Portfolio Management During Pain Management

During physical therapy last week - still working on that Russian bullet in my hip from Ukraine - I was going through pharmaceutical pipeline data on my laptop. Between resistance exercises, I spotted something that made me forget about the pain entirely. After decades of tracking biotech launches, I rarely see numbers that make me sit up straight. But these did exactly that.

My analysis shows a potential $29 billion boom in annual sales by 2030 from the biggest drug launches expected in 2025. That's not a typo - we're looking at almost double last year's forecast of $15.2 billion. And while my therapist kept telling me to focus on my exercises, I couldn't take my eyes off these projections.

The numbers tell a compelling story. Leading the pack is Vertex Pharmaceuticals' (VRTX) cystic fibrosis treatment Alyftrek, which snagged its FDA approval ahead of schedule in late 2024. They're looking at $8.3 billion in annual sales by 2030. As someone who's studied market-moving data across Asia and Wall Street, I know transformative numbers when I see them.

What really catches my attention is Vertex's pricing strategy. They've set Alyftrek's annual list price at $370,269, about 7% higher than their previous treatment Trikafta's $346,048. The drug expands Vertex's CF franchise into 31 additional mutations, potentially treating about 150 new CF patients in the U.S. alone. That's the kind of market expansion that creates blockbusters.

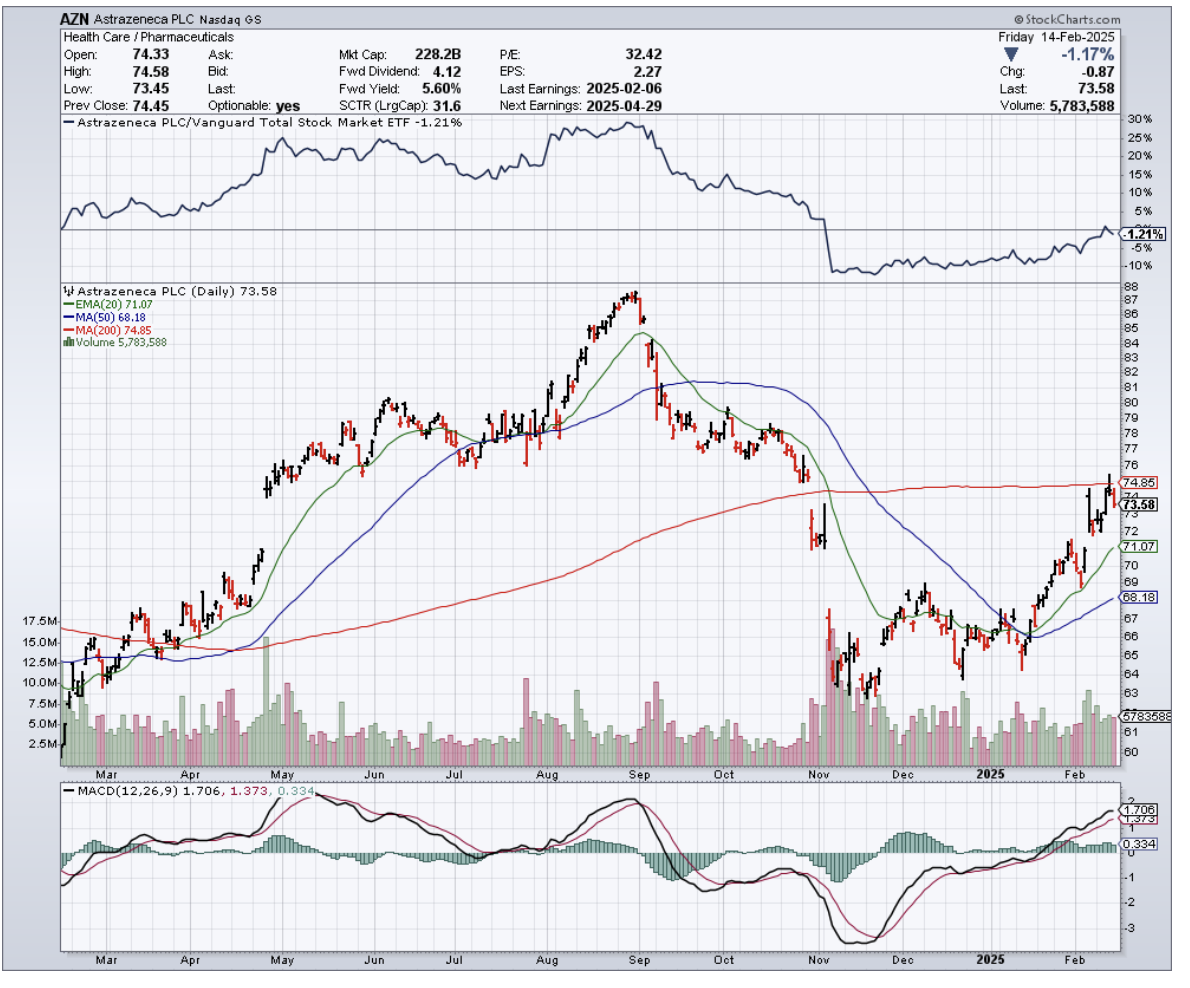

The second spot belongs to Daiichi Sankyo (DSNKY) and AstraZeneca's (AZN) Datroway, projected for nearly $6 billion in 2030 sales. They've already secured their first FDA approval this January for breast cancer. But here's what you need to watch: the bigger opportunity lies in lung cancer. While they faced setbacks in 2023, including patient deaths that intensified doubts, they're now advancing toward first-line treatment data in the second half of 2025. The AVANZAR trial could open up a major market opportunity, particularly if they can leap ahead of Gilead's (GILD) Trodelvy.

Speaking of opportunities, Vertex appears again with suzetrigine, their non-opioid pain management drug targeting both acute and neuropathic pain. With a January 30th FDA decision date looming, they're aiming to become "the first novel pain mechanism to reach the market for decades." My analysis points to just under $3 billion in annual sales by 2030. As someone who knows a thing or two about pain management these days, I can tell you that new approaches without addiction potential are pharmaceutical gold.

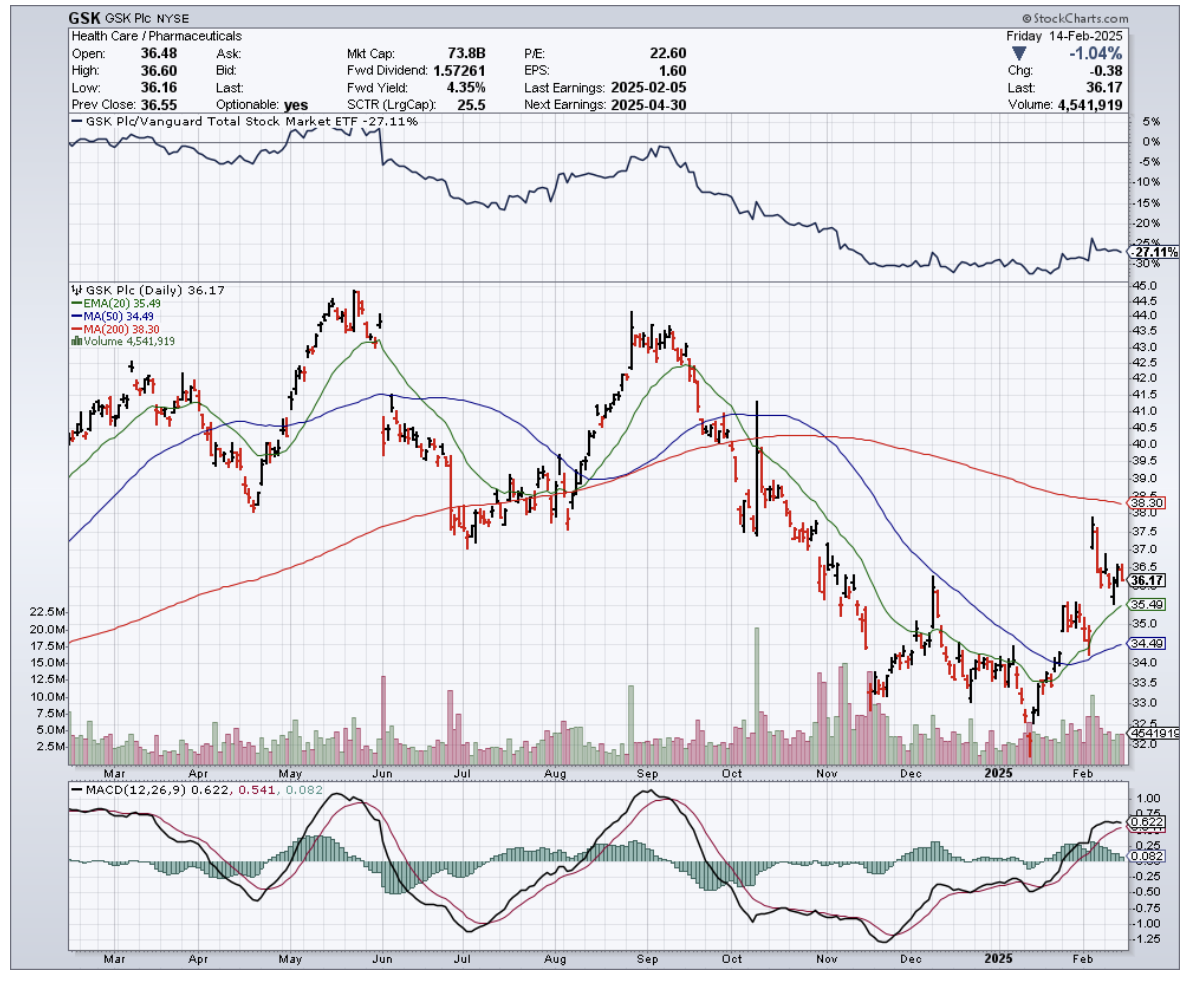

The pattern here is clear: we're seeing a concentration of breakthrough therapies across multiple high-value indications. From Sanofi's (SNY) tolebrutinib for multiple sclerosis to GSK's (GSK) depemokimab for severe asthma, which reduced asthma exacerbations by 54% compared to placebo, these aren't just incremental improvements - they're potential market reshaping events.

Looking ahead, we've got Johnson & Johnson's (JNJ) nipocalimab for myasthenia gravis, which could be the start of multiple autoimmune disorder approvals. GSK's meningococcal vaccine is targeting peak sales of $2.4 billion across its portfolio. Even Innovent and Eli Lilly's mazdutide for diabetes and obesity is showing promise in the Chinese market.

Will all these projections materialize? That's the $29 billion question. But even if only half hit their marks, we're looking at one of the most significant years for pharmaceutical launches in recent memory. The smart money is watching these developments closely, particularly in companies with multiple promising candidates.

Speaking of watching closely - my therapist is giving me that look again. Time to get back to those exercises. But between you and me, a potentially historic year in pharmaceutical launches is a lot more interesting than leg lifts. And with $29 billion in projected sales on the horizon, the pain in my portfolio might be easier to manage than the one in my hip.

The market will be watching these launches carefully. So should you.