Revisiting the ROM

Now that technology stocks have returned from the grave, it is time to increase our exposure to the sector. After all, we are two weeks into a rally that could last until the rest of the year.

It was the stabilization of interest rates that did the trick. While ten-year US Treasury yields (TLT) were soaring from 0.89% to 1.76%, tech stocks smelled like three-day-old sushi left in the sun.

Now that rates have fallen back to 1.64%, tech stocks have caught on fire. Rates didn’t really have to go down, just stop going up at 100 miles per hour.

Markets are now pricing in the end of the pandemic. So, I have been dusting off some of my favorite trades for a decade ago, when we were dealing with similar levels of panic, despair, and desperation.

Suddenly, the (ROM) came to mind.

The (ROM) is the ProShares Ultra Technology ETF, a 2X long in the top technology shares. It holds the fastest growing, cream of the cream of corporate America which you want to hide behind the radiator and keep forever.

Quality is on sale now and here is where you want to be loading the boat. The $683 million market cap (ROM) even pays a modest 0.17% dividend.

(ROM)’s ten largest holdings include:

Microsoft (MSFT)

Apple (AAPL)

Facebook (FB)

Alphabet (GOOGL)

Intel (INTC)

Cisco (CSCO)

Adobe (ADBE)

NVIDIA (NVDA)

Salesforce (CRM)

Oracle (ORCL)

The major (ROM) holdings, like Apple, Amazon, and Facebook (FB) have gone virtually nowhere for eight months. Yet, their earnings have continued to grow at a feverish 20% annual rate. The stocks were just exhausted and needed a time-out.

The great thing about the (ROM) is that it is one of the most volatile ETFs in the market. Over the past two weeks, the (ROM) has rocketed 20%. From the March 2020 bottom, it has rocketed from $20 to $86.

I’d like a piece of that!

It gets better. The (ROM) HAS OPTIONS. That effectively increases your technology leverage from 2:1 to 20:1 with defined limited risk (you can’t lose any more than you put in).

I’ll give you an example.

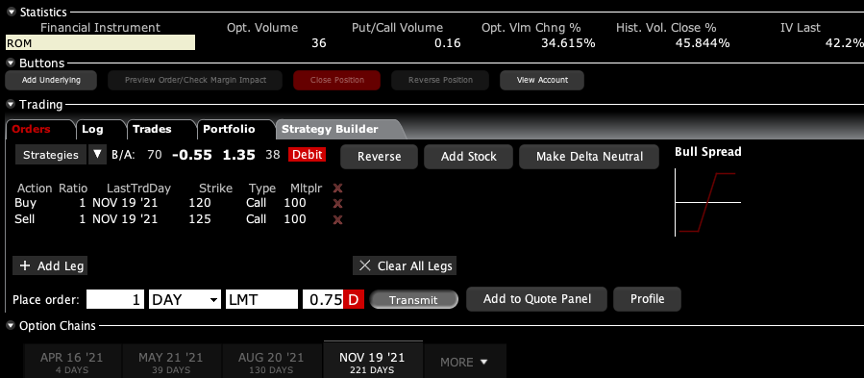

The longest expiration for which (ROM) options are currently trading is November 19, 2021, or six months out. (ROM) is currently trading at $85.03. You can buy the (ROM) November 19 $120-$125 call spread for $0.75.

If tech stocks rise by 23% by November and the (ROM) soars by 47%, then the value of your call spread increases from $0.75 to $5.00, or 466%.

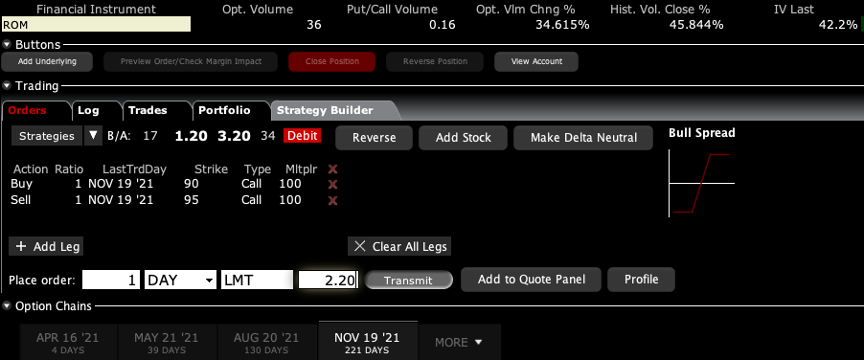

You can engineer yourself closer to the money spreads requiring less prolific moves in tech stocks that will still bring in triple-digit returns,

For example, the (ROM) November $90-$95 vertical bull call spreads cost $2.20 and requires only a 5.9% rise in tech stocks, or an 11.8% increase in the (ROM) to appreciate to $5.00 for a gain of 127% in six months.

Remember too that a 2X ETF can cover a lot of ground in a very short time in a new bull market.

It has since done exactly that.

The harder I work, the luckier I get

To learn more about (ROM), please click here for their website.

The Way Forward is Clear