While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 11, 2014

Fiat Lux

Featured Trade:

(THURSDAY, JULY 17 GLOBAL STRATEGY WEBINAR FROM BARCELONA, SPAIN),

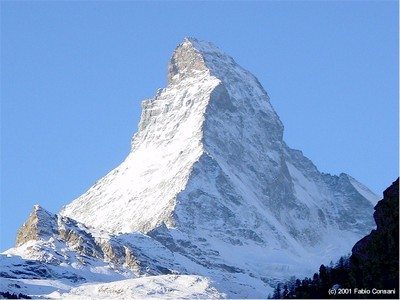

(JULY 24 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR),

(WILL SYNBIO SAVE OR DESTROY THE WORLD?)

Health Care Select Sector SPDR ETF (XLV)

Monsanto Company (MON)

SPDR S&P Biotech ETF (XBI)

SPDR S&P Pharmaceuticals ETF (XPH)

Come join me for afternoon tea for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting high in the Alps in Zermatt, Switzerland at 2:00 PM on Thursday, July 24, 2014.

A PowerPoint presentation will be followed by an open discussion on the crucial issues facing investors today. Coffee, tea, and schnapps will be made available, along with light snacks.

You are welcome to attend in your mountain climbing gear, but you will have to leave your boots at the door. Socks only are welcome, and if it?s cold, we will throw some extra wood on the fire. Last year, someone came down from the Matterhorn summit straight to the seminar, sunburned and tired, but elated. He even gave me a valued pebble from the summit.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $195.

I?ll be arriving early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a central Zermatt hotel with a great Matterhorn view, operated by one of the village?s oldest families and long time friends of mine. The hotel is just down the street from the town?s beautiful 17th century church.

The details will be emailed directly to you with your confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

July 10, 2014

Fiat Lux

Featured Trade:

(WHY IS THE S&P 500 BEATING THE DOW),

(SPY), (BAC), (HPQ), (AA), (GS), (V), (NKE), (AAPL),

(GE), ($NIKK), (CAT), (DIS), (INTC),

(AN EVENING WITH BILL GATES, SR.)

(TESTIMONIAL)

SPDR S&P 500 (SPY)

Bank of America Corporation (BAC)

Hewlett-Packard Company (HPQ)

Alcoa Inc. (AA)

The Goldman Sachs Group, Inc. (GS)

Visa Inc. (V)

Nike, Inc. (NKE)

Apple Inc. (AAPL)

General Electric Company (GE)

Tokyo Nikkei Average (EOD) INDX ($NIKK)

Caterpillar Inc. (CAT)

The Walt Disney Company (DIS)

Intel Corporation (INTC)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.