While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 18, 2014

Fiat Lux

Featured Trade:

(NOVEMBER 19 GLOBAL STRATEGY WEBINAR),

(JAPAN?S RUDE AWAKENING),

(FXY), (YCS), (DXJ),

(IS USA, INC. A ?SELL??)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

WisdomTree Japan Hedged Equity ETF (DXJ)

Traders in Japan suffered a rude awakening yesterday morning when the Ministry of International Trade and Industry announced that the troubled country?s GDP shrunk by -1.6% during the third quarter. Analysts had been expecting a gain of 2.2%.

What?s worse, this is the second consecutive quarter of negative GDP, meaning that the Land of the Rising Sun is now solidly in recession, the fourth since 2008, and the umpteenth since the country fell off a demographic cliff 25 years ago.

The Nikkei Average took it on the kisser, plunging some 3% from its high for the year. The Wisdom Tree Japan Hedged Equity ETF (DXJ) declined by half as much.

Half of the gain since the Bank of Japan?s ?shock and awe? monetization measures on October 15 went up in smoke. Now we know why the central bank had been so aggressive and preemptive.

There are immediate implications from the dismal numbers. Prime Minister Shinzo Abe is almost certain to delay a hike in Japan?s VAT sales tax from 8% to 10% scheduled for the new fiscal year starting April 1.

This year?s rise, from 5% to 8%, is viewed as the chief culprit responsible for the shocking slowdown.

It turns out that clever consumers rushed to beat the tax, pulled their spending forward, creating an artificial boost to economic growth in the first quarter. This lulled the government and Japanese retailers, into thinking their recovery strategy was working.

After the tax increase took effect, the spending boom ground to a complete halt, and the economy came to a juddering stop. The end result was a huge inventory build that was the most destructive aspect of the terrible GDP numbers, as higher prices caused consumers to stay away from the stores in droves.

The conservative Abe was behind the government?s grab for more revenues to head off the country?s runaway budget deficit, which is now seen by many economists as reaching catastrophic proportions, some 160% of total GDP.

The problem is that governments should balance budgets when they can, not when they want to. I have lost count of how many Japanese recoveries have been smothered in the cradle by premature tax increases over the last two decades.

Thank goodness the US government had the sense not to try that here, or we?d all be standing in breadlines by now.

The global implications of a new Japanese recession are, fortunately, not as dire. It?s not like many analysts had built in a Japanese economic miracle into their long-term growth forecasts. Japan only accounts for 7% of world GDP these days, and losing a couple percent of that annualized doesn?t move the needle much.

The fall of the Japanese yen this year has been so rapid and dramatic that there hasn?t nearly been enough time for it to have a positive impact on the economy. It will going forward. That alone should pull the country back out of recession in the current quarter.

Remember too that since Japan is far more dependent than America on imported energy, it will benefit greater from the ongoing collapse in the price of oil.

The disastrous GDP numbers should also encourage the BOJ to become even more aggressive in its own reflationary efforts. Think more growth of the money supply, more quantitative easing, and faster. Buy Japanese printing press stocks!

Fortunately, all of these global, multi market cross currents distill down into a single trade for you and I: sell more yen.

A substantially weaker Japanese currency seems to be the one stop solution for all of Japan?s many intractable problems.

You already saw this in action in the foreign currency markets on Monday after the GDP numbers came out. Normally, a downside surprise of this magnitude on the economic data front generates a big ?flight to safety? move across all asset classes. That would have caused the Japanese yen to rise sharply against the buck.

Not this time. In fact, it barely moved. Japan and yen bears weren?t waiting a nanosecond to sell short more of the beleaguered currency, offsetting whatever profit taking there was from pre existing shorts the GDP figures might have incited.

So the set up here is to sell short the Currency Shares Japanese Yen Trust ETF (FXE), or to buy the 2X ProShares Ultra Short Yen ETF (YCS), two positions I have been recommending non stop for the past three years.

It looks like we have only just gotten started with out big down move in the yen.

![Woman - Hari Kari]() Back in Recession Again

Back in Recession Again

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

November 17, 2014

Fiat Lux

Featured Trade:

(CHICAGO TUESDAY, DECEMBER 23 GLOBAL STRATEGY LUNCHEON)

(BULL MARKET 2.0),

(PLEASE USE MY FREE DATA BASE SEARCH)

By now, the reasons behind this year?s bear market are pretty well known. Even my cleaning lady, Cecelia, can site them chapter and verse.

Quantitative easing went global. Inflation fell, with the prices of almost all business input costs, like commodities, energy, interest rates, collapsing. Labor costs remained muted, so corporate profits rocketed.

Voila! Stocks rose, probably by 17% in the S&P 500 by the end of 2014, and 19% with dividends. Not bad for the fifth year of a bull market.

So is this it? Should we now be taking profits in a topping market and running for the hills to avoid a rollover in 2015?

Is it game over?

Let us think again. We need a new set of reasons to keep this bull alive. The good news is that if we delve down to our inner most thoughts, those reasons are out there. What we are really looking for is a bull market 2.0.

It goes something like this. The rally in bonds almost certainly ended on October 15. It is now ?Sell the rallies? for the next 20 years. The mere fact that they are no longer going up will scare away momentum based investors and ignite some institutional selling in the New Year asset reallocations.

Given the gargantuan size of the global bond market, some $100 trillion, this development is potentially more important for stock prices than five years of QE from the Federal Reserve.

That Herculean effort created $4.5 trillion in new cash. Moving 10% out of bonds into stocks and other risk assets would generate double that amount of firepower, or some $10 trillion.

Mind you, bond prices aren?t going to collapse. They will engage in long, tedious range trading, with an eventual slow grind down. Continued disinflation assures that. Bond traders will die from boredom, and not a heart attack. This is a key element of the bull case for stocks.

In other words, you ain?t seen nothing yet, baby!

It gets better.

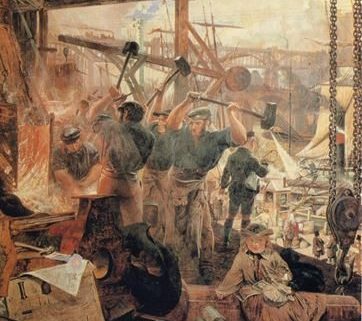

After the first industrial revolution started during the 1820?s, when we saw the transition to modern manufacturing processes that started with textiles, we witnessed a century of rising profits, falling inflation, and booming stock markets, subject to the occasional 50% correction (there was no Fed then).

Sound familiar?

The really interesting thing now is that we are seeing at least five, if not more, new industrial revolutions get underway, which are collapsing business costs at a prodigious rate.

Count the transition from silicon to DNA based computing, biotechnology, health care, alternative energy sources, and transportation. These are all century long trends which are only just getting started.

This is happening against a backdrop of perennially low interest rates and energy costs. Companies can?t help but make more money, and by implication, share prices can?t help but go higher. Think of Goldilocks on steroids.

This leads to self-sustaining economic growth that keeps the major indexes appreciating for years. The Fed understands this, which is why their gentle exit from quantitative easing in recent months had absolutely no effect on asset prices. If anything, it accelerated their upturn.

So how much juice can we count on for next year? Add 10% to company profits, maintain a 2% dividend rate, and that gets us up 12%. Use 2,100 as a launching pad, and that gets us up to 2,350 by the end of 2015.

When did investors realize that an industrial revolution started in the 1820?s? Oh, sometime in the 1850?s. Similarly, investors today may not understand how rosy the current investment environment is for another couple of decades. Then they?ll be kicking themselves for not loading the boat with shares now.

Just thought you?d like to know.

![Industrial Revolution]() Think it?s Time to Buy Stocks?

Think it?s Time to Buy Stocks?

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Chicago on Tuesday, December 23. A three course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $219.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets, please click here.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.