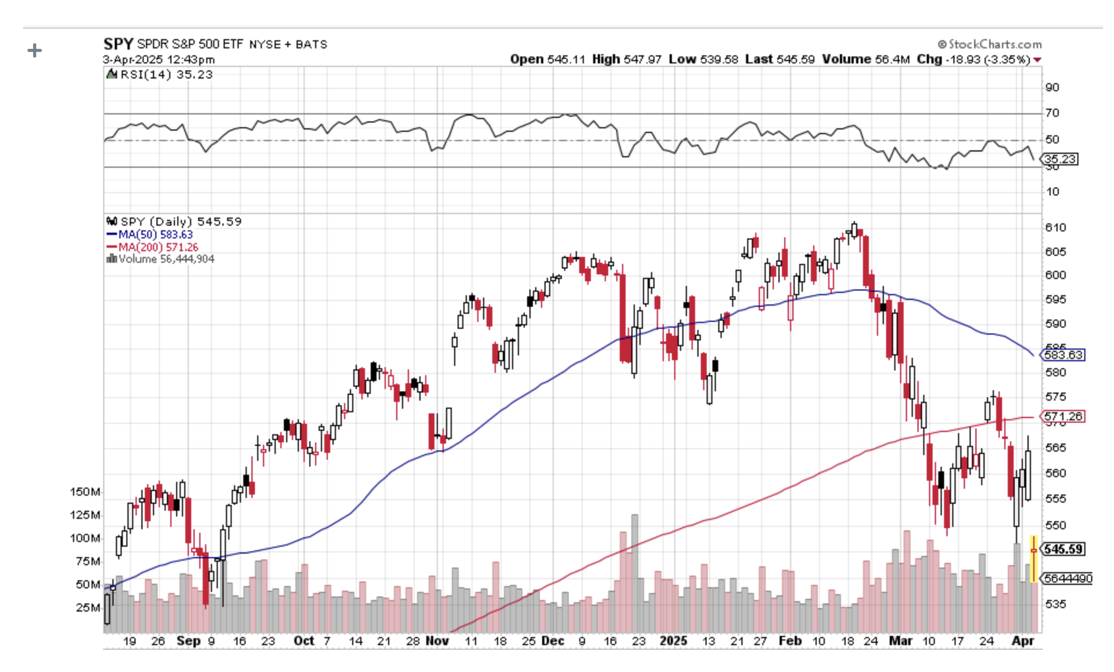

Q: Do you think a 10% decline is enough to reflect all of that?

A: Absolutely not. More like down 20% or down 30% to discount the destruction of the economy—some say by half. So, that's an easy question to answer.

Q: Do you think Palantir (PLTR) will recover from this dip?

A: Only when government spending resumes. That could happen sooner once we get some clarity on where the government is actually going to spend its money. Palantir claims they can save masses of money for the government by getting it just to use their software, and a lot of companies are making that claim, like Arthur Anderson, who also had all their contracts axed. So, we don't know. “We don't know” is the most commonly heard expression in the country today. We just don't know what's going to happen.

Q: And is Palantir (PLTR) cheap after a 40% sell-off?

A: No. It's still incredibly expensive and that is the concern.

Q: Is crypto a good short-term bet in this type of high volatility?

A: No, it's not. It's a horrible bet. A 10% decline in the S&P 500 delivered a 30% decline in crypto. If we drop another 10%, you can expect crypto to drop another 30%. You know, it's like a 3x long NASDAQ ETF. That's how it's behaving. So, I watch it very carefully as a risk indicator. If we get a substantial rally, I'm looking to short the big players in crypto, which would be MicroStrategy (MSTR) and ProShares Bitcoin Strategy ETF (BITO). Looking for a good short there or at least to write calls. The call premiums are extremely high on all these crypto plays—sometimes they're 84%.

Q: How much more inflation can the economy handle before we are in a deep recession?

A: Well, I think we're in recession now. Almost every inflation indicator is pointing to lots of upside and, of course, the tariffs haven't even started yet. They start today, and it'll take at least a month or two to see what the actual impact of the tariffs will be on local prices.

Q: Why do you think the tariffs will be damaging to the economy?

A: Virtually every economist in the world has agreed that the trade wars of the 1930s were a major cause of the Great Depression, but not the sole cause. The only economists that have changed their minds now are the ones that have just gotten Trump appointments. I mean, that's it, clear and simple. You raise the price, you get less demand—basic supply and demand economics. I'm not inventing anything new here. It’s basic economics 101.

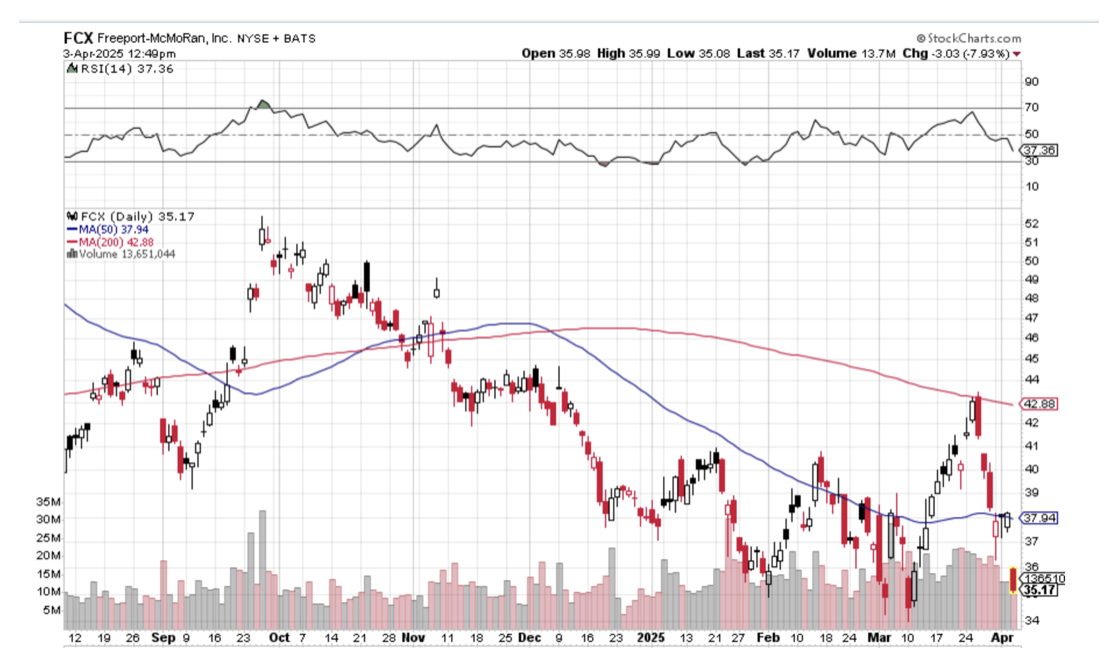

Q: Here's a good question that has puzzled people for a century: If Copper is up, why is Freeport McMoRan (FCX) down?

A: Freeport is a stock first and a commodity producer second. When stocks crash, people flee to commodities, and that is what is happening. Chinese are buying up copper ingots as a gold alternative, and people are dumping Freeport because it's in an index. Some 80% of all the selling is index selling. So if you're in that index, your stock goes down regardless of your individual fundamentals. Whether it's a good company or not, whether your earnings are expanding or not, I'm seeing this happen in lots of other great companies.

Q: Is gold (GLD) subject to 25% import duties? What will that do to the pricing of gold?

A: Physical gold got an exemption, so it is not. However, gold stocks in COMEX warehouses in New York hit record highs as the managers rushed to bring in gold to beat the tariffs to meet the ETF demand in the United States. So there’s a lot of turmoil in that market, as there are in all markets now—people trying to beat the tariffs. By the way, I bought all the computer equipment my company needs for the rest of this year in order to beat the tariff increases because all my Apple (AAPL) stuff comes from China and they're looking at 60% tariffs.

Q: If the silver (SLV) does go to a new all-time high, does that mean the S&P 500 is going to an all-time high?

A: No, if anything (SPY) goes to a multi-year low. We may be losing a generation of stock investors here. That puts silver within easy range at $50.

Q: Will biotech stocks shift because of the policy changes?

A: They're losing their government research funding, the authorization process for new drug approvals has had sand thrown at it. Time delays have been greatly extended on new approvals and suffice to say, the leadership does not have the confidence of the industry, and biotech stocks are doing horribly. You know, when you appoint someone to head a department whose main job is to dismantle that department, that's generally really horrible for the industry, especially when the industry is dependent so much on government grants for research. We are losing a generation of new scientists. That puts off any cures for cancer, Alzheimer’s, or diabetes into the far future.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or JACQUIE'S POST, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

April 3, 2025

Fiat Lux

Featured Trade:

(MIND THE GAP)

(DHR)

Last Thursday, I found myself trapped in an elevator with the former head of R&D at one of Boston's leading life sciences companies – a guy I've known since my Tokyo days in the late '70s.

After we established that neither of us knew how to hack the elevator controls (disappointing, since he has three engineering degrees from MIT), he leaned in and whispered, "You know what's crazy? Everyone's obsessing over AI stocks while Danaher is sitting there at nearly a 30% discount to historical valuations."

The elevator started moving before I could press him for details, but his comment sent me down a research rabbit hole that kept me up until 3 AM.

My old friend wasn't wrong. Danaher (DHR) has quietly become one of the most compelling value opportunities in the life sciences sector.

While lesser investors are chasing the latest semiconductor hype, DHR is trading at 26.9x forward earnings – a substantial discount to its five-year average multiple of 30.2x – all while positioning itself for what looks like a significant rebound in 2026.

I've been tracking Danaher since their earliest acquisition days in the late 1990s, and their current setup reminds me of late 2018 when they were preparing to acquire GE's biopharma business.

Back then, short-term concerns created a buying opportunity that delivered a 150% return over the next three years.

Today's discount stems from China's Volume-Based Procurement initiative and lower respiratory testing revenues at Cepheid – both temporary headwinds that mask the company's extraordinary long-term potential.

What most market participants are missing is that Danaher's core growth engine – its Biotechnology segment – is showing undeniable signs of life.

Their latest quarterly orders grew over 30% year-over-year, marking the sixth consecutive quarter of high single-digit sequential growth.

After two years of inventory destocking that felt like watching paint dry (if the paint cost $10,000 per gallon), the bioprocessing business has returned to positive growth territory.

The company's Life Sciences segment also turned positive last quarter, benefiting from Chinese stimulus funding that took longer than expected to materialize – sort of like waiting for your teenager to clean their room, but with billions of dollars at stake.

While Q1 will face tough year-over-year comparisons due to a large energy project last year, management expects growth to accelerate through 2025, culminating in a major Pall customer project in Q4.

Now, Danaher does face legitimate near-term challenges. Their Diagnostics segment is battling headwinds from China's VBP initiative, which accelerated unexpectedly in late 2024.

Management now estimates a $150 million impact for 2025 on top of the $50 million already absorbed in 2024. They've also guided for respiratory testing revenue to drop from $1.95 billion to $1.7 billion this year.

But here's where things get interesting. The flu season is turning out to be significantly more severe than anticipated – one of the worst in 15 years according to CDC data I reviewed yesterday.

This suggests management's respiratory testing guidance could prove conservative. Meanwhile, their non-respiratory portfolio is growing at mid-teens rates, with their women's health multiplex vaginitis panel increasing by over 20%.

What truly separates sophisticated investors from the herd is understanding that Danaher's management team rarely sits idle during challenging periods.

True to form, they've implemented a cost reduction program targeting at least $150 million in annual savings, focused specifically on offsetting the VBP impact in China and the Diagnostics segment.

This isn't their first rodeo with margin pressure – they've maintained their remarkable 30-year track record of operational improvement through far worse conditions.

The long-term growth thesis remains rock solid. The bioprocessing business is perfectly positioned to capitalize on biologics and biosimilar adoption as major patents expire in coming years.

According to management, there are approximately 600 FDA-approved biologics today with over 20,000 in the pipeline. Their Cytiva business supports over 90% of global monoclonal antibody manufacturing volumes – a stunning competitive position in one of healthcare's fastest-growing segments.

For perspective, it's like owning the only company that makes drill bits during a massive oil boom.

I've analyzed Danaher's forward P/E ratio across multiple market cycles, and the current valuation represents a compelling entry point for patient investors.

At 24x 2026 earnings estimates, the stock is pricing in virtually zero multiple expansion despite the company's historical premium to the market. The consensus expects EPS to grow from $7.66 in 2025 to $8.58 in 2026 – a 12% increase that looks conservative given the margin expansion potential as revenues recover.

I've started building a position at these levels, with plans to add on any further weakness. While timing the absolute bottom is a fool's errand (believe me, I've tried and have the investment scars to prove it), the current valuation provides a meaningful margin of safety.

I'm targeting a return to at least 28-30x forward earnings over the next 18-24 months as growth visibility improves, which would translate to approximately 25-30% upside from current levels.

As a veteran of both market crashes and faulty elevators, I've learned one crucial lesson: the key difference between being stuck in an elevator and stuck in an undervalued stock is that only one of them lets you press the “up” button when you've reached the bottom.

And if Danaher delivers as expected, I might just start hanging out in more broken elevators looking for my next investment idea.

Global Market Comments

April 3, 2025

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS ASSIGNED OR CALLED AWAY)

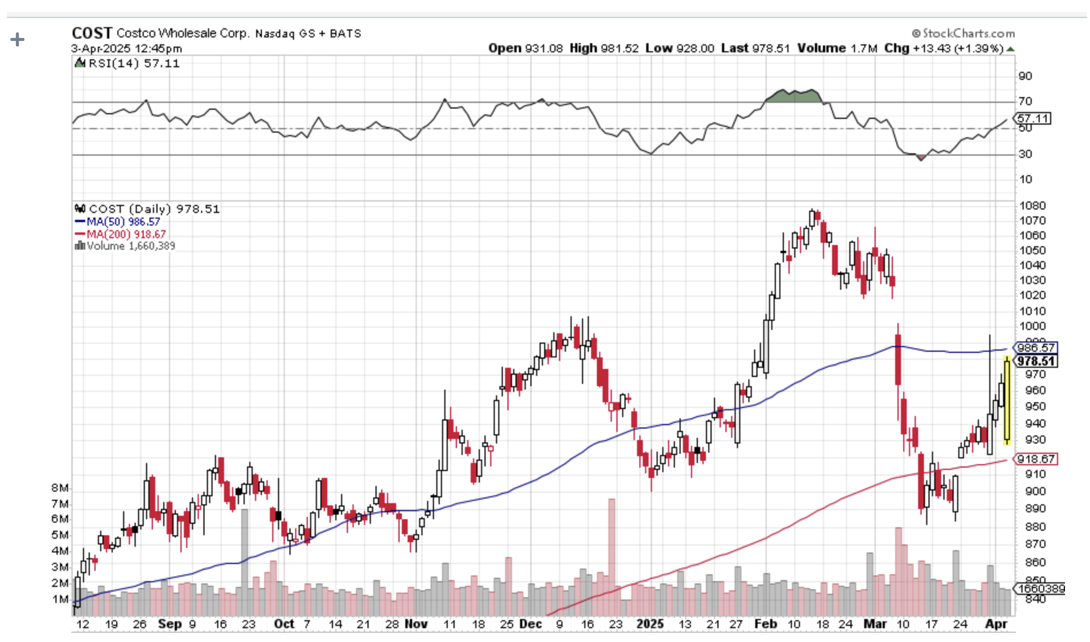

(NVDA), (COST), (TSLA)

I just received an excited text message from an excited Concierge client. His long position in the (NVDA) April 17 2025 $90-$95 vertical bull call debit spread had just been called away. That meant he would receive the maximum profit a full 10 trading days before the April 17 option expiration. Whoever called away the option ended up eating all of the remaining premium.

With the heightened volatility today, I am seeing an increasing number of options positions assigned or called away.

I know all of this may sound confusing at first. But once you get the hang of it, this is the greatest way to make money since sliced bread.

I still have three positions left in my model trading portfolio that are deep in-the-money, and about to expire in 10 trading days on the April 17 options expiration day. Those are the

(NVDA) 4/$90-$95 call spread 10.00%

(COST) 4/$840-$850 call spread 10.00%

(TSLA) 4/$160/$170 put spread 10.00%

That opens up a set of risks unique to these positions.

I call it the “Screw up risk.”

As long as the markets maintain current levels, this position will expire at its maximum profit value.

There is a heightened probability that your short position in the options may get called away.

Although the return for those calling away your options is very small, this is how to handle these events.

If exercised, brokers are required by law to email you immediately.

If it happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

Most of you have short-option positions, although you may not realize it. For when you buy an in-the-money vertical option spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away.

I’ll use the example of the Berkshire Hathaway (BRK/B) from last August $405-$415 in-the-money vertical Bull Call spread since so many of you had these.

For what the broker had done in effect is allow you to get out of your call spread position at the maximum profit point 11 days before the August 16 expiration date.

In other words, what you bought for $8.70 on July 12 is now worth $10.00, giving you a near-instant profit of $1,300 or 14.94% in only 11 trading days.

All you have to do is call your broker and instruct them to “exercise your long position in your (BRK/B) August 16 $405 calls to close out your short position in the (BRK/B) August $410 calls.”

You must do this in person. Brokers are not allowed to exercise options automatically, on their own, without your expressed permission.

You also must do this the same day that you receive the exercise notice.

This is a perfectly hedged position. The name, the ticker symbol, the number of shares, and the number of contracts are all identical, so you have no exposure at all.

Call options are a right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Short positions usually only get called away for dividend-paying stocks or interest-paying ETFs like the (BRK/B). There are strategies out there that try to capture dividends the day before they are payable. Exercising an option is one way to do that.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to sell a long (BRK/B) position after the close, and exercising his long (BRK/B) call, which you are short, is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to blow it by writing shoddy algorithms.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

There is a further annoying complication that leads to a lot of confusion. Lately, brokers have resorted to sending you warnings that exercises MIGHT happen to help mitigate their own legal liability.

They do this even when such an exercise has zero probability of happening, such as with a short call option in a LEAPS that has a year or more left until expiration. Just ignore these, or call your broker and ask them to explain.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. In fact, I think I’m the last one they really did train.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Calling All Options!

“Stock prices have reached what looks like a permanently high plateau,” said economist Irving Fisher….just before the 1929 stock market crash.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.