“US stock performance was good in 2025, but is set to be outperformed by Japan, Europe, and emerging markets,” said a top manager at bond giant PIMCO.

“US stock performance was good in 2025, but is set to be outperformed by Japan, Europe, and emerging markets,” said a top manager at bond giant PIMCO.

It’s here - rules, and a mountain of them.

They didn’t stop until they got their cut.

Blame the industry for attracting the ire of the all-mighty rule makers.

This means that growth in this sector won’t be as gangbusters moving forward, if ever.

It’s a net negative for the original vision of crypto because the industry relies on that extra supercharger growth to attract incremental investors, and all in one poof, it's gone, like the wind.

What exactly happened?

The Financial Stability Oversight Council (FSOC), the U.S. regulatory panel comprising top financial regulators, successfully pushed Congress to enact legislation addressing risks digital assets pose to the financial system, including strict oversight of crypto spot markets and stablecoins.

Anything that Congress touches turns to higher costs and more red tape.

The FSOC's current enforcement regime follows a slate of directives that were released throughout the mid-2020s. The administration’s mandate effectively forced U.S. government agencies to double down on digital asset sector enforcement and close holes in regulation.

Legislative clarity has largely replaced the ambiguity of the past, with bills now codified to address stablecoins and digital commodities regulation.

Federal financial regulators now possess explicit rulemaking authority over the spot market for cryptocurrencies that are not securities, addressing conflicts of interest and abusive trading practices.

It’s not a joke that regulation has raced to the front and center of the crypto narrative as the defining constraint on the industry.

It has been relentless.

Just as we thought the worst had passed, the industry was forced to reckon with the consequences of the trust-toppling scandals that induced this heavy-handed regulation.

The poster child for this era remains reality TV star and influencer Kim Kardashian.

She is the Hollywood socialite who pushed Ethereum Max, a digital coin that aptly borrowed its name from the second biggest crypto, Ethereum.

What were the results?

Ethereum Max is effectively dead, prompting investors to sue Kardashian, who initially failed to disclaim that her marketing was being paid for by the company that owned the token.

Kardashian’s legal battles became a landmark case for influencer liability, even as her lawyers argued there was insufficient evidence that her endorsements led to the plaintiffs buying EMAX.

She paid a settlement of $1.26 million.

EMAX's value was based on the greater fool theory because it had no utility whatsoever.

As investors and promoters like Kardashian talked up such coins, more people invested, and the price went up, allowing the investors at the beginning to cash out.

Kardashian was paid $250,000 by Ethereum Max for her marketing efforts.

Altcoins like EMAX lack the stability of established assets like Bitcoin and Ether.

And EMAX never returned to meteoric highs, meaning the greater fool theory in this coin only reached so high for the previous investors to cash out.

EMAX remains a cautionary tale because investing in such assets is akin to pouring money down a black hole, with the asset depreciating rapidly.

While the exact number of people who invested based on celebrity endorsements is history, data from that period found that Kardashian's advertisement reached about one in five US adults and roughly 30% of crypto owners.

This was a public relations disaster that permanently damaged the crypto industry.

It’s bad enough that the industry impoverished many of its participants during the purge, but it also involved the lowest level of brain activity on the human planet.

One might conclude that the Kardashian fiasco marked the bottom of the industry's reputation, because how much lower and pitiful could crypto get?

The one silver lining in the market's survival is that the big holders haven’t sold out, which bodes well for crypto now that capital markets have stabilized.

That appears to be the last leg crypto is standing on, which could be either scary or a sanctuary, depending on how you look at it.

Lastly, steer away from anything other than Bitcoin if you are going to invest.

Crypto and Terraform Labs co-founder Do Kwon is no longer on the run.

Yes, that’s right – he’s a convict.

The Interpol red list that once alerted 195 countries to his status as a wanted fugitive has been retired, replaced by a federal prison number. We now know that his desperate transfer of 33,131 Bitcoins right after being added to that list was the final act of a man who knew the walls were closing in.

Kwon was the golden boy for stablecoins for quite some time as the native South Korean’s brash attitude led him to billions in wealth.

His “fake it ‘til you make it” attitude got him into deep water, and the quickly escalating investigations have now concluded with a definitive thud.

Why?

His brainchild, Terra’s UST stablecoin, lost its parity to the dollar in May 2022 in a $70 billion collapse, and today is nothing more than a digital tombstone.

Kwon and Terraform Labs fled South Korea for Singapore ahead of Terra’s meltdown, and then he fled Singapore, sparking a global manhunt that ended in Montenegro.

South Korean authorities finally got their answers regarding the violations of capital markets law that resulted in a slew of local suicides by investors who lost everything.

Investigators also confirmed what many suspected: his company misled investors in labeling UST as a stablecoin.

The courts have ruled that his stablecoin achieved the definition of a Ponzi scheme.

It feels like a lifetime ago when Terraform Labs successfully rallied an audience of fans that called themselves the “Lunatics,” praising Kwon as the project’s outspoken hero, as the price of its LUNA token rallied.

Kwon’s unique case set off US regulators with the intent of regulating stablecoins more rigidly, a goal that was realized with the passage of the GENIUS Act last year.

The South Korean sullied the stablecoin industry, and while the manhunt is over, the reputational stain remains.

U.S. lawmakers successfully passed the bill that introduced a ban on UST-like algorithmic stablecoins, safeguarding other decentralized dollar alternatives like MakerDAO’s DAI by forcing them to adhere to strict backing requirements.

Cryptocurrencies have been littered with non-stop streaming of negative headlines over the last few years.

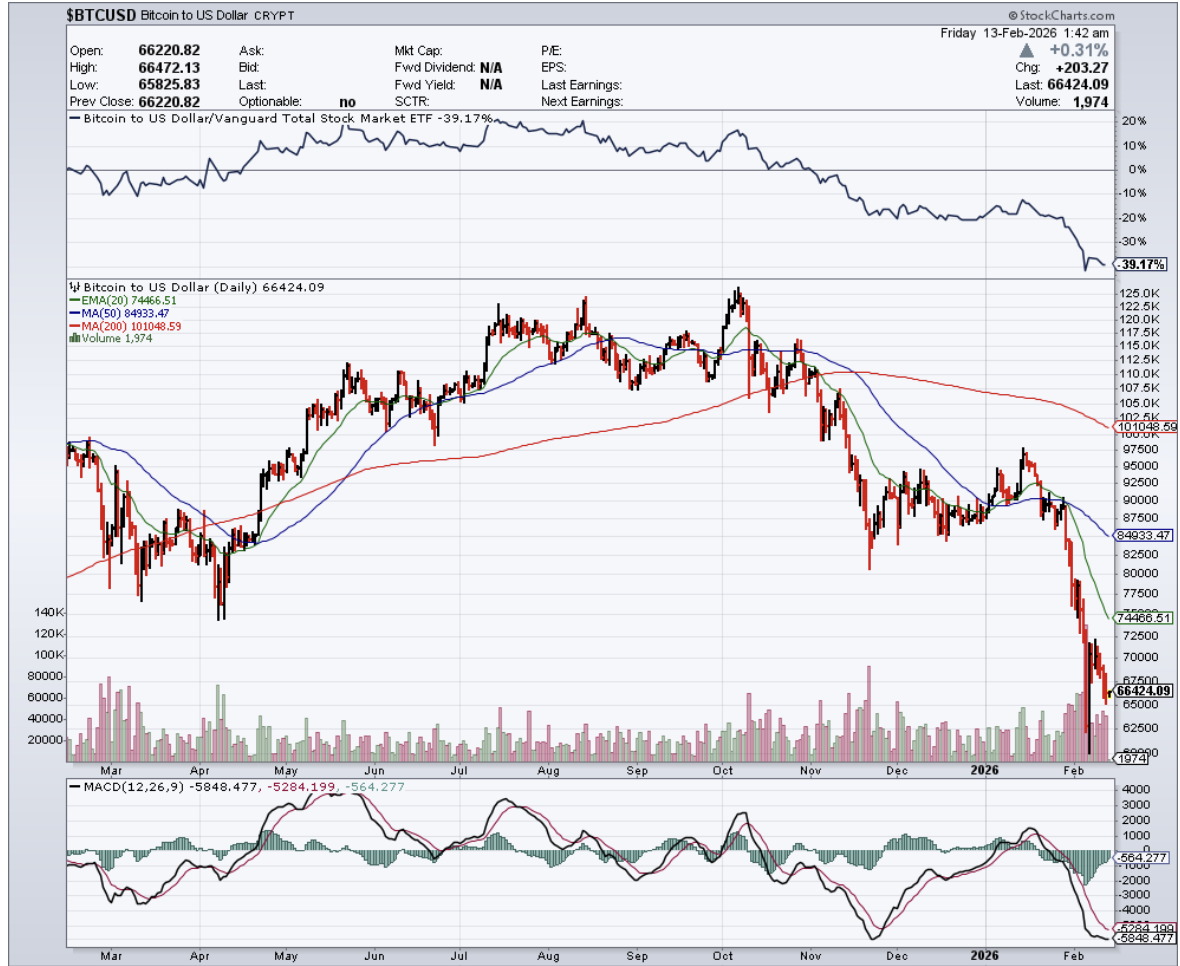

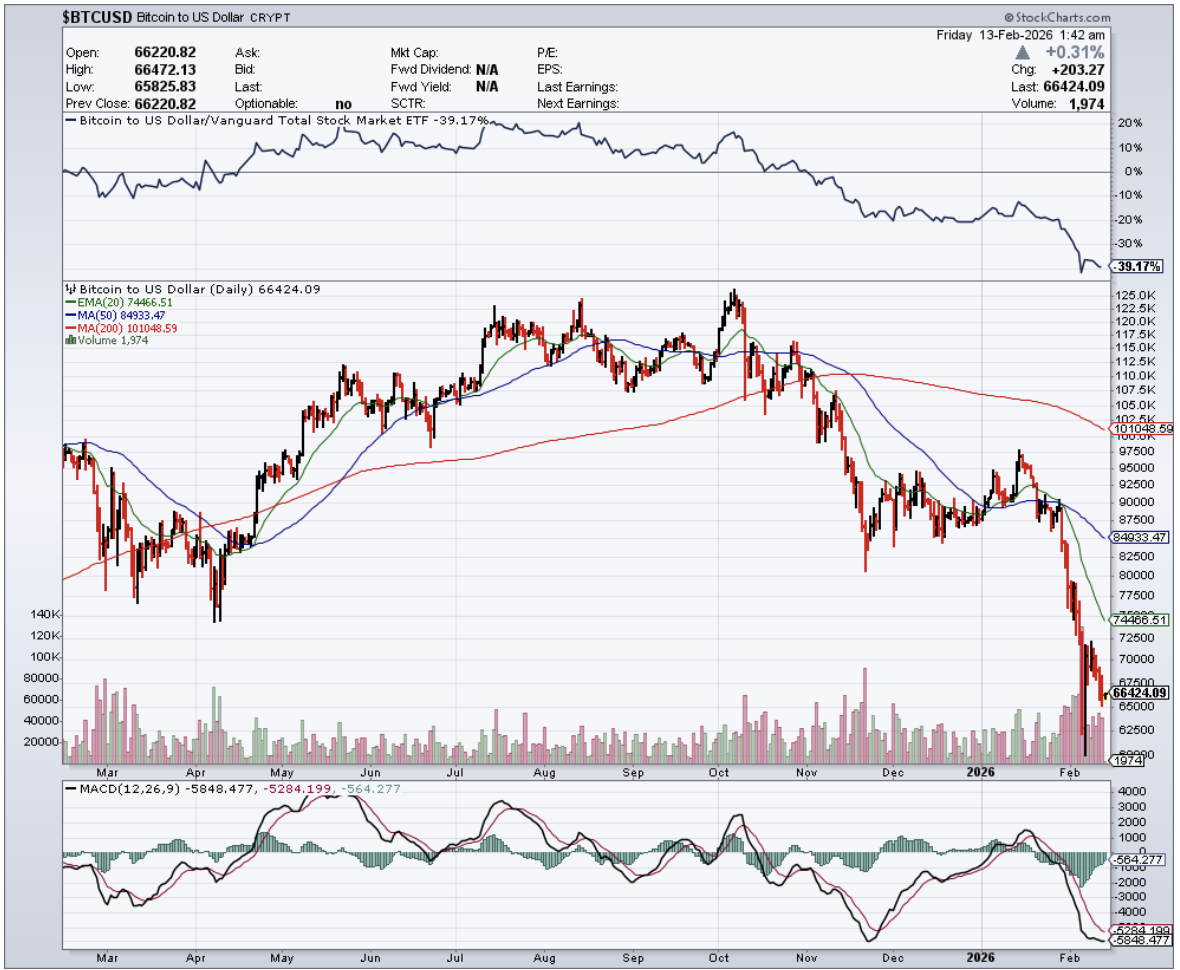

Bitcoin reaching $65,000 back then wasn’t in fact a celebration, but the calm before the storm, before a myriad of structural problems were revealed as the price of Bitcoin collapsed.

Kwon's incarceration has stopped his attempt at fixing LUNA, and the price levels remain a fraction of what they were before the collapse.

The conclusion of this international police case has heaped more fuel on the fire for incremental investors, signaling them to stay away from speculative cryptocurrencies, and rightly so.

Kwon is now serving a 15-year sentence, though legal experts believe he may still face additional time in his native homeland of South Korea.

Financial fraud and running a Ponzi scheme are serious matters in South Korea, which is infamous as a place where Korean oligarchs regularly flout the law, but Kwon was not spared.

Delaying the inevitable stirred up even more unrest for crypto, but at least one of its big-time CEOs can no longer evade the law.

The longer he hid internationally, the longer the damage to the reputation of crypto lasted.

The problem I have is that even with justice served, the lack of cash flow dispensing from these assets keeps them in a gray area of whether they are sustainable or not.

Even more worrisome, the strict regulations born from Kwon’s actions have wiped out the wild-west infrastructure that once fueled the industry's growth.

It caused manhunts for crypto CEOs and the bankruptcy of the masses.

These events remain highly bearish for the cryptocurrency industry's legacy, and I advise readers to continue heading for higher water.

Crypto insider Mike Novogratz has long maintained an upbeat tone, even as crypto remains one of the most frustrating asset classes of the last few years.

His words are mostly silver linings and an optimistic view of the future.

His argument for structural appreciation in Bitcoin centers on the premise that the next phase must differ from historical cryptocurrency rallies in terms of story and utility.

Compared to previous cycles, the thesis is that any future Bitcoin rally will be more focused on utility and less on the story.

An asset can only go so far based on the fear of missing out hype.

The structural issue remains the lack of buyers, and it is no surprise.

Every liquidity event serves as a great exit point for holders to dump more coins.

In my analysis over the years, I chronicle how structural shifts make it less attractive for incremental investors to bite at crypto.

The data backs me up as new buyers have largely exited this speculative industry and sought assets that pay an annuity-like premium.

According to Novogratz, the 2017 era was mostly about the story of people not trusting the government and wanting more privacy and decentralization.

The blockchain narrative has stagnated, and few institutions have integrated the technology into daily tasks.

I do not see where the utility comes from.

The era when speculative investors bought digital real estate in the metaverse in hopes of accruing rental digital revenue defies belief.

I do not see the utility there either.

It is all good to use buzz words like scalable and user-friendly, yet I see no actual development.

I do not believe crypto is the inherent successor to fiat either, and I do believe that, at best, it acts as a nice compliment, and that is if miracle after miracle happens from here on out.

With governments regulating the sector heavily, its value proposition diminishes greatly.

Novogratz needs to stop pushing the inevitable theme like a real estate agent advising buyers to buy the most expensive mansion at the top of the market.

Hilariously enough, one of the knocks on crypto was the elevated volatility, which has dampened significantly.

Why?

The lack of volatility stems from the lack of new buyers and sellers. There are still owners who have not sold and are holding until infinity, so the price does not get pushed down further, but investors are so turned off by the charlatans and dangers in the industry that they would rather put their money in something more real.

Crypto executives need to stop pushing the Bitcoin to $1 million theme, as every headwind imaginable crushes the price of crypto.

Even worse, the industry is still metabolizing billions of dollars in regulatory actions, and I believe it is more responsible to talk about the persistent existential crisis that Bitcoin faces.

If Bitcoin fails, then crypto is finished, so it will be interesting to see what the last big holders do with their coin.

Do they sell out the rest and crash the market? Or wait for a bull run that may never come?

The likely outcome is that the price of Bitcoin remains rangebound for the foreseeable future.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.