Pick Your Spots

The top groups of tech companies ($COMPQ) are still growing around 4X more than the other listed companies, but that doesn’t mean they are sure-fire buy-and-hold stocks today.

In fact, there is a legitimate case that the gap between tech and the rest will narrow as we roll into 2025, making tech stocks marginally unattractive if a full-fledged rotation occurs.

I am not downplaying tech, but sometimes the sector needs a little breather or sideways correction.

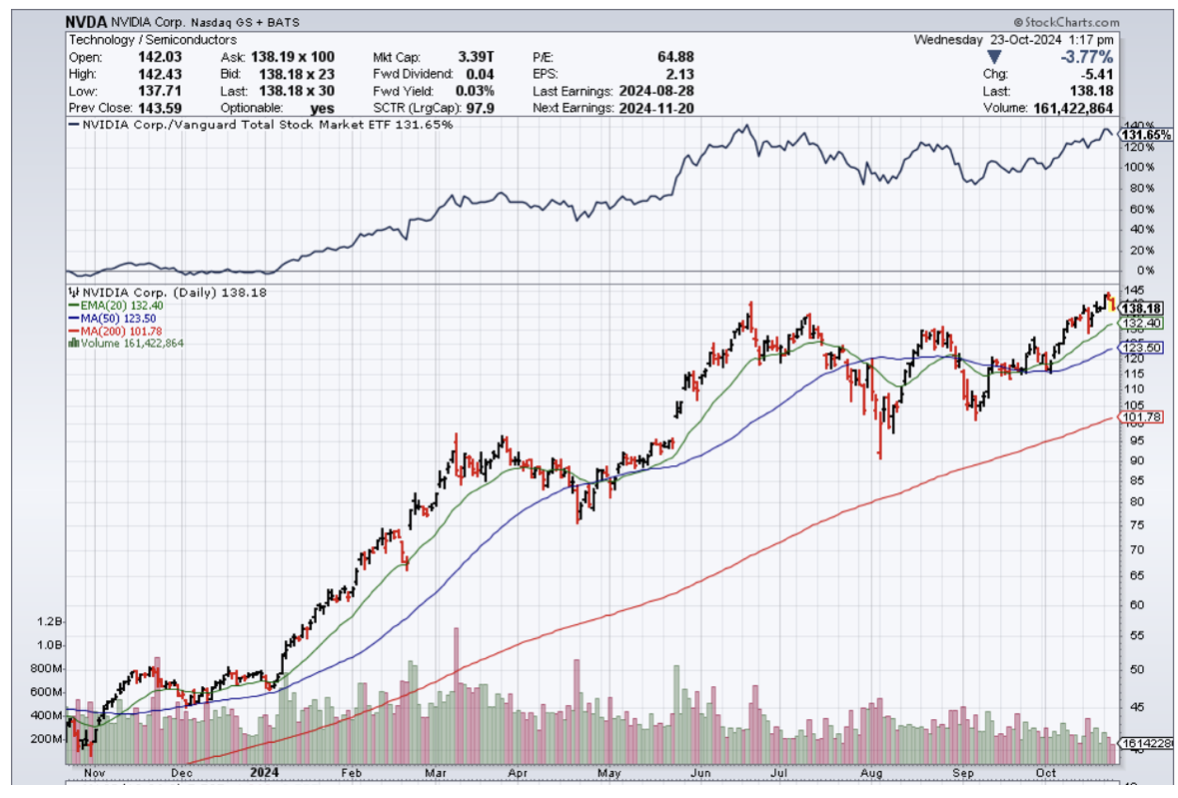

Much of the over performance in 2024 has been breathtaking with the gem of the group Nvidia (NVDA).

I am not saying that there will be a non-tech Nvidia-like firm sprouting up from nothing in 2025, but the rate of stock acceleration could face some resistance in the tech sector.

That is why it is important not to chase big gains and wait for stocks to come to you as investors book profits to close the year.

There will be moments where you wish you waited.

Remember, much of tech’s success has already been priced into the stock, and looking out, they will need to deliver another bounty of alpha for shareholders to bid up the price even more.

That is certainly what Nvidia is doing as they impress and then reestablish a new higher goal.

The rally isn’t over, but readers will need to pick their spots.

Since peaking on July 10, big tech stocks have fallen 2%. That lags every major sector in the S&P 500, with the utilities, real estate, financial, and industrial groups jumping more than 10% and the broader index gaining 3.1% over the same span.

Microsoft faces concerns about its prospects in AI. Apple has seen early signs of tepid demand for its newest iPhones, although long-term optimism helped send the stock to a record last week. Amazon investors are worried about heavy capital spending eating into profits. And Alphabet has regulatory uncertainty as the US Justice Department investigates it for monopoly practices.

In the third quarter, Microsoft, Alphabet, Amazon, and Meta Platforms are projected to have poured $56 billion into capital expenditures, up 52% from the same period a year ago.

This is getting expensive, and investors want to know if the expenses are becoming too burdensome to the point that it doesn’t make economic sense.

Raising concerns about future profit margins was never a concern, but it suddenly is for tech investors looking down the road.

Top-line gains are starting to get offset by surging AI-related capital spending.

The reason for the optimism is fairly simple. For all the concerns, they continue to offer above-average profit growth, exposure to AI, strong capital returns, and less risk than other stock market sectors.

They are still attractive businesses with established business models, but at what price?

This earnings season will finally be the acid test to whether investors co-sign management’s vision to grow earnings in 2025.

The path is certainly much harder than in years past, and the goalpost continues to shrink.

Opportunities will present themselves as many companies might need a short-term haircut after earnings.

I still like the tech sector, but I would like it more if the expensive prices were reigned in.

For companies like Nvidia or Tesla, I don’t believe that will be possible, but the tier after that should offer optimal chances to pocket some high-quality names at better prices.