Record-Breaking Inflows

When an investor like John Paulson buys gold and throws shade on Bitcoin, you know they know that Bitcoin is in the process of disrupting gold and overtaking the store of value mantle.

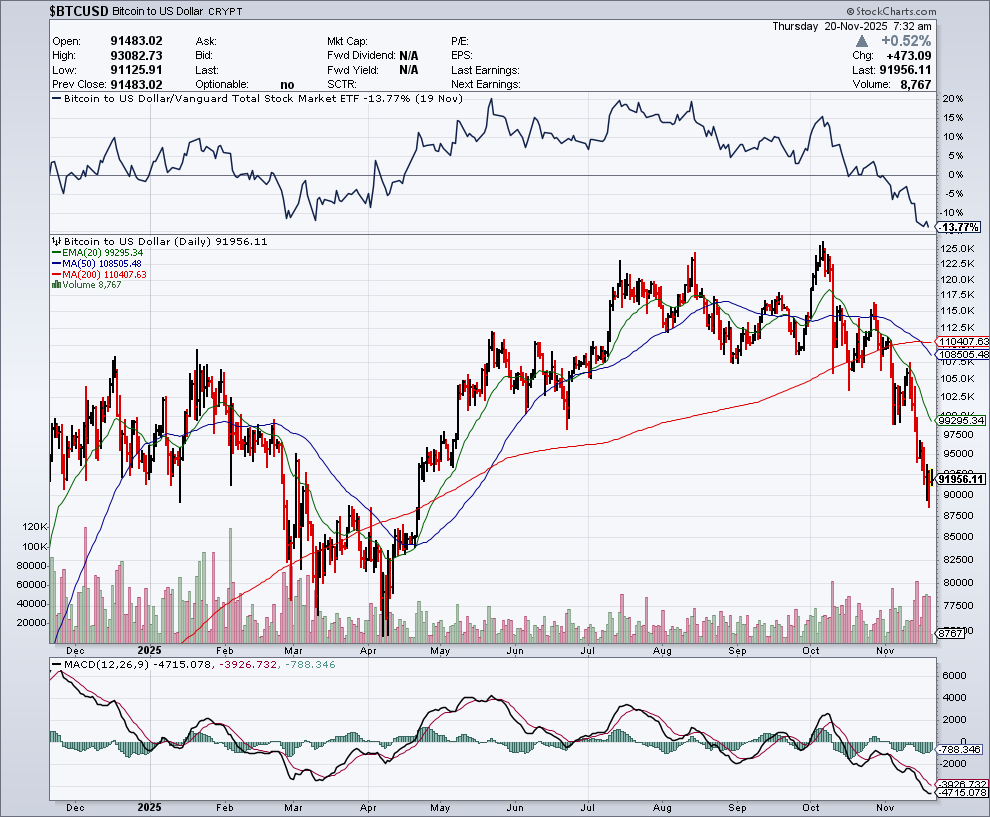

Paulson made his most famous anti-crypto comments back in 2021, claiming cryptocurrencies would eventually “go to zero.” Now that Bitcoin has surged above $125,000 in 2025, those remarks have aged about as well as unrefrigerated milk.

And now, just last week, Bitcoin did not breach $50,000 like it did in the early days. It powered through $120,000 and held it, showing the resilience of a wild mongoose that simply refuses to die.

At what lengths will the old guard go to downplay this legitimate asset class?

Hedge fund manager John Paulson made $20 billion predicting the downfall of the U.S. housing market in 2008. So when he predicted years ago that cryptocurrencies would “go to zero,” the question becomes whether he will look foolish if Bitcoin goes to $200,000.

Talk is talk, nothing more than that.

He said back in 2021, “Cryptocurrencies, regardless of where they are trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero. I would not recommend anyone invest in cryptocurrencies.”

Bitcoin launched on January 3, 2009, and he spoke like he had no idea. So did he mean the “exuberance” had already been happening for 12 years at the time, and now 16 years later he is still waiting for it to wear off?

Despite Paulson’s less than ideal stance on crypto, he admitted even then that the short-term volatility of the digital asset made it too risky for him to short or place bets against.

Paulson continued to say, “Ultimately the price fluctuation has to do more with the relative supply of the coins.”

I would correct Paulson by noting that the supply situation is only one of many drivers of higher Bitcoin prices.

The more “experts” who chime in shouting down crypto assets, the worse they look, as new sets of millionaires and billionaires get minted daily.

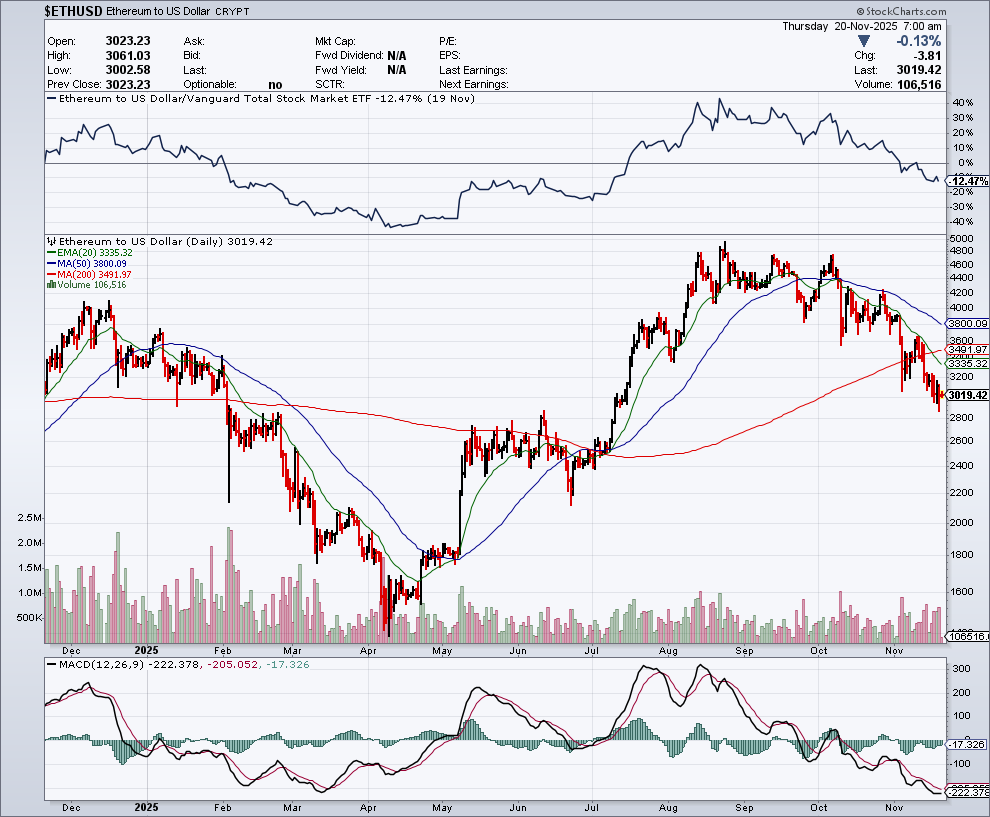

Retail buyers are thirsting for percentage growth while Bitcoin reigns supreme. It has relatively stable growth, while there is exponential growth happening in Ethereum.

That is what really hooks their eyeballs.

Paulson also neglected to say where retail traders could find yield in this world. He might even recommend loss-making gold trades since he has gotten it completely wrong for more than a decade now.

Paulson’s hard line against crypto stands in stark contrast to many of his hedge fund bros who have embraced Bitcoin and shelved their relentless criticism of it.

The biggest takeaway from Paulson is that he never deployed capital against Bitcoin, meaning he acknowledged that it could go up significantly from where it was back then, and he was scared to lose money by shorting the asset.

I would not advocate holding this asset until death, and even the early adopters trim their Bitcoin positions on huge spikes. This is prudent risk management.

Readers need to remember that these “pros” like Warren Buffet and Paulson missed the boat on Bitcoin, so they are incentivized to criticize the asset by delegitimizing its very existence.

This is a simple and garden variety manipulation tactic that is easy to call out.

Who knows, maybe in 10 years all the crypto trillionaires will start to peddle out the reverse theory that stocks and fixed income are not assets as well. I have seen crazier things in my life.

For some top trading shops, the volatility in the price of crypto is seen as a godsend in order to make a fortune from price arbitrage.

Steve Cohen’s Point72 Asset Management is working on launching crypto-focused trading funds. Israel Englander’s Millennium Management has begun trading crypto derivatives. Traders like Paul Tudor Jones and Alan Howard have also taken stakes in cryptocurrencies.

Including Paulson, all of these traders made fortunes betting on other asset classes. Therefore, it is really not certain if they have spent more than two seconds looking into what crypto is about.

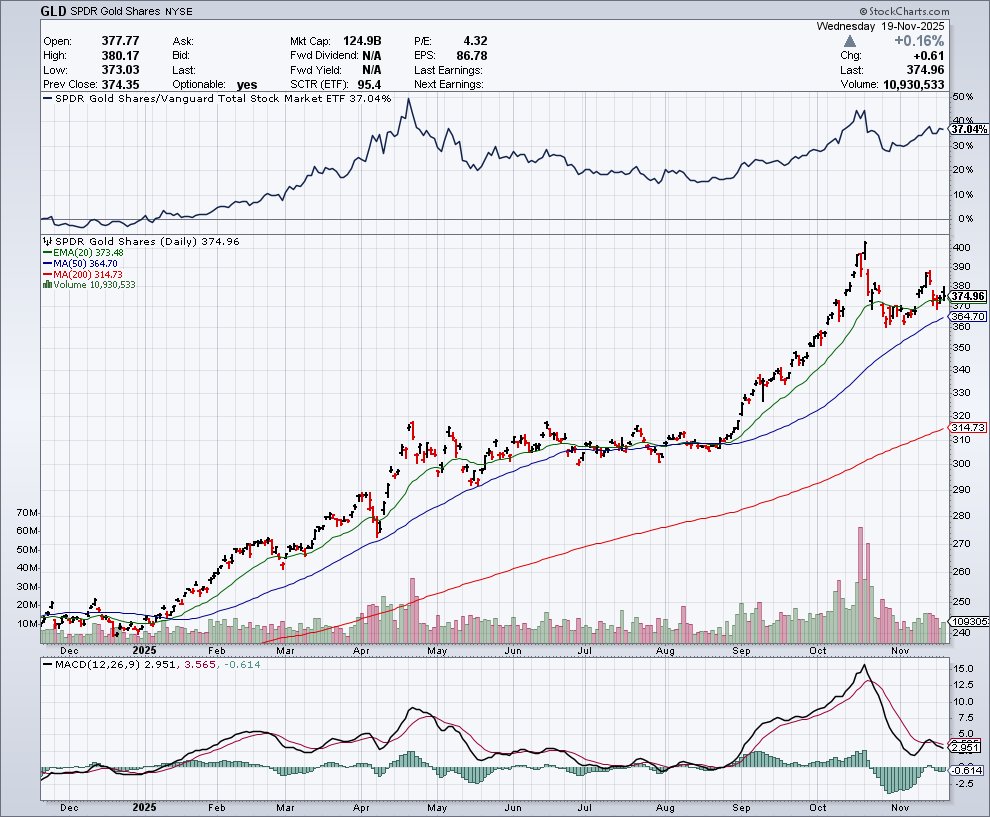

Since then, the avalanche of data points has been snowballing at the right time. Bitcoin broke $125,000, gold’s market value hit roughly $30 trillion, and institutional adoption is at the highest level in Bitcoin’s history.

It has been in the price action that the gyrations of Bitcoin have been smoother lately, and we are not seeing 10 % drawdowns in a day like we did before.

The longer the price action shows continuity, the more investors will feel comfortable placing large amounts into different coins as well as the bellwether Bitcoin.

An avalanche of data points shows more efficacy, higher volume, and broad based adoption as Bitcoin now trades above $120,000.

Granted, it will not be the last time that crypto is talked down, but the problem is every time these guys do it, they look more out of touch by the day.

Paulson made his fortune betting against subprime mortgages at the peak of the 2007 credit bubble, and the evidence is out there that he simply does not understand cryptocurrencies. And that is ok, because after his great call on subprime housing, he rapidly lost a large amount launching a gold fund in 2009.

Since that year, crypto has revealed itself as a better alternative to physical gold, and Paulson simply does not like that. Paulson is hellbent on making this gold trade work. It almost seems like it is a fetish at this point.

People of that stature usually do not like being wrong and throw money at the problem until the variables and price turn in their favor.

But honestly, sour grapes because missing the crypto boat will not make the price of gold go up 10×, 100×, or 1,000×, and that is what crypto is about in the early innings of a 9 inning game.