Phase 2 Or Not Phase 2: That's Not Even A Question In 2025

I had dinner with a veteran biotech investor at San Francisco's Waterbar earlier this month, watching the Bay Bridge lights while discussing what's coming for biotech in 2025.

"The game is changing," he said, picking at his salmon. "It's not about platform promises anymore. Show me the Phase 2 data, or don't show up at all."

He's nailed what I've been seeing in my recent travels through the biotech corridors of Boston, San Diego, and Basel. The days of throwing money at shiny new platforms are ending.

That means that by 2025, we'll see venture capital concentrate in fewer but larger deals, especially in companies with solid Phase 2 data.

Let me break down what this means for our portfolio next year. First, North America will dominate in advanced biologics and AI-driven drug discovery. I've toured enough labs recently to see that our capabilities in these areas are leaving others in the dust.

Europe's doubling down on sustainable manufacturing and rare diseases - smart move given their regulatory environment. Asia? They're positioning to own generics and biologics manufacturing, with India making particularly interesting moves in antibody-drug conjugates.

The money's following these regional specialties. If you're investing in biotech companies that don't align with their region's strengths, you might find yourself waiting longer for returns than a Red Sox fan waiting for another World Series.

My contacts in several major VC firms confirm they're already adjusting their 2025 strategies around these regional strengths.

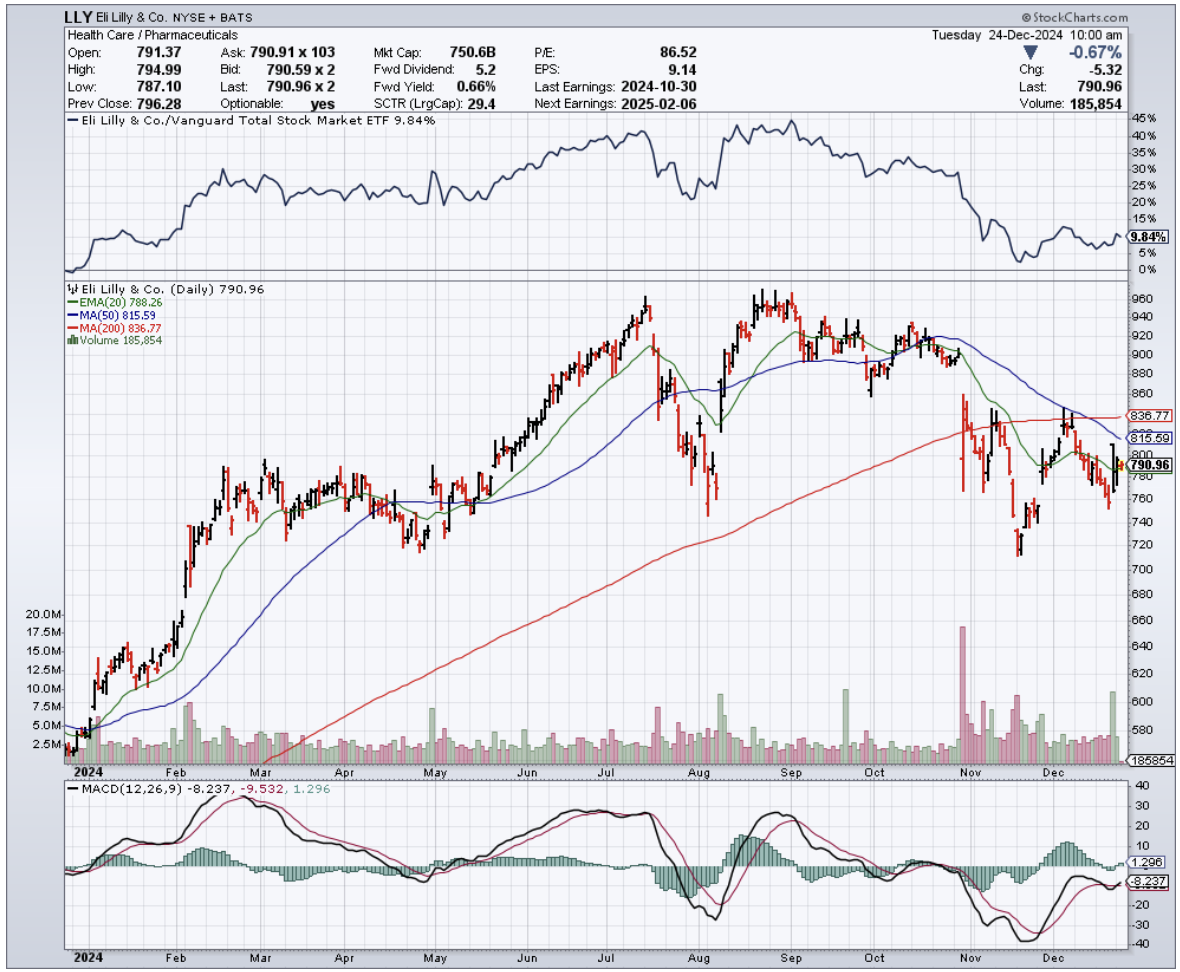

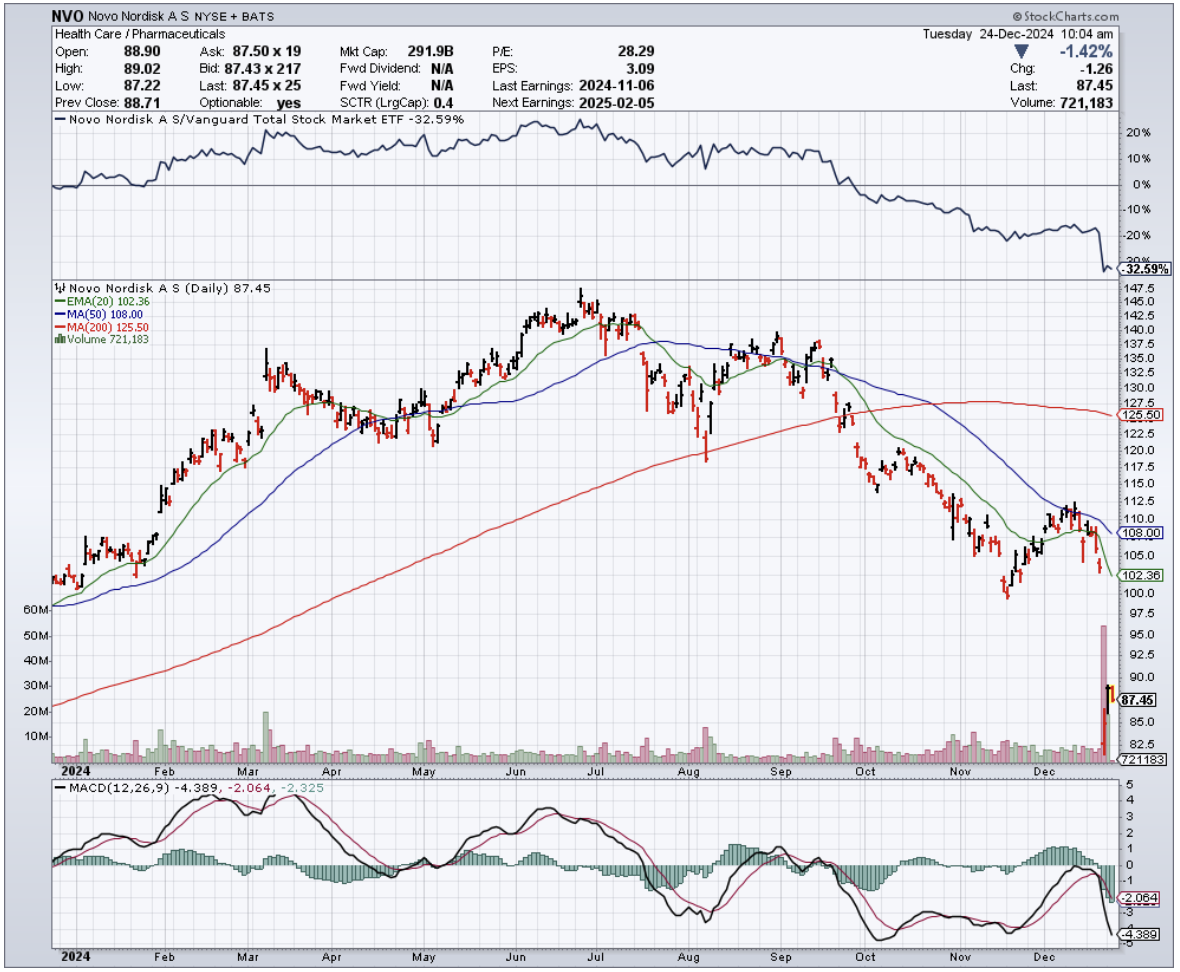

Here's what's really interesting: obesity and GLP-1 drugs are the exception to every rule. After watching Eli Lilly (LLY) and Novo Nordisk's (NVO) recent success, everyone wants a piece of this action.

Even early-stage obesity plays are attracting serious capital, bucking the trend toward late-stage investments.

But remember this about 2025 - being picky about Phase 2 data isn't just smart, it's survival. We're heading into a market where strong clinical validation will matter more than ever.

I've seen enough biotech cycles to know that when the market gets selective, you want to be where the data is solid.

The numbers back this up. Looking at the trends, Phase 2 companies have consistently captured the highest deal sizes, except for that brief period in 2023 when obesity deals sent Phase 1 valuations through the roof.

By 2025, expect this preference for Phase 2 assets to become even more pronounced. Phase 3 investments have been declining - dropping from $4.2 billion in 2021 to $1.7 billion in 2024 - partly because companies with strong Phase 2 data are getting snatched up through partnerships or acquisitions before they even get to Phase 3.

Speaking of partnerships, watch Big Pharma's moves carefully in 2025. They're increasingly hungry for de-risked assets, and strong Phase 2 data is their favorite meal.

I had lunch with a Big Pharma exec last week who told me they've completely restructured their BD team to focus on Phase 2 assets in their regional sweet spots.

As for AI platforms? They'll still get funded - companies like Xaira and Generate:Biomedicines are proving that. But by 2025, they'll need to show more than just fancy algorithms. The market's going to demand real clinical validation.

I recently visited an AI-driven drug discovery company where the CEO proudly showed me their latest neural network. "That's great," I told him, "but show me your clinical data." The silence was deafening.

So, what’s the play here? Well, I'm keeping my own biotech portfolio focused on companies with strong Phase 2 assets heading into 2025, especially in regional sweet spots.

And yes, I've got a position in the obesity space - sometimes a trend is too strong to ignore, even for an old contrarian like me.

One final thought: keep an eye on those time gaps between funding rounds. They're getting longer, and by 2025, companies that don't fit neatly into regional specialties or lack solid clinical data might find themselves in the financial equivalent of a Phase 2 trial that never ends.

Now, if you'll excuse me, I've got a call with a German biotech CEO about their sustainable manufacturing process. These regional specialties aren't going to research themselves.