While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

December 18, 2013

Fiat Lux

Featured Trade:

(THE RECEPTION THAT THE STARS FELL UPON),

(NLR), (CCJ), (CORN), (WEAT), (SOYB), (DBA),

(OIL ISN?T WHAT IT USED TO BE), (USO),

(TAKING A BITE OUT OF STEALTH INFLATION), (SGG), (WEAT)

Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

Cameco Corporation (CCJ)

Teucrium Corn (CORN)

Teucrium Wheat (WEAT)

Teucrium Soybean (SOYB)

PowerShares DB Agriculture (DBA)

United States Oil (USO)

iPath DJ-UBS Sugar TR Sub-Idx ETN (SGG)

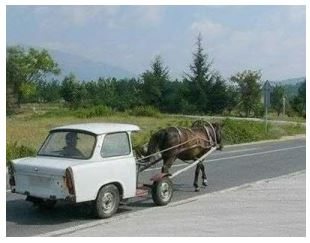

Virtually every analyst has been puzzled by the seeming immunity of stock markets to high oil prices this year. In fact, stocks and crude have been tracking almost one to one on the upside. The charts below a friend at JP Morgan sent me go a long way towards explaining this apparent dichotomy.

The first shows the number of barrels of oil needed to generate a unit of GDP, which has been steady declining for 30 years. The second reveals the percentage of hourly earnings required to buy a gallon of gasoline in the US, which has been mostly flat for three decades, although it has recently started to spike upwards.

The bottom line is that conservation, the roll out of more fuel efficient vehicles and hybrids, and the growth of alternatives, are all having their desired effect. Developed countries are getting six times more GDP growth per unit of oil than in the past, while emerging economies are getting a fourfold improvement. The world is gradually weaning itself off of the oil economy. But the operative word here is 'gradually', and it will probably take another two decades before we can bid farewell to Texas tea, at least for transportation purposes.

![Horse Drawn Car]() But the Mileage is Great!

But the Mileage is Great!

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

Global Market Comments

December 17, 2013

Fiat Lux

Featured Trade:

(THE RISING DRUMBEAT FOR ALIBABA),

(SFTBY), (S), (TMUS), (T),

(RAMPANT WAGE INFLATION STRIKES CHINA), (FXI)

(CHECK OUT OBAMA?S LATEST STIMULUS PLAN),

(TESTIMONIAL)

SoftBank Corp. (SFTBY)

Sprint Corporation (S)

T-Mobile US, Inc. (TMUS)

AT&T, Inc. (T)

iShares China Large-Cap (FXI)

Rumors hit the market Friday that Sprint (S) will mount a $20 billion takeover bid for T-Mobile (TMUS) in early January. The news caused a late day kerfluffle on what would otherwise have been a slow December pre holiday Friday.

The Shares of both companies immediately jumped 10%, which left many analysts scratching their heads. Normally, the shares of the acquirer falls (they?re spending money), while those of the target rise (they are selling for a premium to the market).

Why do I care about a minor US phone company? Guess who owns Sprint? Softbank, which took over the company for $21.8 billion last July, and carries a hefty 20% weighting in my model-trading portfolio.

The move would make Softbank one of the three largest US carriers. That will automatically trigger an antitrust review by the Justice Department, which blocked a similar takeover attempt for giant AT&T (T) earlier. Look at how Eric Holder stood in the way of the American Airlines-US Air deal, which both firms clearly needed to survive. And this is in a country with 100 airlines. So any decision here could be a long wait.

I think this is just an opening shot in a long campaign that eventually leads up to the Alibaba IPO, expected to be one of the largest in history (the biggest was also from China, the $128 billion deal for the Industrial Bank of China in 2010). Expect to hear a lot about Softbank?s role in all of this in coming months. This should be good for its stock price.

As part of the build up, my old employer, the Financial Times of London, named Alibaba founder and CEO, Jack Ma, as its Person of the Year. The paper chronicles Ma?s rise for abject poverty in Hangzhou, China, where he was the son of impoverished traditional performers, to becoming one of the world?s richest men.

Ma was fascinated by the English language at an early age, and used to listen to my own broadcasts on BBC Radio to learn new words (another one of my former employers). After graduating in 1988, he earned $12 an hour as a teacher in China. While working for the Foreign Trade and International Cooperation, he escorted foreign visitors to the Great Wall. One of them turned out to be Jerry Yang, co founder of Yahoo.

Thus inspired, Ma went on to found Alibaba in 1999. Its initial strategy was to match up Chinese manufacturers with American customers, an approach that proved wildly successful. He then took on Ebay. In the following years the US e-commerce giant saw its Chinese market share plummet from 80% to 8%, most of that going to Alibaba. Today, Alibaba has 600 million registered users, and one day in November it clocked a staggering $6 billion in sales.

The FT estimates its current market value at $100 billion. To read the rest of the FT profile, please click here. Its IPO will be one of the preeminent investment events of 2014. Better to get in early.

Followers of my Trade Alert Service will notice that this is one of the few outright equity trades that I have done this year. This is a way for me to deleverage my exposure after a spectacular stock market run. Equity ownership ducks the time decay that plagues call options, and avoids the leverage inherent in call spreads.

If the stock is unchanged over the holidays, it won?t cost me a dime. One thing is for sure. When the Alibaba IPO is announced, it will be a surprise. The only way to participate is to get in indirectly through a minority owner now.

Don?t expect an allocation from your broker, unless they think it is going o fail.

I rely on hundreds of 'moles' around the world whose job it is to watch a single, but important indicator for the world economy. One of them checks for me the want ads in the manufacturing mega city of Shenzhen, China, and what he told me last week was alarming.

Wage demands by Chinese workers have been skyrocketing this year. The biggest increases have been at the low end of the spectrum, where migrant workers from the provinces are earning up to 40% more than a year ago. Wage settlements of 20% or more for trained workers are common. One factory that gave staff only a 10% increase saw many of them fail to return after the recent Chinese lunar New Year.

Of course China's blistering 8% GDP growth is the cause, which has pushed inflation well beyond the government's 4% target. So the cost of living in the Middle Kingdom is rising dramatically. The problem has been particularly severe with imported commodities, such as in food. Hence, the increased demands.

This is important for the rest of us because low wages have been the cornerstone of the Chinese economic miracle. In just the last decade, average monthly Chinese wages have climbed from the bottom rung to the middle tier. That seriously erodes the country's cost advantage, which has gained it such enormous shares in foreign markets, like the US. Take away the country's price advantages, and demand will wither, slowing growth globally.

What will they be demanding next? Collective bargaining rights? In the meantime, keep checking those Craig's List entries for Shanghai.

Average Monthly Salary

$3,099 Yokohama, Japan

$1,220 Seoul, South Korea

$888 Taipei, Taiwan

$235 Shenzhen, China

$148 Jakarta, Indonesia

$100 Ho Chi Minh City, Vietnam

$47 Dhaka, Bangladesh

![Chinese Men]() $1.25 an Hour? You Must Be Joking!

$1.25 an Hour? You Must Be Joking!

Was there is no limit to how far President Obama was willing to go to stimulate the economy and reassure his election? So I had to be amused when a friend sent me a link to his proposal. Warning: the source is a college humor website, so I would take it with so many grains of salt. For a good laugh, click here at

http://www.collegehumor.com/video/6710602/obamas-young-adult-novel-plan .

Fellow writers should be prepared for the worst. The economy will not be the only thing stimulated.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.