QE3 Blows Out Bears.

The big surprise today was not that the Federal Reserve launched QE3, but the extent of it. ?For a start, they moved the ?low interest rate? target out to mid-2015. ?They left the commitment to bond-buying open-ended. ?The first-year commitment came in at $480 billion, in-line with previous efforts.

Reading the statement from the Open Market Committee, you can?t imagine a more aggressive posture to stimulate the economy. ?You have to wonder how bad the data that we haven?t seen yet is, not just here, but in Europe and Asia as well. The big question now is: ?Will it make any difference??

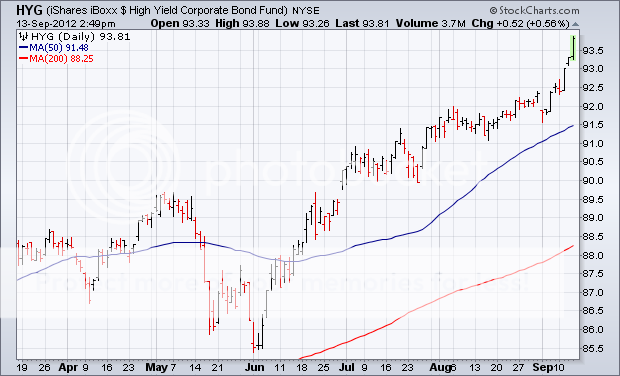

Asset markets certainly bought the ?RISK ON? story hook, line, and sinker in the wake of the Fed action. ?Gold leapt $30, the Dow soared 200 points, the dollar (UUP) was crushed, the Australian dollar (FXA) rocketed a full penny (ouch!), and junk bonds (HYG) caught a new bid at all-time highs. ?The real puzzler was the Treasury bond market, which saw the (TLT) fall 2 ? points. ?I guess this is because the new Fed buying will be focused on mortgage-backed securities at the expense of Treasuries.

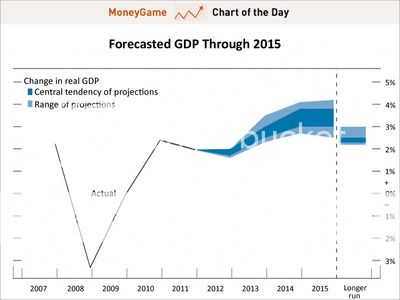

I knew that if they were to do anything, it would be aimed at the residential real estate market, which has been a thorn in their side for the last five years. ?The reason we have 1.5% growth instead of 3% is real estate. Real estate is the missing 1.5%.

But what will be the impact? ?Some $480 billion of buying of mortgage-backed securities over the next 12 months will lower the 30 year conventional mortgage from the current 3.70%. ?But all that will do is enable those who refinanced for the last two years in a row to do so a third time. Those who are underwater on their mortgages and have only negative equity to offer banks as collateral will remain shut out. ?This will generate a big payday for mortgage brokers, but won?t trigger any net new home-buying which the economy desperately needs.

The harsh reality for the housing market is that the demographic headwind of downsizing baby boomers is so ferocious that the Fed is unable to piss against it. Here is the problem:

*80 million baby boomers are trying to sell houses to 65 million Gen Xer?s who earn half as much

*6 million homes are late or in default on payments

*An additional shadow inventory of 15 million units overhangs the market owned by frustrated sellers

*Fannie Mae and Freddie Mac are in receivership, which account for? 95% of US home mortgages.? Each needs $100 billion in new capital. Good luck getting that out of a deadlocked congress

*The home mortgage deduction a big target in any tax revamp. The government would gain $250 billion in revenues in such a move

*The best case scenario for real estate is that we bump along a bottom for 5 years. The worst case is that we go down another 20% when a recession hits in 2013.

It could be that 95% of the new QE3 is already in the market, and that the markets will roll over once the initial headlines and ?feel good? factor wears off. ?With the markets discounting this action for nearly four months, this could be one of the greatest ?buy the rumor, sell the news? opportunities of all time.

Whatever the case, I am not inclined to chase risk assets up here. Anyway, I am now so far ahead of my performance benchmarks for the year that I can?t even see them on a clear day.

Is That My Benchmark Out There?